Read: 424

Time:24months ago

Source:金联创化工、 环氧树脂交流与交易

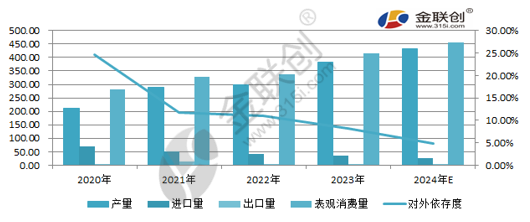

The supply growth rate of most products in the phenol ketone industry chain will slow down in 2024, especially under the background that the downstream bisphenol A continues to be put into production centrally, the demand side will give phenol and acetone a certain lift, and the upstream pure benzene is expected to be strong, with strong cost transmission. The phenol ketone market as a whole is in the adjustment stage from oversupply to weak balance, but the downstream and terminal supply and demand pressure is still large, and the subsequent profits of the industry chain will continue to be concentrated in the upstream products. in 2024, the pace of phenol expansion has not stopped, there are still 3 sets of phenol ketone plant on the market, the new capacity of about 595000 tons, if the new plant capacity is fully released, then China's total phenol production capacity will reach 6.973 million tons. The domestic supply side is expected to increase greatly. Although most of them are phenol-bisphenol A supporting devices, the integration of the industrial chain is the development trend, but the trend of oversupply is still inevitable and gradually intensified, which is bound to suppress the import supply. At the same time, enterprises will actively look for export opportunities and expand new development space.

in 2024, the downstream bisphenol A also has a number of devices put into production, supply and demand double increase, and bisphenol A production capacity growth rate is much greater than phenol, coupled with the recent years, although the development of phenolic resin slow, but the demand is expected to rise further, downstream demand performance is stable, can alleviate the pressure brought about by the rapid expansion of phenol production capacity.

2023 phenol ketone and bisphenol A were put into production in the fourth quarter, the growth rate of bisphenol A production capacity was greater than that of phenol. The demand for phenol was fully released in 2024. With the bottom support given by the cost end, it is expected that the phenol market will start at a low level in 2024 and there will be more room for subsequent upward expansion. However, the fourth quarter may be affected by the low season of cost and demand, resulting in a high-level correction. From the price volatility range in recent years, the 2024 domestic phenol Market Price it will fluctuate around 7000-10000 yuan/ton, and the annual high may appear in the third quarter, and the price center of gravity will increase compared with 2023.

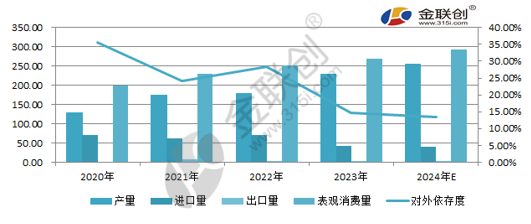

at present, China's acetone market has entered a mature period of development. Some factories have developed a chain of upstream and downstream industries. After centralized production at the end of 2023, only three new units are planned to be put into production in 2024. The total new production capacity of acetone is 357000 tons. Domestic production will continue to increase. In terms of imports, merchants are gradually inclined to operate domestic products. Import demand maintains a downward trend. Overall, the supply in 2024 is expected to increase slightly compared with 2023.

in 2024, new units are planned to be put into production in the downstream acetone industries of bisphenol A, MMA, isopropanol and MIBK, especially the new production capacity of bisphenol A is relatively large. Although some new units of bisphenol A are built in combination with phenol ketone units, there are also many non-supporting units. On the whole, the new production capacity of downstream acetone is relatively concentrated in 2024, and the demand for acetone will be greatly increased.

it is expected that the overall performance of the acetone industry in 2024 will be in short supply. There are more downstream production plans in the first quarter of 2024, which will boost market sentiment to a certain extent under the increase in demand. However, the acetone market lacks the motivation to continue to advance in the second quarter. Driven by the continued release of new production capacity in the third and fourth quarters, the supply of acetone is tight and the market has opportunities to strengthen. 2024 the whole year, it is expected that the price range of acetone market in East China will be between 6000-8000 yuan/ton, and the average annual price will be slightly higher than that in 2023.

the pace of bisphenol A capacity expansion in 2024 is still rapid. Seven new bisphenol A plants are planned to be put on the market, and many of the plants put into operation at the end of 2023 will be released in the first quarter of 2024. The market atmosphere is pessimistic. In contrast, the import volume is shrinking. In addition, the foreign in stock of bisphenol A is high, only a small amount of contract supply is maintained, and the arbitrage window for internal and external markets is basically closed, which is also the reason for aggravating the decline in import volume. Overall, supply is expected to increase significantly in 2024 compared to 2023.

2. Demand Forecasting

although a large number of new projects, mostly in the form of integration, phenol-bisphenol A- PC industry chain integration is the trend, but the downstream capacity increase there is a lag, and 2024 epoxy resin and PC capacity growth rate is far less than bisphenol A, demand and supply growth is difficult to match, supply and demand contradiction is more and more obvious. 03

china's bisphenol A market may be weak in 2024, and the overall volatility space is expected to shrink from 2023. After nearly two years of concentrated production, my country's bisphenol A production capacity has increased significantly, and domestic supply has increased significantly, which has suppressed market conditions. The market price in East China is expected to be between 7,000-12,000 yuan/ton, with a full-year high or in the third quarter.

in 2024, the new production capacity of domestic epoxy resin is still large, mainly concentrated in the second half of 2024. In the next few years, the trend of epoxy resin production capacity is consistent with the trend of raw material epoxy chloropropane, showing a growth trend. According to preliminary statistics, the new production capacity of epoxy resin in China will be about 665000 tons in 2024, when the production capacity of epoxy resin will reach 4.12 million tons, and the output is expected to be 2.3072 million tons. The situation of overcapacity is still intensifying.

in 2024, the growth rate of downstream demand for epoxy resin is far lower than the growth rate of supply. With the implementation of policies and measures such as green development and industrial structure transformation, the proportion of downstream demand such as coatings, floor paints and adhesives has declined significantly. The downstream demand orientation cannot be conducted normally, the overall demand is significantly reduced, and the contradiction between supply and demand is always sharp.

it is expected that in 2024, China's epoxy resin market will maintain a low volatility trend, and downstream demand has always been an important factor restricting the price of epoxy resin. With the implementation of the national green development, industrial structure transformation and upgrading and other policy measures, environmental governance efforts to increase, paint, adhesive, floor paint demand accounted for a decline. It is estimated that the operating range of the East China market will be 11000-14500 yuan/ton in 2024.

Mainly

Mainly

Polyurethane

Polyurethane

Fine Chemical

Fine Chemical

.png)