Affected by the cold weather in the United States and the supply interruption of major oil producing countries in the world, the price of hit a seven-year high on Friday (4th), and the weekly line rose for the seventh consecutive week.

Brent crude oil futures rose $2.16, or 2.4%, to settle at $93.27 a barrel, earlier hitting the highest level of $93.70 since October 2014. U.S. crude oil futures closed up $2.04, or 2.3%, at $92.31 a barrel, after rising to $93.17 during the session,

the highest since September 2014. international crude oil actual production capacity is insufficient, has become the current crude oil market's biggest concern. Data show that since the beginning of December last year, crude oil prices have been rising all the way, Brent and WTI crude oil settlement prices rose by 33.11% and 40.93% respectively. was hit by a winter storm Texas, more than 5000 flights across the United States were canceled, and about 350,000 users were cut off, causing investors to worry about the impact on production in the nation's largest shale oil producing area in Texas. In addition, the tension between Russia and Ukraine makes it difficult to remove geopolitical risks, which will continue to play a role in oil prices, or lead to further tightening of crude oil supply. the

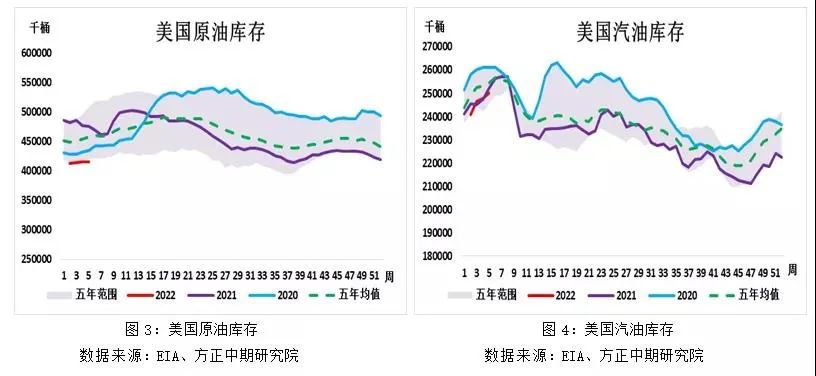

inventory side, the U.S. Energy Information Administration (EIA) data show that as of the week of January 28, U.S. crude oil inventories fell by 1 million barrels to 0.41514 billion barrels, with the exception of Russia, the world's new proven oil and natural gas reserves last year hit the lowest level since 2008. The market is generally worried that the cold weather in the United States may affect production and inventories may continue to decline, which will support oil prices. On the

-demand side, due to strong manufacturing and freight activity, U.S. distillate demand has been running for months at pre-neo-neo-outbreak levels.

However, on February 7, local time, the United States said it was possible to reach an agreement with Iran on the Iranian nuclear negotiations, provided that the agreement must be reached as soon as possible in the next few weeks.

news, crude oil varieties from the high down, the main crude oil contract fell more than 2%, the price returned to 560 yuan/barrel below, the New York Mercantile Exchange WTI March crude oil spot contract closed down $0.99, to $91.32/barrel, down 1.07%. The Intercontinental Exchange Brent April crude oil spot contract closed down $0.58, or 0.62% percent, at $92.69 a barrel. Shanghai crude oil prices fell overnight, the main period of about SC2203 closed at 556.5 yuan/barrel, down 10.4 yuan/barrel, down 1.83%.

The current crude oil market, whether it is market supply or tight geopolitical situation, has provided a strong boost to the rise in oil prices, and last week's U.S. non-agricultural data is relatively strong, crude oil continues to be strong consolidation is likely to be greater.

,

let's take a look at some international information affecting crude oil: (1) Global oil terminal consumption continues to pick up. The latest high-speed mileage released by the U.S. Department of Transportation in

shows that the absolute value of the mileage for the week of January 16 was 0.1% higher than that of the same period in 2019. As of the week of February 2, terminal road traffic in Europe, North America and Asia Pacific all bottomed out, supporting the price difference of refined oil cracking and crude oil prices. (2)OPEC + agreed to increase production by 400,000 barrels per day in March, global crude oil supply is still at risk of supply disruption. According to a Bloomberg survey, OPEC's 13 member countries increased their production by only 50,000 barrels per day in January, as the small increase in the group as a whole was offset by a decline of 140,000 barrels per day in Libya. EA attributed most of the shortfall to reduced supplies from Nigeria and Russia, which are below their monthly quota. In a brief meeting on February 2, OPEC + passed a plan to increase nominal production by 400,000 barrels per day in March. (3) Winter storms swept through the central United States, and the severe cold weather in the United States has spread from the southern Midwest to Texas. Local crude oil production in Texas fell 4000 bpd

to the shutdown of some refineries

. At the same time, bad weather is causing a surge in fuel demand. The United States imported more diesel from Russia this month than it has for at least three years. About 1.55 million barrels of diesel are being shipped from Russia to the United States and will arrive in February, reaching the highest level in three years. (4) low inventory pattern continues. EIA report shows that U.S. crude oil stocks fell 1.04 million barrels in the week of January 28. API crude oil inventory decreased by 1.645 million barrels, expected to increase by 1.833 million barrels, the previous value decreased by 872,000 barrels; Cushing inventory fell by 1.17 million barrels; Gasoline inventory increased by 2.11 million barrels; Distillate oil inventory fell 2.41 million barrels, excluding SPR, total oil inventory fell 5.8 million barrels, good for oil prices. Some industry insiders in the have analyzed that the continued violent rise in international oil prices has recently seen a short-term decline, indicating that the current adjustment trend is still not over. Yesterday's upward rush was blocked and fell. In the past two days, it will be dominated by interval shocks, and later on the 92.40, the long upward trend will reappear.

Source: Material Viewpoint, Chaos Tiancheng Research, Hedge Research Investment * Disclaimer: The content contained in the content comes from the Internet, WeChat public number and other public channels, we maintain a neutral attitude towards the views in the article. This article is for reference only. The copyright of the reprinted manuscript belongs to the original author and the organization. If there is any infringement, please contact Huayi Tianxia Customer Service to delete

Mainly

Mainly

Polyurethane

Polyurethane

Fine Chemical

Fine Chemical

.png)