China's phenol market has recently shown a clear trend in its downstream applications and capacity changes, which has had an impact on the entire industrial chain. China's phenol market is in a critical period of supply and demand balance, how will the phenol market develop in the future?

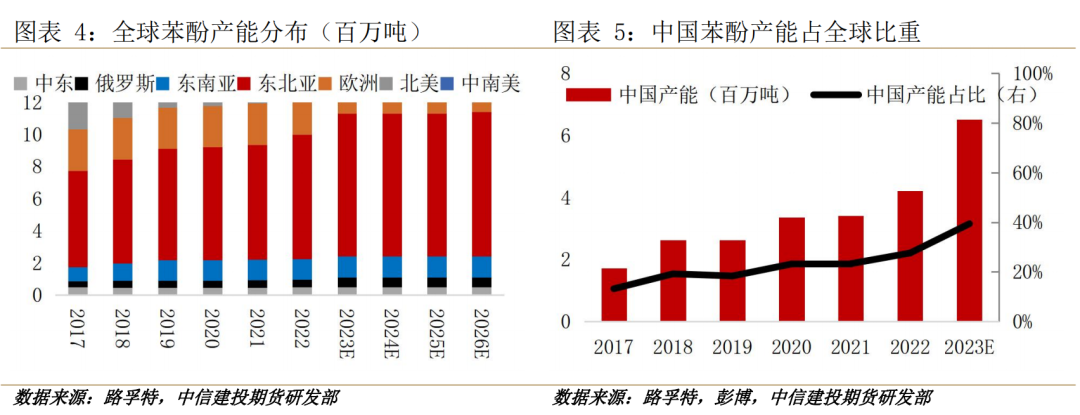

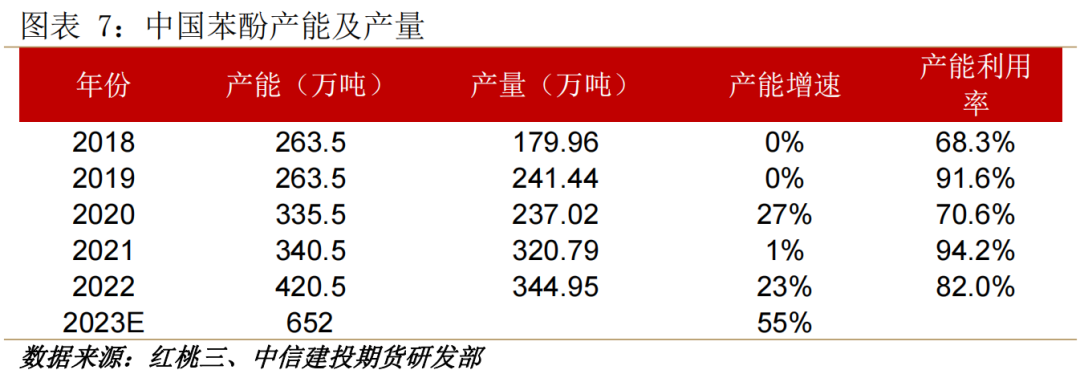

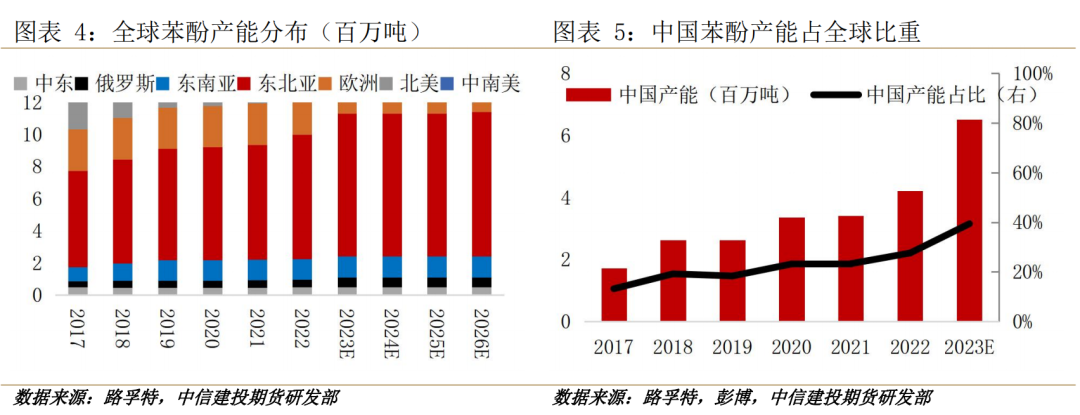

Supply and demand pattern: in 2023, the new production capacity of global phenol will be mainly concentrated in China, and China's total production capacity will exceed 6.5 million tons, accounting for more than 40% of the global production capacity. This trend shows that China is growing rapidly in terms of phenol capacity, which has a profound impact on the market landscape.

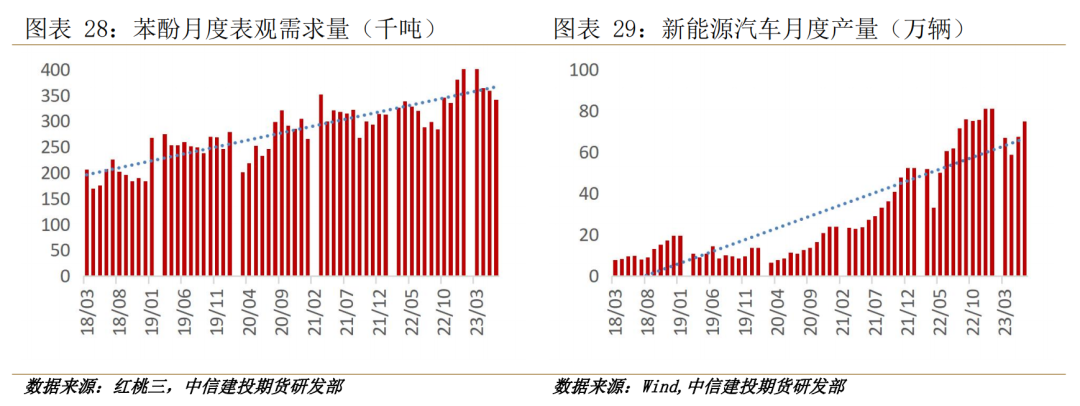

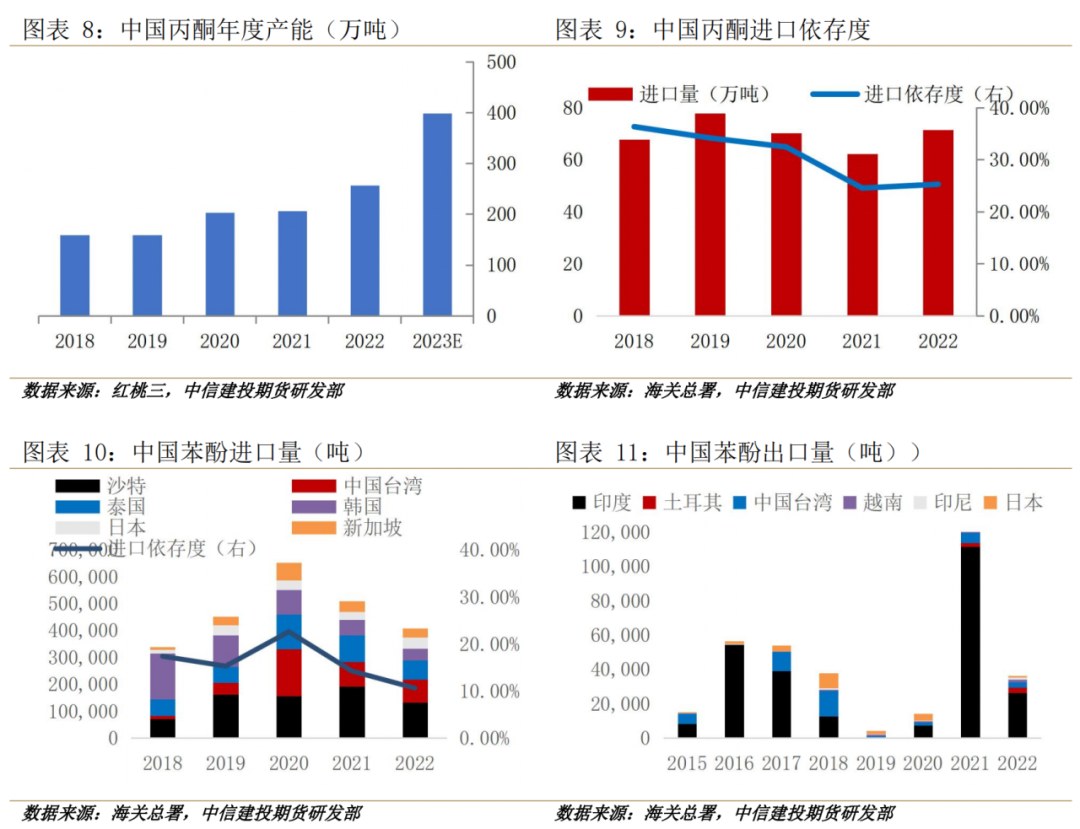

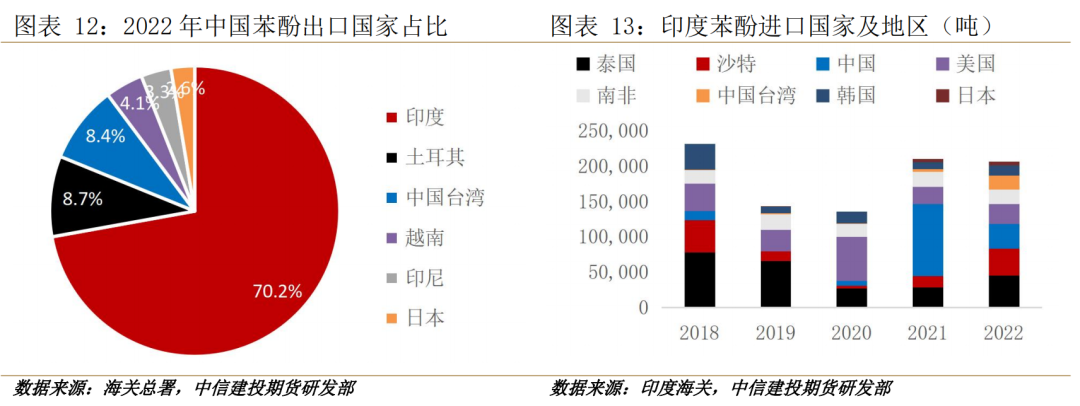

Exports and Imports: in recent years, China's dependence on phenol imports has gradually declined, mainly due to the expansion of domestic production capacity. However, the export of phenol increased in 2019 and exceeded 130000 tons in 2021, with India becoming the most important incremental market. India's data show that India's phenol imports from January to May 2023 increased by 13% year-on-year. In the future, India and neighboring Southeast Asian countries will still become the new growth point of China's phenol export.

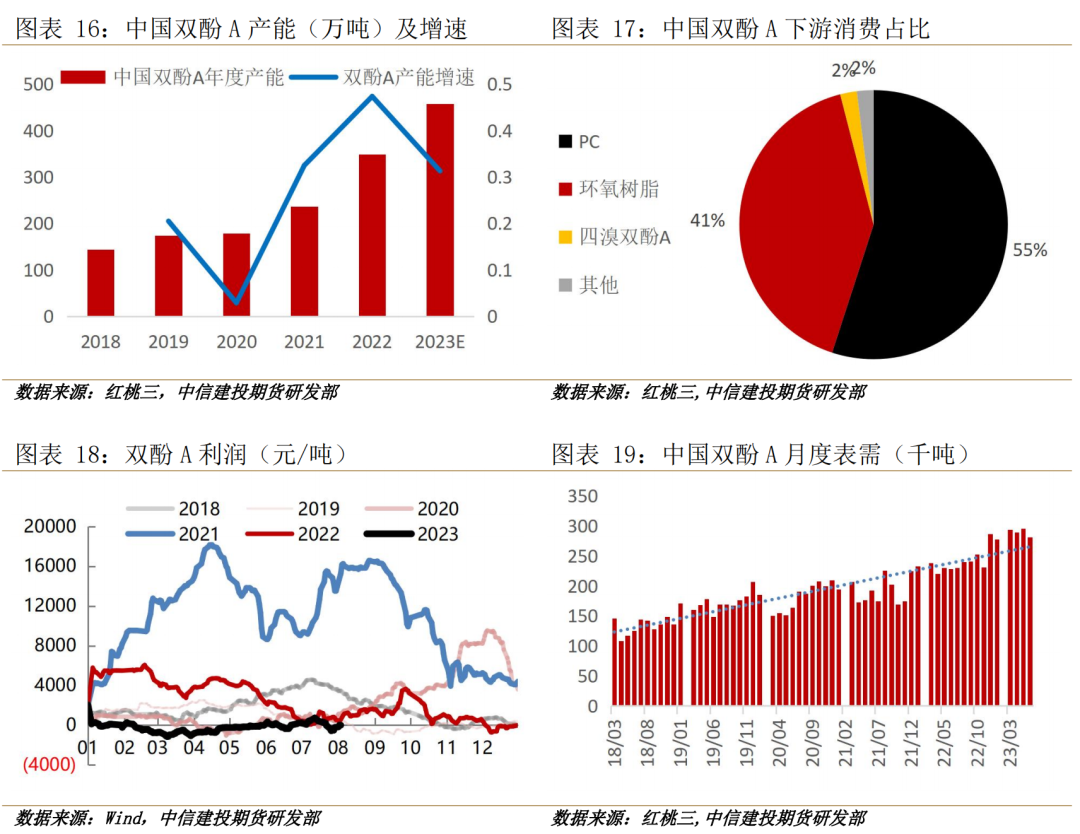

Downstream Demand: in China, the main downstream market for phenol and acetone is bisphenol A, which covers multiple fields such as real estate, electronic appliances, automobiles and panels in the consumer sector. However, with the rapid expansion of bisphenol A production capacity, the profit of bisphenol A will decline significantly in 2022. In 2023, more than 1 million tons of new production capacity are expected to be put into operation, with an annual growth rate of 31%, which may lead to the low profit status of bisphenol A.

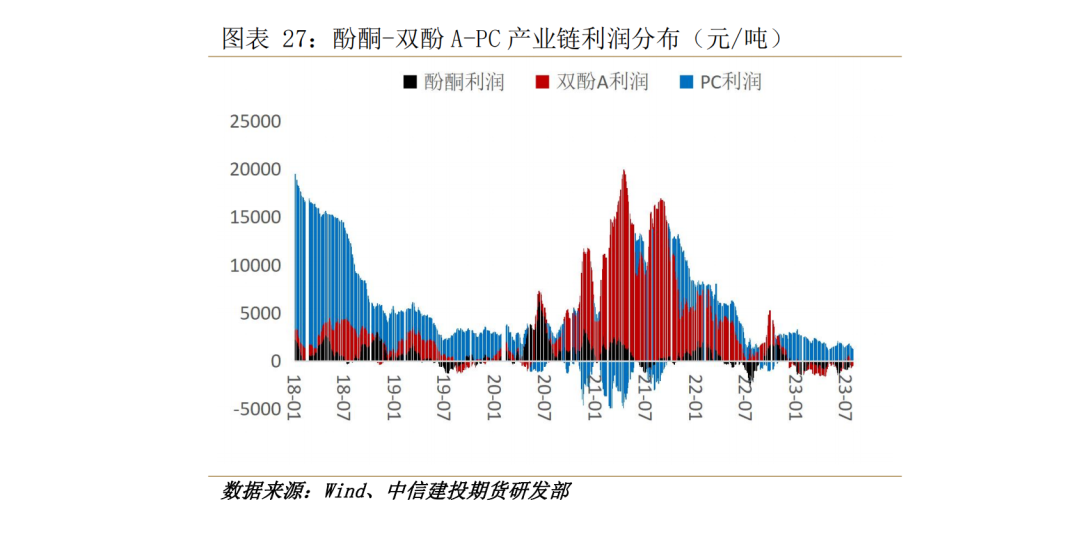

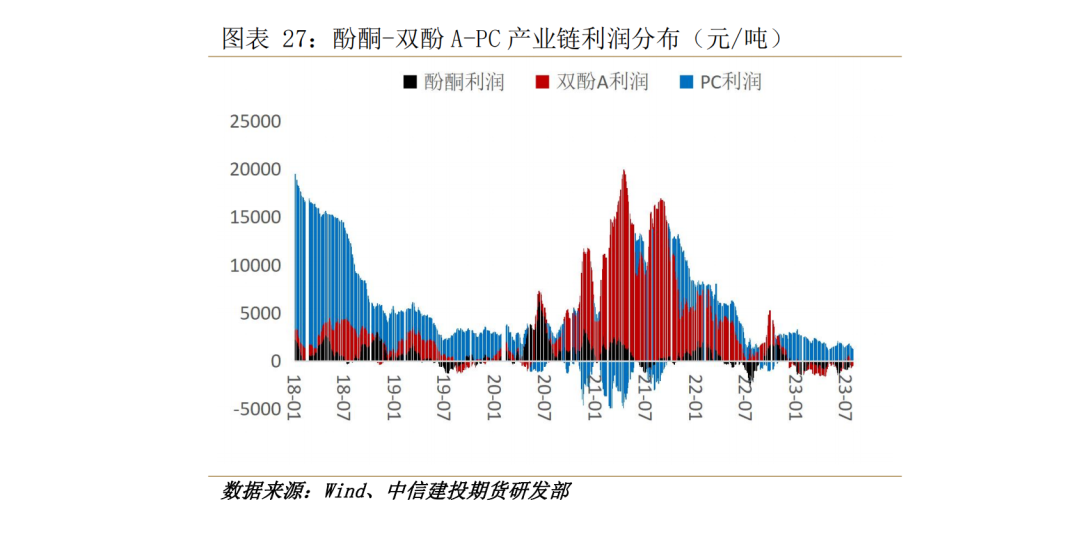

Industry chain integration: phenolic ketone-bisphenol A- PC industry chain in China showed a clear trend of integration. At present, the proportion of bisphenol A supporting manufacturers of phenol is 63%, while the proportion of PC manufacturers supporting bisphenol A and its downstream is 37.2. With the production of Dalian Hengli and Longjiang Chemical, the integration ratio of the industrial chain is expected to continue to increase. Although the improvement of industrial chain integration may lead to profit compression, the current profit focus is still on the PC side.

In general, china's phenol market is in a critical period of supply and demand balance, and the integrated development of the industrial chain will become the future trend. In the changing market environment, the coordinated development of all links will be the key to achieve stable growth.

China's phenolic ketone production capacity continues to expand in 2023, India may be a new bright spot for exports.

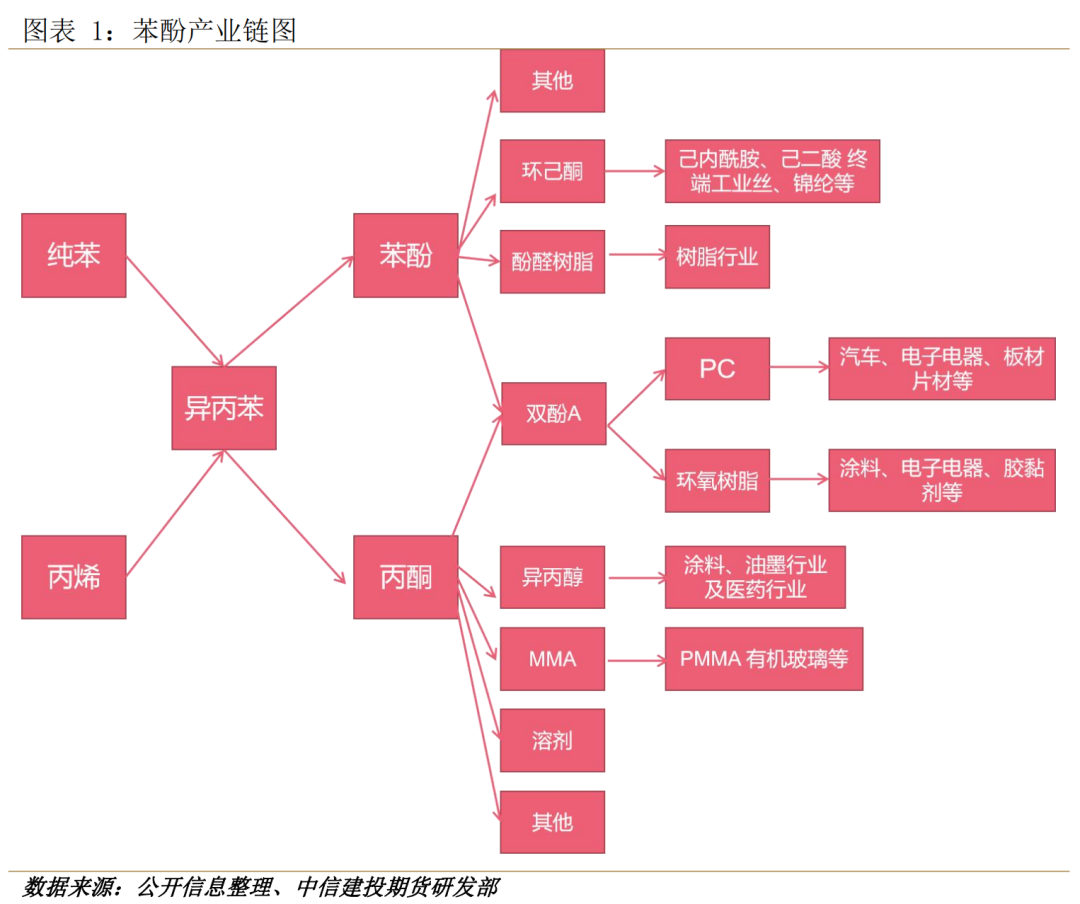

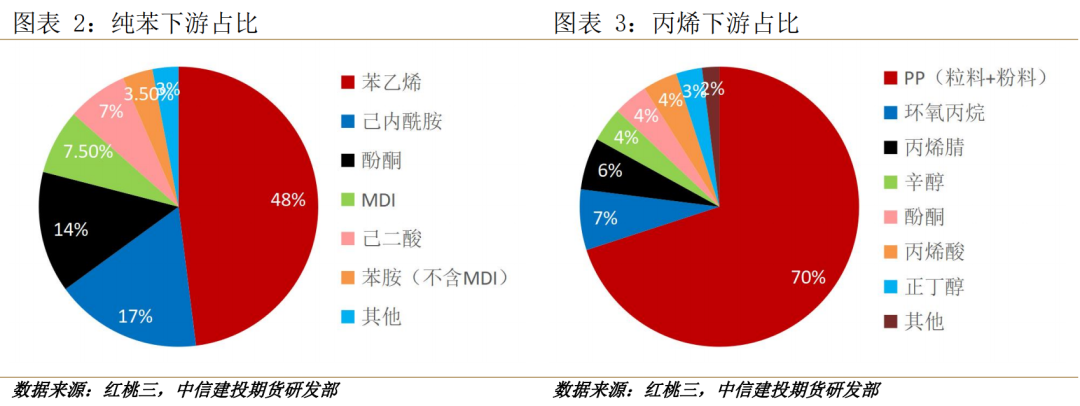

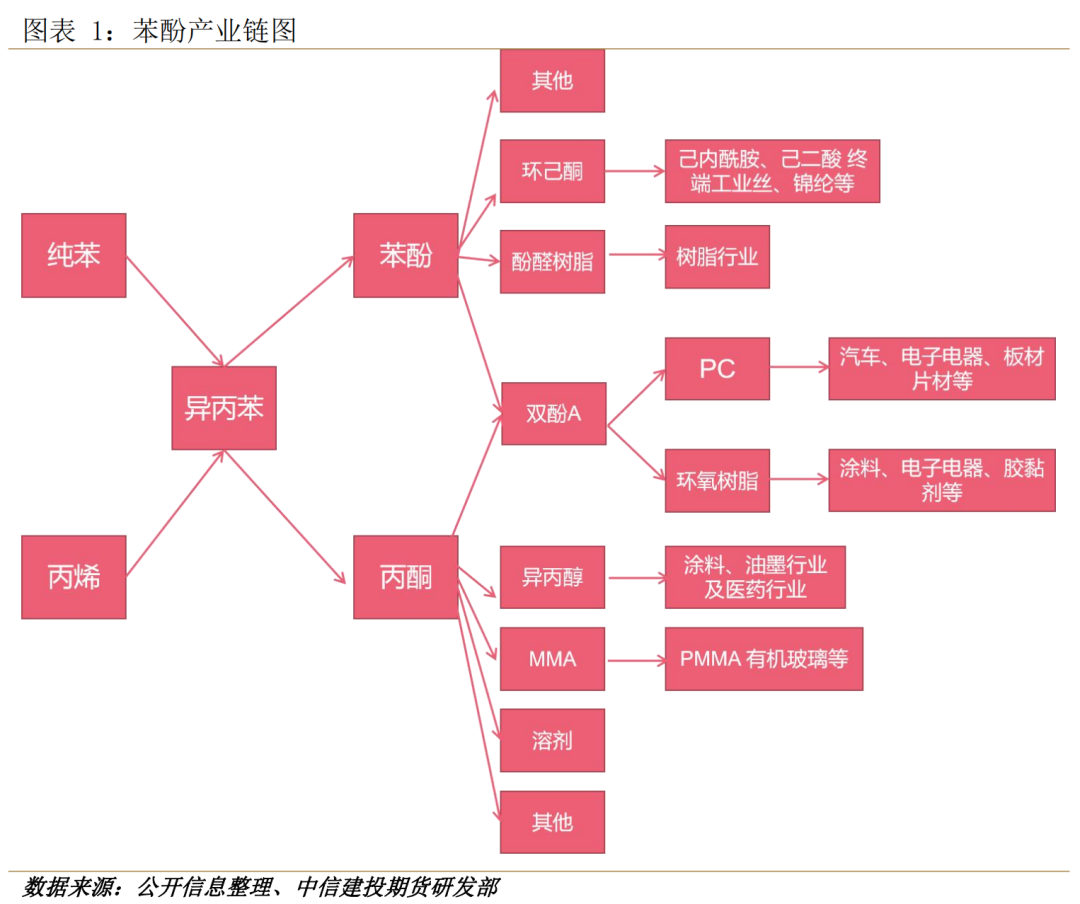

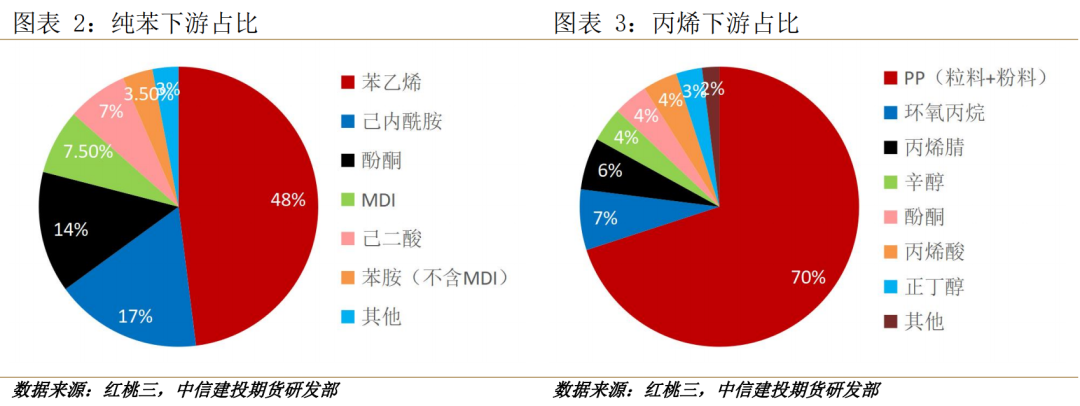

Phenol/acetone accounts for about 14% downstream of pure benzene and about 4% downstream of propylene. According to Lufute and Bloomberg data, global phenol production capacity is about 16.5 million tons by the end of 2022, of which China's production capacity of 4.2 million tons accounts for about 25% of the world's largest. It is estimated that in 2023, the new production capacity of global phenol will be concentrated in China, with an additional capacity of 2.3 million tons. By then, China's total production capacity will exceed 6.5 million tons, with an annual growth rate of nearly 50% and a global production capacity accounting for more than 40%.

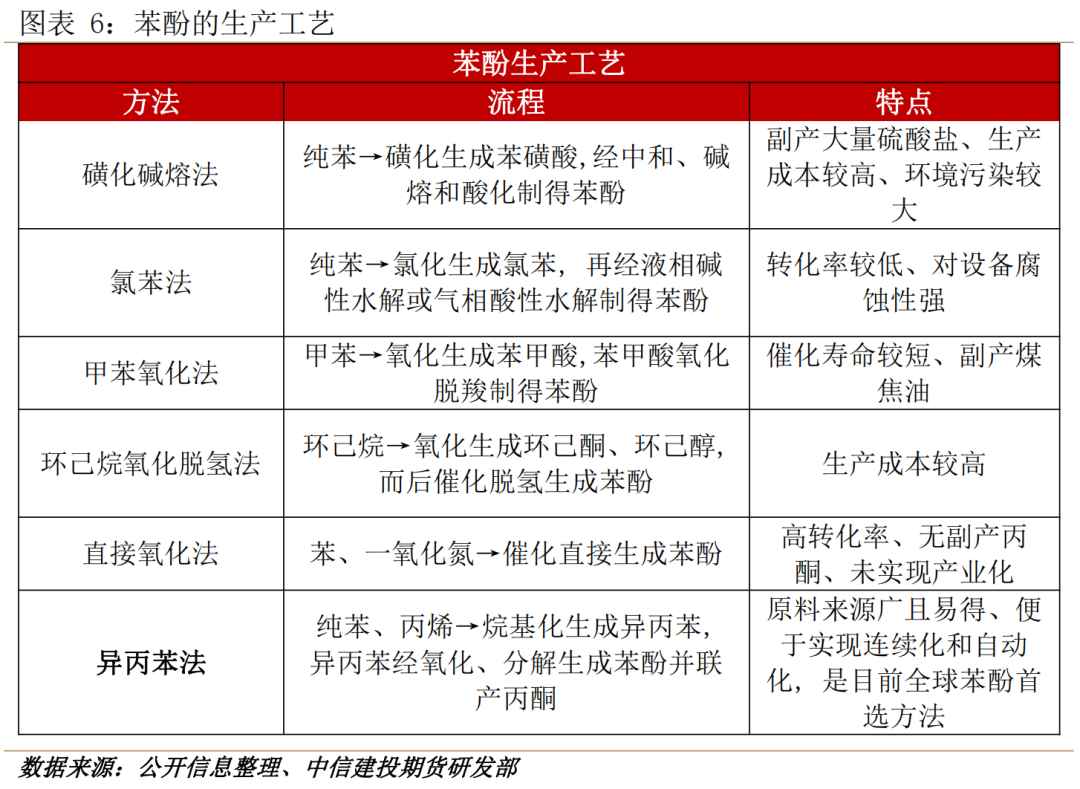

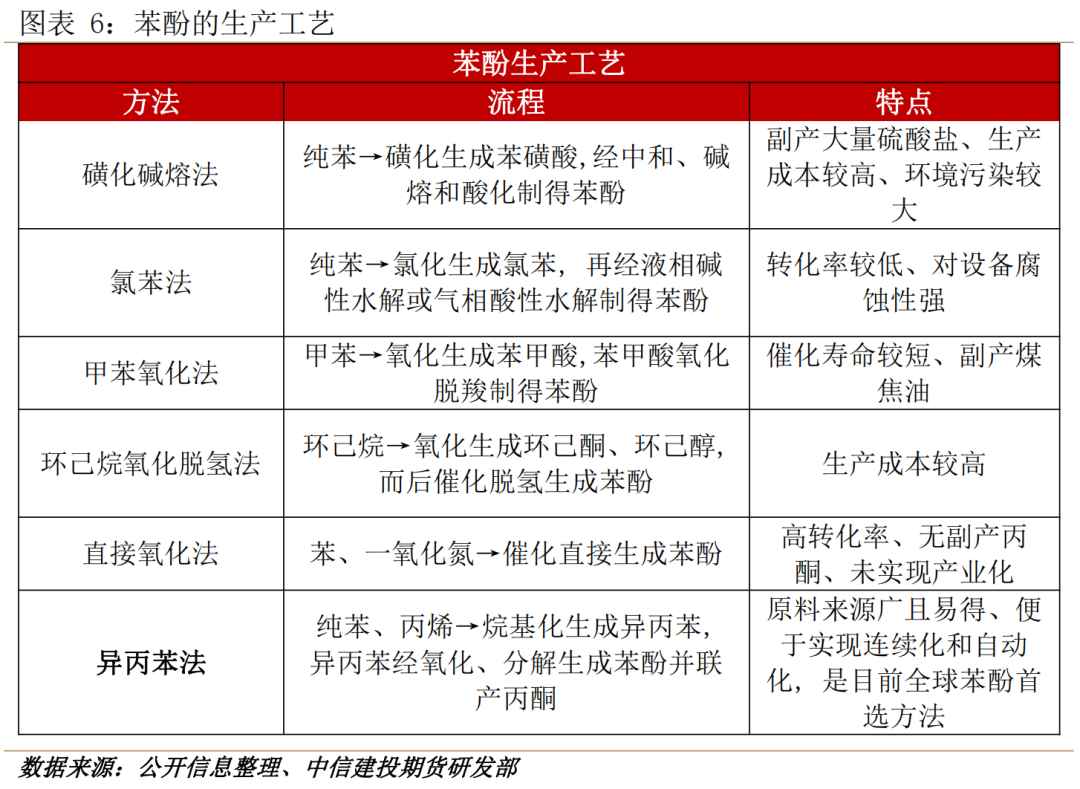

As of July 2023, China's phenol production capacity distribution to Jiangsu, Zhejiang, Shandong-based, the three production capacity accounted for a total of more than 65%, the production process is isopropyl benzene method, the method in the world accounted for more than 90%, the future production of equipment are also the process.

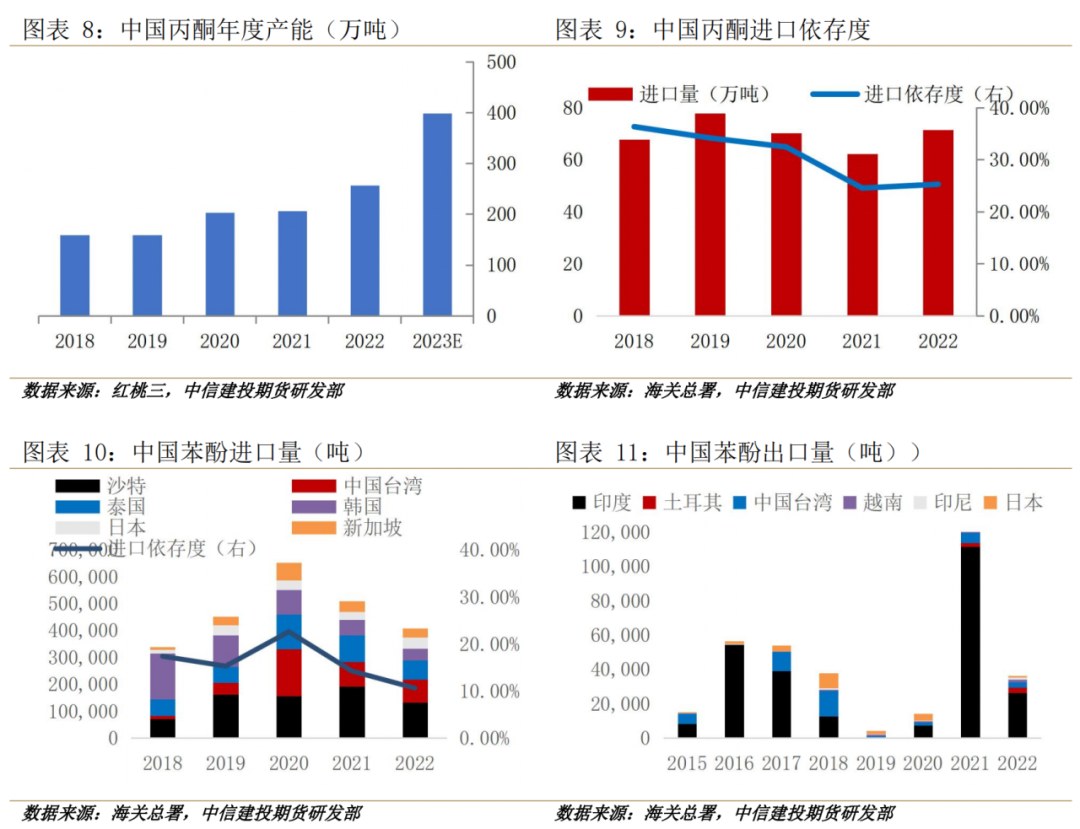

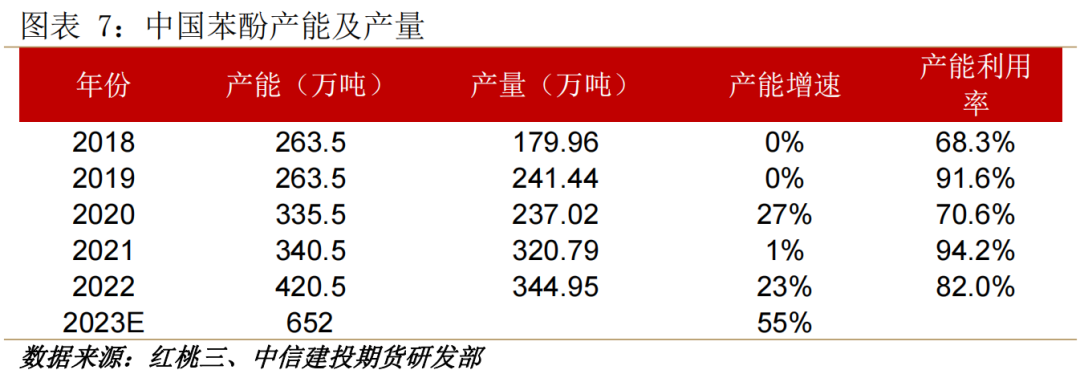

The raw materials of phenol are pure benzene and propylene. Generally, 0.92 tons of pure benzene and 0.505 tons of propylene are required to produce 1 ton of phenol. The intermediate product cumene is synthesized and oxidized to produce cumene hydrogen peroxide, which is then decomposed to obtain phenol and acetone. The main products of the cumene process are phenol and by-product acetone, the ratio of which is usually 1:0.62, I .e. 1 ton of phenol is produced and about 0.62 tons of acetone are produced at the same time. As of 2022, China's acetone production capacity will be 2.5 million tons, and it is estimated that by 2023, the acetone production capacity will be about 4 million tons. In 2022, the import volume was 715000 tons, and the import dependence was 25.26, which remained at a high level.

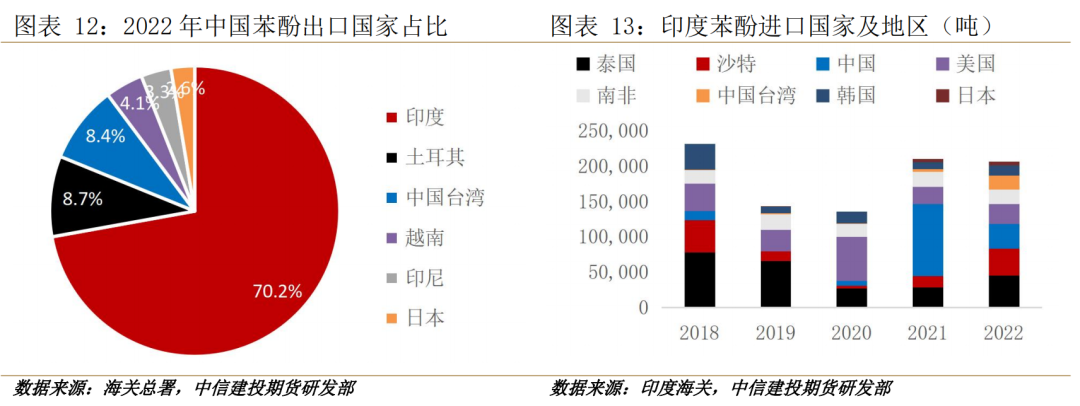

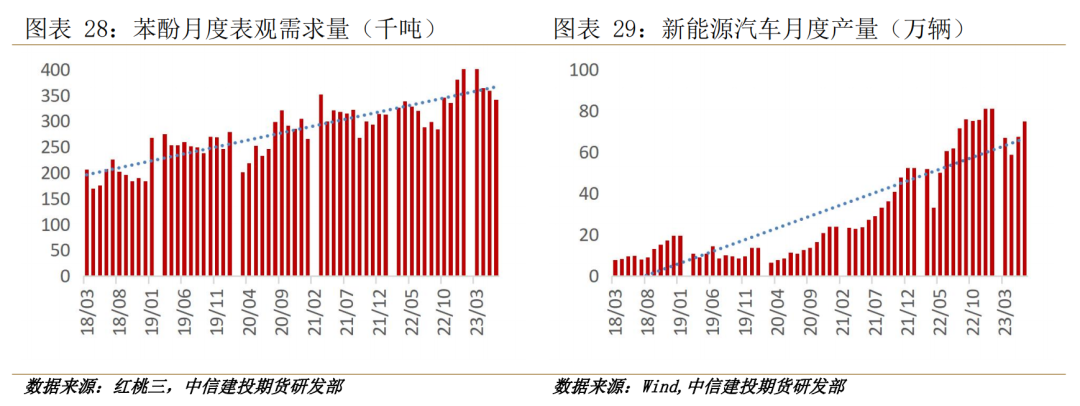

According to Hongtao III data, in the past five years, China's phenol production capacity has increased by an average of 10%, and the production utilization rate has averaged more than 80%. In 2022, the import volume of phenol is 409000 tons. The most important import region is Saudi Arabia, followed by Taiwan, China. In the past three years, with the expansion of production capacity, the import dependence has shown a relatively obvious downward trend, with the import dependence falling from about 25% to 10.6. On the other hand, in 2019, phenol exports have a trend of volume, with total exports exceeding 130000 tons in 2021, of which the most important increase is India, which is still the most important exporter of phenol to China by 2022, accounting for 70.2 percent.

According to Bloomberg data, India's domestic phenol production capacity is only 300000 tons, and its phenol mainly depends on imports. Due to changes in the anti-dumping duty policies of South Korea, Thailand, Singapore and other countries, India's imports from various countries have also shown a trend of ebb and flow. In terms of total volume, India's imports in the past five years have been between 15-250000 tons/year. According to Indian customs data, its cumulative phenol imports from January to May 2023 were 83000 tons, up 13% from January to May 2022. In the future, India and neighboring Southeast Asian countries will still be the new increase in China's phenol exports.

With the deepening of the integration of the phenol ketone-bisphenol A- PC industry chain, there is still room for compression of overall profits in the future.

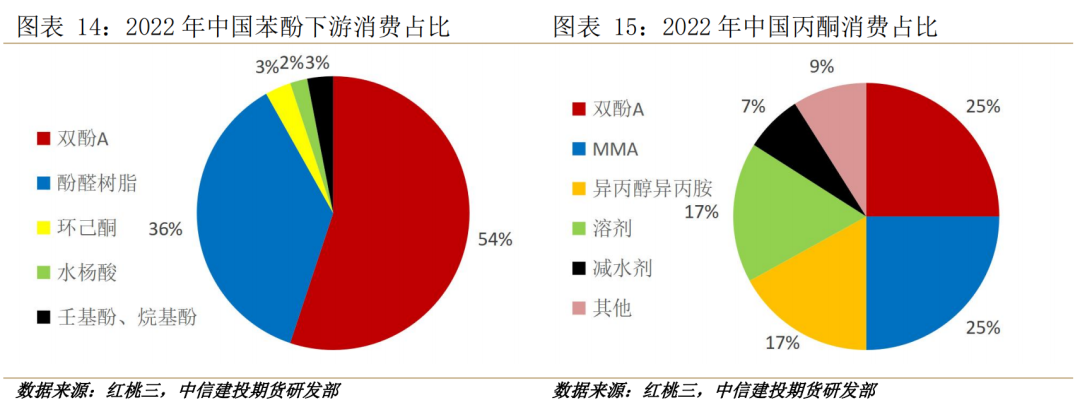

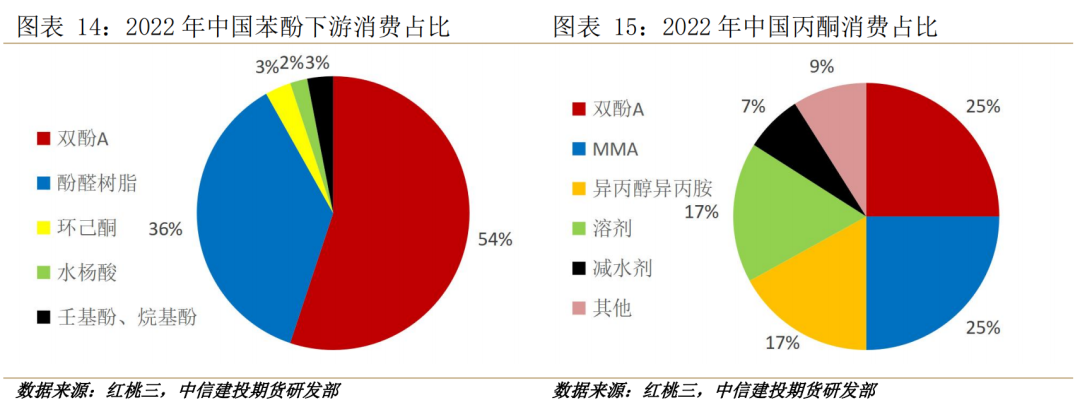

Returning to domestic demand, the largest proportion of phenol and acetone downstream in China is bisphenol A. Bisphenol A accounts for 54% in the downstream of phenol and 25% in the downstream of acetone. Other downstream of phenol involves phenolic resin and cyclohexanone. The remaining downstream of acetone includes MMA, solvent, isopropanol, etc. The end consumption field and real estate, electronic appliances, automobiles, plates, adhesives, etc.

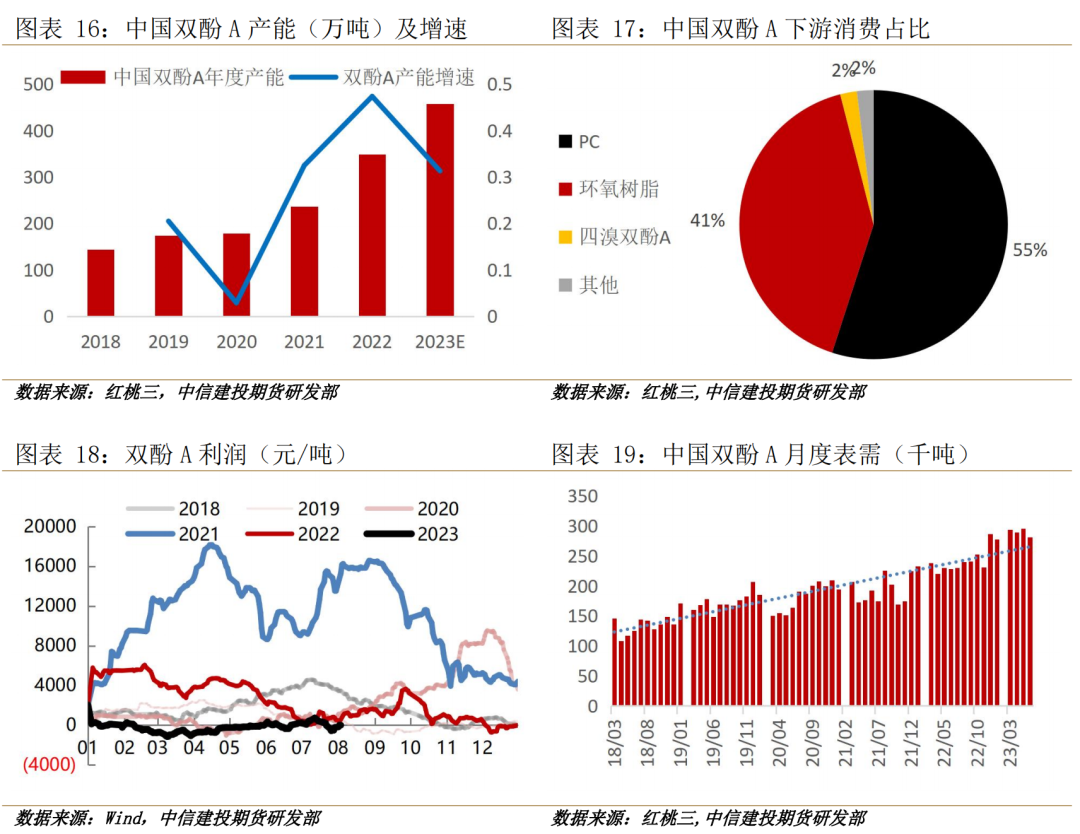

Bisphenol A is still the main source of future demand growth for phenol and ketone. Since 2019, it has shown a trend of rapid expansion. The production capacity will grow by nearly 50% in 2022. By the end of 2022, China's total production capacity will be about 350 tons. The rapid expansion of production capacity will also lead to a significant decline in the profit of bisphenol A in 2022. As shown in Figure 16, its average annual profit in 2022 will be 2360 yuan/ton, down nearly 80% from 10900 yuan/ton in 2021. In 2023, China's bisphenol A will still have more than 1 million tons of production capacity, when the total production capacity will exceed 4.5 million tons, the annual production capacity growth rate of 31%, when bisphenol A or will maintain a long-term low profit operation state.

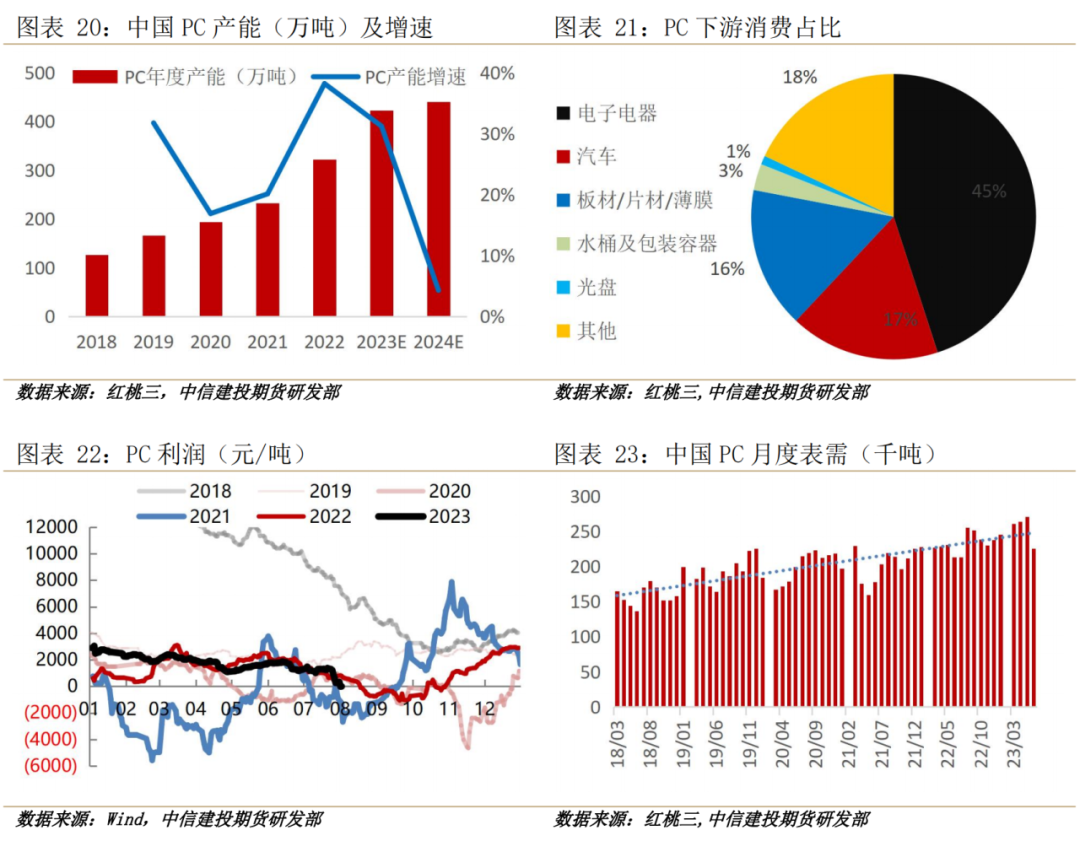

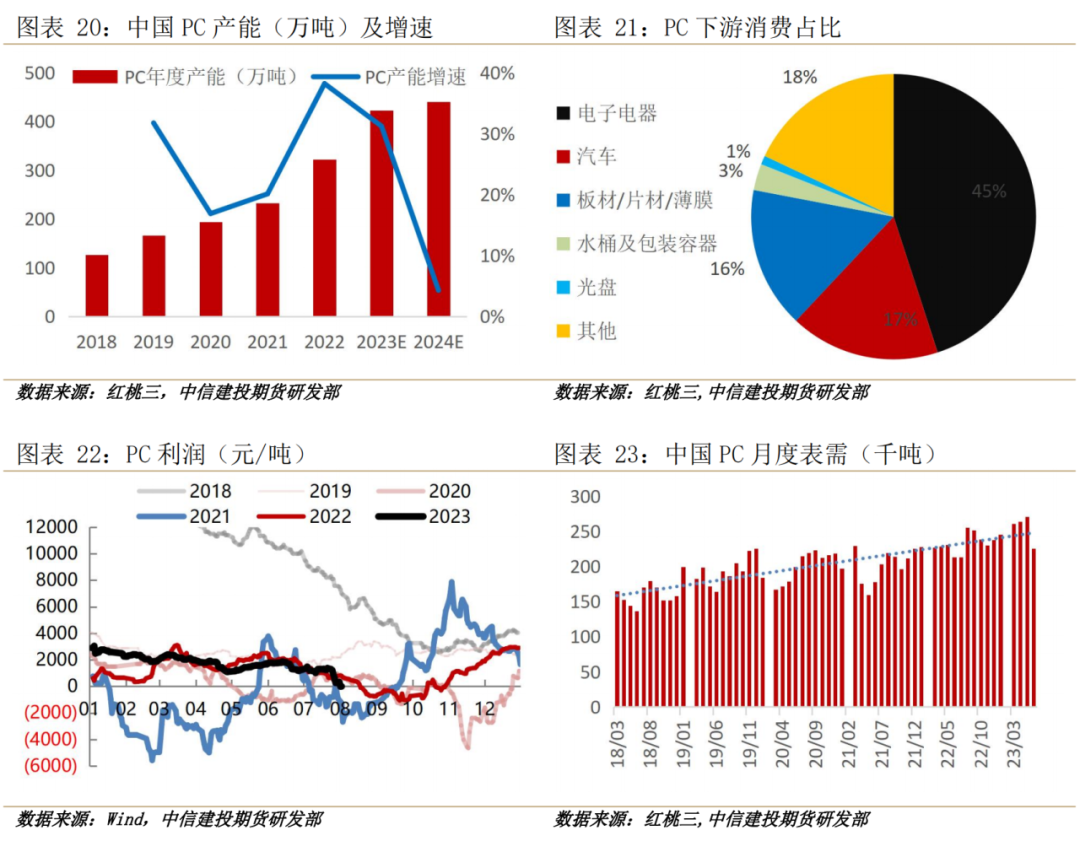

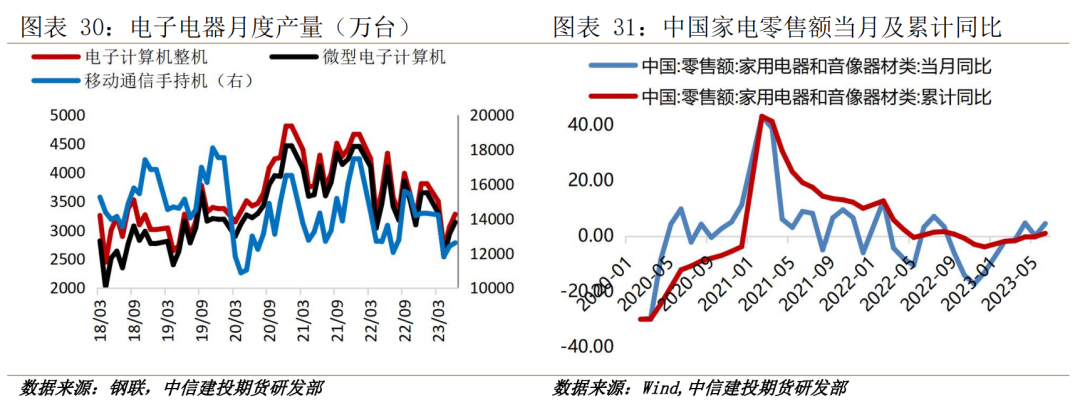

As the main downstream PC (polycarbonate) of bisphenol A, its average annual capacity growth rate since 2019 is about 25%, according to the three data of hearts, as of 2022, China's total PC capacity of 3.22 million tons, 2023 capacity growth rate is still nearly 30%, when the total capacity of more than 4.22 million tons, the subsequent capacity growth rate slowed down. PC production profits will fluctuate significantly in 2021 due to the impact of cost-end bisphenol A, and then in 2022 the price of bisphenol A will fall after the expansion, giving profits to PCs.

From the perspective of phenol ketone-bisphenol A- PC industry chain, the integration trend of China's phenol ketone industry chain is obvious. According to Hongtao III data, as of July 2023, the total production capacity of phenol is 5.03 million tons, of which only 63% are equipped with bisphenol A and 37.2 are equipped with bisphenol A and its downstream PC. It is expected that the integration proportion of phenol ketone industry chain will also increase with the commissioning of Dalian Hengli and Longjiang Chemical Industry.

Also with the integration of the industrial chain is becoming more and more perfect, the industrial chain profit since 2021 shows the overall compression, the current profit is more concentrated in the PC side. Price observations over the past five years have shown a high correlation between phenol and its primary raw material, pure benzene, while acetone as a by-product has no significant correlation with pure benzene.

Growth in demand for new energy vehicles, boosted by China's phenol capacity expansion in 2023

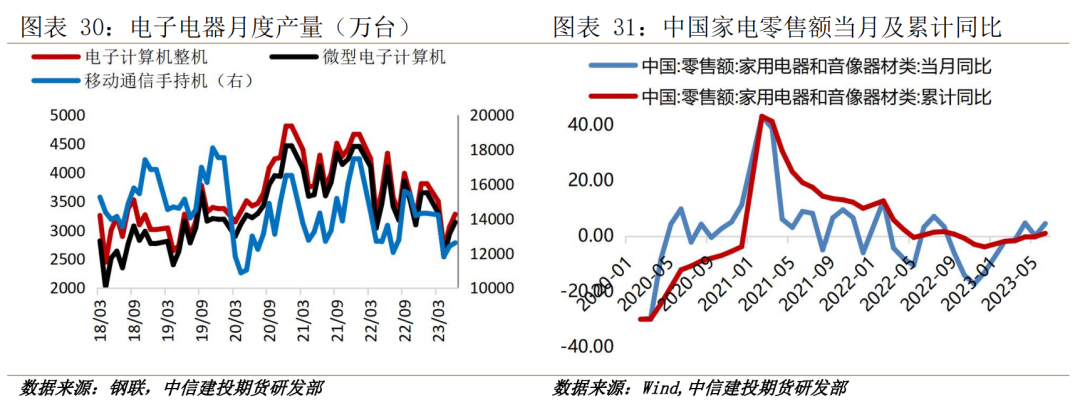

in the field of terminal consumption, at present, electronic appliances maintain a high proportion, computers, mobile phones, plug switches and other housings are mostly used to PC, this part of the monthly output in recent years to maintain fluctuations, demand growth is limited. It is worth paying attention to the automotive field, in which the lighting system, panel buttons and other components are related to PC, the development of new energy vehicles in recent years is the new demand for phenol ketone industry chain.

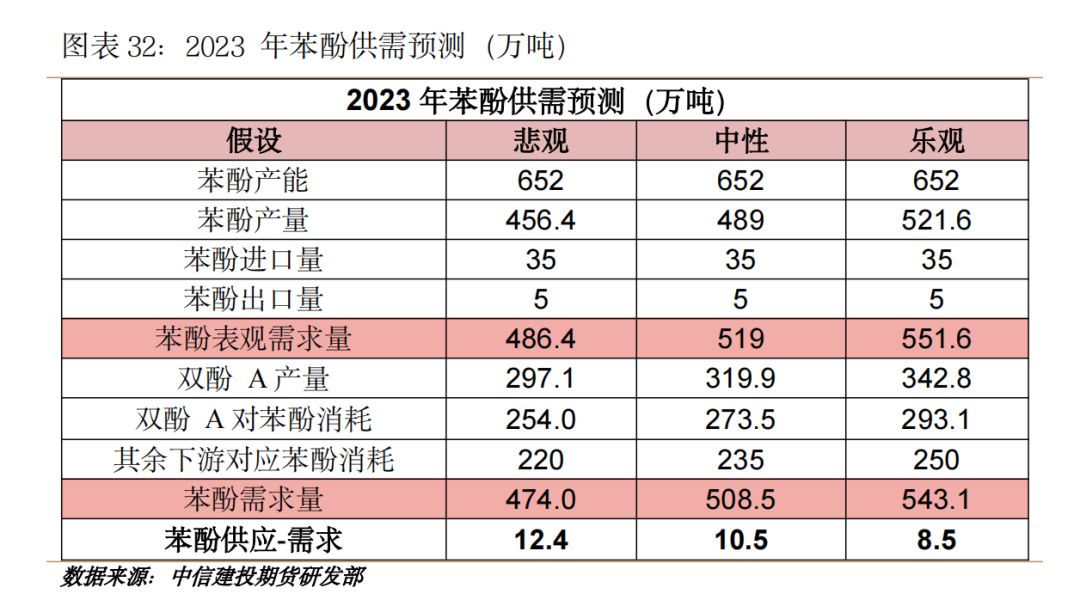

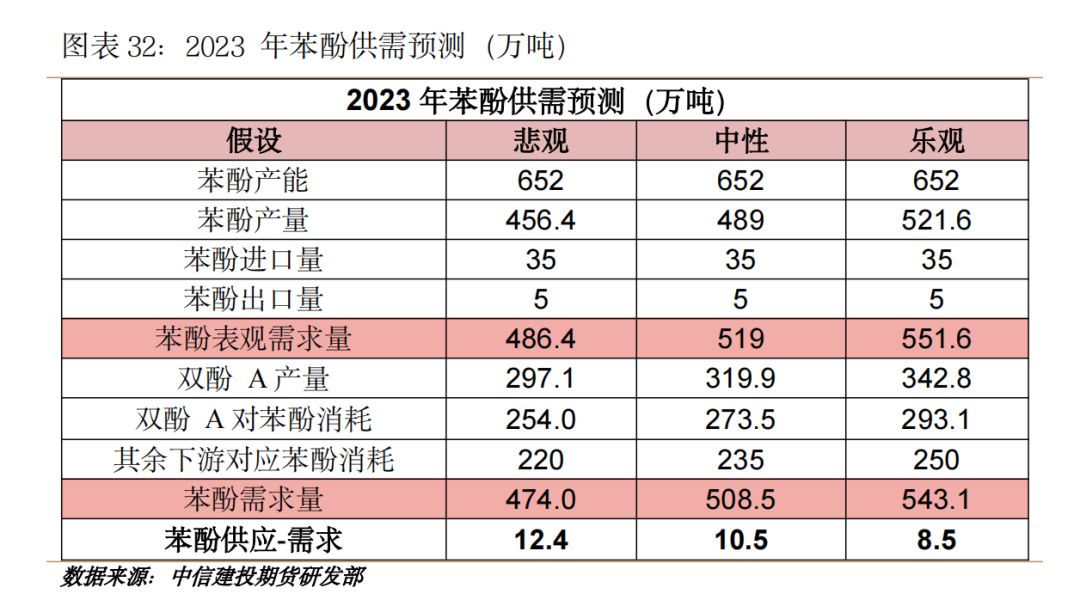

Combined with the growth rate of downstream bisphenol A and other production, we forecast the supply and demand of phenol in 2023.

Hypothesis 1: Under the pessimistic assumption, phenol, bisphenol A and other downstream operating rates are low, phenol operating rates fall to 70%, bisphenol A and other downstream operating rates fall to 65%, and under the condition of weak supply and demand, the corresponding oversupply of phenol is 124000 tons.

Hypothesis 2: Under the neutral assumption, the downstream operating rate of phenol, bisphenol A, etc. refers to the 2022 level, the average annual operating rate of phenol is 75%, the operating rate of bisphenol A is 70%, and the supply exceeds the demand by 105000 tons.

Assumption 3: Under the optimistic assumption, the operating rate of phenol is 80%, the downstream operating rate of bisphenol A is 75%, and the annual surplus of phenol is only 85000 tons under the condition of strong supply and demand.

Therefore, it is expected that although China's phenol production capacity will maintain a relatively high growth rate in 2023, the downstream bisphenol A and PC will also maintain a relatively high growth rate. With the increase in the output of new energy vehicles and the promotion of the policy of building protection, the growth of terminal demand will still support the phenol ketone-bisphenol A- PC industry chain, and the degree of phenol oversupply is not obvious for the time being. The degree of industrial chain integration deepens, the overall profit or with the rapid expansion of production capacity compression, profit will be distributed within the industrial chain.

Mainly

Mainly

Polyurethane

Polyurethane

Fine Chemical

Fine Chemical

.png)