In the first half of the epoxy resin market showed a weak downward trend, weak cost-side support and weak supply and demand fundamentals jointly pressure the market. In the second half of the year, under the expectation of the "Golden Nine and Silver Ten" in the traditional peak consumption season, the demand side may have a phased growth. However, considering that the supply of epoxy resin market may continue to grow in the second half of the year, and the growth of demand side is limited, it is expected that the low range of epoxy resin market in the second half of the year will fluctuate or rise in stages, but the price rise space is limited.

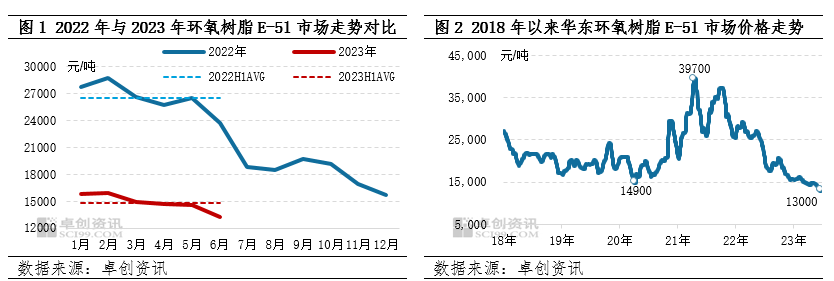

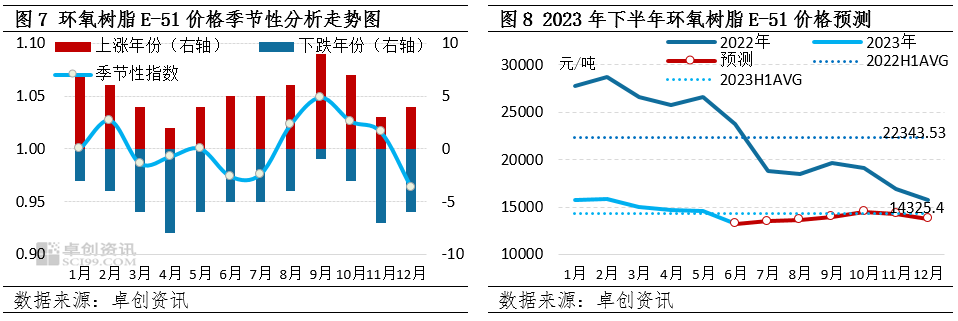

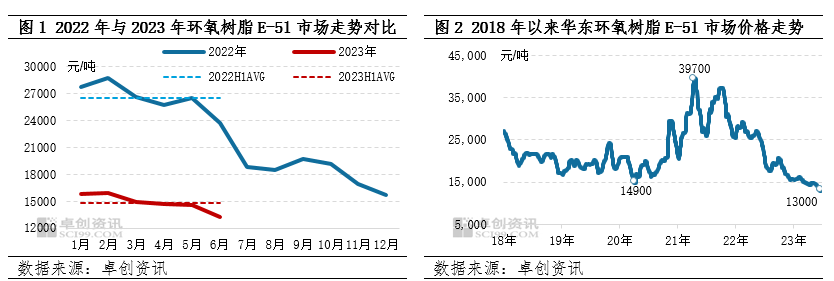

Due to the slow recovery of domestic economic vitality in the first half of the year, downstream and terminal demand for epoxy resin was lower than expected. Due to the release of new domestic equipment capacity and weak raw material cost support, epoxy resin prices entered the downward channel in February, falling more than expected. From January to June 2023, the average price of East China epoxy resin E-51 (acceptance price, delivery price, tax included, barrel, automobile transportation, the same below) was 14840.24 yuan/ton, down 43.99 from the same period last year (see Figure 1). Domestic epoxy E-51 closed at 13250 yuan/ton on June 30, down 13.5 per cent from the beginning of the year (see figure 2).

Epoxy resin dual raw material cost support is insufficient

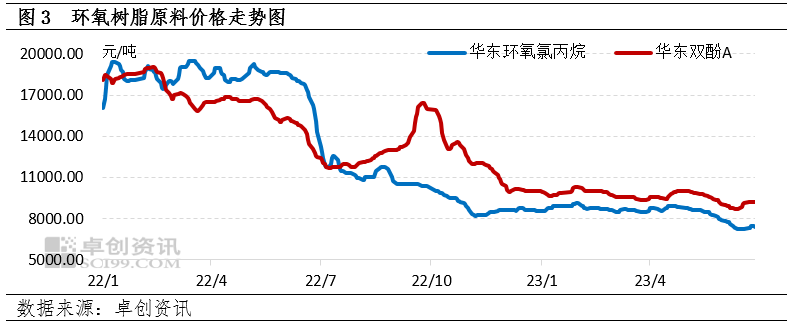

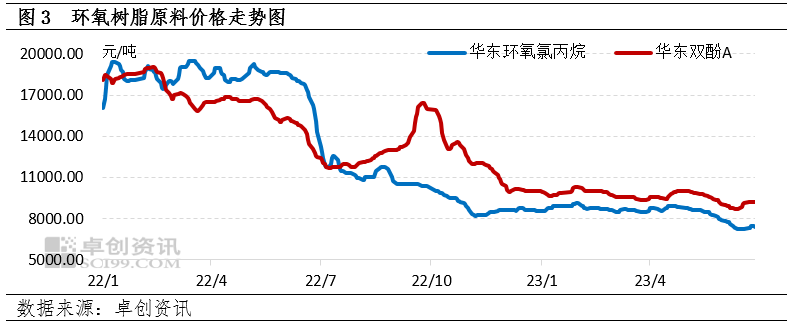

in the first half of the domestic bisphenol A negotiation center of gravity shock decline. Compared with the same period last year, the average market price of bisphenol A in East China was 9633.33 yuan/ton, a decrease of 7085.11 yuan/ton, a decrease of 42.38. During this period, the highest negotiation is 10300 yuan/ton at the end of January, and the lowest negotiation is 8700 yuan/ton in mid-June, with a price range of 18.39. The downward pressure on the price of bisphenol A in the first half of the year mainly came from the supply and demand side and the cost side, in which the change of supply and demand pattern had a more obvious impact on the price. In the first half of 2023, the domestic production capacity of bisphenol A increased by 440000 tons, and the domestic production increased significantly year on year. Although the consumption of bisphenol A increased year-on-year, the development of the terminal industry showed a strong expectation of weak reality, but the growth rate was not as good as that of the supply side, and the pressure of market supply and demand increased. At the same time, the raw material phenol acetone also declined simultaneously, superimposed on the macroeconomic risk sentiment, market confidence is generally weak, and many factors have a negative impact on the price of bisphenol A. In the first half of the year, the bisphenol A market also rebounded in stages. The main reason is that product profits have shrunk significantly and equipment gross profit has lost significantly. Some bisphenol a equipment down to start, downstream factories concentrated to fill positions, supporting price increases.

In the first half of the domestic epoxy chloropropane market weak fluctuations, in late April into the downward channel. Epichlorohydrin prices fluctuated from the beginning of the year to mid-to-early April. The price increase in January was mainly due to the improvement of pre-holiday orders for downstream epoxy resins, which increased the enthusiasm for purchasing raw materials for epoxy chloropropane. Factories deliver more contracts and upfront orders, and market in stock is tight, leading to higher prices. February's decline was mainly due to sluggish terminal and downstream demand, blocked factory shipments, high inventory pressure and a narrow decline in offers. In March, downstream epoxy resin orders were not smooth, resin positions were high, demand was difficult to improve significantly, market price fluctuations were low, and some cyclic chlorine plants were reduced and stopped under cost and inventory pressure. In mid-April, under the influence of the parking of some factories in the market, the in stock supply in some areas was tight, the quotation of new orders in the market rose, and the negotiation of actual orders rose. From the end of April to mid-June, the differentiation of multi-process gross profit gradually became obvious, coupled with the weak upstream and downstream buying gas, the market fell after the actual single negotiation. Towards the end of June, the cost pressure of the propylene method is high, and the sentiment of the market holders is gradually rising. Some downstream just need to follow up, the market trading atmosphere briefly heated up, the actual order price rose narrowly. In the first half of 2023, the average price of epichlorohydrin in the East China market was about 8485.77 yuan/ton, down 9881.03 yuan/ton or 53.80 percent from the same period last year.

Domestic epoxy resin market supply and demand mismatch intensified

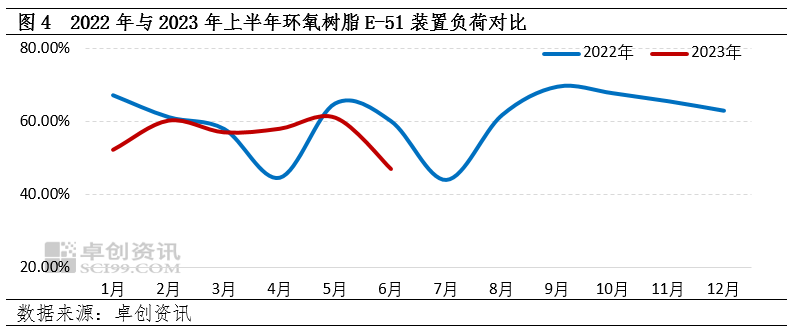

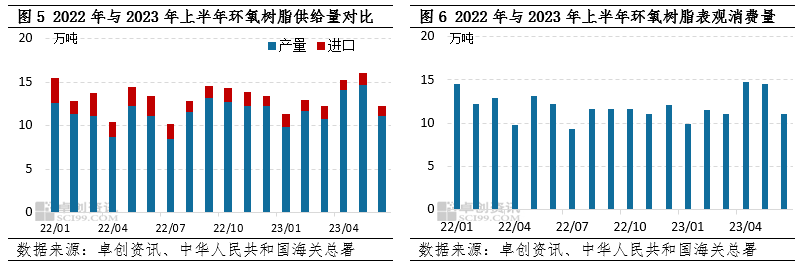

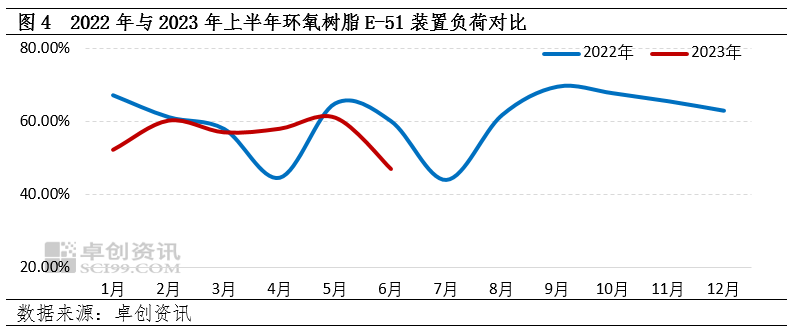

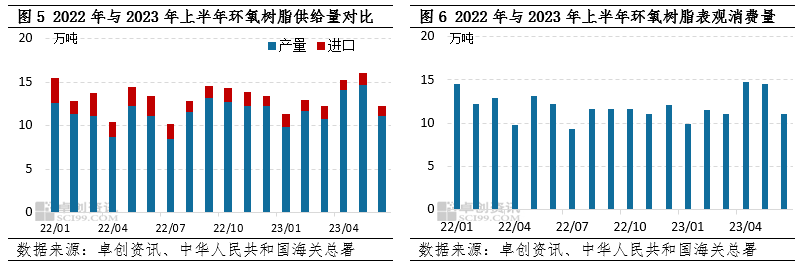

supply side: in the first half of the year, Dongfang Feiyuan, Dongying Hepang and other new production capacity of about 210000 tons was released, while the downstream demand side growth rate is less than the supply side, the market supply and demand mismatch intensified. The average operating load of epoxy resin E-51 industry in the first half of the year was about 56%, down 3 percentage points from the same period last year. At the end of June, the overall market operation was reduced to about 47%; from January to June, the output of epoxy resin was about 727100 tons, up 7.43 percent year on year. In addition, the import of epoxy resin from January to June was about 78600 tons, a decrease of 40.14 from the same period last year. The main reason was that the domestic supply of epoxy resin was sufficient and the import volume was small. The total supply reached 25.2 million tons, an increase of 7.7 percent over the same period last year.; The new capacity in the second half of the year is expected to be 335000 tons. Although some equipment may delay production due to profit levels, supply and demand pressures and falling prices, it is an indisputable fact that epoxy resin production capacity further accelerates the pace of energy expansion compared with the first half of the year, and the market supply capacity may continue to increase. On the demand side, the level of terminal consumption has been slow to recover. It is expected that new policies to stimulate consumption will be introduced in the second half of the year. With the introduction of a number of policies and measures to promote the sustained improvement of the economy, the spontaneous repair of the internal energy of the economy will be superimposed, and China's economy is expected to continue to improve marginally, which is expected to promote the demand for epoxy products.

Demand side: after the optimization of epidemic prevention policies, the domestic economy officially entered the repair channel in November 2022. However, after the epidemic, the economic repair is still dominated by "scenario-style" recovery, tourism, catering and other industries to take the lead in the recovery, the momentum is strong, the demand-driven effect of industrial products is lower than expected. So did epoxy, with lower than expected end demand. Downstream coatings, electronics and wind power sectors recovered slowly and the overall demand side was weak. The apparent consumption of epoxy resin in the first half of the year was about 726200 tons, down 2.77 percent from the same period last year. With the increase and decrease of supply and demand, the mismatch between supply and demand of epoxy resin is further aggravated, and the decline of epoxy resin.

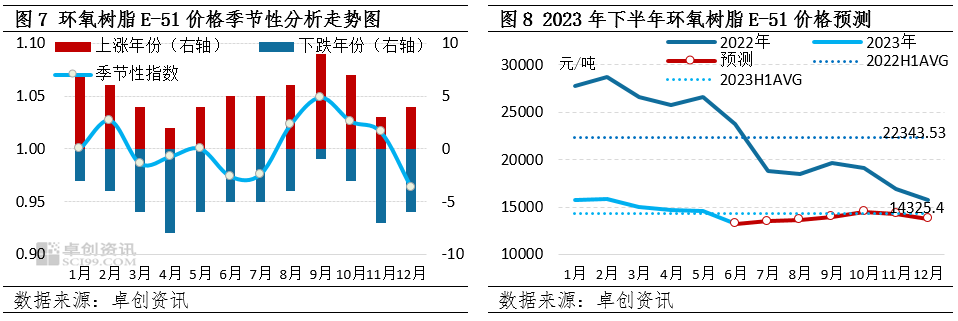

Epoxy resin seasonal characteristics are obvious, the probability of rising in September-October is higher.

Epoxy resin price fluctuations have certain seasonal characteristics, which are specifically manifested in a narrow increase after market fluctuations in the first nine months. Among them, the demand for stock before the Spring Festival in January-February will release support resin prices; September-October will enter the "Golden Nine Silver Ten" traditional consumption peak season, with a high probability of price increases; March-May and November-December will gradually enter the off-season of consumption, epoxy resin downstream digestion pre-inventory raw materials are more, the market price decline probability is higher. It is expected that the epoxy resin market will continue the above-mentioned seasonal fluctuations in the second half of this year, combined with changes in energy market prices and the domestic economic repair process.

It is expected that the high probability of the second half of the year will appear in September and October, and the low point may appear in December. Half a year epoxy resin market low range fluctuations, the mainstream price range may be 13500-14500 yuan/ton.

Mainly

Mainly

Polyurethane

Polyurethane

Fine Chemical

Fine Chemical

.png)