Introduction:

International oil prices rose for nine consecutive weeks, WTI exceeded 85 US dollars, and international crude oil hit a 7-year high.

A series of more than ten articles, the National Development and Reform Commission directly pointed to coal prices, coal supply stability price initial results, coal PP, PE prices fell sharply.

WTI Breaks US $85, International Crude Oil Hits 7-Year High

on October 25, continuing the momentum before the weekend, international oil prices continued to rise on Monday. The price of WTI crude oil in the United States fluctuated sharply during the session. At the beginning of the session, it rose sharply and broke through US $85 per barrel, closing flat and setting a 7-year high. At the same time, Brent Crude oil futures also climbed to a 7-year high. Compared to the pre-epidemic oil price highs, oil prices in October 2019 were about $60 and have now risen by more than 40%.

, the price difference between Brent crude oil futures and WTI continues to narrow, from nearly $4 a barrel earlier this month to about $1.30 a barrel this Monday, which means that the U.S. crude oil supply is tight and the Cushing area crude oil inventory continues to decline.

With the gradual popularization of global vaccines, the economy has steadily recovered from the new crown epidemic and has driven strong demand, with major economies in the northern hemisphere and major energy demand countries such as China, the United States, the European Union and Japan gradually entering the winter, and global energy demand has increased significantly and supply tensions have intensified. Coupled with the recent shortage of global shipping capacity, it has also pushed up transportation costs.

According to Reuters, concerns about the shortage of energy supplies (coal and natural gas) in China, India and Europe have stimulated people to switch to diesel and fuel oil to generate electricity, thus supporting oil prices. Saudi Arabia's crown prince said on Saturday (23) that Saudi Arabia's goal is to achieve "net zero emissions" of greenhouse gases by 2060, 10 years later than the United States. However, a report by Baker Hughes Co, a US energy service company, said on Friday that despite the rise in oil prices, the number of active oil and gas rigs by US energy companies last week still fell for the first time in seven weeks.

The National Development and Reform Commission controls coal prices, coal-based PP and PE impact geometry

On October 25, after pushing more than ten articles to stabilize coal prices a few days ago, the National Development and Reform Commission once again issued four articles to urge the coal market to return to rationality. Specifically:

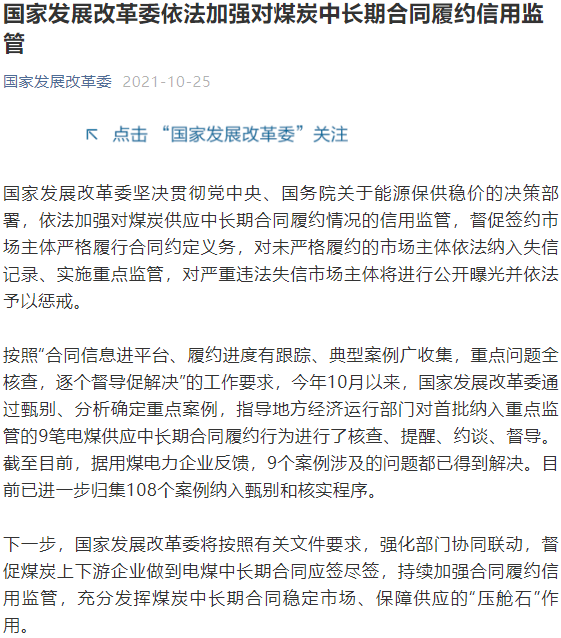

First, the National Development and Reform Commission resolutely implements the decision-making and deployment of the Party Central Committee and the State Council on energy supply and stable prices, strengthens the credit supervision of the performance of coal supply medium and long-term contracts in accordance with the law, and urges the contracted market entities to strictly perform their contractual obligations. Market entities that have not strictly performed the contract shall be included in the untrustworthy records and implemented key supervision, and serious violations of the untrustworthy market entities will be publicly exposed and punished in accordance with the law.

the second

is that the National Development and Reform Commission, in accordance with regulations, has initiated an assessment and compliance review of coal and other energy price indices.

the third is that since October 5, the national unified power plant coal supply has been more than coal consumption for 20 consecutive days. On October 24, the unified power plant supplied 7.14 million tons of coal, and the power plant stored 95.69 million tons of coal, an increase of 17 million tons over the end of September, which can last for 17 days. With the further release of coal production capacity and the completion of the overhaul of the Daqin line, the coal supply of the power plant will be further upgraded.

Fourth, in order to implement the Party Central Committee and the State Council's series of arrangements and arrangements, and do a good job in the safe and stable supply of electric power this winter and next spring, the responsible comrades of the Department of System Reform of the National Development and Reform Commission recently led a team, and the relevant staff of the Department of System Reform and the Operation Bureau participated. The National Energy Group, Huaneng Group, Datang Group, China Coal Group and other investigations and docking central enterprises' coal production and supply work.

Value of the Note that since October 19, the National Development and Reform Commission has successively issued more than ten articles. Judging from the four articles released on the 24th, coal supply and price stabilization have achieved initial results. Datong, Shuozhou, Mengdong, Ordos, Yulin, Tongchuan, etc. Many coal mines have taken the initiative to reduce the sales price of coal pithead, with the price reduction above 100 yuan/ton, with the highest price reduction reaching 360 yuan/ton.

the key areas (Shanxi, Shaanxi and Mongolia) and coal enterprises actively play a leading role, requiring coal enterprises to stabilize prices and reduce prices, curb coal prices from rising too fast, and maintain the stable operation of the coal market. At present, Qinhuangdao Port has increased the supply and transportation of spot coal, and the supply price is 1190-1200 yuan/ton.

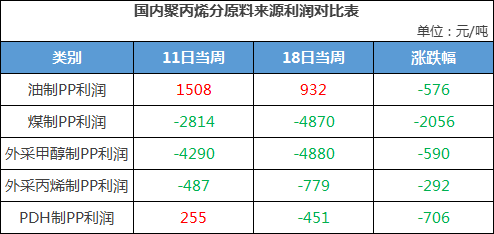

, by the NDRC's focus on coal prices and methanol, thermal coal plate continuous decline and pressure, the PP, PE market began to enter the Waterloo-style decline mode.

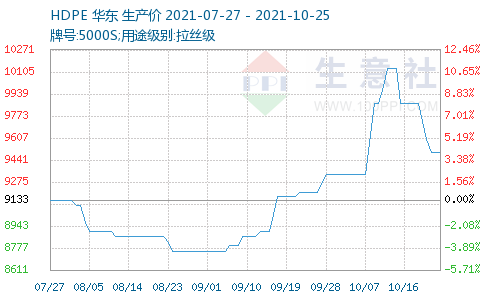

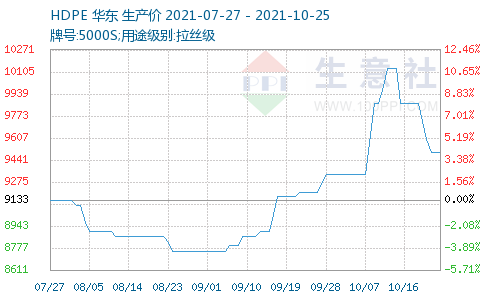

Polyethylene (PE): The domestic PE market suppressed downward, with some brands falling 50-450 yuan per day. Raw material costs are negative, coal is down, crude oil is weak and volatile, market confidence is frustrated, manufacturers' quotations are lowered, and spot prices are down.

East China linear material 7042 yuan/ton mainstream material 9400 yuan/ton, down 300 yuan/ton; East China high pressure 2426H mainstream material 13000 yuan/ton, down 250 yuan/ton; South China low pressure wire drawing material 5000S mainstream price 9650 yuan/ton, down 100 yuan/ton.

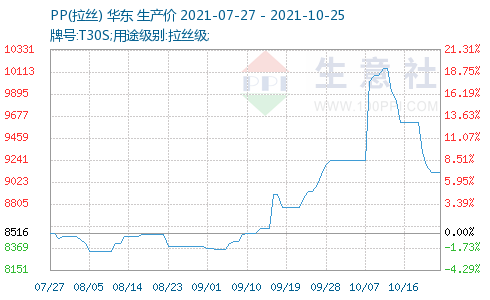

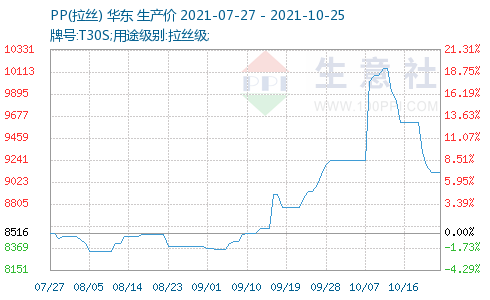

Polypropylene (PP): The domestic PP spot market fell sharply, with some brands falling 50-350 yuan/ton per day. Thermal coal fell, market panic increased. Petrochemical plants significantly cut factory quotations, traders followed, market prices quickly down.

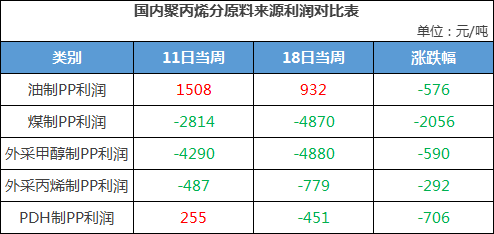

the previous, due to coal prices too fast high, coal PP October average cost of 13838 yuan/ton, month-on-month growth rate of 32.78%, year-on-year growth rate of 116.49%. The rapid rise in the cost of coal-based PP has put pressure on enterprises, and most coal-based enterprises have been squeezed by high costs, resulting in a serious contraction in profits.

the average profit of coal-based PP in October in

fell 145.18% month-on-month, down 160.92% from the average profit in the same period last year. It can be seen that the shrinking profit of coal-based PP has become an obvious representative of the high cost of PP market squeezing the profit of manufacturers.

Statement: The content of this article is reprinted from the eighth element. Some of the materials come from business news, Longzhong information, looking for plastic viewpoints, etc. Personal opinions are for reference only. Please contact the authorization and indicate the source for reprinting. If you have any questions, please contact us first, we will deal with them as soon as possible.

Mainly

Mainly

Polyurethane

Polyurethane

Fine Chemical

Fine Chemical

.png)