Global MMA capacity reduction in 1. and the reasons behind it

in 2024, a number of chemical giants around the world have announced that they will halve or shut down their MMA plants, giving up more than 340000 tons/year of production capacity. Behind this move, it reflects that the global MMA market is facing multiple challenges such as oversupply, fierce competition and cost-benefit considerations. For example, Japan's Kolali Company reduced MMA's annual production capacity from 67000 tons/year to 33500 tons/year, a 50% reduction. Mitsubishi Chemical was even more radical, announcing the termination of its 107000-ton/year acetone cyanohydrin process MMA plant in Hiroshima, Japan, and the closure of its 200000-ton/year production capacity in the UK. The strategic adjustments of these giants have undoubtedly exacerbated the turmoil in the global MMA market.

The main reason for the reduction in production capacity is that the rapid growth of global MMA supply in recent years has led to increased competition in the market. In order to reduce competitive risk, enterprises have to optimize resource allocation through capacity adjustment. In addition, the profit margin of traditional processes such as the ACH method is gradually shrinking, which is also one of the important reasons why enterprises choose to withdraw from the market.

Global MMA Capacity Distribution and Growth Trends in 2.: Challenges and Opportunities in the Asian Market

as of mid -2024, the global MMA production capacity is close to 6 million tons/year, of which the total production capacity in Asia is close to 4 million tons/year, accounting for 66% or more of the global total production capacity, making it the world's largest MMA production base. This distribution of production capacity makes the Asian market a major competition for MMA, especially in Northeast Asia. However, the competitive environment in the Asian market is also deteriorating, and local companies are facing fierce competition from the global market.

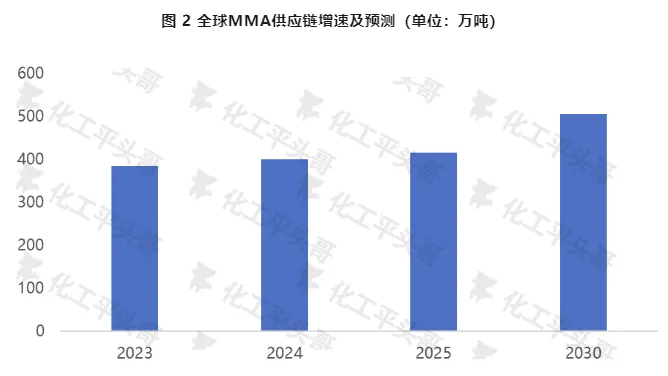

Although global MMA production is expected to continue to grow, from close to 4 million tons/year at the end of 2023, it is expected to exceed 5 million tons/year by 2030, with an average annual growth rate of about 4%. However, this rapid growth trend has not brought too many opportunities to the Asian market, but has intensified the intensity of market competition. Asian companies need to continuously improve their competitiveness to meet the challenges from the global market.

Competitive situation of different production processes in 3.: ACH method and C4 method

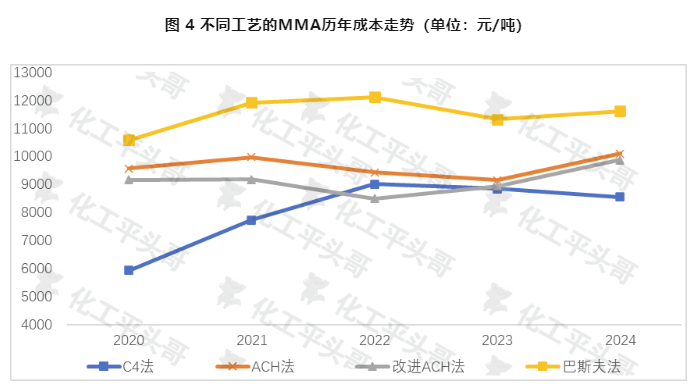

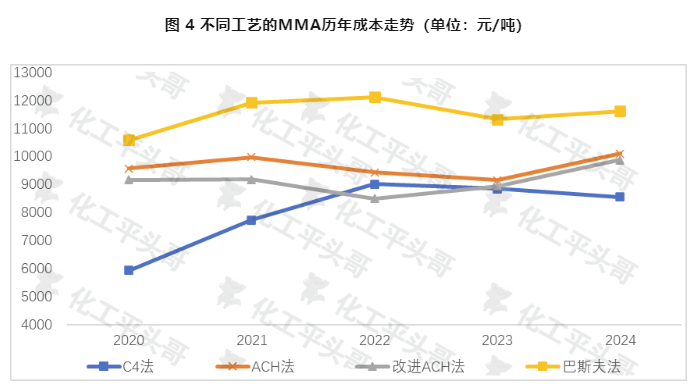

in the global MMA production plant, ACH method (acetone cyanohydrin method) and C4 method are the two main production processes. ACH method accounts for 64% of the production capacity and is the most widely used MMA production method. However, with the high cost of acetone and the gradual narrowing of the profitability of the ACH method, more and more companies are turning to C4 production.

As the earliest industrialized production process of MMA, ACH method has the advantage of matching with acrylonitrile by-product hydrocyanic acid, which can reduce the production cost to a certain extent. However, in recent years, the continuous rise in the cost of acetone makes the cost advantage of ACH method gradually lost. In contrast, the C4 method is more competitive due to its lower cost and the significant differences between the basic raw material market influencing factors and the ACH method.

The competition between different processes is not only reflected in the cost, but also in the supply of raw materials, technical maturity and environmental requirements and other aspects. With the intensification of competition in the global MMA market and the impact of the new energy vehicle industry on the basic raw material market, the profitability of traditional processes such as the ACH method will be further squeezed, while new processes such as the C4 method will gain more room for development.

The impact of changes in demand in the 4. downstream market on the MMA market: the shrinking consumption of PMMA and the rise of substitutes

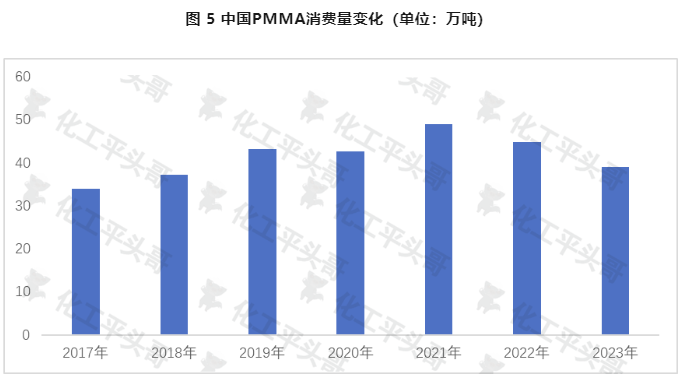

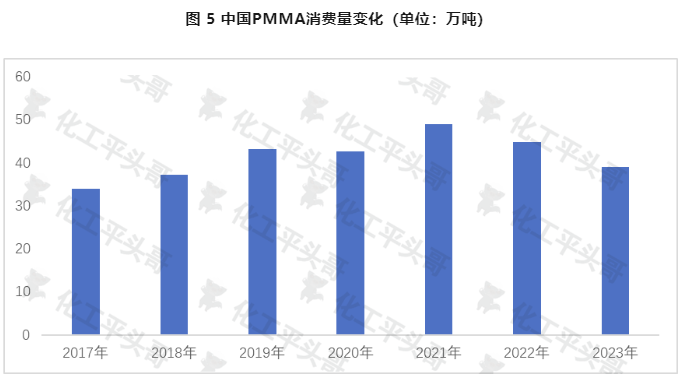

the main downstream application of MMA is PMMA (polymethyl methacrylate), accounting for more than 56%. However, in recent years, China's PMMA consumption growth has been weak, with an average annual growth rate of only 2.3, and it has gradually shrunk from 2021 to about 380000 tons in 2023. This trend is mainly influenced by the serious homogenization of products and the accelerated competition of substitutes.

The homogenization rate of PMMA products in China is relatively high, concentrated in the low-end market, while the output ratio of high-end products is not high. This makes Chinese PMMA enterprises in a disadvantageous position in the market competition. At the same time, the industrial breakthrough of new materials such as MS resin, COC, PC, etc. has further intensified the competitive pressure of PMMA market. These new materials have better performance and application areas, and gradually replace the traditional PMMA products.

The shrinking demand in the downstream market directly affects the price of MMA support. With the decrease of PMMA consumption, the sales pressure of MMA market is also increasing. Enterprises need to pay close attention to the changes in downstream market demand and the development trend of new materials, and actively explore new application areas and market space to meet this challenge.

Impact of 5. China Market and Coping Strategies: Seizing Opportunities and Coping with Challenges

capacity adjustment and increased competition in the global MMA market will have a profound impact on the Chinese market. On the one hand, the withdrawal of international giants from the market will provide Chinese companies with certain market space and development opportunities; on the other hand, the domestic MMA market will also face a more intense competitive environment and challenges from substitutes.

In order to cope with this situation, Chinese enterprises need to make long-term strategic planning and strengthen their technological innovation and product development capabilities. Expand market share by increasing product added value and market competitiveness. At the same time, it is also important to pay close attention to the changes in downstream market demand and the development trend of new materials. Enterprises need to actively explore new application areas and market space to adapt to changes in market demand.

In addition, strengthening cooperation and coordination with upstream raw material suppliers is also one of the important ways to enhance the overall competitiveness of the industrial chain. By establishing long-term and stable cooperative relations with suppliers to ensure the stability and quality reliability of raw material supply, thereby reducing production costs and improving product quality and market competitiveness.

To sum up, the global MMA market is undergoing a profound capacity adjustment and market change in 2024. Chinese companies need to seize opportunities, respond to challenges, and actively adjust their strategic layout to respond to future market competition and development needs. Through technological innovation, product development, market expansion and industrial chain cooperation and other efforts to enhance their competitiveness and achieve sustainable development.

Source: Chemical Flat Head Brother

* Disclaimer: the content contained in the Internet, WeChat public number and other public channels, we maintain a neutral attitude to the views in the article. This article is for reference only, exchange. The copyright of the reprinted manuscript belongs to the original author and organization. If there is infringement, please contact the customer service of Huayi World to delete it.

Mainly

Mainly

Polyurethane

Polyurethane

Fine Chemical

Fine Chemical

.png)