Read: 227

Time:16months ago

Source:Chemical flat head brother

Overview of overall 1. health

in 2024, the overall operation of China's chemical industry is not good under the influence of the general environment. The profit level of production enterprises generally decreased, the orders of trading enterprises decreased, and the pressure of market operation increased significantly. In order to seek new development opportunities, many enterprises strive to open up overseas markets. However, the current global market environment is also weak and fails to provide sufficient growth momentum. Overall, China's chemical industry is facing greater challenges. Analysis of the profitability of bulk chemicals in 2.

In order to gain insight into the operation of China's chemical market, a survey of 50 bulk chemicals was conducted to analyze the industry average profit margin level and its year-on-year change rate from January to September 2024.- Distribution of profitable and loss-making products: among the 50 bulk chemicals, there are 31 profitable products, accounting for about 62%; There are 19 loss-making products, accounting for about 38%. This shows that although most products are still profitable, the proportion of loss-making products cannot be ignored.

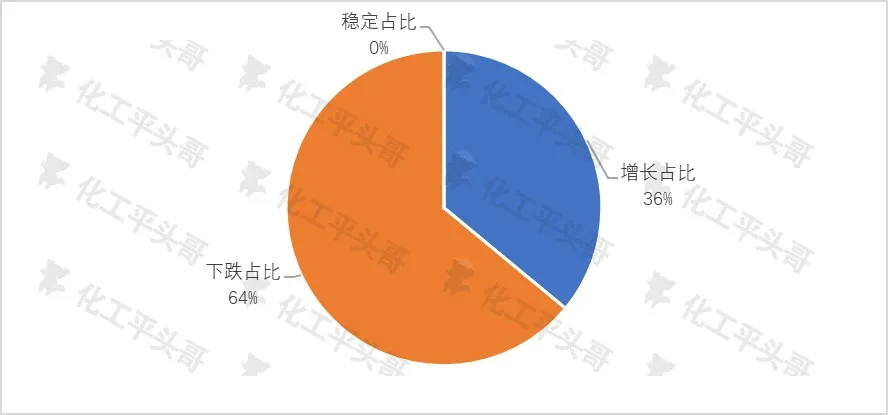

Figure 1 The proportion of the break-even distribution of the top 50 chemicals in China in 2024.

- Year-on-year change in profit margin: from the year-on-year change rate, the profit margin of 32 products fell, accounting for 64%; only 18 products saw a year-on-year increase in profit margin, accounting for 36%. This reflects that the overall situation this year is significantly weaker than last year. Although the profit margins of most products are still positive, they have declined compared with last year, and the overall performance is not good.

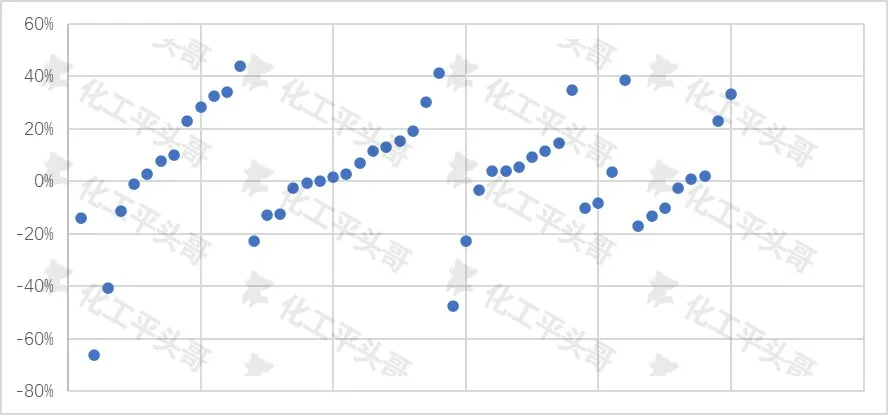

Figure 2 Distribution of year-on-year growth in profit margins of China's top 50 chemicals in 20243. profit margin level distribution

- profit margin of profitable products: the profit margin level of most profitable products is concentrated in the 10% range, and the profit margin level of a few products is above 10%. This shows that although the overall performance of China's chemical industry is profitable, the level of profitability is not high. Taking into account financial expenses, management expenses, depreciation and other factors, the profit margin level of some enterprises may further decline.

- Profit margin of loss-making products: for loss-making chemicals, most of them are concentrated in the loss range of less than 10%. If the enterprise is an integrated project and has its own raw materials, it is still possible for a small loss-making product to be profitable.

Figure 3 Profit margin distribution of China's top 50 chemicals in 2024

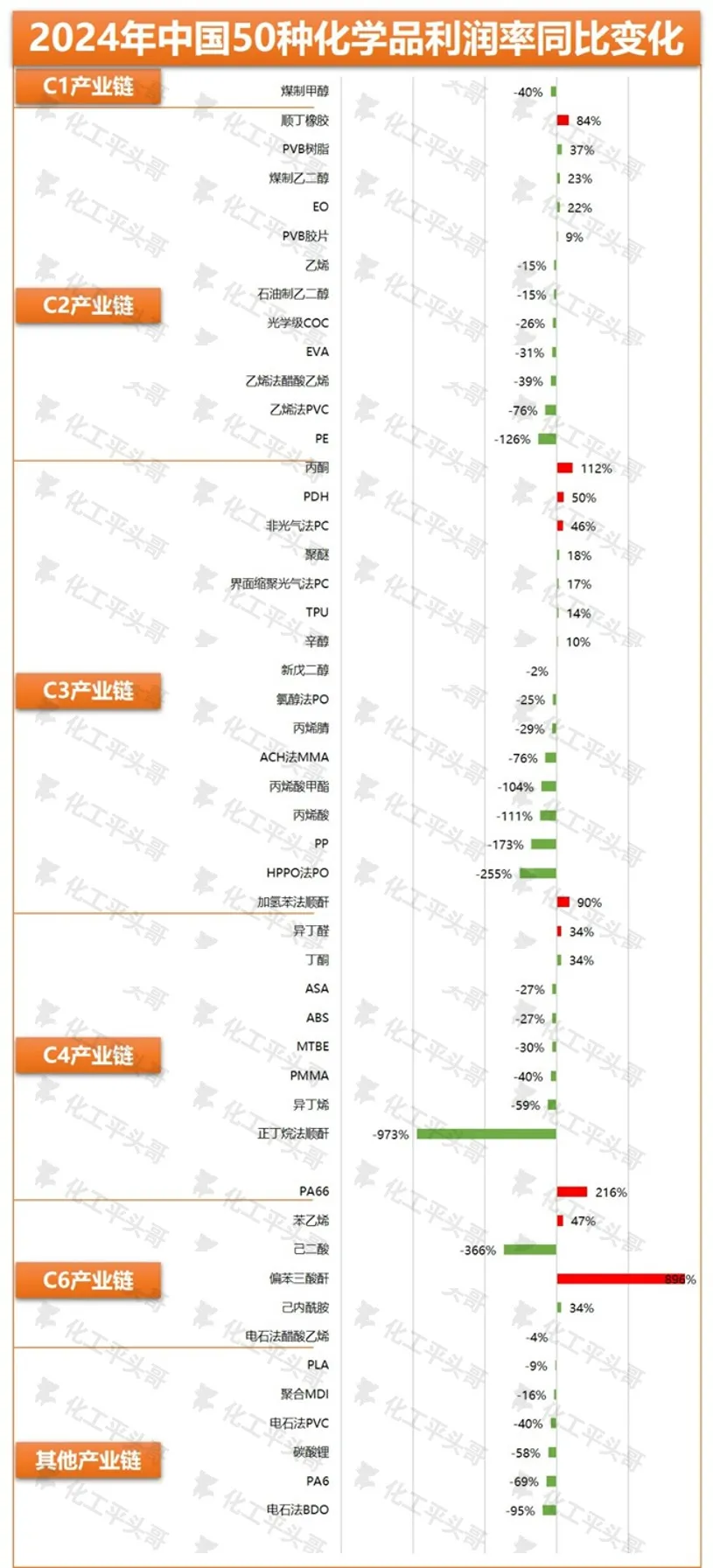

comparison of profitability of 4. industry chain

figure 4 Comparison of profit margins of China's top 50 chemicals in 2024 based on the average profit margin level of the industry chain to which the 50 products belong, we can draw the following conclusions:- high profit products: PVB film, octanol, trimellitic anhydride, optical grade COC and other products show strong profit characteristics, with an average profit margin of more than 30%. These products usually have special properties, or are in a relatively lower position in the industry chain, with weak competition and relatively stable profit margin space.

- Loss products: petroleum to ethylene glycol, hydrobenzene maleic anhydride, ethylene and other products showed a large loss, the average loss level of more than 35%. As a key product of the chemical industry, the loss of ethylene reflects the overall poor performance of China's chemical industry.

- Industrial chain performance: C2 industrial chain and C4 industrial chain as a whole performed well, with the largest proportion of profitable products. This is mainly due to the decline in the cost of downstream products due to the downturn in the raw material end of the industrial chain, and the downward transmission of profits through the industrial chain. However, the upstream feed end performed poorly.

Extreme cases of year-on-year changes in 5. margins.

- n-butane maleic anhydride: its profit margin changed the most year-on-year, from a small profit in 2023 to a loss of about 3% in January-September 2024. This is mainly because the price of maleic anhydride decreased year-on-year, while the price of raw material n-butane increased, resulting in higher costs and lower output value.

- Trimellitic anhydride: its profit margin rose nearly 900 percent year-on-year, making it the most extreme product in 2024. This is mainly due to the crazy rise in the global market caused by the withdrawal of Ineos from the global trimellitic anhydride market.

Figure 5 Year-on-year rate of change in profit margins for the 50 largest chemicals in 20246. Future Outlook

in 2024, China's chemical industry experienced a year-on-year decline in overall revenue and a significant decline in profitability after a reduction in cost pressures and a lower product price pivot. The refining industry has repaired profits against the backdrop of smooth crude oil prices, but demand growth has slowed significantly. In the bulk chemicals industry, the contradiction of homogenization is more prominent, and the supply and demand environment continues to deteriorate. It is expected that in the second half of 2024 and 2025, China's chemical industry will still face certain pressure, and the industrial structure adjustment will continue to deepen. Breakthroughs in key technologies and new products are expected to drive product upgrades and promote the continued high-profit development of high-end products. In the future, China's chemical industry needs to make more efforts in technological innovation, structural adjustment and market development to meet current and future challenges.

Mainly

Mainly

Polyurethane

Polyurethane

Fine Chemical

Fine Chemical

.png)