1. market landscape changes: rapid expansion of production capacity

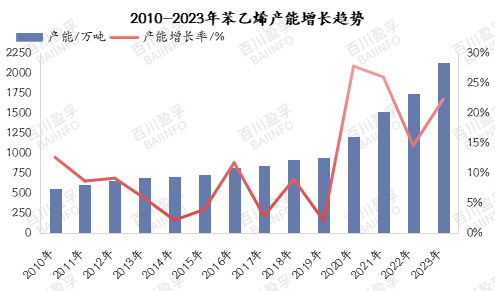

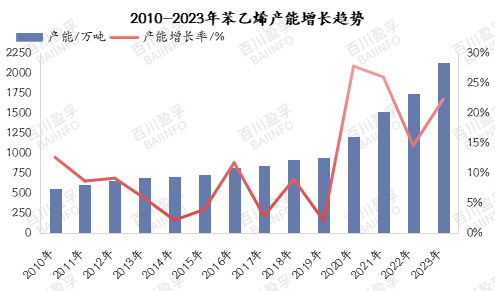

in recent years, the styrene market has experienced unprecedented capacity expansion. Encouraged by national policies, refining and chemical integration has become the main direction of industry development, and the production of styrene units has been significantly increased. Especially after 2020, the domestic styrene production capacity has accelerated significantly, and the industry has officially entered the peak era of capacity expansion. It is expected that by the end of 2024, the annual production capacity of domestic styrene plants will reach a staggering 22.6515 million tons. This change not only enhances China's position in the global styrene market, but also has a profound impact on the market supply and demand pattern.

The rapid expansion of production capacity makes the competitive landscape of the styrene industry increasingly fierce. The launch of new production capacity has intensified market competition, and companies have adopted price wars and other strategies to seize market share. At the same time, the risk of overcapacity is gradually emerging, and some enterprises are facing problems such as underemployment and inventory backlog.

2. supply and demand imbalance: downstream production lag and local oversupply

while styrene production capacity continues to grow, the downstream industry is lagging behind. The downstream industry's demand for styrene has not kept pace with capacity growth, resulting in a mismatch between supply and demand in the market. There has been an oversupply in some regions, styrene prices have been suppressed, and corporate profitability has been squeezed.

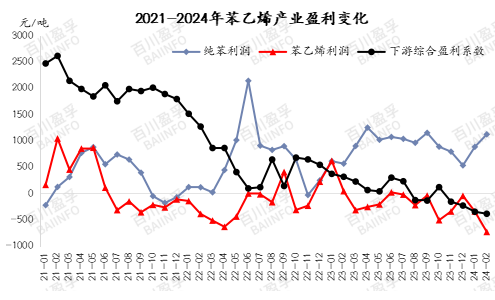

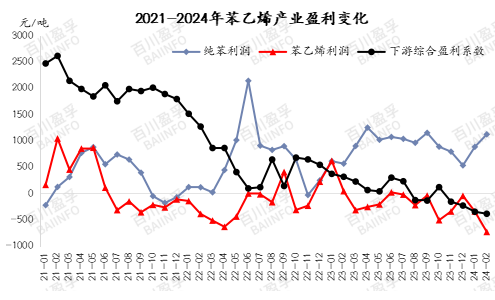

In addition, the profitability of the downstream industry has gradually weakened in the past two years. Due to rising raw material prices and fierce competition, some downstream industries have experienced long-term losses. This further exacerbates the imbalance between supply and demand in the styrene market, making it difficult for styrene and downstream industries to reach full production levels.

3. Trade Flows and Arbitrage Opportunities

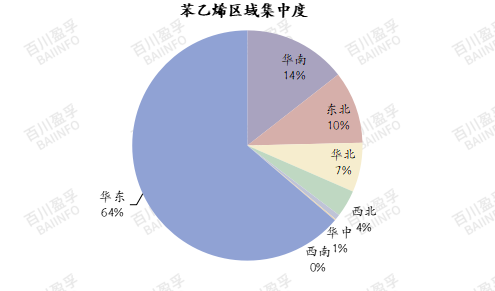

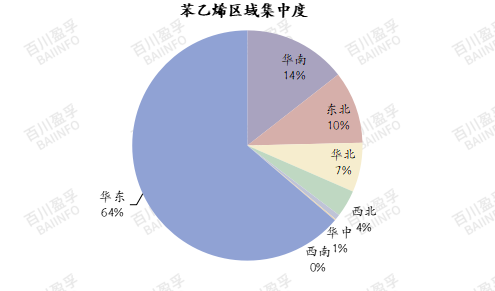

with the growth of domestic styrene production capacity, the supply flow has also shown a diversified trend. East China, as a traditional styrene consumption center, its supply flow center position is still stable. However, with the launch of production capacity and market development in other regions, the trade flow of styrene has gradually diversified. For example, arbitrage transactions between North China, Shandong and East China are becoming more frequent, and production capacity in Northwest China has increased the outflow of goods to East China, Central China or Southwest China.

The increase in arbitrage opportunities has brought more trading opportunities to the styrene market. However, due to profit or demand constraints, factories and cargo holders are still mainly reducing their inventory, and the scale of arbitrage trading has not increased significantly. This suggests that market participants remain cautious about future market movements.

4. Fundamental Weakness and the Impact of Derivatives

in recent years, the fundamentals of the styrene market have shown the characteristics of a weak game. Although the demand side has increased year by year, the growth rate of supply is more than that of demand, resulting in a gradual widening of the mismatch between supply and demand. Market in stock demand continues to be weak, and most operators continue to participate in paper or futures markets for trading, with an increase in the number of inter-month basis spreads or inter-product basis spreads. This makes the price fluctuation of styrene more affected by more factors, and the market changes more complex and changeable.

In addition, the increase in derivatives in the styrene market has further affected price changes. The active derivatives market provides investors with more trading opportunities and risk management tools. However, this also makes styrene prices affected by more external factors, such as macroeconomic situation, policy changes, international crude oil price fluctuations. The combination of these factors makes the fundamentals of the styrene market more complex and price movements more difficult to predict.

5. integration development trend

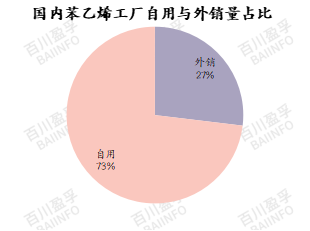

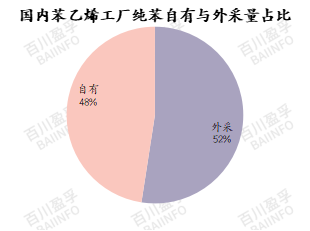

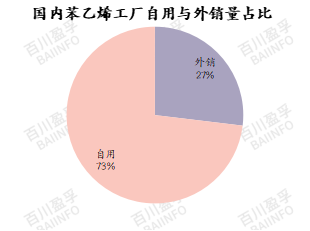

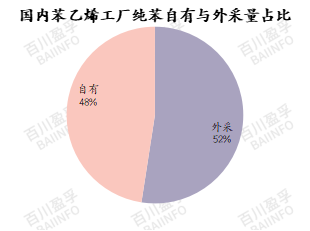

from raw materials to downstream, the integrated development trend of styrene industry is increasingly obvious. More and more styrene plants are starting to have their own downstream units to reduce production costs and improve market competitiveness. At the same time, the proportion of raw material pure benzene is also gradually increasing, which helps to stabilize the supply of raw materials and reduce procurement costs.

Integrated development can not only improve the profitability of enterprises, but also enhance the right to speak in the market. By controlling raw materials and downstream industrial chains, companies can better respond to market fluctuations and risks, and achieve stable operations and sustainable development.

Weakening of Discourse Power and Upward Shift of Profit Focus in 6. Industry

with the expansion of styrene production capacity and the intensification of market competition, its position in the industrial chain has gradually weakened. As the main raw material of styrene, the price trend of pure benzene has a higher proportion of styrene. Due to the rapid expansion of styrene production capacity in recent years, the demand for raw material pure benzene industry has been increasing, and the inventory of pure benzene has remained low for a long time. This makes the voice of pure benzene in the industrial chain gradually strengthened, and the influence on the price of styrene is also increasing.

At the same time, the profitability and start-up level of the styrene downstream industry are also gradually weakening. Due to fierce competition and insufficient demand, some downstream industries have suffered long-term losses. This further weakens the position of styrene in the industrial chain, making its profit focus gradually move up. From the perspective of the overall industry profitability, regardless of the comprehensive calculation of the refinery, the profitability of the pure benzene industry itself has performed well in the past two years, while the profit of styrene has continued to be compressed.

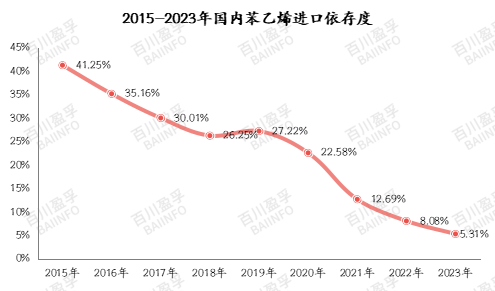

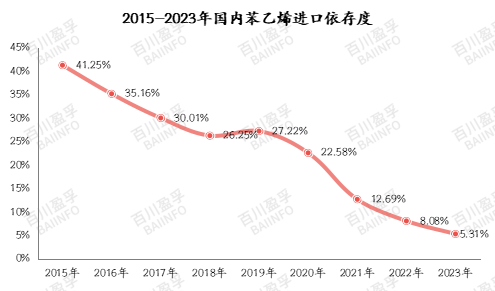

7. import and export pattern change

china's styrene production capacity in the world accounted for a relatively high, and the expansion rate is faster. This makes China's position in the global styrene market gradually improved, but also has an impact on the import and export pattern. In recent years, due to the implementation of anti-dumping duties, domestic and foreign arbitrage and other factors, China's dependence on styrene imports has gradually decreased. At the same time, with the growth of domestic production capacity and the expansion of market demand, China's styrene exports have gradually taken shape.

In addition, the global styrene profit level has also had an impact on the import and export pattern. Due to poor profitability, some foreign styrene plants have been shut down for a long time. This further reduces the supply in the international market and provides more opportunities for China's styrene exports. However, this also makes the international market competition more intense, and puts forward higher requirements for the quality and price of China's styrene exports.

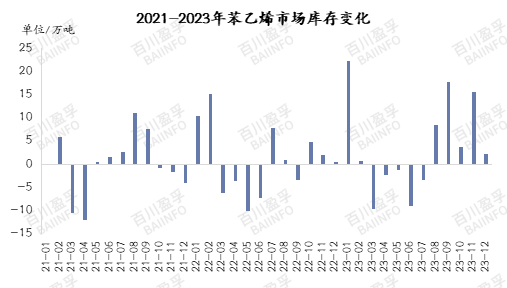

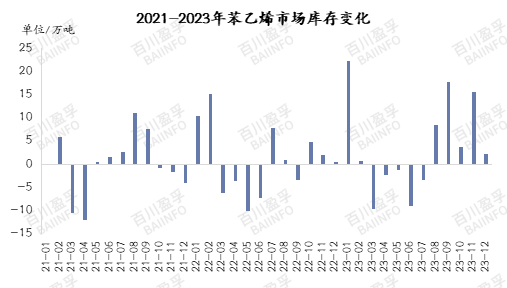

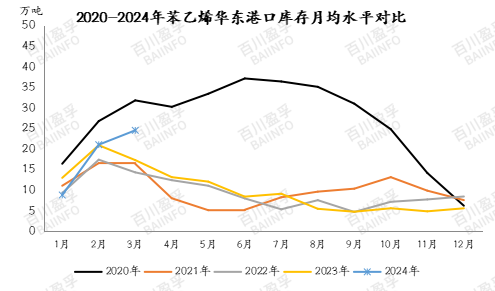

8. market weakness appears, inventory inverse decline

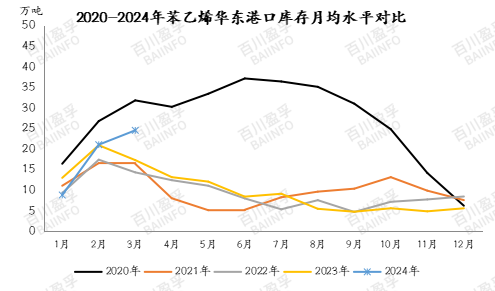

the pattern of regular changes in styrene port inventories tends to show accumulation in the first and fourth quarters, while the 2. third quarter is gradually digested. However, since 2020, this rule has been completely broken. In 2020, due to the impact of the epidemic, downstream demand was severely suppressed, while the arrival of domestic and imported sources of goods also brought considerable pressure, resulting in difficulties in picking up goods at the terminal, inventory levels were once close to a high of 400000 tons.

However, with the deterioration of profitability and insufficient demand in domestic and foreign markets, more and more devices choose to stop, and my country's imports have also decreased. In the period of high styrene prices in the European and American markets, the opening of the arbitrage window further promoted the increase in export orders. Despite the weak performance of the styrene market, port inventories have shown an inverse downward trend, which is quite unusual.

9. Styrene Market Outlook

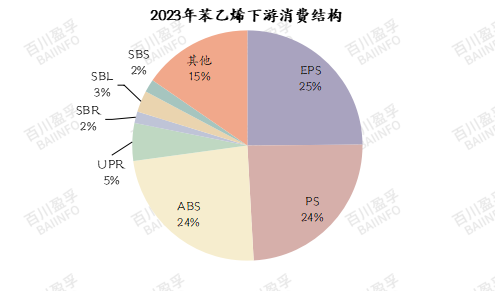

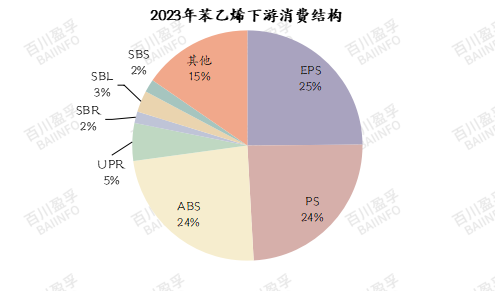

looking ahead, styrene and its downstream industries are plagued by profit pressure, and the production uncertainty of industrial chain devices increases. It is expected that domestic styrene production capacity will continue to expand by 2024, but due to the delayed release of downstream production capacity in the first two years, the growth rate of downstream production capacity may exceed that of raw materials in the future. In particular, PS, ABS and other products, its capacity growth will be more obvious. However, the negative feedback effect of the downstream industry still exists, and the overall profitability is difficult to improve in the short term.

In 2023, the profitability of the downstream industry is generally poor. While plastic companies continue to expand their capacity, the follow-up of the terminal market appears to be inadequate. Industry cash flow is expected to be difficult to improve significantly in the short term, and the level of construction is likely to remain low for a long time. Although there are more projects planned to be put into production downstream of styrene, there is still uncertainty about whether it can be put on schedule. As a result, the problem of supply and demand mismatch and local oversupply in the styrene market remains, and the industry's overall cash flow is expected to remain at a loss.

In terms of import and export, domestic factories may continue to actively carry out export business to ease the situation of oversupply. It is expected that the profitability of domestic styrene and downstream industries will continue to be poor in 2024, while raw material pure benzene is expected to maintain good profit expectations due to the expected tight supply and favorable factors such as oil transfer. Styrene companies may choose to stop and reduce production due to phased losses, and imports will continue to remain at a limited level. Export contracts will maintain certain negotiated orders based on internal and external arbitrage. In terms of terminal inventory, after this stage of accumulation, it is expected to remain at a relatively low level for a long time to come.

Overall, styrene prices are still expected to rise in stages in 2024. However, due to poor industry earnings expectations, cost support will continue to be strong, and arbitrage transactions between styrene and raw material pure benzene will remain frequent. There is still uncertainty about the delivery of downstream demand, and changes in industry earnings and terminal demand may have a dampening effect on the price increase of raw material styrene. In this case, the logic of cost support will continue to be greater than the impact of supply and demand.

In the next 2-3 years, styrene and downstream industry capacity expansion rate is still fast. As the market gradually becomes saturated or oversupplied, a critical period of replacement of old and new capacity is coming. In the context of carbon neutral and non-integrated poor profitability, styrene inefficient devices may continue to stop to reduce the burden, or even face elimination. With the continuous entry of integrated devices into the market, it will be difficult for the profits of the styrene non-integrated industry to increase significantly. There is more uncertainty about the release of downstream capacity, and end demand is difficult to determine due to economic policies and other factors. Therefore, the transformation of market supply and demand pattern, the change of profitability of enterprises in the industry and the future competitiveness will still be the focus of attention of styrene industry and related industries.

In the overall market supply increment is expected to be more, the current and upcoming production of styrene enterprises are actively looking for new development opportunities and expand the downstream industry. In the face of the continued poor profit of styrene in the future, the integrated development of products for their own use or to continue to promote the new model is still the direction pursued by enterprises. At the same time, companies may maintain profitability by setting up off-peak driving. However, due to the current poor profitability of the rubber and plastics industry, the task of finding new opportunities and coping with the current market pressure is still arduous.

Mainly

Mainly

Polyurethane

Polyurethane

Fine Chemical

Fine Chemical

.png)