In the global chemical industry, Wanhua Chemical is known for its leading position in the field of polyurethanes. As a leader in the industry, Wanhua Chemical not only makes continuous breakthroughs in product innovation, but also shows a strong momentum in capacity expansion and market expansion.

In 2024, Wanhua's multiple projects are progressing in an orderly manner.

Wanhua two projects EIA acceptance

on May 16, 2024, Wanhua Chemical (Penglai) Co., Ltd. Acrylic Acid and Ester Phase II Project and 400000 Tons Annual Polyolefin Elastomer (POE) Project will be accepted and publicized by EIA.

the project has newly built 160000 tons/year acrylic acid plant, 400000 tons/year butyl acrylate plant and supporting public works and auxiliary facilities. The project has a total capacity of 58 people. It is planned to start construction in May 2024 with a construction period of 14 months.

the second phase of ethylene project is located in Wanhua Chemical Yantai Industrial Park, covering an area of about 1215 mu, the planned investment is 17.6 billion yuan, mainly to build 1.2 million tons/year ethylene cracking unit, 250000 tons/year low density polyethylene (LDPE) unit, 2 × 200000 tons/year polyolefin elastomer (POE) unit, 200000 tons/year butadiene unit, 550000 tons/year pyrolysis gasoline hydrogenation unit (including 30000 tons/year styrene extraction), 400000 tons/year aromatics extraction unit and supporting auxiliary works and public facilities.

The 400000-ton/year POE project of Penglai Base Phase II has been started and is expected to be completed and put into operation by the end of 2025.

Progress has been made in POE, citral, propane dehydrogenation, ethylene project and MDI technical transformation and capacity expansion.

In 2024, Wanhua has expanded in POE, citral, propane dehydrogenation, ethylene project, MDI technical transformation and expansion:

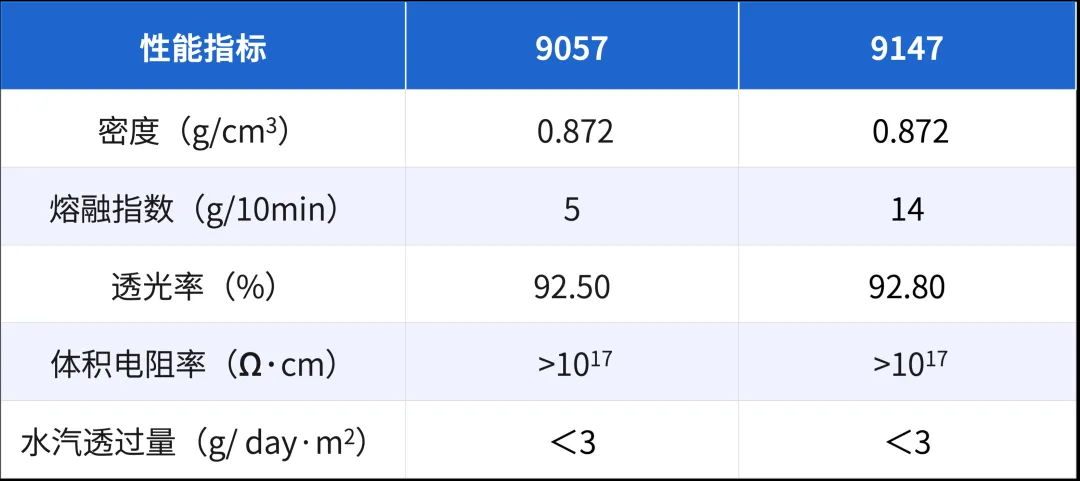

currently developed WANSUPER®9057 and WANSUPER®9147 two products, used in the field of photovoltaic.

Wanhua Chemical two POE product performance

- in the third quarter of 2024, 48000 tons/year citral-flavor and fragrance project was put into operation;

in addition, Penglai Phase I 900000 tons/year propane dehydrogenation project is expected to be put into operation in the fourth quarter of 2024;

the Yantai 1.2 million tons/year ethylene project is expected to be put into production from the end of 2024 to the beginning of 2025.

Fujian MDI technical transformation and capacity expansion project was completed at the end of April 2024, marking the further consolidation of Wanhua Chemical's leading position in the polyurethane industry.

The commissioning of these projects will continue to enhance the company's production capacity and market competitiveness.

Main products MDI market rebound

in April 2024, the output of freezers and household refrigerators in China showed a significant growth trend, of which the output of freezers increased by 25% year-on-year, and the output of household refrigerators increased by 15%. At the same time, the number of exported refrigerators also achieved a year-on-year growth of 21%. This positive downstream market performance has brought an opportunity for Wanhua Chemical's main product MDI market to pick up.

However, the supply side of MDI has experienced some contraction in the short term due to multiple influences such as equipment maintenance and force majeure factors. According to Baichuan Information, as of the end of April 24, the total global MDI production capacity was 10.66 million tons. However, since April, frequent force majeure events and maintenance of some production capacity around the world have affected about 2.38 million to 2.48 million tons of production capacity, accounting for nearly 1/4 of the world's total production capacity.

Specifically, MDI devices in North America, Japan, Europe and China have been overhauled or shut down to varying degrees. Among them, Dow Chemical's MDI plant in the United States was discontinued due to raw material supply problems, while BASF and Costco's plants were briefly discontinued or operated at low load due to force majeure factors. In Japan, Dong Cao's MDI device has also been overhauled for about 40 days. In addition, installations such as Europe's Boost, Covestro and Huntsman in the Netherlands have experienced similar challenges.

In China, the overhaul of BASF's MDI plant in Shanghai began on May 14 and is expected to last a month. The plant in Chongqing is in low-load operation. Together, these events affected the market supply of MDIs.

Affected by the force majeure event of Dow MDI device, the domestic polymeric MDI market price showed an upward trend. According to the Business News Agency, as of May 24, the quotation for Shanghai goods in the East China market was between 17,200-17,400 yuan/ton, an increase of 700 yuan/ton from the beginning of May. Wanhua Chemical's MDI product quotation also reached 17,500-17,600 yuan/ton. The market expects that the aggregate MDI market will remain strong in the near future and prices are expected to rise further.

Wanhua Chemical continues to expand its MDI capacity. By the end of 2023, its MDI capacity had reached 3.1 million tons. At the end of April 2024, 400000 tons of technological transformation capacity was added in Fujian, and the 600000 tons of technological transformation and expansion project in Ningbo was completed on April 26 and entered a three-month commissioning period. These initiatives are expected to make Wanhua Chemical's share of the global MDI market close to 40%, bringing more room for growth to its polyurethane business.

Petrochemical sector or will usher in significant growth

wanhua Chemical, in addition to its leading position in the field of polyurethane, also actively layout petrochemical plate and fine chemicals and new materials plate. In the context of the current high international oil prices, thanks to geopolitical tensions and other factors, the cost of petrochemical products has been strongly supported. At the same time, with the recovery of the downstream export market and the steady growth of domestic demand, the prices of some petrochemical products of Wanhua Chemical have shown a positive trend of recovery.

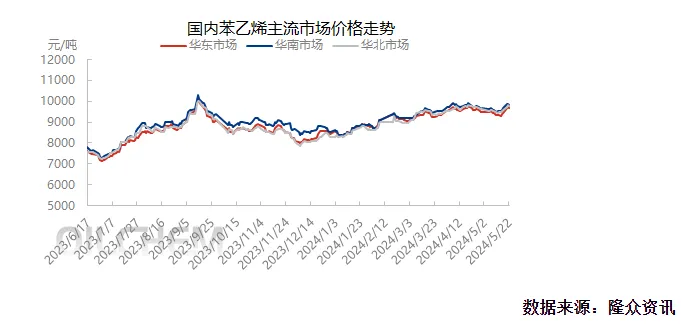

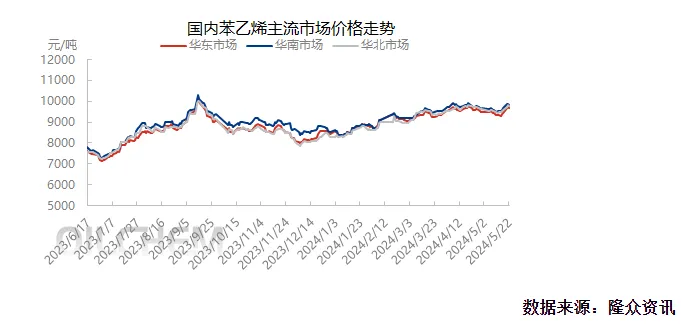

According to Wind information data, as of May 24, 2024, the prices of propylene, acrylic acid, butadiene, styrene, linear low-density polyethylene and polyvinyl chloride in the second quarter of 2024 increased by 2% and 8% respectively year-on-year., 50%, 20%, 4% and 1%, month-on-month also showed a positive growth trend, especially the prices of acrylic acid, butadiene and styrene rose more significantly. This price trend not only highlights the strong market demand for petrochemical products, but also indicates that Wanhua Chemical's upcoming petrochemical project will bring significant improvement to the company's performance.

The following is the specific price trend chart of acrylic, butadiene and styrene:

wanhua Chemical currently operates a PDH project with an annual output of 750000 tons and an LPG cracking to ethylene project with an annual output of 1 million tons. This year, the company plans to start production of larger and more technologically advanced 900000 tons of PDH and 1.2 million tons of ethylene projects, which will further strengthen the company's industrial base. The new ethylene project uses a mixed feed of naphtha and ethane, which is expected to improve the company's profitability. At the same time, in order to ensure the stability and cost-effectiveness of raw material supply, Wanhua Chemical has also ordered six ethane carriers.

Overall, as a leader in the polyurethane industry, Wanhua Chemical's positive performance in product innovation and market expansion indicates that the company will continue to maintain its leading position in the industry in the next few years. With the commissioning of new projects and the growth of market demand, Wanhua Chemical is expected to achieve sustained performance growth.

However, despite the promising prospects, the company also faces some potential risks, such as lower-than-expected project production, rising raw material prices and lower-than-expected downstream demand. Therefore, the company will continue to pay attention to market dynamics, actively respond to challenges, to ensure the steady growth of performance.

Mainly

Mainly

Polyurethane

Polyurethane

Fine Chemical

Fine Chemical

.png)