In February, the domestic of methanol prices in was weak and volatile. Under the influence of cost decline and delayed demand recovery, the operating range of methanol prices decreased. In addition to the negative cost impact caused by the decline in coal, the weak demand for methanol caused by the relatively sufficient inventory of raw materials for downstream products is also a major factor in the decline in methanol prices.

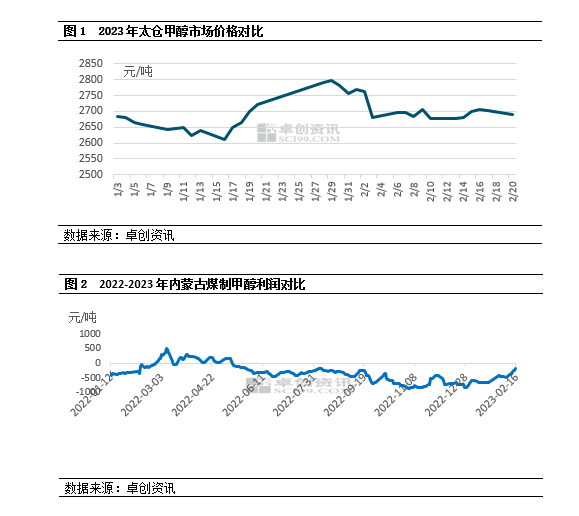

January 2023 to date, China's methanol market price trend first up and then down. The cost of acrylic acid fell in February, the recovery of demand after the holiday was slow, and the price of methanol continued to fall. While a downward trend in costs is expected in February, there are also expectations of a decline in supply and demand. Up to now, Jiangsu Taicang methanol closed at 2690 yuan/ton. Compared with the end of January, the month-on-month decrease was 65 yuan/ton, or 2.36 percent, while methanol in Inner Mongolia closed at 2145 yuan/ton, down 5.92 percent from the end of January. Main influencing factors: 1. Cost decline drags down methanol prices; 2. Delay demand recovery time, suppress prices; Third, the supply and demand game is fierce, operators cautiously amplify.

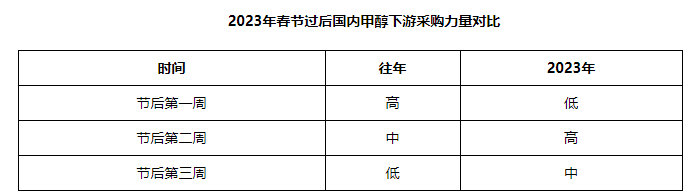

1, cost declines drag on methanol prices, but industry profits don't improve

February 2023, methanol price fluctuations are less than raw material price fluctuations. Although the price of methanol fluctuated weakly this month, the decline in raw materials such as coal was more pronounced for methanol in the first place. Declining costs had a negative impact on methanol prices, but poor profits limited the decline in methanol prices. Domestic coal prices continued to fall due to the continued decline in imported coal and weak rigid demand. However, since 2023, the profits of coal methanol plants have been at a loss, the overall profitability of the methanol industry is poor, the northwest production enterprises continue to make profits, price cuts and the willingness to discharge goods is limited, but also limit the price of methanol downward space.

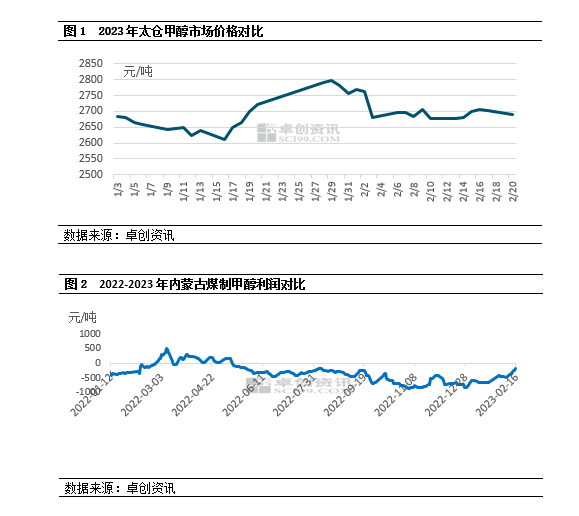

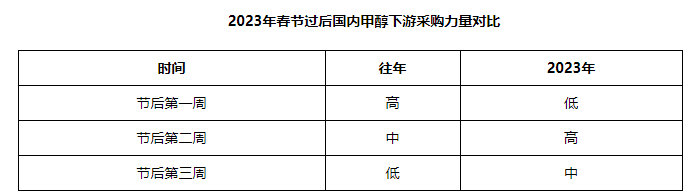

2. It is expected that domestic demand will decline month-on-month in February, and the support for prices will be limited.

February, the total domestic methanol demand has decreased from the previous month, and domestic consumption has increased from the previous month, but the export volume has not changed much. As the 2023 Spring Festival holiday is earlier than in previous years, the downstream inventory time is also earlier than in previous years. In addition to some traditional downstream factories during the Spring Festival to reduce the burden or close, most of the important downstream factories during the Spring Festival normal operation, consumption of inherent raw material inventory. In the first week after the Spring Festival, most downstream factories still have raw materials in stock. In addition, after the Spring Festival, cars and ship goods have arrived one after another, most downstream factories of raw material methanol inventory in the upper-middle position, pick-up enthusiasm decreased. As a result, the recovery of post-holiday demand has been delayed from previous years. In addition, although the downstream formaldehyde operating load increased significantly after the Spring Festival, the load operation of MTBE, methanol-to-olefin units and DMF products was relatively obvious due to maintenance concentration, profit and device problems. Total domestic demand for methanol is expected to decline in February compared with January, and demand support for prices is relatively limited.

of 3, supply and demand game, operators carefully magnify the mentality of

Although the growth in total supply (imports plus production) is not expected to be significant. In February, equipment load reduction or shutdown maintenance in Northwest, North and Central China led to a decrease in the national methanol start-up load and a year-on-year decrease. As of February 16, the overall start-up load of methanol plants across the country was 66.66, down 1.63 percentage points from last week and 2.72 percentage points from the same period last year. In terms of imports, due to delays in the restart of equipment in other parts of the Middle East, the blockade cycle of important terminals in East China is longer, and the actual recovery cycle of imports is also delayed. Therefore, the inventory pressure on the mainland and ports is not large, which has a certain supporting effect on methanol prices. However, the above-mentioned demand recovery cycle is delayed, the long-short mentality game, the operator's willingness to hold positions and speculative demand decline.

Generally speaking, on the supply side, the import volume in February was difficult to repair, and the operating load of the national methanol plant decreased compared with the previous month and the same period last year. Inventory in the main northwest producing areas is expected to remain controllable in the short term, and port inventory is still in a moderate position. On the demand side, enthusiasm for downstream pick-up is likely to increase further as downstream demand recovers further. However, new methanol plants and the restart of the early shutdown program have obvious restrictions on the methanol market. In the medium term, the recovery of demand remains the main influencing factor in determining the trend of methanol prices. Overall, the volatility of methanol and downstream units is expected to increase, and the market supply and demand game will intensify. In the short term, the domestic methanol market price is expected to be weak.

Source: Zhuochuang Information * Disclaimer: The content contained in the article comes from public channels such as the Internet and WeChat public numbers, and we maintain a neutral attitude towards the views expressed in the article. This article is for reference only, exchange. The copyright of the reproduced manuscript belongs to the original author and institution. If there is any infringement, please contact the customer service of Huayi World to delete it.

Mainly

Mainly

Polyurethane

Polyurethane

Fine Chemical

Fine Chemical

.png)