In recent years, with the expansion of some domestic polyether factories, the production capacity of polyether has been increasing year by year. As of 2022, the domestic production capacity of polyether has reached more than 6.5 million tons. However, due to the improvement of people's living standards and the increase in purchasing power for durable goods, the downstream industry of polyether The demand is basically saturated. In addition, the occurrence of the new crown virus in recent years has curbed the demand for polyether, so the phenomenon of polyether overcapacity is more serious. Later polyether still has new production capacity, although the factory expansion is a good thing, but facing the current market, in the production capacity is abundant, polyether challenges are relatively large.

Production capacity continues to expand, demand is weak, market confidence has been hit.

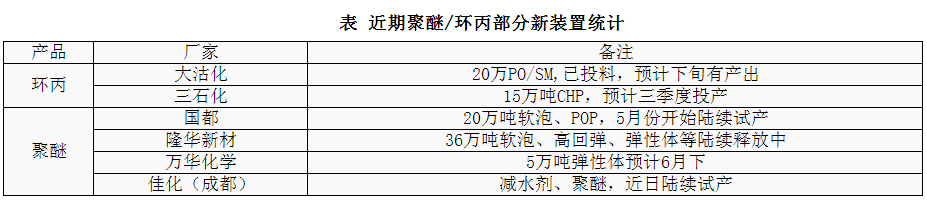

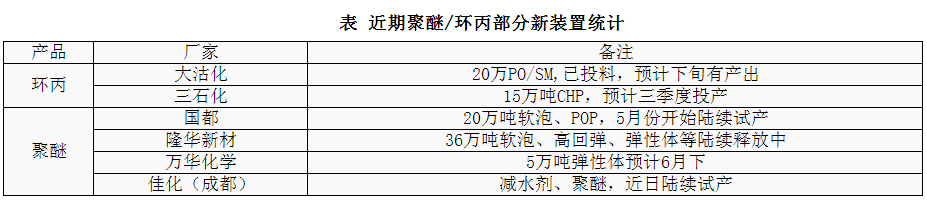

Recently, many factories such as Polyether Longhua New Material, Wanhua Chemical, Binzhou Jiahua, Tianjin Sanshihua, Yueyang Changde and other factories have put in new production capacity. At that time, the consumption of raw material cyclopropyl will also increase. However, due to the dismal market demand, the factory operating rate is generally not high under sufficient production capacity, and the pressure of polyether continues to exist, so the consumption of cyclopropyl by polyether has not increased too much, and cyclopropyl also has certain new production capacity to be put into production, for example, Daguhua, Sanshihua, Jincheng Petrochemical, Satellite Petrochemical, Qixiang Tengda, etc., under the obvious increase in production capacity, polyether also has certain obstacles to the consumption of cyclopropyl. Therefore, although elastomer polyether is gradually ushering in the traditional peak season, under the influence of many factors, the exuberant situation may be difficult to show, which has a deep impact on the mentality of the industry. If demand gradually recovers, the consumption will make a big leap, but at present, polyether demand is more difficult to improve, prices or remain low trend.

Cyclic propylene rebounded only 100 yuan, polyether first rose and then suppressed

, under the imbalance between supply and demand, polyether orders are difficult to be strong, short-term downstream inventory digestion is the main, and the upstream cost of cyclopropyl is weak, and the price downward space is increasing. In addition, polyether and cyclopropyl have new production capacity in the later stage, which makes it difficult to boost the confidence of the industry. However, due to the influence of external uncertain factors, the specific situation remains to be seen, but the overall situation is not too optimistic.

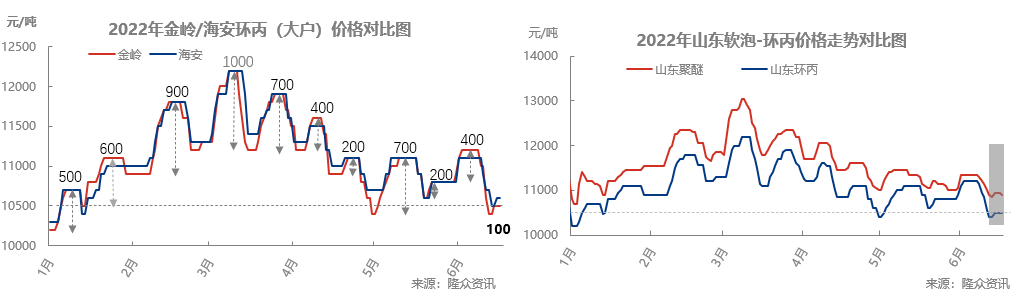

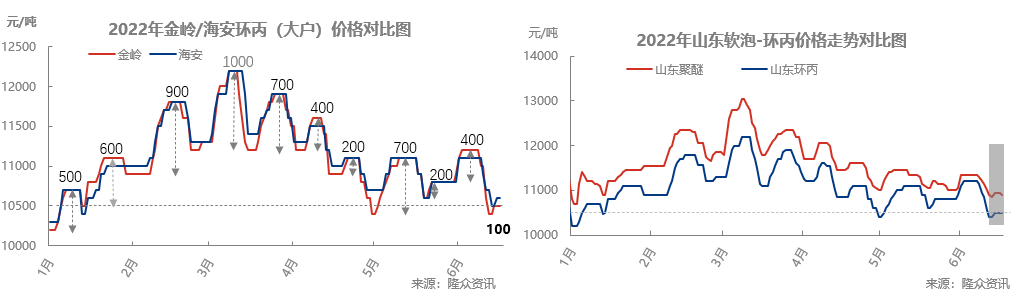

Figure 1 2022 polyether/cyclopropyl price trend comparison

polyether began to fall last week, while cyclopropyl began to fall in the middle of last week and maintained an accelerated trend at the weekend, rapidly falling to 10400 yuan/ton, the lowest point since May and the second lowest point since 2022. There were moderate purchases in the middle and lower reaches, and more waiting for the polyether reaction at the beginning of the week. Although there were some low-level discussions at the polyether end over the weekend to promote the single news, most of them were cautious and the soft bubble-cyclopropyl spread was widened, in addition, the promotion of orders in early trading on Monday had some effect. Some factories added cyclopropyl, and the signal to stop the decline was confirmed one after another. Polyether orders were further followed up. Overall, most factories showed a large volume performance on Monday (Longzhong Evaluation Department was the highest since the second quarter, and some mainstream factories had a single volume of more than 4000 yuan/ton in the week). Polyether has declined rapidly, and most manufacturers have maintained their willingness to reduce their shipments. The low price below 10800 yuan/ton is recovered, but the high price above 11000 yuan/ton is also difficult to clinch a deal. Cyclic C is only a narrow increase of 100 yuan/ton, stable at 10500-10600 yuan/ton in the north and 10600-10800 yuan/ton in East China.

Compared with the market and price trend of cyclopropyl and polyether since 2022, polyether microwave movement and in the second half of the week there was a low promotion order, while the low rebound of cyclopropyl was only 100 yuan, which is true to be a rare weak rebound in the polyether/cyclopropyl market, and it is also a real hammer for the polyether/propylene oxide industry to expand rapidly during the surplus weakening change.

Polyether peak season market is difficult to present, challenges and opportunities coexist.

At present, polyether is in a light demand stage, with few orders, relatively large shipping pressure, and prices are falling sharply. The market mentality is not optimistic for the time being. Due to poor sales, downstream factories only maintain 5-60% of the operation. The consumption cycle of raw material inventory is increasing, the enthusiasm for purchasing is greatly reduced, and more people are in a wait-and-see state. The overall trading atmosphere in the market can be said to be very weak compared with last year, at present, there is no sign of improvement in demand, and the downstream mentality is weak. No matter whether the price rises or falls or not, the industry will not have much demand. It can be said that it is numb to the current market. At present, the price of polyether in North China is 10500-10850 yuan/ton, and the price of cyclopropyl is 10100-10300 yuan/ton, both of which have reached the lowest price in the year. History repeats itself again. Although the current price is already at a low level, the price may continue to fall under the influence of sluggish demand, and the cost of cyclopropyl is still weak. Therefore, the negative guidance continues to spread, there is no positive factor support for the time being, the demand is weak, and the price trend will continue to explore the bottom, in the later period, it will be difficult to appear in the peak season of polyether. Although opportunities still exist, the greater challenge is the pressure brought by the general environment.

Source: Jinlianchuang Chemical, Longzhong Polyurethane * Disclaimer: The content contained in the content comes from the Internet, WeChat public number and other public channels, we maintain a neutral attitude towards the views in the article. This article is for reference only. The copyright of the reprinted manuscript belongs to the original author and the organization. If there is any infringement, please contact Huayi Tianxia Customer Service to delete it.

Mainly

Mainly

Polyurethane

Polyurethane

Fine Chemical

Fine Chemical

.png)