On April 6, 2024, Arnold Bertrand, a well-known French entrepreneur, posted an article on social media, deeply analyzing the current argument about China's "overcapacity. He clearly pointed out that this argument is actually the worry and unease of Western countries about China's rapid development. They are afraid that China's economic take-off will surpass itself and pose a threat to their interests. This view reveals that when we look at the problem, we should not just stay on the surface, because the truth behind it is often more complicated than what we see.

In view of the current widely discussed problem of overcapacity in China's chemical market, we conducted in-depth research and analysis. Overcapacity is usually judged by key indicators such as capacity utilization, profitability and inventory levels. Therefore, we have conducted a detailed survey of the market situation of these major bulk chemicals and have reached the following conclusions:

1. operating rate analysis

figure 1 Changes in operating rates of major chemical products over the past few years

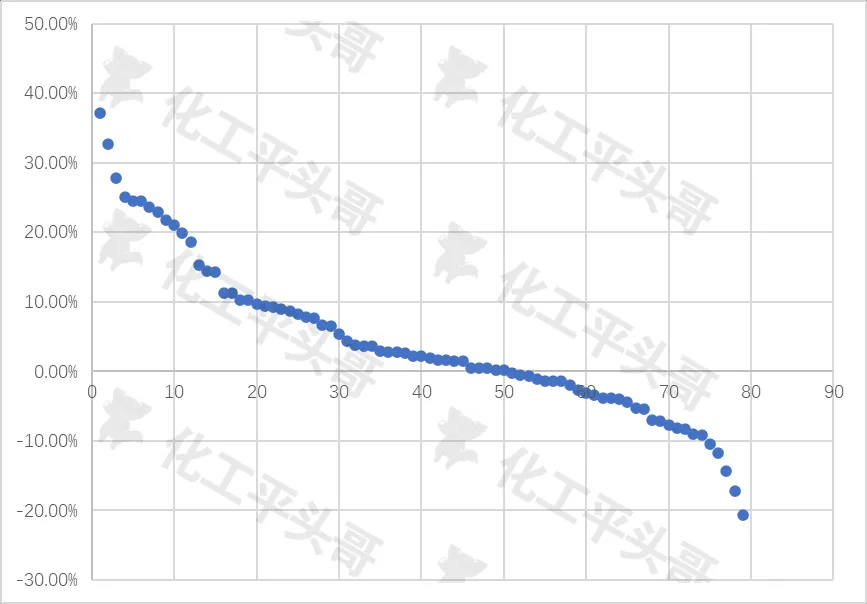

china's chemical industry generally faces low capacity utilization, with an average of 73%. Capacity utilization is calculated by the ratio of production to capacity, and 75% is usually regarded as the baseline for assessing whether there is excess capacity. We conducted an in-depth study of the changes in capacity utilization of nearly 30 bulk chemicals over the past seven years and concluded that:

1. Within the scope of our investigation, the capacity utilization rate of most chemicals is divided by an average of 75%, that is, about half of the chemical capacity utilization rate is higher than 75%, while the other half is lower than this level. In other words, about half of the Chinese chemicals surveyed had an average annual operating rate of less than 75 per cent.

2. Looking back at the data of the past 7 years, the average operating rate of these chemicals is only 73%, which is lower than the industry standard value of 75%, showing obvious signs of overcapacity.

3. For those chemicals whose capacity utilization rate is less than 75%, they are mainly concentrated in the upstream of the industrial chain, such as methanol, alkylated oil, MTBE, etc. These products are often related to the expansion of raw materials, and their production capacity reduction is more due to passive factors. On the contrary, chemical products with a capacity utilization rate of more than 75%, such as ethylene, polyethylene, propylene oxide, etc., are mostly raw material properties or downstream products in the industrial chain. They are greatly influenced by the business climate of the industry, and the operating rate has remained at a high level in the past few years.

In particular, it should be noted that the capacity of this statistics is based on actual capacity, not effective capacity. Therefore, we have excluded those devices that have been parked all year round and may no longer operate permanently. These devices are mainly concentrated in markets with low technical barriers and mature product development. If these so-called "zombie capacity" is removed, the operating rate of some products will exceed 75%, such as styrene, pure benzene, synthetic ammonia, and oil refining.

Figure 2 Changes in operating rates of major chemicals in China in 2023

2. Profitability Analysis

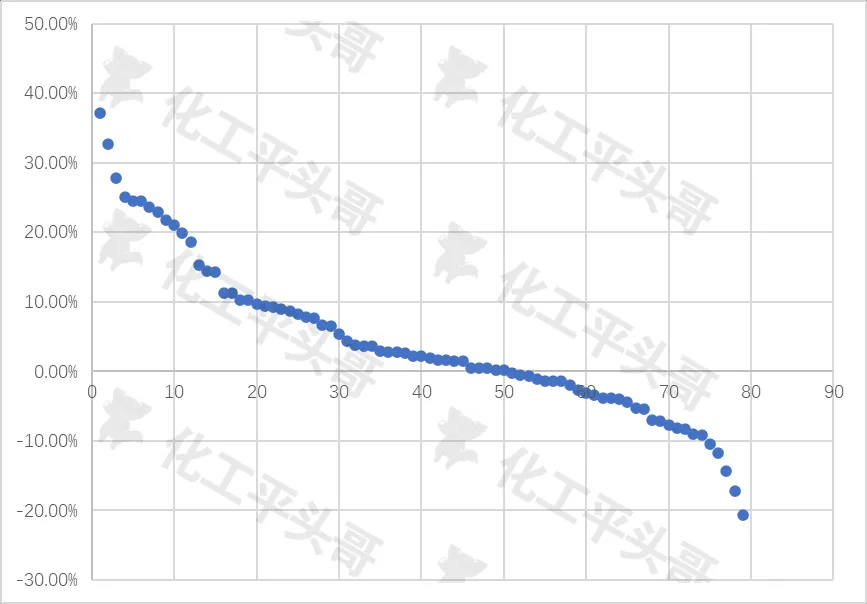

figure 3 Changes in the profit margin of major chemicals in China in 2023.

In 2023, most chemicals were profitable and a small number of products were at a loss. Another measure to assess excess is profit margin, for which we calculated the 2023 profit margin level of about 100 chemicals based on the industry mainstream formula, based on average processing costs and market mainstream prices, and the calculated profit margin is the industry average profit margin and does not represent the business situation.

1. Most products in China's chemical industry will still be profitable in 2023, with only a small number of products theoretically losing money. Among them, the number of loss-making products accounted for 37% and the number of profits accounted for 63%. It can be seen that from the theoretical profitability, most of the products in China's chemical industry are generally good.

2. Among the profitable chemical products, 39% of the chemical products have a profit margin of less than 10%, which is a state of low profit. Since this calculation is the average profit margin level of the industry, which does not include financial costs, depreciation and management expenses, if the profit margin level is lower than 10% in a strict sense, there may be a certain risk of loss, especially If the profit margin is lower than 5%, if the enterprise belongs to a new device, there is a high probability of loss.

3. Judging from the profit margin level of nearly 100 chemicals tracked in 2023, the maximum profit margin has not yet exceeded 40%, and the maximum loss profit margin has exceeded 20%. This time, the statistics are for bulk chemicals, and there are no profiteering products in the statistics. It can be seen that the profit margin of bulk chemicals in 2023 is limited, and the profitability is not as good as that of new materials and fine chemicals.

3. inventory level analysis

in chemical inventories, inventory capacity is limited and inventory levels do not reflect signs of excess. As a special product for storage, chemicals are quite different from the storage of daily necessities, in which the storage capacity determines the inventory level of chemicals. Chemical inventory exists in yards, warehouses, spherical tanks, liquid tanks and other storage facilities, most of which are limited by the size of the chemical storage environment and scale, so want to deliberately enlarge the inventory, in a short period of time almost impossible to reach.

In addition, the trading volume of the trade environment in chemical products is huge, and the trading volume of most products accounts for 50% or more of the total volume, while the trade environment more reflects the prediction of the future market trend, so many traders have the phenomenon of inventory gambling, which also virtually increases the inventory level, thus reflecting the illusion of high market inventory.

4. comprehensive assessment

through the comprehensive judgment of the two indicators of capacity utilization rate and profit margin, combined with the current actual situation and historical situation of bulk chemicals, we can get that there is no large-scale surplus in China's chemical market, and the Chinese chemical market is still developing in a healthy state. However, it should also be noted that due to the huge number of projects under construction in China and the inability to quickly eliminate backward production capacity, there may be some products and negative expectations in the short term in the future, or it may lead to a weak market in the chemical market.

Mainly

Mainly

Polyurethane

Polyurethane

Fine Chemical

Fine Chemical

.png)