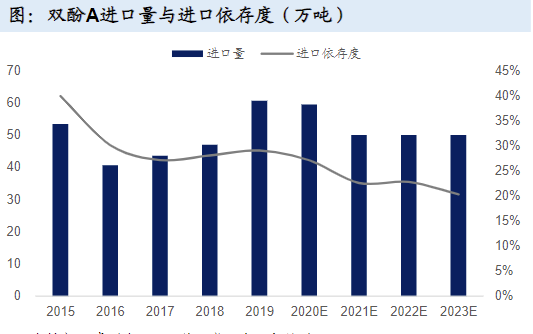

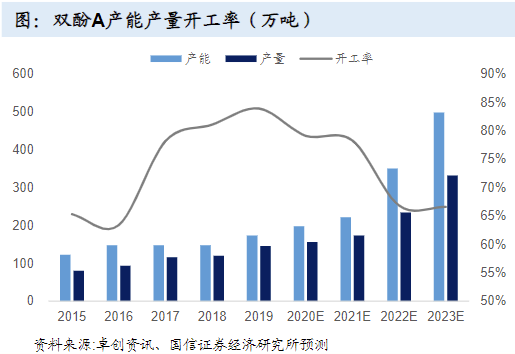

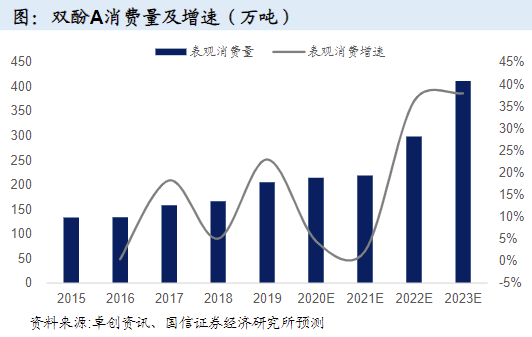

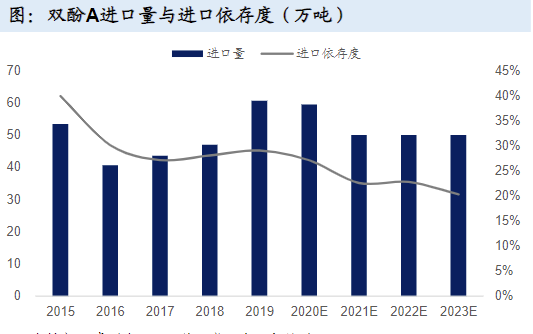

2015-2021, China's bisphenol A market production continued to grow, the development of more stable. In 2021, China's bisphenol A market output is expected to reach about 1.7 million tons, and the comprehensive operating rate of the major units of bisphenol A is about 77%, which is at a high level. It is expected that the annual output is expected to gradually increase from 2022 onwards, with the successive commissioning of the BPA plant under construction. In 2016-2020, China's bisphenol A imports grew slowly, and the import dependence of bisphenol A market was close to 30%. It is expected that with the substantial increase in domestic production capacity, the import dependence of bisphenol A is expected to continue to decline. bisphenol A downstream demand structure is concentrated, mainly used to make PC and epoxy resin, almost half of the proportion. The apparent consumption of bisphenol A is expected to be about 2.19 million tons in 2021, up 2% year-on-year. In the future, with the downstream PC and epoxy resin new devices are put into production, the market demand for bisphenol A is expected to increase significantly.

PC new capacity is more, driving the growth of bisphenol A market demand. China is an importer of polycarbonate, and there is an urgent need for import substitution. According to Baichuan Yingfu statistics, in 2020, China's PC output was 819,000 tons, down 19.6% from the same period last year, the import volume was 1.63 million tons, up 1.9% from the same period last year, the export volume was about 251,000 tons, the apparent consumption was 2.198 million tons, down 7.0% from the same period last year, and the self-sufficiency rate was only 37.3%. China's PC import demand is urgent. in

January-October 2021, China's PC production 702,600 tons, down 0.38% YoY, domestic PC imports 1.088 million tons, down 10.0% YoY, exports 254,000 tons, up 41.1% YoY, with China's new PC production capacity gradually put into production, import dependence is expected to continue to improve., wind power industry, electronic materials and other industries drive epoxy resin to continue to expand. The main application fields of domestic epoxy resin are coatings, composite materials, electronic appliances and adhesives. In recent years, the application proportion of each part has basically remained stable, accounting for 35%, 30%, 26% and 9% respectively. The

of predicts that in the next 5 years, in many downstream application fields of epoxy resin, composite materials and capital construction epoxy resin will become the main areas to support the growth rate of epoxy resin production. The demand for wind power continues to increase. The construction and maintenance of high-speed railways, highways, and subways and airports in the development and construction of urbanization will promote the development of epoxy resin. Especially with the promotion of "the belt and road initiative", the demand for epoxy resin will be greatly increased. PCB industry is the main downstream application of epoxy resin in the field of electronics and electricity. The core material of PCB is copper clad laminate, and epoxy resin accounts for about 15% of the cost of copper clad laminate. With the rapid evolution of new generation information technologies such as big data, Internet of Things, artificial intelligence, and 5G, as the basic material of the electronics industry, it is expected that the demand and growth rate of copper clad laminate will expand year by year. The bisphenol A market in

is in a high boom cycle. We assume that the downstream demand for bisphenol A will be put into production on schedule. At present, the downstream epoxy resin of bisphenol A market has 1.54 million tons of production capacity under construction and PC has 1.425 million tons of production capacity under construction. These production capacity will be put into production in the next 2-3 years, which will have a strong boost to the demand for bisphenol A. On the supply side, the bisphenol A market itself to maintain a reasonable growth, the current bisphenol A production capacity under construction has 2.83 million tons, these production capacity in 2-3 years have been put into production, since then the industry growth mainly to integrated development, a single set of equipment to be put into production alone reduced, the industry growth rate fell to a reasonable level. the

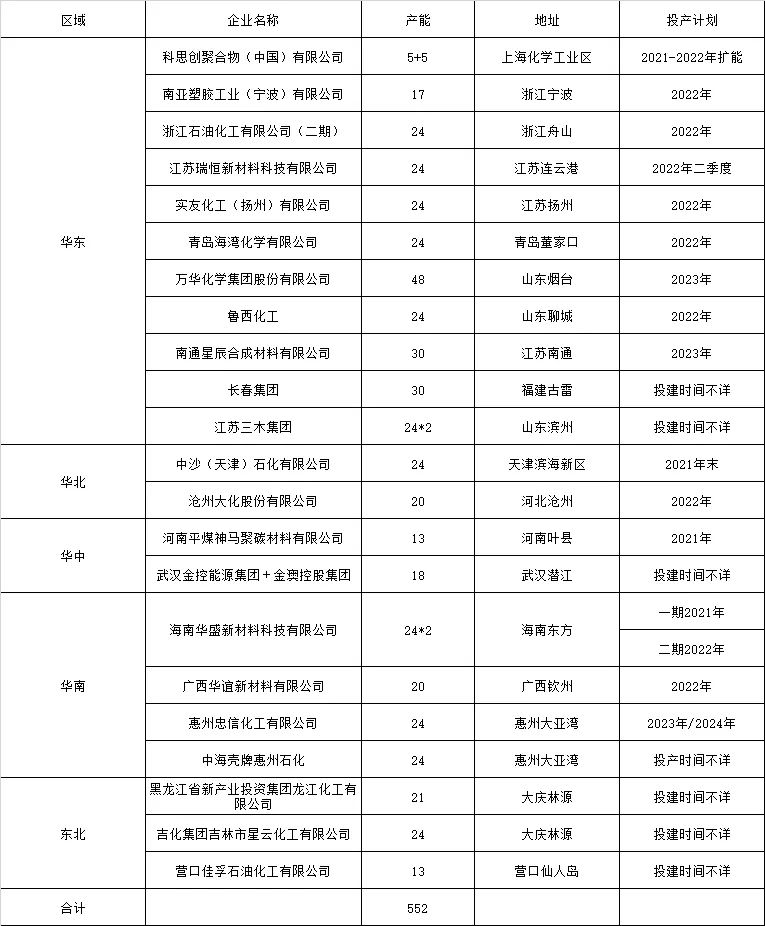

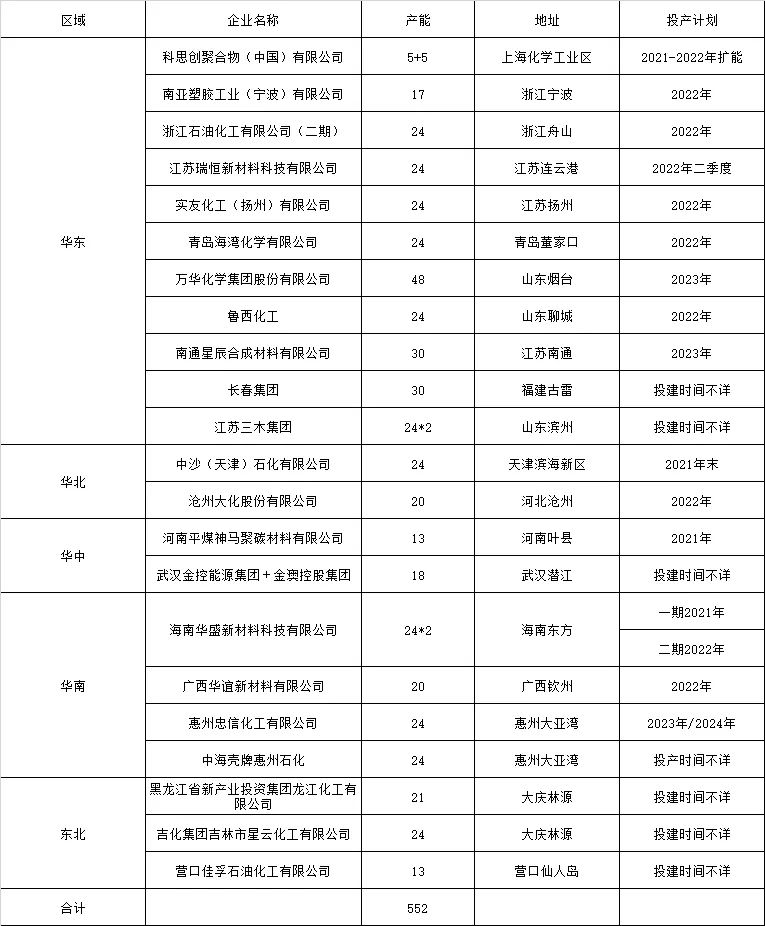

2021-2030 China bisphenol A market to be under construction projects still have 5.52 million tons/year, which is 2.73 times the production capacity of 2.025 million tons/year at the end of 2020. It can be seen that the future bisphenol A market competition will become more fierce and the market supply and demand contradiction will be reversed. Especially for newly entered enterprises, the project operation and marketing environment will become increasingly fierce.

As of the end of 2020, there were 11 domestic bisphenol A market enterprises with a production capacity of 2.025 million tons, of which 1.095 million tons were foreign-funded enterprises, 630,000 tons were private enterprises, and 300,000 tons were joint ventures, accounting for 54%,31% and 15% respectively. From 2021 to 2030, the total production capacity of China's bisphenol A market planning and projects under construction is 5.52 million tons, which is still concentrated in East China. However, with the expansion of downstream PC industry, the production capacity in South China, Northeast China and Central China will also increase significantly. At that time, the distribution and coverage of domestic bisphenol A production capacity will be more balanced. At the same time, with the gradual production of the project, the current situation that the supply of bisphenol A market is less than the demand will gradually ease, and anticipates an excess of resources. List of Bisphenol A Plant to be Built (2021-2030) Unit: 10,000 Tons/Year

Source: Longzhong Information

2010-202020With the expansion of bisphenol A market capacity, production showed a significant growth trend, during which the compound growth rate of production capacity was 14.3%, and the compound growth rate of production was 17.1%. The industry operating rate was mainly affected by the market price of the year, the industry profit and loss situation and the production time of new units, with the operating rate reaching a peak 85.6% in 2019. After 2021, with the coming of a new wave of bisphenol A capacity expansion, the oversupply of bisphenol A industry has intensified. It is estimated that the operating rate of China's bisphenol A market will show a downward trend in 2021-2025. The reasons for the decline in the operating rate are:,

1.2021-2025, China's bisphenol A plants will be added year by year, while the output will be released later than the production capacity, resulting in a decline in the operating rate in 2021-2025. 2.

2. Affected by the intensification of the contradiction, the industry's high profit situation is gradually disappearing, subject to production costs and profits, and low production intentions during the loss period; 3. The company has annual routine maintenance, ranging from 30 to 45 days, which affects the industry's operating rate.

Table 1 Production Capacity and Operating Rate of Bisphenol A (2010-2025)

Source: Longzhong Information

In the future capacity growth and operating rate decline data expectations, the future project operation risk significantly increased. From the perspective of

industry concentration, the proportion of CR4 production capacity will 68% in 2020and will drop to 27% in 2030, which shows that the number of participants in the bisphenol A market will increase significantly, and the position of leading enterprises in the industry will decline significantly. At the same time, due to the concentrated downstream demand of bisphenol A mainly in epoxy resin and polycarbonate, the field distribution is concentrated and the number of large customers is limited. In the future, the competition degree of bisphenol A market will intensify. In order to ensure market share, enterprises will specify sales strategies more flexibly.

Table 2 Analysis of Bisphenol A Industry Concentration

Source: Longzhong Information

in terms of

market supply and demand, after 2021, the bisphenol A market will once again usher in the expansion trend, especially in the next 10 years, the bisphenol A market capacity compound growth rate of 9.9%, while the downstream consumption compound growth rate of 7.3%, bisphenol A market overcapacity, oversupply contradictions highlighted, some poor competitiveness of bisphenol A production enterprises may face the follow-up shortage of work, equipment utilization is insufficient.,

in the future capacity growth and operating rate decline data expectations, the future project resource flow and downstream consumption direction has become the main focus of existing and future projects. China's downstream consumption of bisphenol A is mainly composed of epoxy resin and polycarbonate, with the largest proportion of epoxy resin consumption in 2015-2018, but with the expansion of PC production capacity, the proportion of epoxy resin consumption is on a downward trend. In 2019-2020, PC production capacity was concentrated and expanded, while epoxy resin production capacity was relatively stable, with PC accounting for more than epoxy resin, and PC consumption accounted for as much as 49% in 2020, making it the largest downstream. At present, China has excess production capacity of basic epoxy resin, and it is difficult to break through high-quality and special resin technology. However, due to the development of wind power, automobile, electronic and electrical, and infrastructure construction, the consumption of basic epoxy resin and polycarbonate has maintained a good growth momentum. From 2021 to 2025, although high-quality and special epoxy resin and PC will expand simultaneously, the scale of PC expansion will be larger, and the unit consumption ratio of PC will be much higher than that of epoxy resin. Therefore, it is expected that the proportion of PC consumption will further expand to reach 52% in 2025. Therefore, from the perspective of downstream consumption structure, PC devices will be the focus of future bisphenol A projects. However, it should be noted that the upstream of the new PC device is mostly matched with bisphenol A, so the direction of epoxy resin still needs to be an important supplementary concern. In terms of the main consumer markets of

, since there are no large-scale bisphenol A market manufacturers and no large-scale downstream consumer enterprises in the northwest and northeast, there is no key analysis here. East China is expected to change from insufficient supply to oversupply in 2023-2024. North China has always been oversupplied. Central China has always maintained a certain supply gap. The South China market changed from oversupply to oversupply in 2022-2023 and to severe oversupply in 2025. It is estimated that by 2025, the bisphenol A market in China's major regions will mainly consume surrounding resources and compete at low prices to seize the market. It is suggested that bisphenol A enterprises can take export as the main consumption direction when considering the surrounding and low-cost outflow to the main consumption places. Table 3 BPA Supply and Demand Balance by Region

Source: Longzhong Information

Source: PC Polycarbonate Industry Chain * Disclaimer: The content is from the Internet, WeChat public account and other public channels, we maintain a neutral attitude towards the views in this article. This article is for reference only. The copyright of the reprinted manuscript belongs to the original author and organization. If there is infringement, please contact Huayi Tianxia Customer Service to delete the.

Mainly

Mainly

Polyurethane

Polyurethane

Fine Chemical

Fine Chemical

.png)