Read: 207

Time:44months ago

Source:

International Oil Price Collapse Drops Nearly 7%

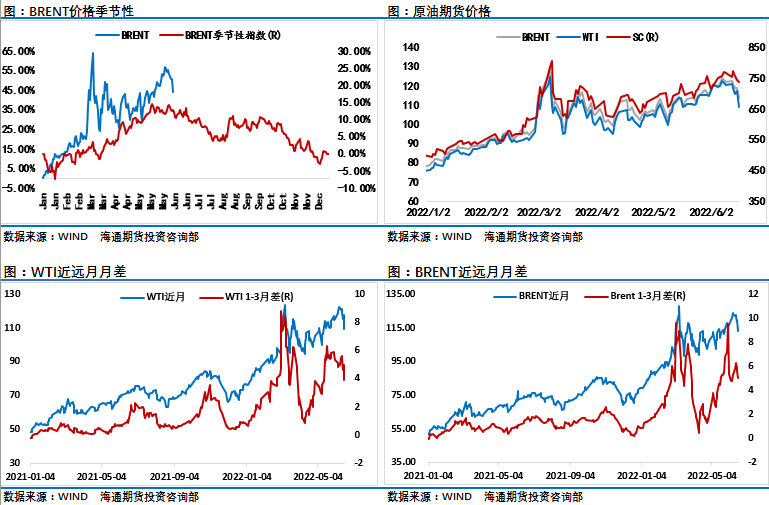

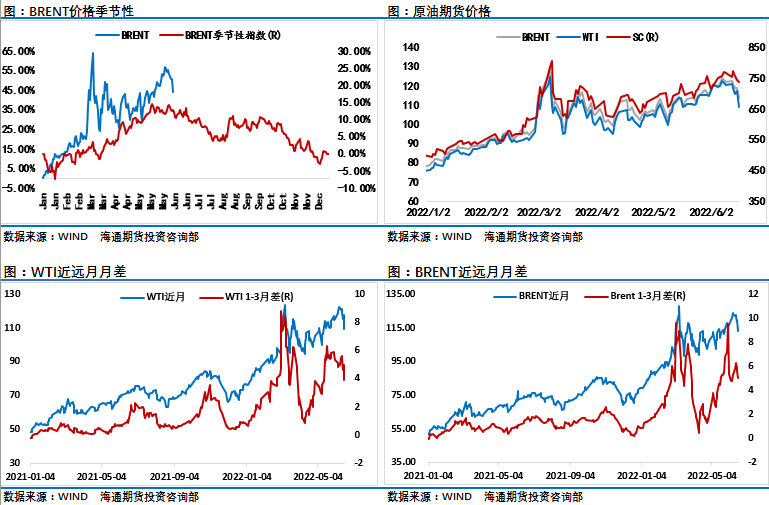

Due to market concerns that the economic slowdown has lowered oil demand and the number of active oil rigs in North America has increased significantly, the international oil price crash fell nearly 7% last weekend, and Monday's opening continued the downward trend.

to the end of the day, the New York Mercantile Exchange July delivery of light crude oil futures prices fell $8.03 to close at $109.56 a barrel, a decrease of 6.83%; August delivery of London Brent crude oil futures prices fell $6.69 to close at $113.12 a barrel, a decrease of 5.58%.

demand is weak! A variety of chemical prices dive!

at present, the chemical industry generally has a downturn in the market and a sharp decline in downstream demand. Many companies have chosen a relatively low-key and gentle way to reduce the operating rate to cope with the current declining market. What chemicals are under pressure in the deep sea at the tip of the iceberg?

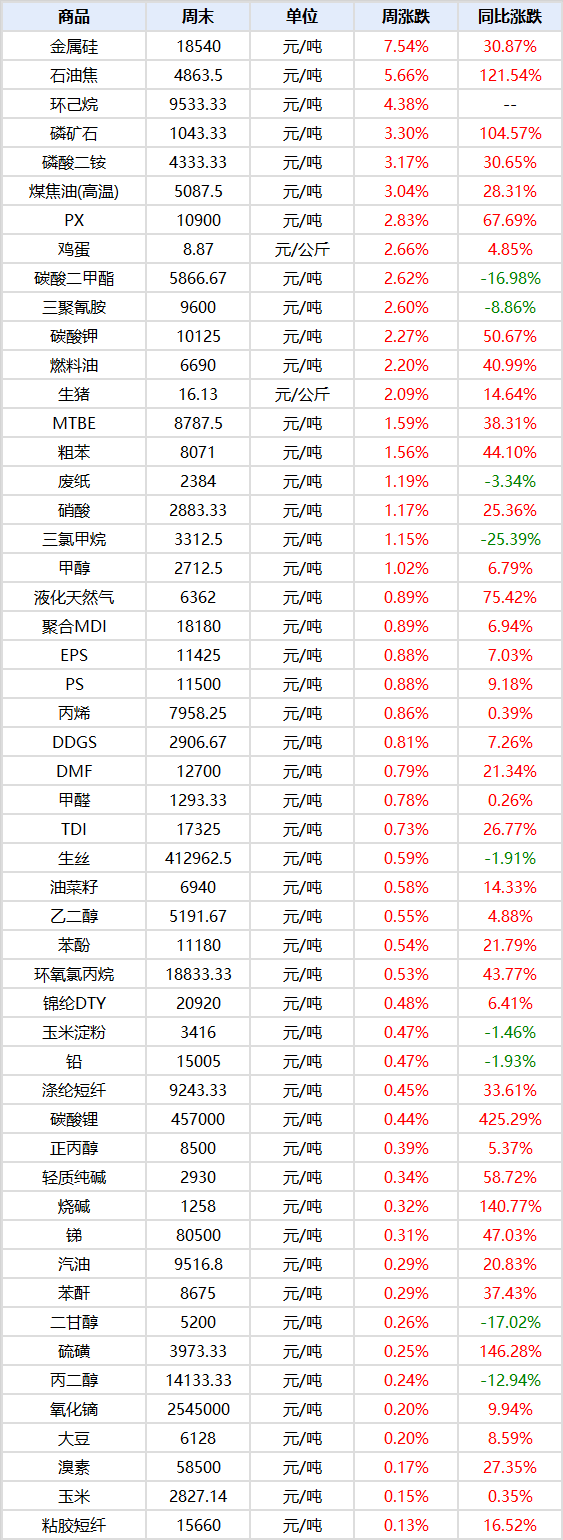

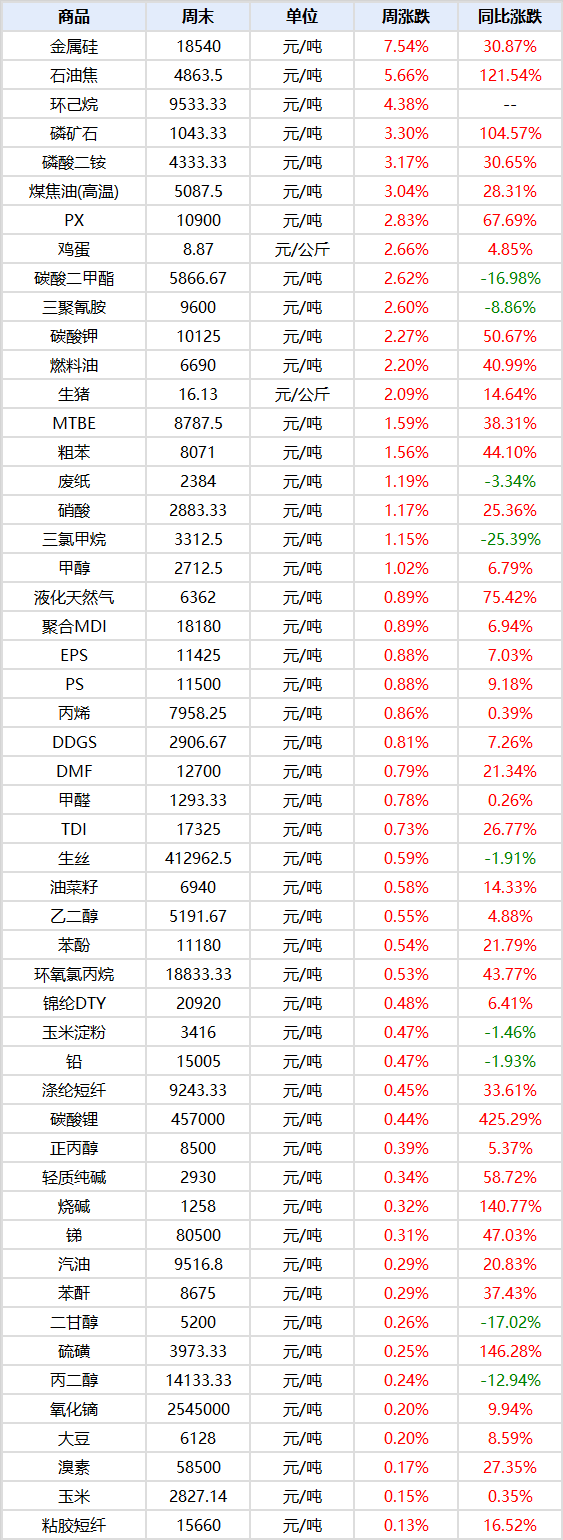

Bisphenol A: The overall demand of the industrial chain is weak, and there is still room for downward

In the first half of this year, the price of epoxy resin hovered around 25000 yuan/ton on average, which also had a certain impact on the demand for bisphenol A. Policy on the bisphenol A, epoxy resin industry chain has been basically digested by the market, the current bisphenol A industry chain as a whole demand is weak. Downstream epoxy resin, PC contradiction is particularly prominent, supply is relatively sufficient and demand is difficult to follow up, it is expected that bisphenol A still has downward space. Polyether: Downstream Downward Purchase Weak, Industry Price War Difficult to Have Winners After the Dragon Boat Festival Holiday, Polyether Demand Opens a Decline Channel, Order Transactions Are Rare, New Order Follow-up Pressure Increases, Polyether Negotiation Shipment Declines, Under both Weak Cost and Demand, Cyclic C Opens a Decline Mode, Polyether Actively Follows Cyclic C, Downstream Purchase of Raw Materials Is Still Weak, and the Market as a Whole, prices continue to run down. In addition, the three giants of polyether price war fierce, in the domestic demand downturn, foreign prices are still lower than domestic prices, coupled with the continued development of foreign epidemics, demand significantly reduced, polyether exports have no good support. Epoxy resin: domestic sales and foreign trade are blocked, the mainstream price is low, the price of epoxy resin in this round, whether it is a first-line, second-line or third-line brand, the solid price is 21000 yuan/ton, and the liquid price is about 23500 yuan/ton, which is about 5000 yuan/ton lower than the same period last year, and the mainstream is low. However, downstream demand is still difficult to pick up, export-oriented economy has encountered the world economic downturn, exports are blocked. At present, consumption is on a downward trend, and the purchase of epoxy resin is also affected. Ethylene oxide: the largest downstream into the off-season, just need to follow up the lack of ethylene oxide the largest downstream polycarboxylic acid water reduction agent monomer into the seasonal off-season, demand is facing the peak season is not strong off-season weak market. In June, the rainy season increased significantly, and the overall consumption will show a significant decline in expectations. In addition, the downstream of the terminal is still facing the pressure of repayment, just need to follow up insufficient, the stock game is obvious. In the future, downstream destocking is still the main tone, polycarboxylic acid water-reducing agent monomer will show a stable and weak operation, and the consumption of ethylene oxide will show an insufficient trend. Glacial acetic acid: downstream due to losses down negative, people's livelihood consumption reduction accelerated off-season hit the first half of the two waves of bottoming prices based on locked in the level of 3400-3500 yuan/ton, the main factor is the downturn in just demand. Downstream product loads are low, most due to loss reduction and parking maintenance, resulting in a low operating rate. And the traditional off-season itself just need to decline, plus the first half of the epidemic affected people's livelihood consumption reduction, industrial chain transmission to reduce the demand for raw materials, downstream on the spot purchase intention is scarce. n-butanol: downstream butyl acrylate demand flat, the price fell 500 yuan/ton into June, the n-butanol market fluctuated, the downstream demand was slightly weak, the market turnover was not high, the market continued to decline, compared with the opening market price fell 400-500 yuan/ton at the beginning of the week. Butyl alcohol, the largest downstream butyl acrylate market performance is weak, the overall downstream industry tape roll and acrylate emulsion demand is flat, gradually entering the demand off-season, spot traders turnover is not smooth, the market center of gravity narrow softer. Titanium dioxide: the operating rate is only 80%, and the downstream profit and loss are difficult to change. The domestic titanium dioxide market is somewhat weak. The orders received by manufacturers are not as expected, and the market transportation is limited in a large range. At present, the overall operating rate of titanium dioxide enterprises is 82.1%. The downstream customers are currently in the inventory consumption stage. Sporadic large factories and some small and medium-sized manufacturers are actively reducing the load. At present, the domestic titanium dioxide market is difficult to change the expectation of partial air transportation in terminal industries such as real estate, in the short term, due to the limited capacity release space of foreign suppliers, domestic and foreign trade will be negative. June 20 Commodity Price Rise Ranking

Source: Global Chemical Industry * Disclaimer: The content contained in the content is derived from public channels such as the Internet and WeChat public accounts. We maintain a neutral attitude towards the views in this article. This article is for reference only. The copyright of the reprinted manuscript belongs to the original author and the organization. If there is any infringement, please contact Huayi Tianxia Customer Service to delete it.

Mainly

Mainly

Polyurethane

Polyurethane

Fine Chemical

Fine Chemical

.png)