Phenol is intertwined, maintaining a wide range of shocks.

Entering November, the mainstream market price of phenol in East China basically showed a box shock, with a fluctuation range of 9200-9600 yuan/ton during the month. Long and short news are intertwined, and the buying and selling mentality is playing. The space for ups and downs is limited.

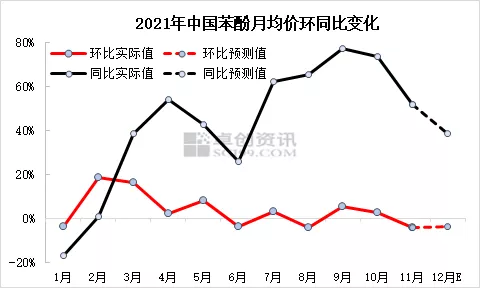

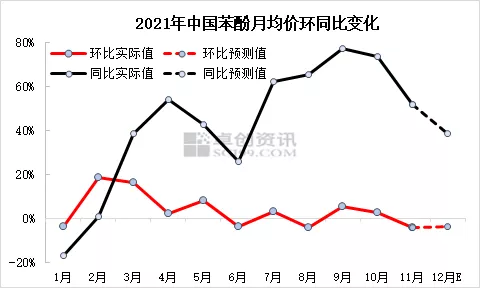

As can be seen from the above figure, after the concentrated rebound in the first half of the year, the Chinese phenol market showed a high volatility trend in the second half of the year, and the monthly average price narrowed month-on-month. According to statistics from Zhuochuang Information, in November 2021, taking the East China market as an example, as of November 29, the monthly average price was 9354 yuan/ton, down 4.33% from the previous month, and the monthly fluctuation range was 9200-9600 yuan/ton.

Pure Benzene Falling Cost Lack of Support

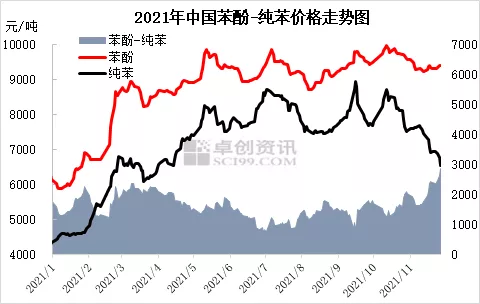

As can be seen from the above figure, the recent phenol and pure benzene markets have shown an obvious differentiation trend, and the price difference between the two has gradually expanded. As of November 29, the East China phenol market closed at 9300-9350 yuan/ton, and the East China pure benzene market closed at 6350-6430 yuan/ton, with the price difference reaching 2935 yuan/ton, the highest point in this year's historical data. Due to the pressure of supply and demand of pure benzene in the upstream, the price continued to fall to the bottom, and the international oil price fell by more than 10% last weekend, the cost side of the decline, aggravating the cautious mood of downstream buying, more wait-and-see bearish attitude, the current price acceptance of raw material phenol is limited.

Port inventory is not high and available for sale is limited.

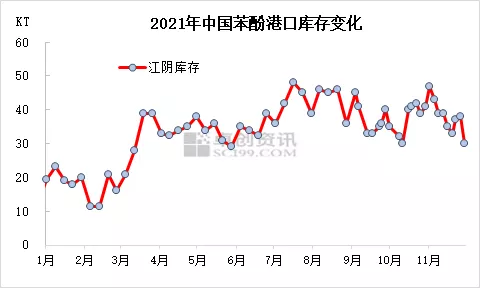

entering November, due to the delay in the implementation of export orders in October to this month and limited shipping replenishment (some of the arrivals are domestic sources with slightly higher color), the overall port inventory showed a trend of low volatility. As of the morning of November 29, the inventory of West China Port was 18KT and that of Hengyang Port was 12KT million tons, totaling 30KT. Port inventory gradually returned to a reasonable level, but because Hengyang warehouse still has some slightly higher chroma of domestic sources, the port can actually raise the spot volume is limited, so in the upstream pure benzene falling background, phenol market shows a relatively strong resilience.

Imported goods supplement limited hedge domestic demand shortage

According to the current shipping date data, the replenishment of imported goods in the later period is limited, and it is reported that some phenolic ketone plants in the Asia-Pacific region are concentrated in the first quarter of 2022 for maintenance, and the import volume may maintain a downward trend compared with the previous period. Therefore, importers do not have a greater panic about the future market, but domestic demand is weak, especially the recent increase in supply and demand pressure in North and South China. On the one hand, the industry is concerned about the overall changes in downstream construction before and after the 2022 Winter Olympics, on the other hand, some traders consider that in late December, some downstream factories are expected to park ahead of schedule for holidays, and the sales pace will be advanced. Of course, they also need to consider the stock demand in the downstream of New Year's Day and the early Spring Festival.

On the whole, the December phenol market is intertwined, maintaining a wide range of volatility trend, based on the cost side of the negative impact, the monthly average price compared to November will show a narrow low trend. However, the dominant role of supply and demand fundamentals is still strong, and the probability of a deep fall is small.

Bisphenol A supply and demand double increase, high price state or will continue

domestic bisphenol A production capacity is relatively concentrated, the industrial chain integration degree is high. The upstream raw materials of bisphenol A are phenol and acetone. Phenol and acetone are made from pure benzene and propylene at the same time through the isobenzene propylene method device. The downstream is mostly matched with PC or epoxy resin, which has a high degree of industrial chain integration. Domestic bisphenol A production capacity is relatively concentrated. At present, there are 10 domestic bisphenol A production enterprises with a total production capacity of 2.215 million tons, CR5 is about 70%,CR3 is about 50%, of which Kostron and Changchun Chemical have the largest production capacity, accounting for 20% and 18% of the total production capacity respectively. the

high degree of industrial chain integration also leads to China's bisphenol A industry commercialization rate is low. the supply side, bisphenol A production capacity is expected to begin to grow rapidly in 2022. In 2021, new installations represented by China-Saudi Tianjin have been completed and put into operation, and major enterprises have continued to increase their production. It is expected that China's bisphenol A production will reach about 1.7 million tons in 2021, an increase of 150,000 tons compared to 2020, and the production will increase significantly. It is expected that from 2022, with the production of bisphenol A units under construction, the annual output is expected to gradually increase. the demand side, PC, epoxy resin capacity expansion will lead the growth of bisphenol A demand. Bisphenol A downstream demand structure is concentrated, mainly used to make PC and epoxy resin, almost half of the proportion. In recent years, the PC industry is in a period of rapid development, and the future production capacity will continue to be released. It is expected that by 2023 there will be nearly 1.4 million tons of production capacity, and China's total PC production capacity will be close to 3.6 million tons. With the vigorous development of domestic epoxy resin downstream, epoxy resin production capacity will also be steadily increased, it is expected that by 2023 there will be nearly 1.5 million tons of production capacity, the domestic epoxy resin total production capacity of nearly 3.8 million tons. In the long run, the market demand for bisphenol A will continue to increase and the industry prospects are good.

supply and demand have a clearer increase in the background, we expect bisphenol A will continue to be tight balance, high prices or will continue. Driven by downstream epoxy resin and PC demand, bisphenol A is expected to remain high in the future. Source: Zhuochuang Chemical Industry, Epoxy Resin Development Research Center

* Disclaimer: The content contained in the content comes from the Internet, WeChat public number and other public channels, we maintain a neutral attitude towards the views in the article. This article is for reference only. The copyright of the reprinted manuscript belongs to the original author and the organization. If there is any infringement, please contact Huayi Tianxia Customer Service to delete

Mainly

Mainly

Polyurethane

Polyurethane

Fine Chemical

Fine Chemical

.png)