Polyether polyol prices in

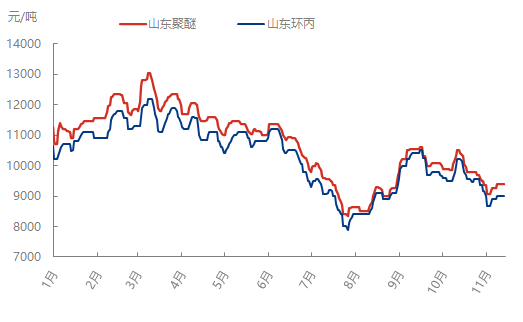

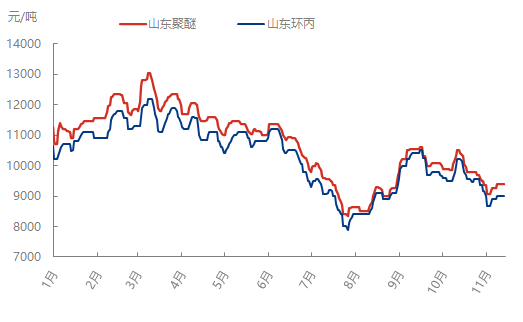

November first fell and then rose, last week in a row, market pressure intensified, Sunday afternoon Shandong ring propylene rose 100 yuan, the market direction is still unclear; at the end of the year full chain profit is weak, production insurance price restrictions and new capacity hedging continue to affect the market mentality, the market can tentatively advance.

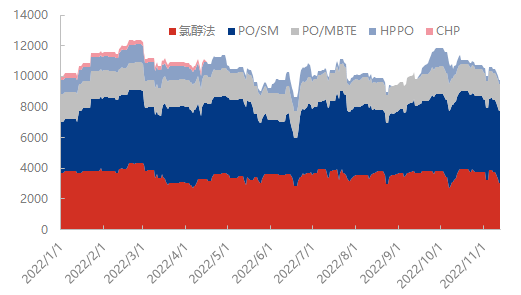

Figure 1 2022 Shandong polyether polyol flexible foam-cyclopropyl price trend comparison chart

Source: Longzhong Information

November polyether polyol factory quite market spread narrow, the main raw materials ring propylene south tight north loose support difference operation

.

Although the market fell sharply in the second half of October, during this period, polyether large factories in South China supported the market, large factories in the north and traditional factories worked hard respectively, and the market formed a phased micro-balance, so the market successfully stopped falling 8700-9000 yuan/ton. In November, on the one hand, the main downstream sponge desalination, the national outbreak of the outbreak of sealing control. On the other hand, the propylene oxide plant once again enters the passive adjustment of cost pressure emissions, and the market is empty and multi-force. Spot market operators were forced to continue to adjust the direction of trading, the overall effect is flat. In November, although the price of soft foam was still low in the south and high in the north, the upside-down situation improved compared with the previous period-mainly because there was no obvious shipping pressure from large factories in South China, and the market continued to adjust and repair under the delay of shipments from East China in October. Although propylene oxide is still cautious, after stopping the decline around 8700 yuan/ton, the final report of three adjustments in 10 natural days is 9100-9200 yuan/ton, which is obviously slower than before. At this stage, polyether orders are indeed unsustainable, but the total level of replenishment in November is still ideal. Although Shandong/Tianjin two sets of epoxy propane plant trial operation, but still no qualified product production, import supply reduction, Zhenhai liande phase II decline, East China again north replenishment, successfully promote the East China spot circulation cautious, Shandong ring propylene factory accumulation speed is slow.

the

of the downstream light + long-term stability, market participants to fall sentiment heating up, but limited production and price protection + space is limited, support various possibilities

after July, under the condition of poor market performance in October, propylene oxide once again changed its strong style and maintained low-load operation: first, Jilin Shenhua plant stopped again after the National Day holiday, then the failure of Bohai plant was reduced, Zhenhai Liander Phase II was reduced, and the chlorohydrin plant Xinyue, Sanyue and Binhua were reduced irregularly. Therefore, although the industry personnel waiting for a large number of new capacity, expected to be empty, but the new capacity is still advancing, the original supply contraction has become an important factor to support the market.

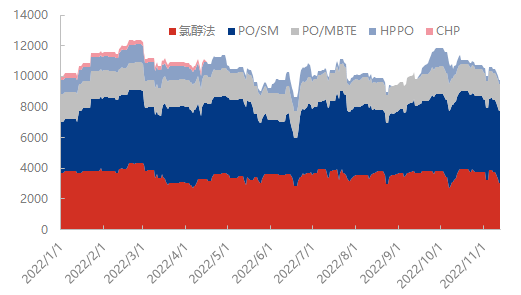

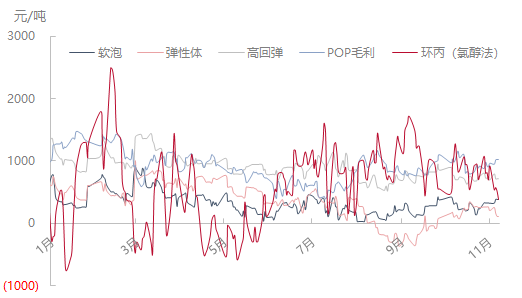

Figure 22022 Propylene Oxide Supply Statistics

Source: Longzhong Information

At present, the supply of propylene oxide the main raw material of polyether polyols is still attracting the attention of the industry. Compared with the supply in 2022, the supply of chlorohydrin/HPPO/CHP process contracted, and the supply of PO/SM increased from the beginning of the year, but lower than the rest of the year. In fact, as far as the cyclopropyl process is concerned, they all have high load starting capacity PO/SM. In addition to the failure of new equipment, it is more likely to reduce production and burden due to the deviation of economic benefits. The supply of HPPO has also decreased significantly. In the early stage, the transportation distance of the two sets of equipment and the transportation cost away from consumption is an important factor. However, although capacity is dependent only on polyether manufacturers, the overall cost pressure for new equipment is still significant. Therefore, the future process cost competition is inevitable, phased PO/SM pressure again, chlorohydrin method also exists in the possibility of small profit scheduling and then down, effective price support;

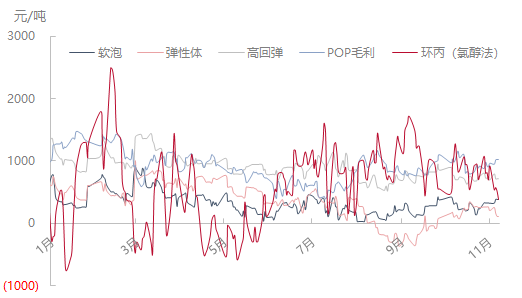

Figure 32021-2022 Polyether Chain Theoretical Gross Profit Comparison Figure

Source: Longzhong Information

Source: Longzhong Information the overall gross profit level of the

polyether chain is relatively thin, in terms of the above theoretical gross profit comparison, high rebound, POP theoretical gross profit remains at about 1000 yuan/ton, other flexible foam/elastomer and chlorohydrin method cyclopropyl in a thin profit state of less than 500 yuan/ton. Considering that the northern soft bubble shrinkage is obvious, the actual profit will be more difficult. Full-brand polyether profit is meager, epoxy propane profit and supply ratio of the relative preference of the chlorohydrin method also continued to be profitable, which is also one of the factors of the recent promotion of large factories, individual brands of traditional factory efforts.

has a mediocre performance in the terminal market at this stage. After Shuang Dan abroad, the performance of the domestic Double Eleven is also mediocre, and the support of the demand side is not strong. In addition, TDI with supply-side blessing has also returned to a low level, and the support of the demand side is not strong, and it is difficult to stimulate the stocking under the subsequent release of new production capacity, if the weak balance at this stage is difficult to break the market still has a strong market or even high foundation, and if the news force is insufficient, the mentality of brick fatigue under the market narrow downward space is limited, but if the new production capacity is smooth and up to production operation, the market will enter a new round of downward bidding competition!

source: Longzhong polyurethane. * Disclaimer: The content comes from the Internet, WeChat public accounts and other public channels, we maintain a neutral attitude towards the point of view. This article is for reference only, exchange. The copyright of the reproduced manuscript belongs to the original author and institution. If there is any infringement, please contact the customer service of Huayi World to delete it.

Mainly

Mainly

Polyurethane

Polyurethane

Fine Chemical

Fine Chemical

Source: Longzhong Information

Source: Longzhong Information

.png)