on the domestic styrene mainstream price slightly back. On Monday (December 6), the price of the sample enterprise was 8200.00 yuan/ton, and on Friday (December 10), the price of the sample enterprise was 8262.50 yuan/ton, an increase of 0.76%. Prices rose 7.54% from the same period last year.

Styrene market prices rose slightly last week. On December 6, East China styrene closed at around 8100-8200 yuan/ton, and on December 10, 8250-8300 yuan/ton, up 100-150 yuan/ton, above the price of Zhangjiagang. On December 6, South China styrene quoted 8200-8250 yuan, on December 10, 8250-8300 yuan/ton, up 50 yuan/ton, and the above factory delivered the price.

raw materials, after the rise of crude oil finishing, the chemical industry as a whole shock finishing. Pure benzene in the upstream of styrene followed the trend of crude oil and styrene, and stabilized after rising. On Friday (December 10), the mainstream price of pure benzene was 6420.00 yuan/ton, up 80 yuan/ton from 6340.00 yuan/ton on Monday (December 6), up 1.26%.

operating rate, the average operating 75.93% of domestic styrene plants, down 0.39% from last week, the overall supply is slightly oversupplied. During the week, South China Q enterprise phase I restart, Keyuan, Yuhuang, Shengyuan has no restart plan, Sinochem Quanzhou parking maintenance. CNOOC Shell Phase 2 is expected to be overhauled in December. In terms of new equipment, Wanhua may release materials in mid-December. Lihuayi may be postponed to January; Zhenhai Liande plans to ignite at the end of the month, and the products are expected to be produced in January. Tianjin Bohua is expected to be postponed to the first quarter of next year, which does not rule out that due to the postponement of the Winter Olympics, the overall long-term profit is too high.

crude oil consolidation, pure benzene temporarily stable finishing, the cost side to the styrene bottom support, can not provide upward momentum. With the impact of the epidemic, Zhenhai area policy requirements on the overall impact of the upstream and downstream industrial chain, the overall impact of the empty, coupled with the new device production expectations, overall, the expected this week's styrene market is weak consolidation state.

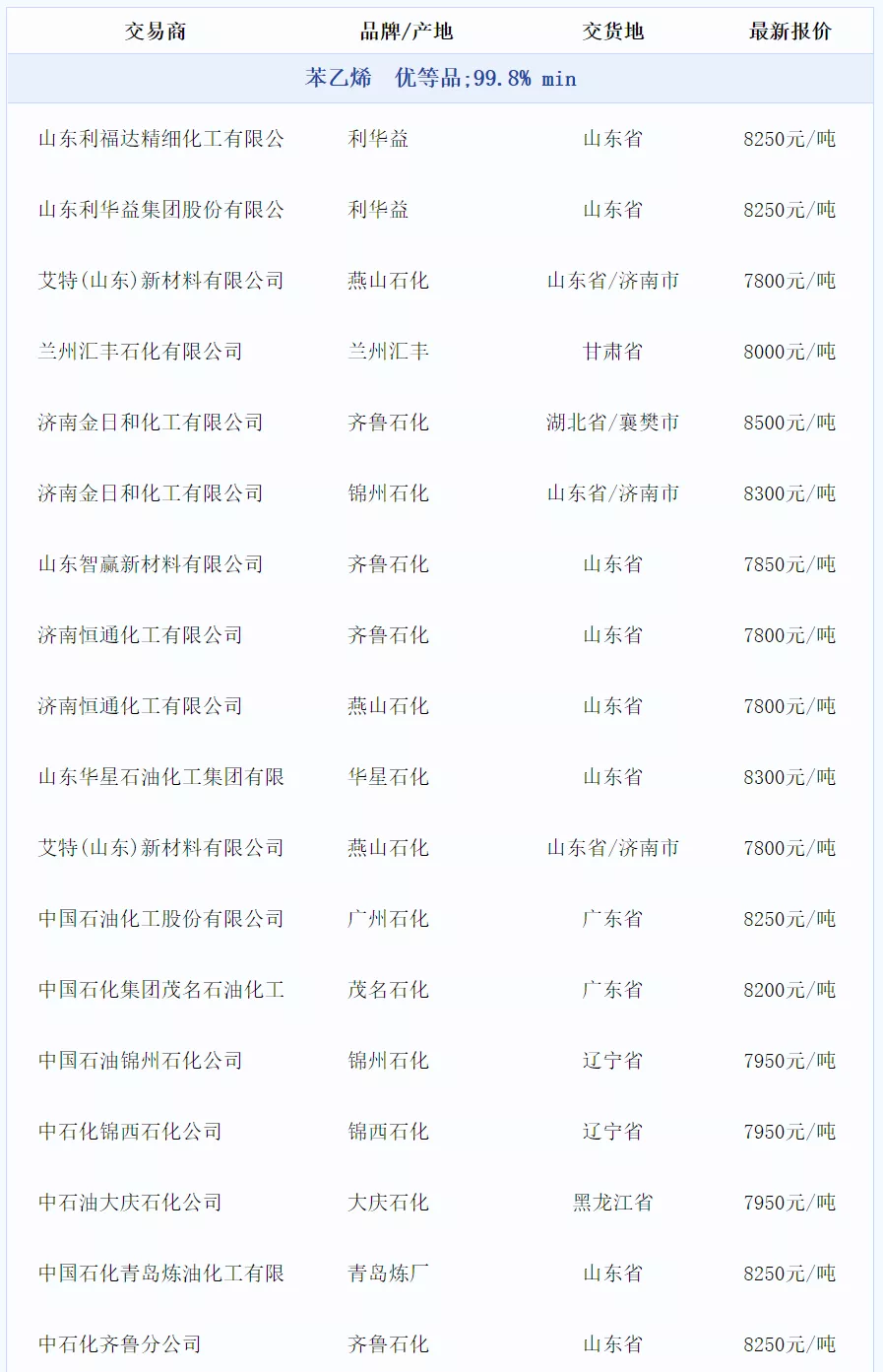

Styrene Price Dynamics on December 10:

of

On December 10, the average price of oil-based ethylene glycol P was 4950 yuan/tonne, down from last week's 75 yuan/tonne.

in terms of

market price, the spot price of ethylene glycol in the East China market on December 9 was 4984 yuan/ton, which was 104 yuan/ton higher than the previous trading day, or 2.13%.

device, more internal and external maintenance in December, the new device put into operation but the overall increase is limited. Fude Energy 500,000 tons/year, Sinochem Quanzhou 500,000 tons/year, Zhongke Refinery 500,000 tons/year ethylene glycol plant shutdown maintenance; Zhenhai Refinery EO cut back to EG; Zhonghai Huizhou 1#MEG unit has been restarted.

international crude oil prices fluctuated within a narrow range, long-term coal prices strengthened slightly, MEG external market weakened in the morning, the recent ship offer was around US $645/ton, the delivery price was around US $640/ton, and the negotiation was US $640/ton or slightly above the level. Downstream, polyester load is still slightly decreased, the real single atmosphere is light. It is worth mentioning that due to the domestic outbreak, the closure of Zhenhai led to EO switching EG, while local EG shipments are currently blocked. After logistics resume, supply is expected to increase.

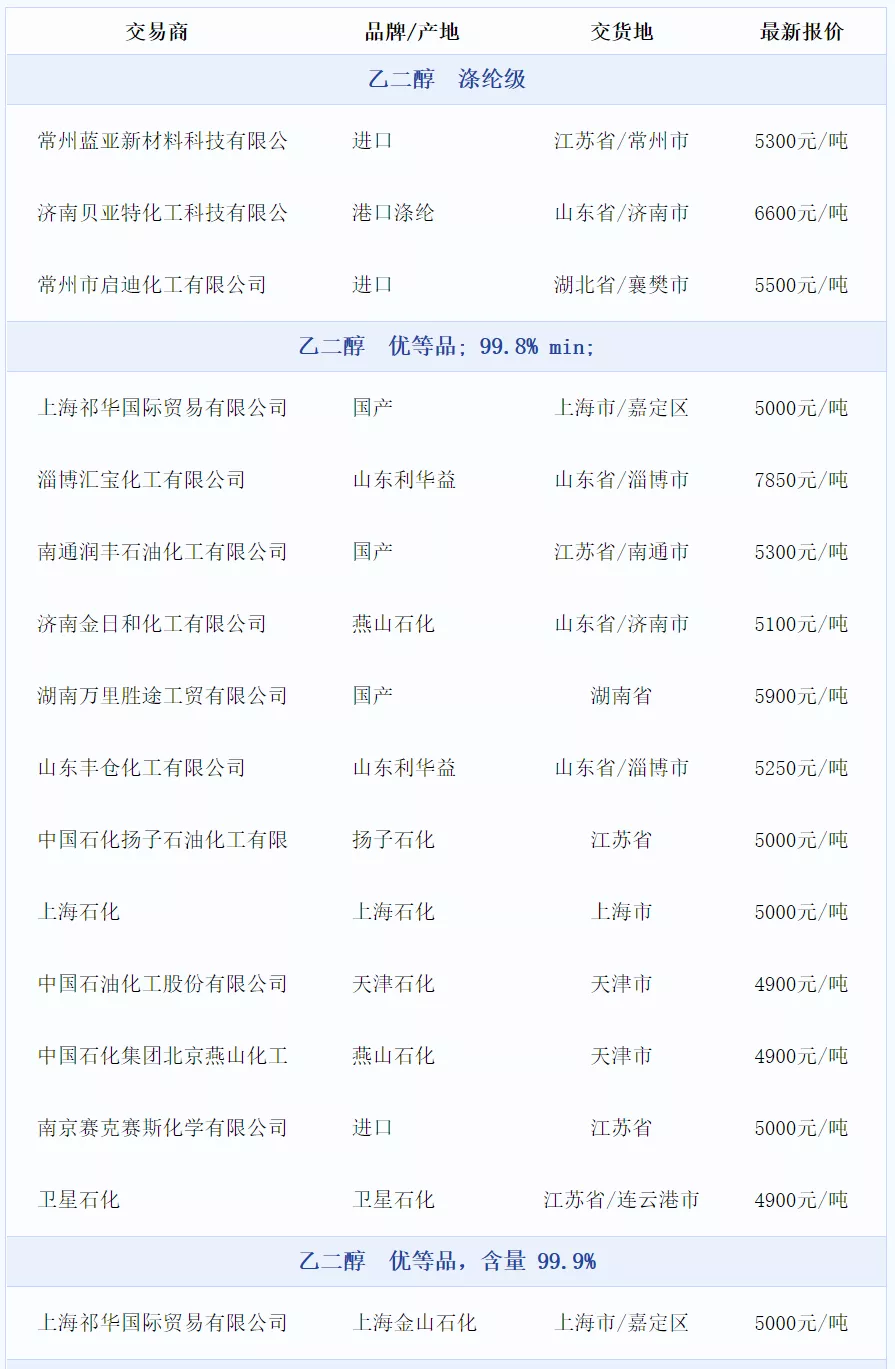

Ethylene glycol price trends on December 10:

of

Styrene Expansion Forecast in 2022

In 2022, as a year of concentrated styrene explosion and capacity expansion, what trend changes will the domestic production capacity, output, import and export, and apparent consumption usher in? The editor now makes a simple guess and estimate of each data:

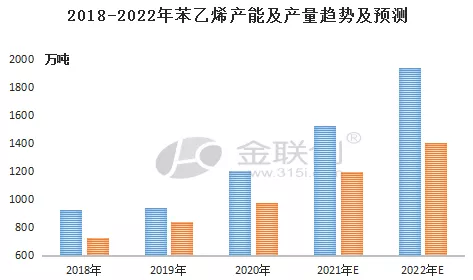

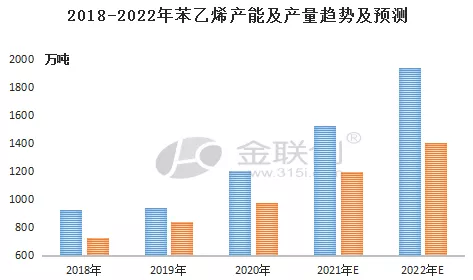

"One" capacity and output trend change conjecture:

China Styrene New Production Plan from the End of 2021 to 2022 (Unit: Yuan/Ton)

According to statistics, from the end of 2021 to 2022, China has more than 6 million tons of styrene new plant plans to be launched. From the point of view of the new plant process, the proportion of PO/SM co-production process has increased, and from the scale point of view, to medium-large or integrated large refining, compared with the traditional ethylbenzene dehydrogenation process, the cost has obvious advantages, anti-risk ability is stronger.

, in terms of the new production plan of styrene, although it is not ruled out that some devices may be delayed in production, it is undeniable that 2022 is still the year of concentrated expansion of styrene in China, and by the end of 2022, Jinlianchuang initially predicts that China's styrene production capacity is expected to approach the 20 million-ton integer mark. Comprehensive production time node and start-up trend of multiple factors, domestic production growth rate is significantly less than the growth rate of production capacity, in 2022, the preliminary forecast of domestic styrene production will increase to 14 million tons near.

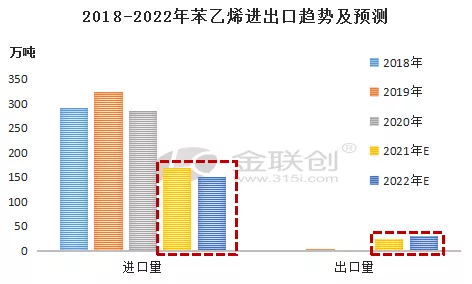

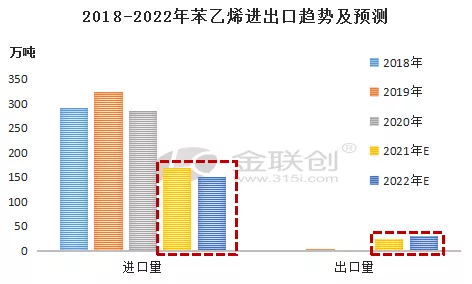

"II" Import and Export Trend Conjecture;

From the perspective of styrene export trends, as China's production capacity, output, and self-sufficiency rate continue to increase, in order to alleviate the pressure caused by domestic concentrated capacity expansion, it is a general trend for Chinese styrene companies and traders to actively explore export channels. Due to large restrictions such as shipping and the continuous cycle of regional arbitrage windows, it may be difficult to increase volume temporarily.

Judging from the styrene import trend, it is expected that the stock will continue to decline in 2022. However, US dollar imports still have many advantages over domestic products, such as payment methods, and still have a place in the domestic market. Especially after a sharp contraction in 2021, there is relatively limited room for further shrinkage in 2022. Preliminary estimates show that China's styrene import will drop to about 1.5 million tons in 2022.

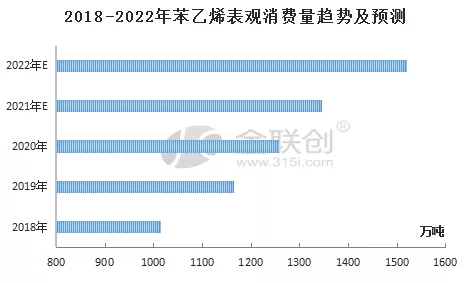

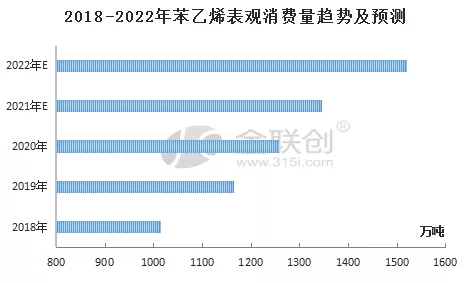

"Three" apparent consumption trend conjecture:

From the development of China's styrene apparent consumption shows a steady increase trend, after the apparent breakthrough of 10 million tons in 2018, since 2019, the domestic volume continued to hit a new high, and the main downstream performance is bright, China's styrene apparent consumption continues to break through. It is initially expected that China's apparent consumption of styrene will rise to about 13.5 million tons in 2021, while in 2022, the apparent consumption is expected to reach around 15 million tons, supported by the incremental expansion of styrene and downstream industrial chains.

On the whole, 2022 is a year of concentrated styrene expansion. Yantai Wanhua, Shandong Lihuayi, Zhenhai Refinery Liander, Bohua Development, Lianyungang Petrochemical and other large units will be released in mass production. While domestic production capacity and output continue to break through, the self-sufficiency rate is expected to rise significantly. At the same time, from the import supply side, although there is still a continued contraction expectations, but after the rapid downward trend in 2021, further shrinkage space is relatively limited, the U.S. dollar import supply in the domestic market still has a place. In addition, combined with several major downstream capacity expansion plans, the overall growth rate is relatively lower than that of styrene, with PS industry being the most concentrated in new production, EPS mainly in some delayed production projects, ABS new release is relatively limited, and 2022 styrene and downstream industrial chain phased production mismatch will bring more opportunities and challenges.

Source: Business Society, Composite Materials Community, Jinlianchuang

* Disclaimer: The content contained in the content comes from the Internet, WeChat public number and other public channels, we maintain a neutral attitude towards the views in the article. This article is for reference only. The copyright of the reprinted manuscript belongs to the original author and the organization. If there is any infringement, please contact Huayi Tianxia Customer Service to delete Mainly

Mainly

Polyurethane

Polyurethane

Fine Chemical

Fine Chemical

.png)