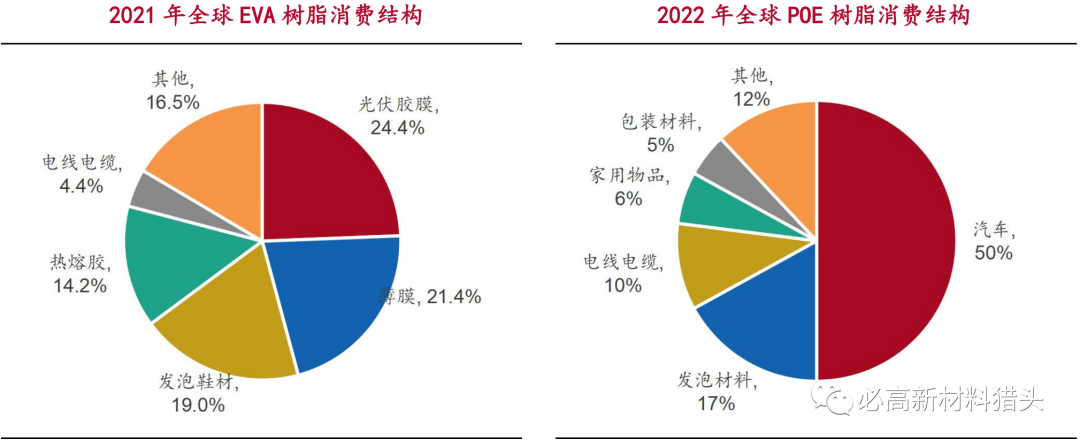

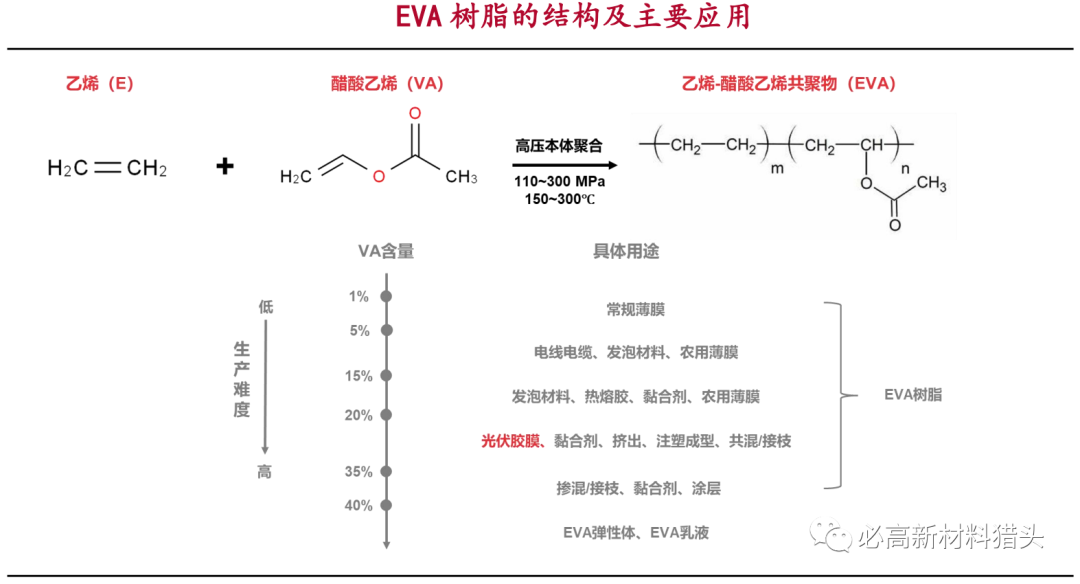

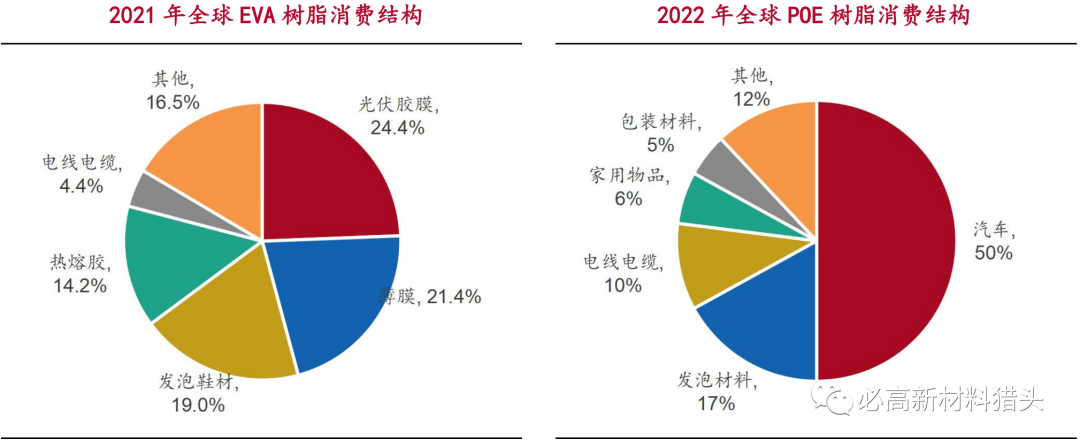

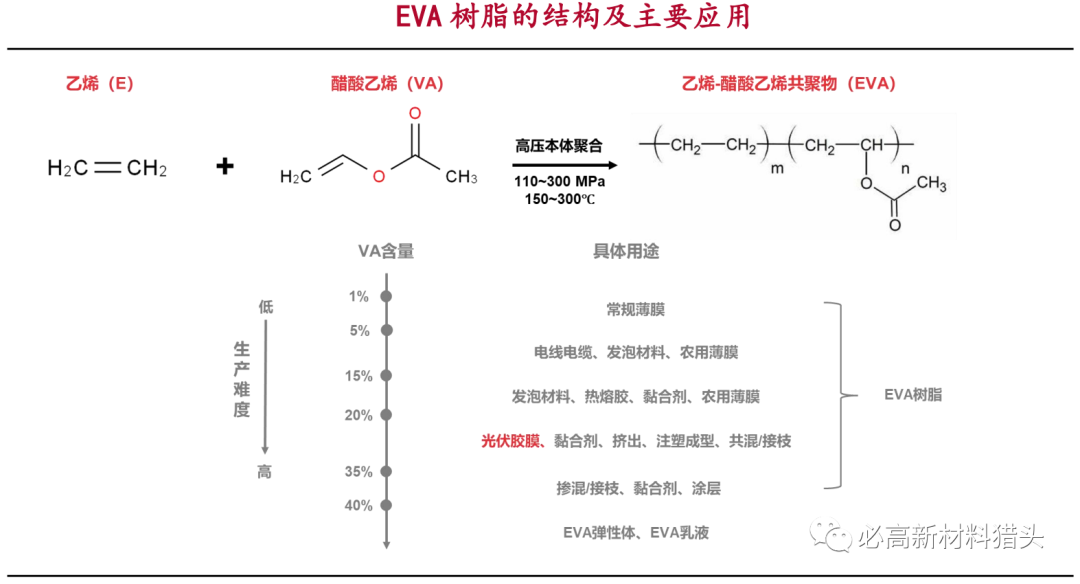

EVA and POE resin are the core raw materials of the encapsulation film, both of which are prepared by copolymerization of ethylene and special monomers. Among them, EVA resin is a copolymer of ethylene and vinyl acetate (VA) (VA mass fraction is generally less than 40%), and POE resin is a random copolymer elastomer formed by coordination polymerization of ethylene and high carbon alpha-olefin (usually 1-octene, mass fraction greater than 20%). Compared with the traditional general-purpose polyethylene, EVA and POE resins are more difficult to synthesize, have higher application performance and stronger specificity, and belong to the high-end polyolefin materials that need to be developed in China. In recent years, with the continuous production of large-scale coastal refining and chemical integration projects, general-purpose polyethylene is facing the risk of overcapacity. In order to cope with the increasingly fierce homogenization competition and enhance the added value of products, EVA and POE resin has become a hot new material field for the development of refining enterprises, and the process of localization is accelerating. Although EVA and POE resin can be used in packaging film, foam shoe material, automotive and plastic modification and other fields, but the photovoltaic film is the fastest growing demand, the highest market attention applications. According to the "China Chemical New Materials Industry Development Report (2022)", photovoltaic film has become the world's largest downstream demand for EVA resin, accounting for about 25%, and the demand in the domestic market has reached 47%. In terms of POE, about half of the world's POE resins are currently used in the automotive field (usually as toughening modifiers to improve the impact strength of internal and external components such as dashboards and bumpers), while the rest are mainly used for foamed shoes, wires and cables. With the rapid growth of N-type module shipments, photovoltaic film will become the main driving force for POE demand growth in the next two years.

EVA resin short-term still need to import photovoltaic material capacity climbing and verification cycle impact release rhythm EVA resin industrial production mostly using high-pressure continuous bulk polymerization process, its polymerization mechanism and production process and LDPE (low density polyethylene, mainly made into film products) is basically the same. The lower the VA content, the closer the nature of EVA to LDPE, with relatively good wear resistance and electrical insulation, can be used in the production of agricultural film, foam shoes, packaging materials and other low-end products. The higher the VA content, the closer the nature of EVA to rubber, with relatively good elasticity and transparency, can be used for photovoltaic film, coating materials and other high-end products. Among them, the VA content of EVA resin used for photovoltaic film needs to be controlled between 28% and 33%, which is difficult to produce and has high market value.

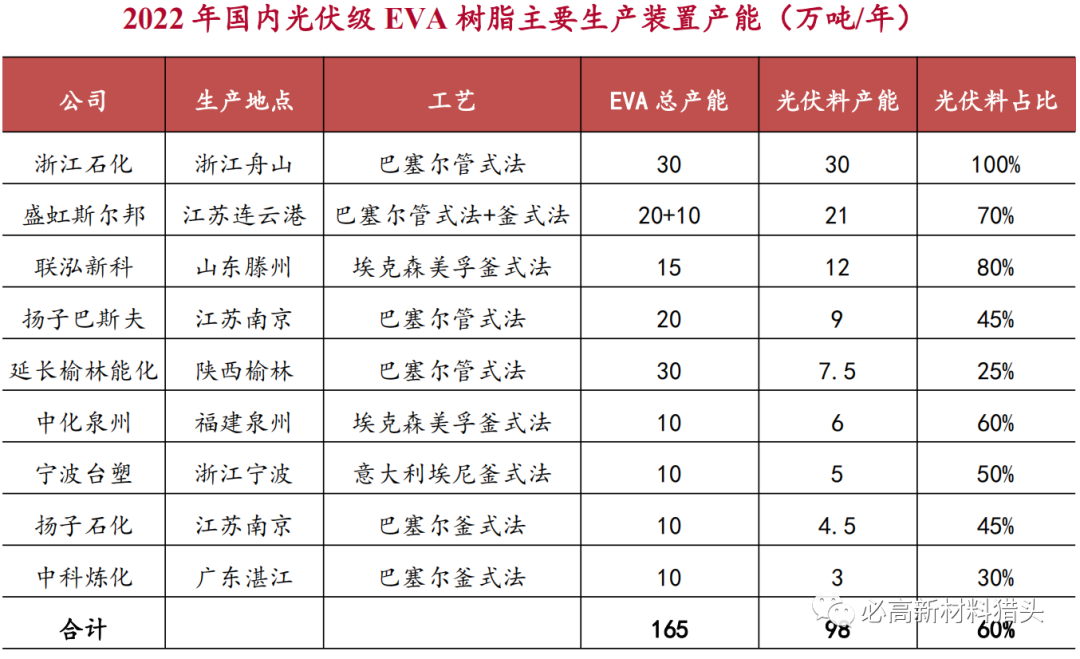

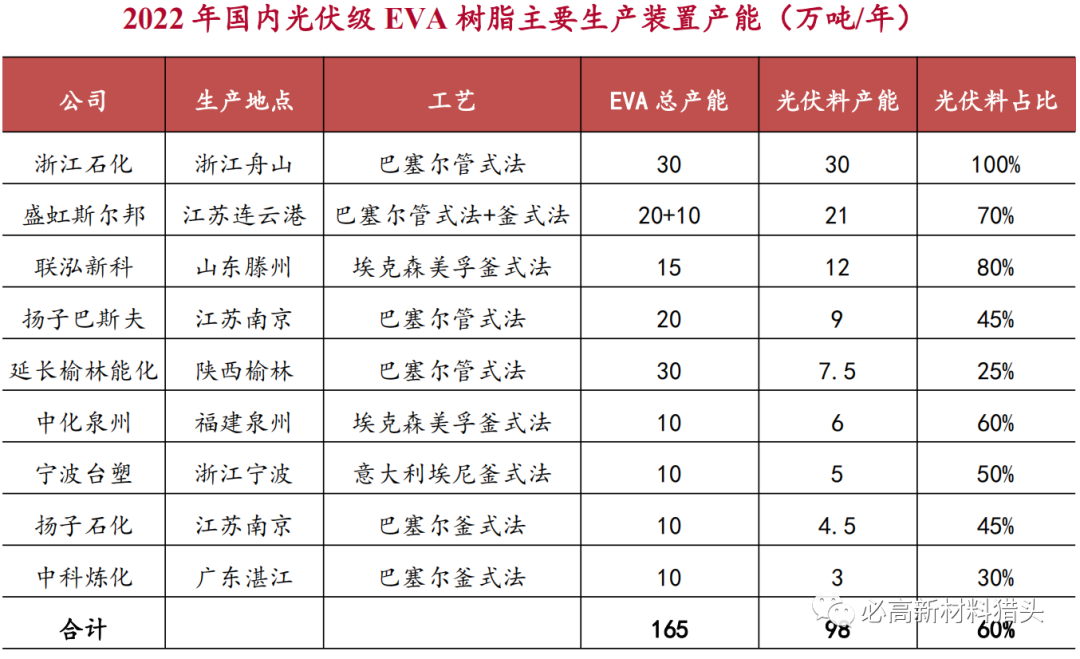

From 2017 to 2020, the total production capacity of EVA resin in China will be stable at 972000 tons, but only three enterprises, namely, Sirbon Petrochemical, Lianhong Xinke and Ningbo Formosa Plastics, will have the production capacity of photovoltaic materials, with the total production capacity of only about 300000 tons, and the import dependence will remain above 60%. In recent years, affected by the leapfrog development of the downstream photovoltaic industry, refining enterprises have introduced technical process packages (mainly the Liander Basel tube method), hoping to avoid the Red Sea competition of general-purpose polyethylene by converting EVA. In the second half of 2021, Sinochem Quanzhou, Zhejiang Petrochemical, Yulin Energy and other enterprises have successfully produced photovoltaic materials. By the end of 2022, the total domestic EVA resin production capacity has increased to 2.15 million tons, and the number of enterprises that can stably produce photovoltaic materials has increased to 9, with a total photovoltaic material production capacity of 980000 tons. According to statistics from Zhuochuang Information, the output of EVA resin will total 1.676 million tons in 2022, of which the cumulative output of photovoltaic materials will reach 837000 tons, and the annual output of photovoltaic materials will reach 50%. Combined with the estimated demand for photovoltaic-grade EVA resin in Table 3, import dependence has dropped to about 26%, and the supply capacity of domestic photovoltaic materials has increased significantly.

Looking ahead to 2023, although EVA's new production capacity is expected to reach 550000 tons, the new supply of photovoltaic materials is relatively limited, incremental demand can only be met through overseas supply, and import dependence is expected to rise again in 2023. This is due to the long capacity ramp cycle of EVA resin and the great uncertainty of the actual capacity of photovoltaic materials. From the experience of the industry, it takes at least one year for the new device to successfully start up and supply photovoltaic materials in bulk. First of all, the device needs to stably produce LDPE for more than half a year before converting to EVA. Secondly, the production of EVA also needs to start from the foaming material with low VA content, and only after accumulating enough experience in the operation of the device can it be gradually converted to the photovoltaic material with higher process difficulty. Finally, it will take about 4 months for the product to be delivered to the film manufacturer for verification and import. Therefore, even if Tianli Hi-Tech, which realized the feeding and driving in the third quarter of last year, it is very difficult for its photovoltaic materials to achieve stable shipment in 2023. Considering the capacity ramp and verification cycle, it is expected that most of the new capacity will not be effectively supplied until 2025. However, due to the existence of the upper limit of photovoltaic material production capacity of the device (the tubular method is generally about 80%, because the photovoltaic material has high VA content and strong viscosity, and requires regular maintenance and cleaning of the equipment), even if it is optimistic that all manufacturers can successfully complete the verification and realize the maximum output of photovoltaic materials, it is difficult to meet the supply gap caused by the rapid growth of module shipments in the next two years, therefore, it is expected that the high probability will remain in short supply by 2025.

POE resin industrialization there are three major technical barriers to domestic substitution first dawn POE (polyolefin elastomer) is a new type of thermoplastic elastomer material first developed by Dow Chemical in 1993. The structural characteristics of POE determine its excellent comprehensive performance. First of all, the molecular structure of the polyethylene main chain crystalline region and the amorphous region formed by the introduction of α-olefin, so that it has both good thermoplasticity and high elasticity. Secondly, the absence of polar groups and unsaturated bonds in the molecular chain gives POE excellent weather resistance and moisture barrier properties. Finally, the addition of metallocene catalyst also makes the relative molecular weight distribution of POE narrow, which has good tensile strength and impact resistance.

At present, the global POE resin production technology and industrial equipment concentrated in Dow Chemical, LG Chemical, Mitsui Chemical, SSNC(SABIC and SK joint venture), ExxonMobil, Nordic Chemical 6 overseas chemical giants. The production units of each company are based on proprietary polymerization technology and metallocene catalysts, with a total production capacity of 1.605 million tons. Considering that the actual production process can be flexibly switched to POP (polyolefin plastomer), OBC (olefin block copolymer) or other elastomer materials, the real production capacity of POE is lower than the published data. According to ChemAnalyst statistics, the global demand for POE in 2022 is about 1.5 million tons, and the actual output is expected to be basically in line with this data. Dow Chemical is the world's largest and most technologically advanced POE manufacturer. Its devices are mainly located in the United States, Thailand, and Saudi Arabia, with a total production capacity of 760000 tons, accounting for about 50% of the global market share. LG Chemical, SSNC and Mitsui Chemicals followed, with production capacity of more than 200000 tons. Due to the foreseeable growth in demand in the photovoltaic sector, the above three companies have announced plans to expand production, and overseas POE production capacity is expected to increase to 1.925 million tons within two years. Combined with the estimated demand for PV-grade POE resin in Table 3, the film manufacturer needs to get about half of the order share to meet the packaging needs of the N-type module. However, under the trend of automobile lightweight, the demand for traditional downstream automobile plastic modification still has room for growth, and the demand in other fields also starts (according to the statistics of Sinicization Letter Consulting, China's net POE import volume is about 590000 tons in 2021 and CAGR reaches 28% in the past three years). Therefore, the global POE resin supply will continue to be tight in the next few years, and the competition for orders will also affect the upgrading process of photovoltaic film.

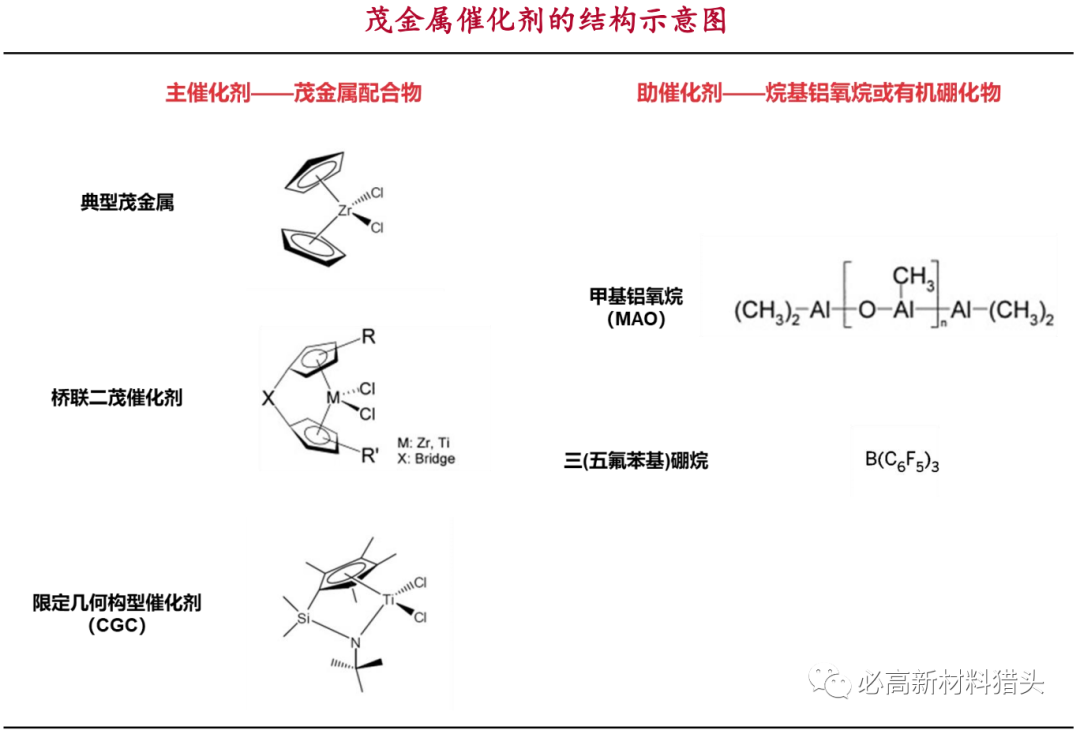

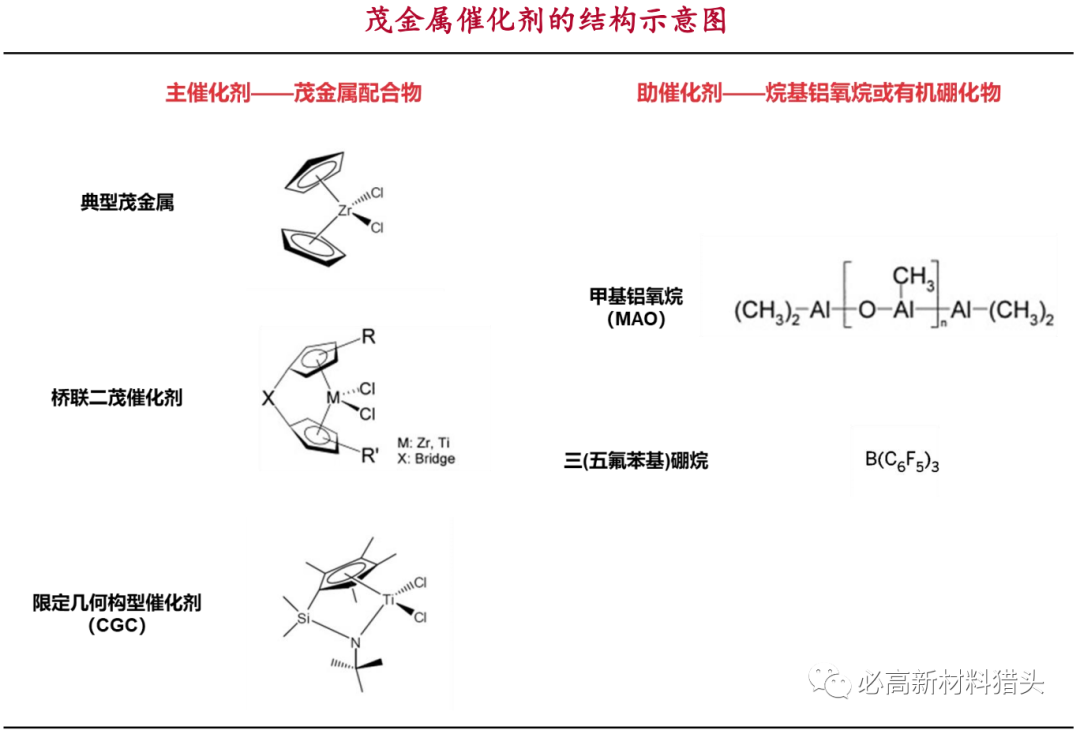

Facing the huge demand opportunities in emerging markets, domestic petrochemical enterprises are also accelerating the layout of POE resin. However, due to the difficulty of production, high profit margins, the current overseas leaders have no external technology authorization transfer, so domestic enterprises can only develop their own, and need to gradually overcome the preparation of metallocene catalyst, alpha-olefin synthesis, solution polymerization process three major technical problems. (1) Metallocene Catalyst Metallocene (Metallocene) is a general term for a class of organometallic complexes, which are generally formed by the interaction of group IVB transition metal elements (such as Ti, Zr, Hf) and cyclopentadienyl (or derivatives thereof). The catalytic system with metallocene as the main catalyst and alkyl aluminoxane (such as MAO) or organic boride as the co-catalyst is called metallocene catalyst. Compared with traditional Ziegler-Natta catalysts, metallocene catalysts have the advantages of high catalytic activity, single active center, precise control of polymer structure and relative molecular weight distribution, and are mainly used in the preparation of high-end polyolefins. At present, the industrial production of POE mainly uses bridged two-metallocene catalyst and limited geometry catalyst (CGC), these two types of catalyst center metal around the space is more open, conducive to long-chain co-monomer insertion, more suitable for POE reaction system.

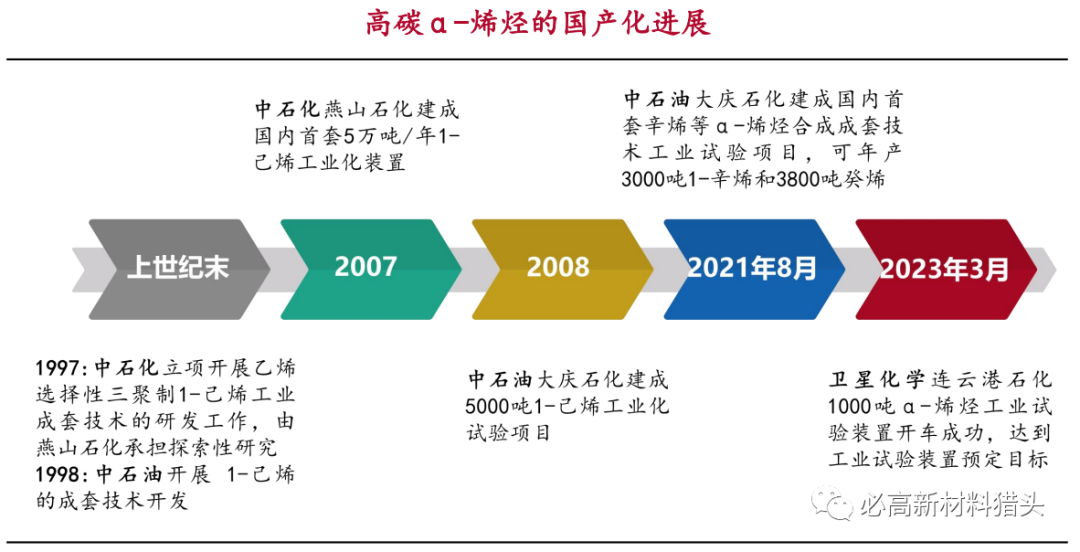

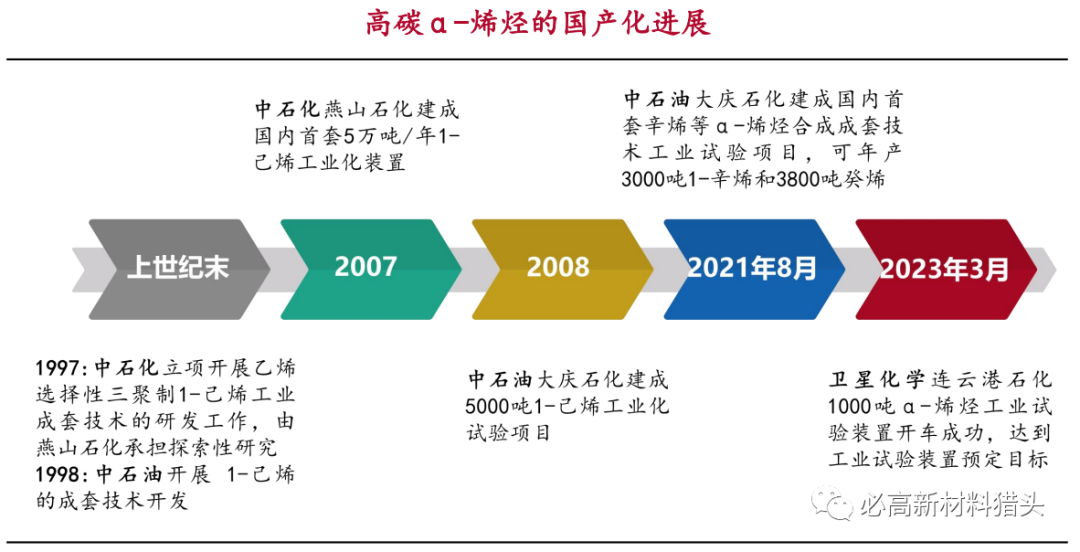

Catalyst is the core of polymerization reaction. After the industrialization of metallocene catalyst in the 1990 s, many large foreign enterprises have completed the development and application work, and applied for patent protection for the research and development results. In addition to the above-mentioned six enterprises, the international metallocene catalyst manufacturers also include Leander Basel, Total, American Univation (Dow Chemical and ExxonMobil joint venture), ChevronPhillips and other enterprises. However, the supporting processes of the above-mentioned enterprises are mainly gas phase or slurry method. Although technology transfer is allowed, only metallocene polyolefin (mPE/mPP) can be produced, which is not applicable to POE. China's metallocene catalyst research started late, how to bypass many patent restrictions and from the vast number of metallocene complexes to screen out the appropriate new catalyst system is the difficulty of research and development. National institutions such as PetroChina, Sinopec, universities and research institutes have been developed for many years, and have successfully realized the industrial application of mPE/mPP based on independent metallocene catalyst, but the catalyst for the preparation of POE has not yet achieved industrial breakthrough. At present, CGC catalyst is still the key breakthrough direction, and with the gradual opening of the downstream market space, Dow Chemical's first generation of CGC technology patents expire, a number of domestic listed leaders have accelerated the pace of entry. In recent years, Wanhua Chemical, Satellite Chemical, Shenghong Sirbang and other enterprises have accumulated relevant patents, but industrialization amplification is still in the technical exploration period. (2)α-Olefin The α-olefin is a linear long-chain monoolefin in which the carbon-carbon double bond is located at the end of the molecular chain. Among them, 1-butene (C4), 1-hexene (C6) and 1-octene (C8), which have relatively short carbon chains, are generally used as comonomers for improving the material properties of polyolefins. At present, the global mainstream POE products are basically ethylene-octene copolymer elastomers, so 1-octene is the key raw material to realize POE localization. Ethylene oligomerization is the mainstream production process of high-carbon alpha-olefins (C6 and above) in the world, which is mainly divided into non-selective oligomerization and selective oligomerization. Among them, selective oligomerization (such as ethylene trimerization to prepare 1-hexene and ethylene tetramerization to prepare 1-octene) has a higher yield of target products and is a more advanced technical direction. At present, Sinopec and PetroChina have basically mastered the ethylene trimerization method, and the total production capacity of 1-hexene is about 100000 tons. The ethylene tetramerization law has not yet been industrialized, so China still does not have the production capacity of 1-octene. However, under the catalysis of the demand for high-end polyolefins such as POE, the technical research of 1-octene has achieved preliminary results. At present, two enterprises, PetroChina Daqing Petrochemical and Satellite Chemical Lianyungang Petrochemical, have built industrial test devices.

Looking ahead, the next 2 to 3 years of domestic alpha-olefin plant planning more, basically used for supporting the production of POE, most of the technology from self-research, scientific research institutes or universities joint development, the temporary lack of mature large-scale production experience. Whether we can find a catalyst with high activity and selectivity and solve the problems of by-products blocking the pipeline, we still need to wait and see. (3) solution polymerization The current industrial POE production device basically adopts the solution polymerization process. Its core process development is highly bundled with metallocene catalysts, so technology patents are also in the hands of Dow, LG Chemical, Mitsui Chemical and other companies. Overseas, only the Sclairtech medium pressure solution polymerization process of NOVA Company of Canada can be authorized for transfer, but the existing plant mainly produces polyethylene, and there is no precedent for POE production. Domestically, the "1000 tons/year POE production technology and process design package" jointly developed by Zhejiang University and Sinopec Beijing Research Institute of Chemical Industry passed the appraisal of scientific and technological achievements organized by the China Chemical Industry Society in 2015. Although there is no report on the acceptance of industrial application process packages, it is expected that they will still become the main source of technology for many domestic enterprises. With the gradual deepening of the research and development of metallocene catalysts, the complete set of POE technology package based on solution polymerization is expected to make further breakthroughs simultaneously. At present, petrochemical enterprises all over the country have launched POE projects, with a total planned production capacity of 3.6 million tons. At present, Wanhua Chemical's industrialization progress is relatively leading, the company has successfully realized the pilot plant start-up in March 2021, and became the first domestic enterprise that can produce POE resin for photovoltaic applications. According to research, Wanhua Chemical's two photovoltaic-grade POE products have been sent to major adhesive film manufacturers and started verification. It is expected that the first 200000-ton industrial plant will be put into production in the second half of 2024. In addition, Shenghong Sirbang and Sinopec Maoming Petrochemical have also completed the pilot test in 2022 and are undergoing industrial project construction. Most of the other projects are in the pre-planning stage, and the construction period is about 2 to 3 years.

Looking ahead, both 2023 and 2024 will be the vacuum period of domestic POE resin production capacity, and the supply shortage will continue to intensify. The period from the end of 2024 to 2025 is the key stage of each project verification, when manufacturers who really master the core technology will continue to update the project progress. Considering the difficulty of tackling the three key barriers, it is expected that no more than five enterprises will eventually be able to put into production as scheduled, and most other enterprises may not be as fast as expected or eventually withdraw from the competition because they cannot successfully break through the technical problems. In summary, the next two years are likely to be the first year of POE resin localization, but there is great uncertainty about the specific capacity landing scale. From the technical difficulty point of view, the industrial preparation of metallocene catalyst is the most difficult, so it is relatively optimistic about the leading enterprises in the development of metallocene catalyst.

Mainly

Mainly

Polyurethane

Polyurethane

Fine Chemical

Fine Chemical

.png)