1. market status: a short period of decline after the stabilization of the rise.

after the may day holiday, propylene oxide the market experienced a brief period of decline, but then began to show a trend of stabilization and a slight rise. This change is not accidental, but is influenced by multiple factors. First of all, during the holiday period, logistics is limited, trading activity is reduced, resulting in a steady decline in market prices. However, with the end of the holiday, the market began to regain vitality, coupled with the end of maintenance of some production enterprises, the market supply has decreased, driving up prices.

Specifically, as of May 8, the factory price of mainstream cash exchange in Shandong rose to 9230-9240 yuan/ton, an increase of 50 yuan/ton compared with the holiday. This change, while small, reflects a shift in the market's mindset from idling to cautiously optimistic.

2. East China Supply: Tension Eases Gradually

source: Longzhong Information

from the supply side, it was originally expected that the 400000-ton/year HPPO unit of Ruiheng New Materials would resume operation after the festival, but the actual situation was delayed. At the same time, Sinochem Quanzhou's 200000-ton/year PO/SM plant was temporarily shut down during the festival and is expected to return to normal in the middle of the month. The industry's current capacity utilization rate is 64.24 percent. East China is still facing the problem of insufficient supply of effective in stock in a short period of time, while downstream enterprises have certain rigid demand after the resumption of work after the festival. In the case of large price difference between the north and the south of propylene oxide, the northern supply of goods is deployed to the south, effectively reducing the accumulated supply pressure of the northern factory during the festival, the market began to turn from weak to strong, and the quotation rose slightly.

In the future, Ruiheng new materials are expected to start shipping this weekend, but it will take some time for normal release. The restart of satellite petrochemical and the overhaul time of Zhenhai Phase I are tentatively scheduled for around May 20, which basically overlap and will have a certain supply hedging effect. Although the East China region is expected to increase in the future, the actual volume is relatively limited this month. The tight in stock supply and high price difference are expected to be moderately eased by the end of the month, and may gradually return to normal in June. During this period, the tight supply of goods in East China is expected to continue to support the overall propylene oxide market, with limited room for downward price fluctuations.

3. raw material costs: limited volatility but need attention

source: Longzhong Information

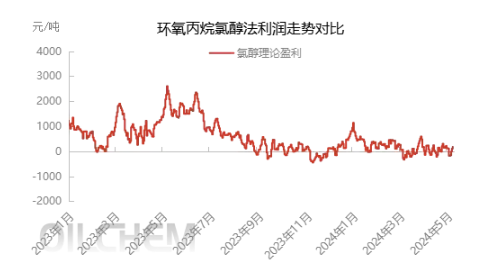

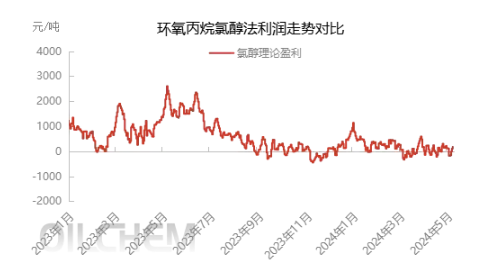

from the cost point of view, the price of propylene has maintained a relatively stable trend in the near future. The price of liquid chlorine once rebounded to the high level of the year during the festival, but after the festival, due to the resistance of the downstream market, the price fell to a certain extent. However, it is expected that the price of liquid chlorine may rebound slightly again in the second half of the week due to fluctuations in individual units within the site. At present, the theoretical cost of the chlorohydrin method is maintained in the range of 9,000-9,100 yuan/ton. With the slight increase in the price of propylene oxide, the chlorohydrin method began to return to a small profit state, but this profit state is not enough to form a strong market support.

Subsequent propylene prices are likely to show a narrow upward trend. At the same time, taking into account the chlor-alkali industry in May part of the device maintenance plan, it is expected that the market cost side will show a certain upward market. However, as the support for the small incremental increase in the supply side weakens in the middle and late of the month, the support of the market cost side may gradually strengthen. Therefore, we will continue to follow the development of this trend.

4. downstream demand: stable growth but volatility

source: Longzhong Information

in terms of downstream demand, after the May Day holiday, feedback from the polyether sector showed that the number of new orders was temporarily limited. Specifically, the order volume in Shandong remains at an average level, while in East China, due to the high price of propylene oxide, the market demand is relatively deserted, and end customers are cautious about the market. Some customers intend to wait for the increase in the supply of propylene oxide to seek a more favorable price, but the current market price trend is easy to rise and fall, most just need customers still choose to follow up the purchase. At the same time, some customers are resistant to high prices and choose to reduce the production load slightly to adapt to the market.

From the perspective of other downstream industries, the propylene glycol dimethyl ester industry is currently in a state of comprehensive profit loss, and the industry's capacity utilization rate remains stable. It is reported that in the middle of the month, Tongling Jintai plans to stop for maintenance, which may have a certain impact on the overall demand. On the whole, the current downstream demand performance is relatively flat.

in the short term, Ruiheng New Materials will be the main contributor to the increase in commodity volume this month, and it is expected that these increments will be gradually released to the market in the mid-to-late period. At the same time, other sources of supply will have a certain hedging effect, so that the overall volume peak will be concentrated in June. Nevertheless, due to the favorable factors on the supply side, although the support may be weakened in the middle and late of the month, it is still expected to maintain a certain supporting role in the market. Coupled with the relative stability and strength of the cost side, it is expected that the price of propylene oxide in May will mainly run in the range of 9150-9250 yuan/ton. On the demand side, it is expected that there will be a passive follow-up. Therefore, the market should pay close attention to the fluctuation of key devices such as Ruiheng, satellite and Zhenhai to assess further market movements.

When evaluating the future market trend, we need to pay special attention to the following risk factors: first, there may be uncertainty in the time node of the device surface increment, which may have a direct impact on the market supply; second, if there is pressure on the cost side, it may reduce the enthusiasm of enterprises to start work, thus affecting the supply stability of the market; third, the landing of actual consumption on the demand side, this is also one of the key factors that determine the market price trend. Market participants should pay close attention to changes in these risk factors in order to make timely adjustments.

Mainly

Mainly

Polyurethane

Polyurethane

Fine Chemical

Fine Chemical

.png)