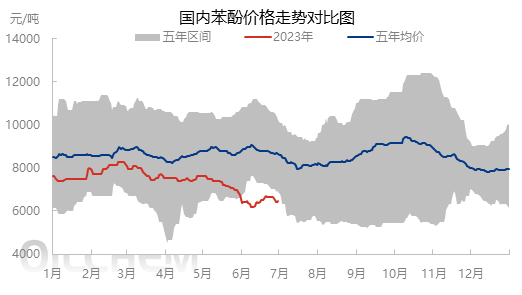

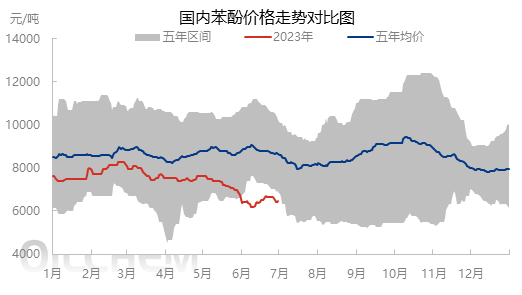

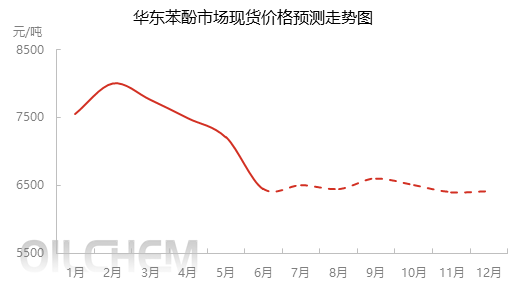

In the first half of 2023, the domestic phenol market fluctuated greatly, and the price drive was mainly dominated by supply and demand factors. The price of in stock fluctuated between 6000-8000 yuan/ton, which was at a low level in the past five years. The average price of phenol in East China in the first half of 2023 was 7410 yuan/ton, down 3319 yuan/ton from 10729 yuan/ton in the first half of 2022, down 30.93 percent. In late February, the high point in the first half of the year was 8275 yuan/ton; The low point of 6200 yuan/ton in early June.

Phenol in the first half of the market review

苯酚价格走势.jpg" contenteditable="false"/>

苯酚价格走势.jpg" contenteditable="false"/>

the New Year holiday returned to the market. Although the inventory of Jiangyin Phenol Port was as low as 11000 tons, considering the impact of the production of new phenol and ketone plants, the terminal purchase slowed down and the market decline increased the wait-and-see of the operators. Later, due to the lower-than-expected production of new equipment, the in stock was tight and favorable, stimulating the market to rise. With the approach of the Spring Festival holiday and the increase of traffic resistance between regions, the market gradually turned to the market closed state. During the Spring Festival, the phenol market started well. In just two working days, it increased by 400-500 yuan/ton. Considering that it will take time for the terminal recovery after the holiday, the market stopped rising and falling. When the price is as low as 7700 yuan/ton, considering the high cost and average price, the intention of the cargo holder to make a profit to ship is weakened.

In February, Lianyungang two sets of phenol ketone plant running smoothly, phenol market domestic products to enhance the voice, the terminal wait-and-see participation in the impact of supplier shipments. Although the export shipment and negotiation operations in the same period are conducive to phased stimulus, but the support is limited, the overall market rise and fall is larger.

In March, the downstream bisphenol A started to decrease, the domestic phenolic resin competition pressure is greater, the demand side downturn led to the decline of phenol in many places. During this period, although high costs and average prices supported the market's rise in stages, it was not easy to maintain a high level, and the weak market was interspersed intermittently.

From April to May, the domestic phenolic ketone plant ushered in a period of concentrated maintenance, affected by the interactive game between supply and demand. In April, the market ups and downs appeared each other. In May, the external environment was weak, the demand side performance was sluggish, the device maintenance benefits were difficult to release, the falling market dominated, and the low prices were continuously broken down. Near mid-June, the downstream large-scale bidding operation increased the participation of operators, increased the circulation of domestic in stock, eased the pressure on holders to ship, and increased the enthusiasm to push up. In addition, the appropriate replenishment of the terminal before the Dragon Boat Festival has steadily increased the support center of gravity. After the Dragon Boat Festival, the market bidding operation temporarily ended, the participation of operators slowed down, the supplier shipments decreased, the center of gravity was slightly weaker, and the transaction turned quiet.

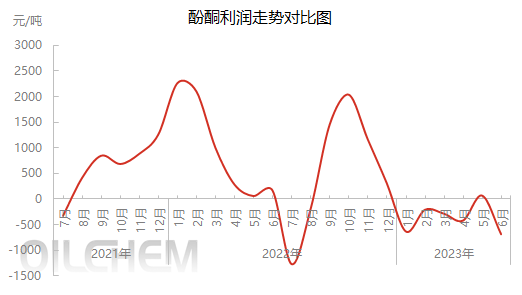

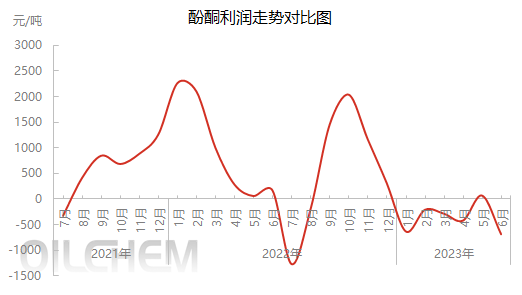

Phenol market is poor, profits are mostly negative

in the first half of 2023, the average profit of phenolic ketone enterprises was -356 yuan/ton, down 138.83 percent from the same period last year, the highest profit after mid-May was 217 yuan/ton, and the lowest profit in the first half of June was -1134.75 yuan/ton. In the first half of 2023, the gross profit of domestic phenolic ketone plants was mostly negative, and the overall profit time was only one month, with the highest profit not exceeding 300 yuan/ton. Although the price trend of double raw materials in the first half of 2023 is not as good as that of the same period in 2022, the price of phenol ketone is also the same, even worse than the performance of the raw material side, and the loss of profits is difficult to alleviate.

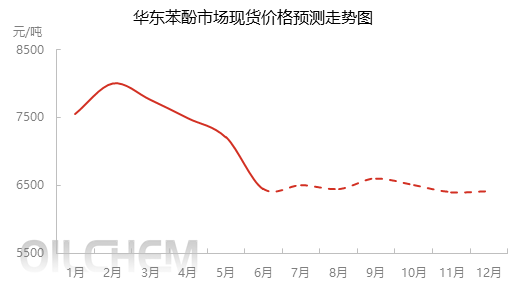

Phenol Market Outlook for the Second Half of the Year

in the second half of 2023, under the expectation that the new equipment of phenol and downstream bisphenol A will be put into production in China, the supply and demand pattern is still in a dominant position, and the market is variable or normal. Affected by the new equipment production plan, the competition between domestic products and imported products, domestic products and domestic products will be further intensified. There are variables in the start-up and start-up status of domestic phenolic ketone equipment. Whether the export and domestic competition situation in some downstream fields can be alleviated, the new production pace of bisphenol A and the start-up of new equipment are particularly critical. Of course, in the case of continued losses in the profits of phenolic ketone companies, we should also pay attention to cost and price trends. Comprehensive judgment of supply and demand fundamentals will face losses and current profits. It is expected that the domestic phenol market in the second half of the year will not have a large rise and fall, and the price fluctuation range is expected to be 6200-7500 yuan/ton.

Source: Longzhong Information

* Disclaimer: the content contained in the Internet, WeChat public number and other public channels, we maintain a neutral attitude to the views in the article. This article is for reference only, exchange. The copyright of the reprinted manuscript belongs to the original author and organization. If there is infringement, please contact Huayi World Customer Service to delete it.

Mainly

Mainly

Polyurethane

Polyurethane

Fine Chemical

Fine Chemical

苯酚价格走势.jpg" contenteditable="false"/>

苯酚价格走势.jpg" contenteditable="false"/>

.png)