the overall market supply of glacial acetic acid in August is large, some downstream is in the off-season, the demand for acetic acid may be limited. The glacial acetic acid market in August may continue to fluctuate and fall in July. Due to the small number of maintenance enterprises this month, only Shanghai Huayi and Dalian Hengli have maintenance plans, the supply remains at a high level, and the factory inventory is at a medium-to-high level. In order to promote shipping sentiment, the factory actively reduces prices and promotes shipments. At the same time, operators still hold a bearish mentality, so the negotiation enthusiasm is not high, and the consumption of glacial acetic acid market is difficult to increase significantly; in the short term, there are many negative effects in the glacial acetic acid market, which is difficult to support price increases. Subsequently, the rise and fall of the price of glacial acetic acid requires more attention to the changes in the cost and profit of the acetic acid factory, as well as the changes in the inventory of the acetic acid factory, as well as the market operator's psychology.

In recent years, the production capacity of glacial acetic acid and its main downstream industries has shown an upward trend. However, the profit transmission in the industrial chain is not balanced. In the future, it is still one of the driving forces of profit and demand expansion. The supply capacity of glacial acetic acid is bound to reach a higher level. At that time, the balance of supply and demand will be broken.

Although the production capacity of glacial acetic acid is gradually increasing, consumption is also showing an increasing trend, but the profit transmission in the industrial chain is not balanced, and some downstream profit conditions are hardly ideal.

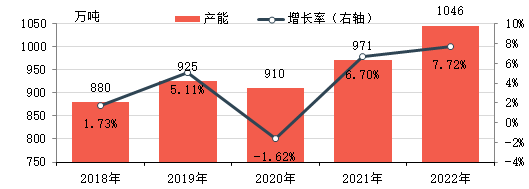

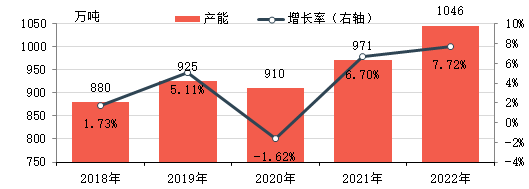

glacial acetic acid production capacity gradually expanded

2018-2022, China's glacial acetic acid production capacity steadily increased, supported by downstream demand development and good profitability. As of 2022, the annual effective production capacity of glacial acetic acid is 10.46 million tons, an increase of 18 tons over 2018. 86%.

In the past five years, the overall price of glacial acetic acid has been rising with increasing domestic demand and active export markets. At the same time, most of the time and raw methanol to maintain a large price difference, so has a strong profitability and a longer profit time.

2017-2018, the operation of foreign glacial acetic acid plants was unstable, and the export market provided support for the domestic market. In addition, with the slowdown of domestic glacial acetic acid production capacity and the expansion of downstream production capacity, the demand for glacial acetic acid has just increased, which jointly supports the rise of domestic glacial acetic acid prices. Although the trend with the raw material methanol is basically consistent, but the spread continues to expand, profit margins continue to expand. In 2018, the average theoretical gross profit in the East China market was about 1753 yuan/ton. In 2019-2020, domestic glacial acetic acid production capacity increased steadily and supply increased. Demand declined in stages due to unexpected factors. The price of glacial acetic acid in China fluctuates greatly, and the price difference with methanol has decreased to some extent. In 2020, the average theoretical gross margin of the East China market will be about 504 yuan/tonne. In 2021, although the prices of methanol and glacial acetic acid showed an upward trend, the price of glacial acetic acid rose sharply due to the increasing demand at home and abroad and the phased decline in supply, which made the average gross profit margin of the East China market continue to expand.. 41%.

Although the profit is considerable, the downstream demand shows a continuous growth momentum, which makes existing manufacturers and new market participants formulate new glacial acetic acid project plans, most of which have been implemented.

downstream demand is still growing in the future.

still has new capacity plans for most downstream products in the future, pushing the supply capacity of glacial acetic acid to continue to improve.

From 2021 to 2022, EVA production capacity expanded rapidly, and products also grew rapidly. VA vinyl acetate content was close, the demand for vinyl acetate increased significantly, vinyl acetate production capacity expanded, and there was a shortage of non-calcium carbide supply. Since 2022, some calcium carbide supply has been supplemented to the original ethylene supply users, China's vinyl acetate supply mode has changed from structural surplus to structural tension. EVA partly considers self-built vinyl acetate due to the difficulty and increased cost of user purchase. Prior to this, some projects under construction are in progress, and the production capacity of vinyl acetate will be released in 2023.

ethyl acetate is also one of the main downstream products of glacial acetic acid. In recent years, the contradiction between supply and demand of ethyl acetate is prominent, and the growth of production capacity is relatively slow. In 2022-2023, new capacity will still be mainly in existing enterprises, mainly to expand the industry share, further reduce costs and improve efficiency. In addition, as the current trend of integration of the petrochemical industry is becoming more and more obvious, some enterprises plan to build new ethyl acetate units to expand the industrial chain. However, due to the simple production process of ethyl acetate, rapid changes in domestic equipment and flexible production, mainly according to changes in cost and demand, the output has increased slowly in recent years.

In terms of acetic anhydride, in recent years, new equipment and elimination equipment coexist, and the overall supply shows an increasing trend. From the perspective of consumption structure, it is mainly used in the production of acetate fiber, pharmaceutical intermediates, pesticide intermediates, spices, dyes, food additives, chemical dehydrating agents and other fields. Some domestic acetate fiber plants are equipped with acetic anhydride units, and the degree of integration in other fields is not high. In the future, the acetic anhydride plant will continue to be built. Ningxia Donghe plans to put into production 150,000 tons in the second half of this year. Henan Ruibai also plans to build a new acetic anhydride plant, and the industry's production capacity is expected to continue to expand. Acetic anhydride downstream field is extensive, the demand side still has some room for growth, but with the improvement of production capacity, the industry competition will become more and more fierce.

There will be many new glacial acetic acid projects in the future, and the supply-demand balance may be broken.

In recent years, the supply of glacial acetic acid has also maintained an upward momentum, and downstream demand has continued to grow, and the next three years will be no exception.

the table above shows the new production capacity plan for some glacial acetic acid in the next three years. In addition, some enterprises have new construction and energy expansion plans. It can be seen that the expectation of future glacial acetic acid production capacity growth is still very high. Although downstream demand will continue to rise, it remains to be seen whether the incremental supply of glacial acetic acid can be fully digested. It does not rule out China's glacial acetic acid overcapacity.

Source: Zhuochuang Chemical, Molecular Society

* Disclaimer: The content comes from public channels such as the Internet and WeChat official accounts. We remain neutral on the views in the article. This article is for reference and communication only. The copyright of the reprinted manuscript belongs to the original author and institution. If there is any infringement, please contact the world customer service department to delete it.

Mainly

Mainly

Polyurethane

Polyurethane

Fine Chemical

Fine Chemical

.png)