On the evening of the 13th, there was big news from the National regular meeting that it was going to be lowered. The Meeting proposed timely use of monetary policy tools such as precision reduction, reduce comprehensive financing costs

main contents of the meeting decision:

i. Encourage large banks with higher levels of provision to reduce the provision rate orderly II. Timely use of monetary policy tools such as downgrade III Plus-sized financial support for the real economy IV. Reasonably transferring profits to the real economy and reducing the cost of comprehensive financing

CCTV Full text:

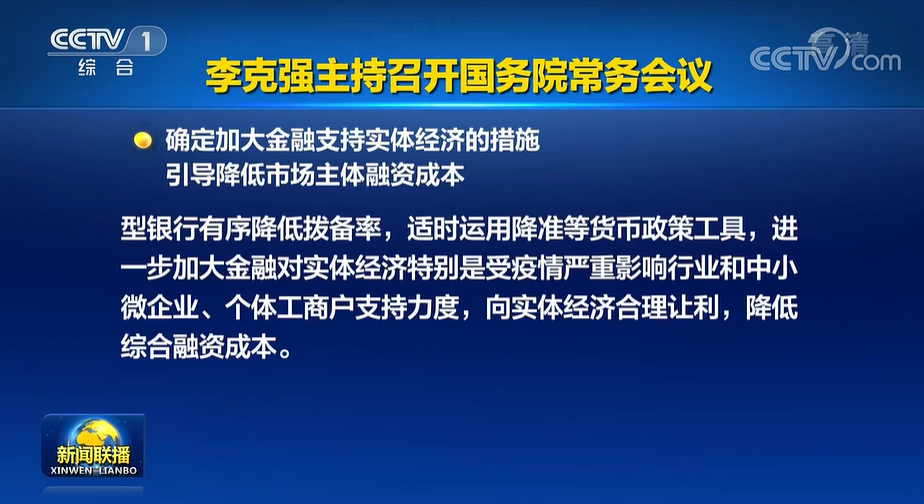

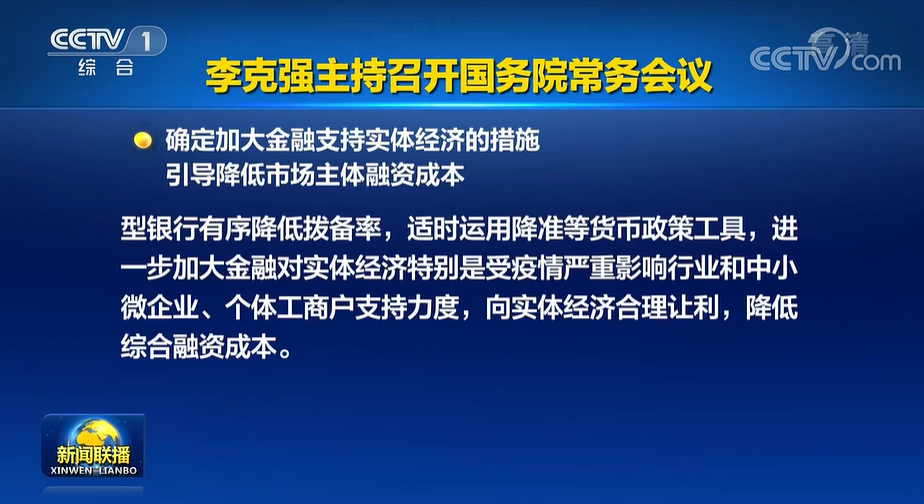

premier Li Keqiang of the State Council presided over the executive meeting of the State Council on April 13 to deploy policies and measures to promote consumption to help stabilize the basic economic situation and ensure the improvement of people's livelihood; Decided to plus-sized policy support such as export tax rebates, promote the steady development of foreign trade; Determine plus-sized financial support for the real economy and guide to reduce the financing costs of market entities.

The meeting pointed out that consumption has a lasting driving force for the economy and is related to ensuring and improving people's livelihood. It is necessary to implement the deployment of the Party Central Committee and the State Council, make concerted efforts, give consideration to both distance and distance, stabilize current consumption and release consumption potential.

First, we should deal with the impact of the epidemic and promote the recovery and development of consumption. Pay close attention to the implementation of the relief policies for the special hardship industry, and stabilize more consumer service market entities. Ensure the stable price of basic consumer goods and ensure smooth logistics.

Second, we should speed up the integration of online and offline consumption and cultivate and expand the "wisdom +" consumption of smart products and services.

Third, expand consumption in key areas. Promotion health care, old-age care and care and other consumption, support social forces to supplement the short supply of services. Encourage the bulk consumption of automobiles, household appliances, etc., and no new vehicle purchase restriction measures are allowed in all regions. The gradual increase of incremental indicators for purchase restriction has been implemented. Support the consumption of new energy vehicles.

Fourth, we should guide business circulation enterprises and e-commerce platforms to extend to rural areas and promote brand quality consumption into rural areas.

Fifth, we should strengthen the guarantee. Deepen the reform and remove the obstacles that restrict consumption. Promote the healthy and sustainable development of consumer platforms. Guide financial institutions to enrich bulk consumption of financial products. Accelerate the construction of key projects with investment and consumption. Punish counterfeit and shoddy behaviors according to law.

The meeting pointed out that in order to promote the steady development of foreign trade, we should give full play to the inclusive and fair export tax rebate, conform to international rules and policies, and optimize the business environment of foreign trade.

First, the processing trade enterprises are allowed to transfer the input tax to deduct the value-added tax for the amount of tax that should be refunded after implementing the consistent policy of tax refund rate for export products. The export credit insurance indemnity shall be regarded as the collection of foreign exchange and the tax refund shall be handled.

Second, speed up the tax refund progress, the whole process is implemented online, and the tax refund processing time is reduced from an average of 7 working days to 6 working days.

Third, it is to improve the efficiency of customs clearance for export goods return, formulate policies for facilitating cross-border e-commerce return and exchange, make customs clearance and tax refund more convenient for trustworthy enterprises, and severely punish acts such as defrauding tax refund.

The meeting decided to encourage large banks with higher levels of provision to reduce the provision rate in an orderly manner in view of the changes in the current situation, and timely use monetary policy tools such as downgrade, plus-sized the financial support to the real economy, especially the industries seriously affected by the epidemic, small and medium-sized enterprises and individual industrial and commercial households, reasonably transfer profits to the real economy, and reduce the cost of comprehensive financing.

The meeting studied other matters.

Interpretation of accuracy reduction information

The reason why the national regular meeting proposed to lower the standard is that the current economy is facing new downward pressure and needs the power of monetary policy.

Although the macro-View data performed well from January to February, the spread of the epidemic in mid-March may have an impact on the data in March and the first quarter. The China-Thailand Securities solid collection team said that since March, many epidemics have occurred and the economy is facing greater adverse effects. The team used the growth rate of industrial production and the growth rate of service industry production index to fit the quarterly year-on-year growth rate of GDP, and estimated that the growth rate of GDP in the first quarter was about 4.8%.

The National regular meeting held on April 6 said that China's economic operation was generally kept within a reasonable range, but the uncertainty of domestic and foreign environmental complexity exceeded expectations. The economic recovery of the world is slowing down, the commodity market such as food and energy fluctuates greatly, the domestic epidemic has been frequent recently, the market main body is difficult to increase, and the new downward pressure on the economy increases.

Wen Bin, chief researcher of Minsheng Bank of China, said that in the current situation of economic development facing triple pressure and insufficient total demand, taking timely measures to reduce the accuracy is conducive to stabilizing market expectations and enhancing the confidence of market players, improving and expanding aggregate demand has created positive conditions for stabilizing the macro-economic market and maintaining the economic operation in a reasonable range. "Lowering the standard can also optimize the term structure of funds in the banking system, release long-term liquidity and reduce the cost of bank liabilities, which is helpful to encourage and guide financial institutions to expand credit delivery and continuously reduce the financing cost of the real economy." wen Bin said.

The joint chief economist of CITIC Securities clearly said that although the maturity scale of MLF is low in the next quarter, there is still a liquidity gap caused by the peak of tax period, centralized issuance of government bonds, and large maturity scale of interbank certificates of deposit, these may be the trigger factors for the downgrade. Secondly, from the perspective of expanding the scale of new loans, the current bank's over-storage rate is declining again. To further guide financial institutions plus-sized credit delivery and reduce loan interest rates, on the one hand, it is necessary to make up for the medium and long-term funding gap, on the other hand, we need to reduce the debt cost.

"Under the current basic inject money mechanism, there will be a liquidity gap every six months, and MLF needs to be supplemented or replaced by means such as standard reduction, so it is still necessary to lower the standard." zhang Jiqiang, deputy director of Huatai Securities Research Institute, said.

There is still room for current downgrade. Liu Guoqiang, deputy governor of the central bank, said at the press conference of the state new office on January this year that the average deposit reserve ratio of financial institutions is 8.4%, which is no longer high, whether compared with other developing economies or the deposit reserve ratio in our history, it should be said that the level of deposit reserve ratio is not high, and the space for further adjustment is smaller. However, from another perspective, the space becomes smaller but there is still some space. We can use it according to the economic and financial operation and the needs of macro-control.

According to the comments made by Liu Guoqiang and other central bank officials, the space of monetary policy points to two important aggregate tools: the statutory deposit reserve ratio and interest rate, and also points to the space for lowering.

Central bank data show that the current weighted average survival rate is 8.4%, which is still far from the lowest 6% in history. However, in recent times, 6% of the institutions are no longer included, so to some extent, 6% can be regarded as the bottom line of the current legal deposit rate. Considering that the deposit reserve ratio of more than 4,000 small and medium-sized banks has dropped to 6%, the space for downgrade may be mainly in state-owned banks, stock banks, some head city commercial banks and agricultural commercial banks.

Looking back, in the past three years, the general meeting of the state will make a sound first, and then the central bank will announce the measures to lower the standard within a week, and the announcement time is usually on Friday.

For example, the National regular meeting held on March 10, 20202020 (Tuesday) requires that we should promptly introduce the targeted downgrade measures for inclusive finance and plus-sized the downgrade efforts for joint-stock banks, promote commercial banks plus-sized loan support for small and micro enterprises and individual industrial and commercial households. On Friday, March 13, the central bank announced the relevant downgrade measures.

Another example is the requirement of the National regular meeting held on July 7, 2021 (Wednesday) that in view of the impact of rising commodity prices on the production and operation of enterprises, on the basis of insisting not to flood water, maintain the stability of monetary policy, enhance the effectiveness, timely use monetary policy tools such as downgrade to further strengthen financial support for the real economy, especially small and medium-sized enterprises, and promote the steady and moderate reduction of comprehensive financing costs. On Friday, July 9, the central bank announced relevant measures.

After the statement of the National regular meeting, the market expects that the central bank may announce specific downgrade measures on Friday.

However, the aforementioned laws also have failures. The National regular meeting held on June 17, 2020 proposed to comprehensively use tools such as downgrade and refinancing to maintain reasonable and abundant market liquidity, plus-sized efforts to solve financing difficulties and ease the financial pressure of enterprises. But since then, there has been no reduction measures. In short, this Friday will be an important observation window.

According to the convention, the central bank will conduct MLF operations on April 15 (this Friday), and the market also pays close attention to whether MLF will cut interest rates this time.

Zhang Jiqiang believes that it is also necessary to cut interest rates, but the Federal Reserve is in the channel of raising interest rates. The interest margin between China and the United States has been upside down and the space is limited. Under the condition that the economic growth rate is obviously lower than the target, the interest rate reduction can be a game, but it is not certain. The probability of the reduction is slightly higher than the reverse repurchase and MLF interest rate reduction. If the interest rate is not cut in April, the probability of the Federal Reserve raising interest rates will be lower from May to July.

Source: CCTV News, 21st Century Economic Report* Disclaimer: the content contained is from public channels such as the Internet and WeChat public accounts. We maintain a neutral attitude towards the views in this article. This article is for reference and communication only. The copyright of the reprinted manuscript belongs to the original author and organization. If there is any infringement, please contact Huanyi world customer service to delete it. Mainly

Mainly

Polyurethane

Polyurethane

Fine Chemical

Fine Chemical

.png)