Propylene is called the most important basic raw material for the extension of China's chemical industry chain. With the continuous improvement of refinement rate in China's chemical industry, it is an important raw material that determines the extension of the industrial chain. This paper analyzes the value transmission logic of propylene production cost under different processes.

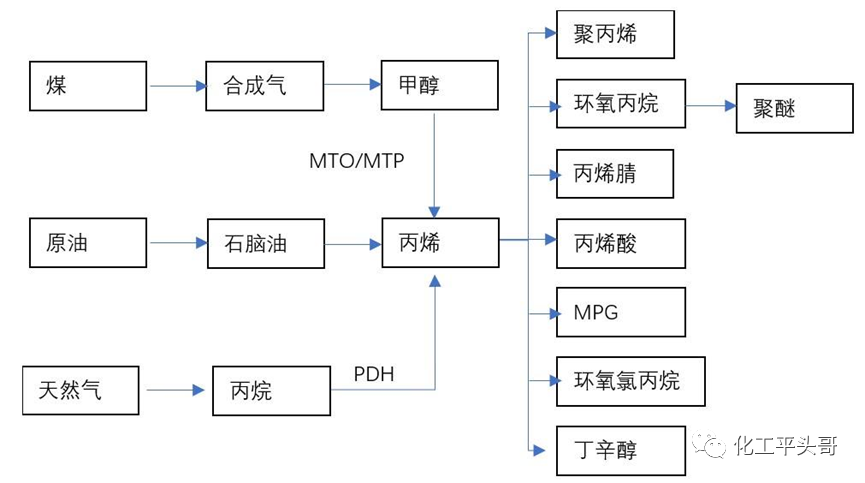

The main source of propylene.

1. Propane dehydrogenase to produce propylene

2. Cracking naphtha to produce propylene

3. Oil refinery catalytic cracking gas separation after separation of propylene

4. The production mode of coal to olefin, including methanol to olefin

in addition, there are small-scale production methods, such as DCC heavy oil cracking to produce propylene, C4 catalytic cracking to produce propylene, etc. The market size is relatively small and is not within the scope of our analysis.

The analysis of propylene value chain is carried out from the following: PDH value chain, Naphtha Cracking value chain, coal propylene value chain.

the way of producing propylene by propane dehydration, because the production process is relatively low-carbon and the investment threshold is low, some provinces have certain policy encouragement, resulting in the explosive growth of the industry scale in recent years. By the end of 2021, the production scale of PDH in China had exceeded 10 million tons per year.

Figure 1 flow chart of China's propylene industry chain In the PDH industry chain, the main raw material is Propane. Compared with propane separated by gas separation unit, PDH requires higher propane purity. According to the calculation of 1.18 tons of propane producing 1 ton of propylene, and the processing cost is 1200 yuan/ton, propane price accounts for a larger proportion of PDH producing propylene cost. According to the calculation in the past few years, the average ratio of propane price to propylene cost reached more than 77%. Therefore, the price of propane in PDH industry chain has the greatest impact on PDH industry chain.

The propane used by PDH is imported propane. Currently, the imported propane in the world mainly comes from the Middle East and North America, all of which are produced from natural gas by-product. At present, more than 95% of the global propane pricing adopts Saudi Aramco CP + rise of the premium. The CP price refers to the fluctuation of crude oil price and the monthly contract order quantity of Saudi Aramco. In other words, the price of imported propane in China's PDH industry chain will be affected by the price of crude oil and the order quantity of Saudi Aramco.

According to the calculation, the average price of propane import in China has a correlation with Japanese naphtha price of more than 93%, while the correlation between Japanese naphtha price and Brent crude oil is more than 98%. Therefore, the price fluctuation of China's propane import still refers to the fluctuation of international oil price.

Naphtha Cracking to propylene value chain

naphtha Cracking is used to produce ethylene and propylene. Due to the numerous products of cracking unit, ethylene and propylene are recognized as the same cost in the industry. Therefore, the cost of cracking naphtha to produce propylene can also be regarded as equivalent to the cost of ethylene. As for the cost of naphtha cracking to produce propylene, Sinopec has its own algorithm inside the system, PetroChina also has its own algorithm inside the system, and the international market also has the algorithm in the international market. In addition, in the main enterprise system, there are different calculation formulas for taking ethylene as mutual supply or allocation of enterprises.

The cost of cracking naphtha to produce propylene, of which naphtha accounts for the largest proportion of propylene cost, about 75%, while the price correlation between naphtha and crude oil is as high as 98%. In other words, the key factor affecting the cost fluctuation of naphtha cracking to propylene still lies in the fluctuation of crude oil price.

The high price of crude oil will quickly transmit the cost to the naphtha end, while there are many downstream naphtha products, and the correlation between the downstream naphtha products and crude oil will be reduced. Therefore, the cost changes of naphtha driven by the rise of crude oil, there is a certain lag for downstream products, including propylene.

Coal-to-propylene value chain

for coal to propylene, the industry is collectively referred to as coal to olefin, which is the process of coal processing to produce syngas, then producing methanol, and finally producing ethylene and propylene. In other words, the raw materials for producing propylene from methanol and propylene from coal are similar, which is only the difference in the length of the industrial chain process.

The cost of ethylene and propylene produced in the industry is regarded as the same cost calculation, which is consistent with the cost of naphtha cracking production. Therefore, for the value chain of coal to olefin, coal has the greatest impact on the cost of ethylene and propylene.

At present, in the process of producing coal to olefin, due to the progress and development of technology, the unit consumption of coal has been reduced from about 7.2 to less than 7. The cost of coal from coal to olefin accounts for about 79% of the cost of propylene, which is the largest cost component. Other costs are electricity, water, etc.

Source: chemical Pingtou brother* Disclaimer: the content contained is from public channels such as the Internet and WeChat public accounts. We maintain a neutral attitude towards the views in this article. This article is for reference and communication only. The copyright of the reprinted manuscript belongs to the original author and organization. If there is any infringement, please contact Huanyi world customer service to delete it. Mainly

Mainly

Polyurethane

Polyurethane

Fine Chemical

Fine Chemical

.png)