Recently, the tension in the Palestinian-Israeli conflict has made it possible to escalate the war, which has affected the fluctuation of international oil prices to a certain extent, making it at a high level. In this context, the domestic chemical market has also been hit by high upstream energy prices and weak downstream demand, and the overall market performance is still weak. However, macro data in September showed that market conditions are improving marginally, which is a departure from the recent downturn in the chemical market. Under the influence of geopolitical tensions, the international crude oil continued to fluctuate strongly, from the cost side, the bottom of the chemical market has support; but the fundamentals, gold nine silver ten demand did not break out, continued weakness is an indisputable fact, so it is expected that the chemical market in the near future or the continuation of the downward correction thinking.

Chemical market to maintain a downturn

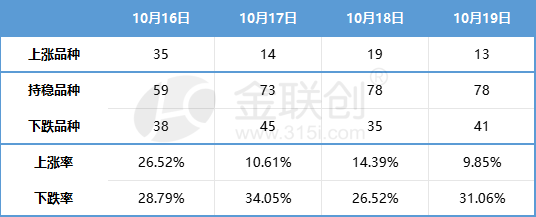

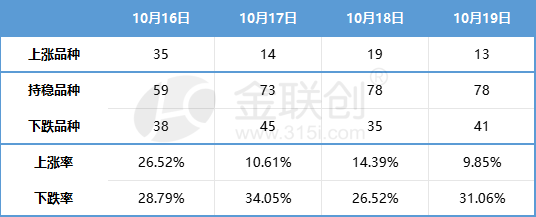

last week, the domestic chemical in stock continued its weak performance. According to the 132 chemicals monitored by Jinlianchuang, the domestic in stock closed as follows:

data source: Jin Lianchuang

marginal improvement in September's macro data deviates from the recent chemical downturn.

The National Bureau of Statistics released economic data for the third quarter and September. The data showed that the consumer goods retail market continued to pick up, industrial production activity remained stable, and real estate-related data also showed signs of marginal improvement. However, despite the improvement, the extent of the improvement is still limited, especially the decline in real estate investment is still large, which makes real estate still a drag on the domestic economy.

From the third quarter data, GDP grew by 4.9, better than market expectations. This growth was mainly driven by a significant increase in the pull of consumption. However, the four-year compound growth rate in the third quarter (4.7 per cent) was still lower than the 4.9 per cent in the first quarter. In addition, the GDP deflator remained negative, although it improved slightly to -1.4 per cent year-on-year from -1.5 per cent in the second quarter. These data show that the economy still needs further repair.

The economic recovery in September was mainly driven by external demand and consumption, but investment was still negatively affected by real estate. The production side recovered in September from August, with the industrial value added and service sector production indices up 4.5 per cent and 6.9 per cent year-on-year, respectively, basically unchanged from August. However, the four-year compound growth rate increased by 0.3 and 0.4 percentage points respectively from August. Judging from the change in demand in September, the economic recovery was mainly driven by external demand and consumption. The four-year compound growth rate of social zero and exports improved further from August. However, the decline in the compound growth rate of fixed asset investment is still mainly affected by the negative impact of real estate.

From the main downstream areas of the chemical industry:

in the real estate field the year-on-year decline in new home sales in September improved only slightly. Continued efforts are needed to promote policy development at both the supply and demand ends. Although real estate investment is still weak, new construction shows a phased improvement trend, while completion continues to maintain a boom.

in the automotive field, "Golden Nine" retail continued the trend of positive growth in the same period. Due to the increase in holiday travel demand and the promotion activities at the end of the quarter, although the retail sales in August hit a record high, the retail sales of passenger cars in September continued the trend of positive growth from the same period last year, reaching 2.018 million vehicles. This indicates that end demand remains solid and good.

In the field of home appliances, domestic demand remains stable. Retail sales of consumer goods totaled 3,982.6 billion billion yuan in September, up 5.5 percent year-on-year, according to the statistics bureau. Among them, the total retail sales of household appliances and audio-visual equipment goods was 67.3 billion billion yuan, down 2.3 percent from the same period last year. However, the total retail sales of social consumer goods from January to September was 34,210.7 billion billion yuan, up 6.8 percent year on year. Among them, the total retail sales of household appliances and audio-visual equipment goods was 634.5 billion billion yuan, down 0.6 percent from the same period last year.

It is worth noting that the marginal improvement in macro data in September, but deviated from the recent chemical downturn. Although the data is improving, the industry's confidence in the demand in the fourth quarter is still relatively insufficient, and the policy gap in October also makes the industry have reservations about the policy support in the fourth quarter.

The bottom has support, weak demand under the chemical market to continue the callback ideas.

The Palestinian-Israeli conflict has triggered five small-scale wars in the Middle East, and it is expected that it will be difficult to find a solution in the short term. In this context, the escalation of the situation in the Middle East makes the performance of the international crude oil market volatile. From a cost perspective, the chemical market has thus gained some bottom support. However, from a fundamental point of view, although it is the traditional peak demand season for gold, silver and silver, demand has not broken out as expected, but has continued to be weak. This is an indisputable fact. Therefore, it is expected that the chemical market may continue the trend of downward correction in the near future. However, the market performance of specific products may be different, especially products closely related to crude oil may continue to be strong.

Mainly

Mainly

Polyurethane

Polyurethane

Fine Chemical

Fine Chemical

.png)