Under the support of cost, the price center of polypropylene in the first quarter of 2022 moved up. Affected by factors such as epidemic control, Spring Festival holiday and poor logistics, the market demand of polypropylene is not as expected.

In the first quarter of 2022, the price center of polypropylene moved up as a whole. Taking the drawing in East China as an example, the final price closed at 8890 yuan/ton, up 6.79% compared with the initial price of 8325 yuan/ton. From the perspective of price operation, the fluctuation in the first quarter is more frequent, with the amplitude of high and low prices reaching 20.07%, among which the more prominent sharp rise and quick fall appeared in March.

The limited production and guaranteed price in the first quarter supported the price of polypropylene. The improvement of the current situation of inactive demand is limited, and the active replenishment kinetic energy of downstream factories is insufficient. In the downstream demand, the demand for BOPP, fiber and thin-wall injection molding increased slightly, but the weak adjustment situation of Polypropylene Market in April was difficult to change.

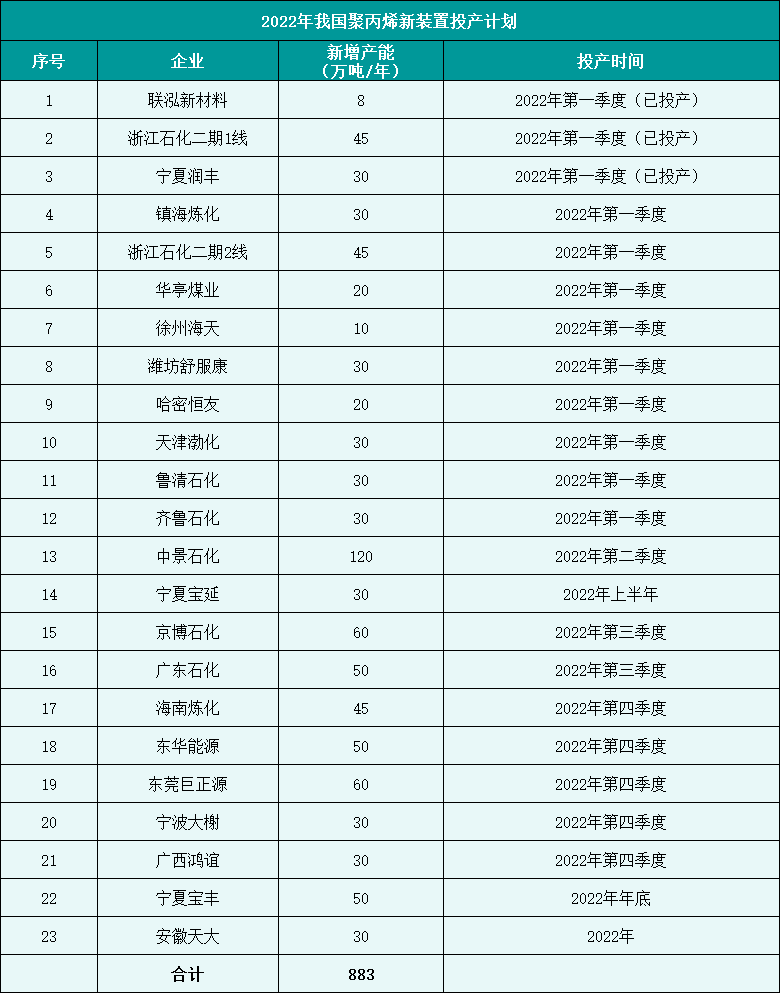

Production capacity erupts and 23 polypropylene units are planned to be put into operation.

In 2021, 11 polypropylene units were put into operation in China, increasing the scale by 3.3 million tons. By the end of 2021, China has built 36.09 million tons of polypropylene and 450,000 tons of polypropylene plant per year.

In 2022, China plans to put into operation 23 sets of polypropylene units, and the new production capacity will reach about 8.83 million tons/year. The production capacity is expected to increase year-on-year or significantly increase. If the production capacity is not measured, it is estimated that the total domestic polypropylene production capacity will exceed 40 million tons/year for the first time in 2022.

At present, Zhejiang Petrochemical and Lianhong new materials have been put into production. The main supply of polypropylene in China is Zhejiang, Guangdong, Shandong, Liaoning and Shaanxi. Large enterprises with large capacity scale include: zhejiang Petrochemical, national energy group ningmei, Donghua Energy, Yanchang China coal Yu energy, Hengli Petrochemical, China-South Korea petrochemical etc.

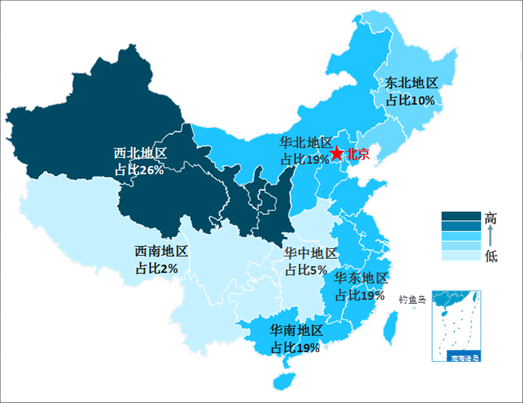

Regional distribution of polypropylene capacity in China

source: Zhiyan Consulting

this year is still a year of large-scale expansion of polypropylene production. Many Giants enter the polypropylene industry or increase investment on the basis of the original industry:

fujian Yongrong New Material Co., Ltd.2 million tons/year propane to propylene and downstream New Materials Project, the total investment is 39.6 billion yuan. After the completion of the project, the production capacity of 2 million tons of propylene and 2 million tons of polypropylene will be added annually. Currently, the project has started.

1.2 million tons of polypropylene copolymer of Zhongjing petrochemical company is expected to be put into production within the year after being put into operation, the annual capacity of polypropylene can reach about 2.2 million tons. By then, Zhongjing Petrochemical will become the world's largest production base of polypropylene per unit area.

Donghua Energy Maoming project, the content of Phase I construction is 2 sets of 600,000 tons/year propane dehydrogenase unit +3 sets of 400,000 tons/year polypropylene unit +1 set of 200,000 tons/year ammonia plant as well as public works and supporting docks, pipe corridors, tank farms and supporting facilities, Donghua Energy Maoming Phase I (I) Includes 1 set of 600,000 tons/year PDH, 1 set of 400,000 tons/year PP, A 200,000-ton/year ammonia plant was started in June 2021and is expected to be completed and put into operation before the end of 2022.

Qinghai mining also promotes 600,000 tons of olefin and 400,000 tons of polypropylene projects, using technologies such as coal gasification to methanol, methanol conversion to olefin, propylene polymerization, etc., to produce major products such as ethylene monomer and granular polypropylene, as well as petrochemical by-products such as MTBE, C4 +, C5 +, etc, it is expected to produce 260,000 tons/year of ethylene, 415,400 tons/year of polypropylene and other products.

Caofeidian the people's government issued a notice on attracting investment and plans to launch it in this area. "750,000 tons/year propane dehydrogenase and polypropylene, phenol/acetone, phenol-a project". The content of the project includes: the main construction of a set of 750,000 tons/year propane dehydrogenase, 1 set of 400,000 tons/year polypropylene, 1 set of 200,000 tons/year polypropylene.

Jin Guotou (Jinzhou) Petrochemical Co., Ltd. It is planned to invest 17.025 billion yuan to build propane dehydrogenase and fuel oil desulfurization projects in Binhai Chemical Industry Park, Binhai New Area, Jinzhou city, Liaoning province, including 2 sets of 900,000 tons/year propane dehydrogenase units and 3 sets of 600,000 tons/year polypropylene units.

CNOOC plans to build 300,000 tons/year polypropylene project in Ningbo Daxie it is to deeply process the propylene monomer produced by the third phase project and extend the propylene industry chain. The project started construction in April 2020and is planned to be built and put into operation in December 2022.

Wanhua chemistry sell polypropylene again and explain in the latest project announcement that it will continue. Construction of 900,000 tons/year propane dehydrogenase, 300,000 tons/year polypropylene, it is expected to start production in June, 2024.

How can polypropylene develop under involution?

During the period of 2021, some polypropylene production in China experienced a phased loss. This is also the initial manifestation of the imbalance between supply and demand in the industry and the result that the rising cost of raw materials cannot be effectively transmitted. The cost of polypropylene products, except for propylene monomer, different costs of catalysts, additives and comonomers lead to certain differences in the cost of different types of polypropylene products.

At present, the growth rate of polypropylene demand is relatively stable, and the rapid growth of production capacity may lead to the overall excess of polypropylene production capacity, and the competition among polypropylene enterprises will be more intense. Under serious involution, how should polypropylene enterprises develop?

upgrading scale has become the choice of many private enterprises. Donghua Energy has a deep layout of Daxie and Maoming. Zhongjing Petrochemical has put into production within 1.2 million tons/year of polypropylene copolymer, and Zhejiang Petrochemical has a polypropylene scale of 1.8 million tons/year. Baofeng Energy Ningdong base and Erdos base are built at two points. Reducing comprehensive production costs through scale has become the first choice for many enterprises.

Method 2: expand the port

in 2021, China's polypropylene export volume was 1.3911 million tons, an increase of 227.24% year-on-year, mainly flowing to Southeast Asia. In the first quarter of 2022, affected by the rising costs, the price of polypropylene in the outer disk rose significantly. The Polypropylene Export window opened and some of the polypropylene exports were made every month. In January and February, the export volume increased year-on-year. Although the export volume in March was lower than that in the same period last year (the cold wave in the United States affected the global supply shortage and domestic exports increased sharply for a short time), it was expected to increase significantly from the previous month. It is estimated that the export volume will be 249,500 tons from January to March 2022, down 7.93% month on month and 21.79% year on year.

Method 3: Product Direction

looking at the profit of different kinds of products, the profit of pipe materials in hot water pipe has remained relatively good in recent years, which is mainly affected by the demand of home decoration market. The profit rate is about 25%, and the profit of pipe materials in some enterprises is higher. Secondly, the profit of ternary copolymer polypropylene film products is better, represented by Yanshan Petrochemical, but the market demand is currently uncertain, and the profit of products can be 20%-26%, which does not rule out that some enterprises have better profit.

In 2021, many enterprises such as Shanghai SECCO, Maoming Petrochemical, Baofeng Energy and Donghua Energy were actively developing and scheduling transparent plastic. The profit of transparent plastic is highly recognized by enterprises, and the product profit is close to 20%.

In addition, the profit of products such as high-melting anti-punching materials, high-rigidity and high-crystalline polypropylene, random copolymer injection plastics, thin-wall injection plastics, thermoforming special materials can reach 15%, or even higher.

In recent years, in the high-end development direction of polypropylene, Metallocene polypropylene, high melt strength polypropylene, waterproof coil polypropylene special material, high rigid high crystalline polypropylene, "three high and two low" polypropylene, etc.

Hot water pipe has always been a highly profitable product in the polypropylene industry, but the high-end brand of hot water pipe has a high profitability level, which is limited by production technology. The production of domestic high-end polypropylene products is limited by technological breakthroughs. The imbalance between supply and demand caused by technology has become the key factor affecting the profit of polypropylene production.

However, the profit of ordinary standardized products such as wire drawing material and low melting fiber materials is about 10-12%. The output of high-melting fiber materials in 2021has basically returned to normal.

In addition to technological breakthroughs, changes in market consumption also need special attention. In recent years, the epidemic changes and repeated changes have brought many changes to the market consumption behavior. The sales team needs to maintain the sensitivity to consumption demand and control the market channels actively.

Method 4: bundle R & D and production with downstream customers

sinopec, PetroChina, Wanhua Chemical and other well-known leading enterprises have basically formed a mode of jointly developing new polyolefin products with downstream customers. According to customer needs, improve product indicators and increase the stability of product quality, increase customer stickiness and form effective profits.

Some private enterprises are trying to get through the whole industrial chain model of upstream and downstream. For example, Zhongjing petrochemical is building a whole industrial chain model from propane, propylene, polypropylene and Polypropylene Films. Hongji petrochemical builds the whole industry chain model of propane, propylene, polypropylene, meltblown materials and masks. Some enterprises are building the whole industrial chain model of propane, propylene, polypropylene and polypropylene modified/meltblown materials.

Source: eighth element plastic version

* Disclaimer: the content contained is from public channels such as the Internet and WeChat public accounts. We maintain a neutral attitude towards the views in this article. This article is for reference and communication only. The copyright of the reprinted manuscript belongs to the original author and organization. If there is any infringement, please contact Huanyi world customer service to delete it.

Mainly

Mainly

Polyurethane

Polyurethane

Fine Chemical

Fine Chemical

.png)