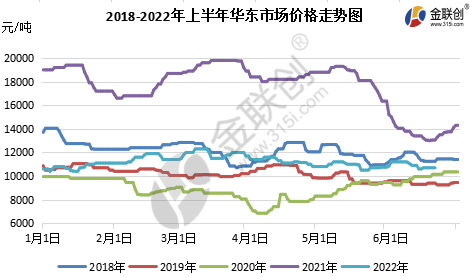

in the first half of 2022, the domestic propylene oxide market price was mostly low and fluctuated frequently, with a fluctuation range of 10,200-12,400 yuan/ton and a difference of 2200 yuan/ton between high and low prices. The lowest price appeared in the Shandong market in early January and the highest price appeared in the East China market in mid-March. The reason why the lowest price appeared in January was: in the off-season of the traditional industry in January, the Spring Festival was approaching, and the demand in the downstream was poor. At the same time, the new production capacity of Wanhua Phase II and Zhenhai Phase II was put into operation, the supply was increased, the profits and losses gathered, and the market mentality was relatively empty, which led to a continuous decline in the center of gravity. The reason why the highest price appeared in March was: Zhenhai Phase I, Shandong Sanyue, Xinyue, Hangjin and other maintenance was favorable, the supply was, trading improved, the market center of gravity rose, the highest price in the first half of the year. A slight breakdown in the first half of the year:

Data source: Jin Lianchuang

New production capacity cashing, traditional industries off-season, weak market operation, north and south frequently upside down

in early January to continue the inertial decline at the end of December last year, the price once fell to the lowest price in the first half of the year in 10200 yuan/ton, and then affected by the negative pollution drop in Shandong and the negative overhaul in Jishen, the supply was favorable, but the range was limited. Follow-up Zhenhai Phase II smooth output, superimposed on the import of Huan C concentrated in Hong Kong, the market mentality is more pessimistic under abundant supply, Huan C again under pressure decline, however, due to the strong support for the high prices of liquid chlorine and propylene raw materials, some factories under the inverted profit cost of chlorohydrin process began to limit production and guarantee prices, and the downstream also made replenishment before the Spring Festival. The favorable atmosphere in the market warmed up and the price rebounded. Although the spring refining plant was successfully restarted in the second half of the month, the real supply was mostly in February. The factory inventory was low and accumulated slowly, and the market was deadlocked at the end of January.

in the first ten days of February,

coincided with the Lunar New Year. The factory kept a low warehouse for the New Year. Shida, Huatai and Sanyue were in negative operation and the market was temporarily in stable operation. After the festival, the logistics and transportation improved, the superimposed cost support strengthened, and the "good start" was ushered in after the Ring C festival. After the downstream just needed replenishment, it returned to digest the inventory and waited and watched the operation. After a short period of stability in the middle of the month, although the overhaul of Dongying factory in Jinling, Shandong, king Huan C has a negative operation, but it is difficult to change the cautious atmosphere in the market. Factory shipments are under pressure, inventory is accumulated, and ex-factory prices are lowered. In the second half of the month, raw materials propylene and liquid chlorine both rose. The downstream also followed up in a moderate amount of panic under the international marginal political conflict. However, due to poor terminals and limited sustainability, only the northern market rebounded by 100 yuan/ton, but the inventory pressure shifted smoothly.

in March, the epoxy propane market rose and fell frequently, generally showing an "M"-shaped trend, with a narrow range of shocks. In early March, Zhenhai Phase I device all stopped, Shandong Sanyue, Xinyue, Hangjin technology to reduce the negative, supply contraction, downstream appropriate just need to follow up, the center of gravity rose, the first half of the highest price.

The epidemic has blossomed at multiple points, affecting demand and logistics, and the integrity of the industrial chain has been hit hard.

in mid-March. Although Jinling in Shandong Province stopped for maintenance as planned, the epidemic broke out at many points, especially the fall of Zibo, the gathering place of polyether in Shandong Province. The already weak operation of cyclopropyl was even worse. Although the units of many cyclopropyl plants in Shandong Province were reduced to negative operation, the demand continued to be light and the center of gravity was under pressure. Then the cost pressure of raw materials became stronger. Cyclic propyl followed the increase in raw material prices and the raw materials weakened again at the end of the month, cyclic cost, demand double negative down again.

April-May epoxy propane market weak volatility, multi-cost led to ups and downs. During the Qing Ming Festival in April, the cost pressure rose sharply and the factory raised its ex-factory price. At the same time, with the recovery of some logistics after the festival, Cyclic C rebounded smoothly. However, due to the weak terminal and the impact of the epidemic, the rebound was limited. Then, with the weakening of cost support and the continuous light demand, the price fell under pressure. After that, liquid chlorine rebounded widely, with a small increase of 100-200 yuan/ton under cost support. Downstream demand was short-lived, but under high cost pressure, ring C factory cost upside down, further reduce negative operation, then raw materials withdrawal, cost pressure disappeared, the factory decisively lowered the price, stimulate the downstream May Day before replenishment, the effect is general. During the labor festival in May, under the favorable supply and cost, the manufacturers of Cyclic C raised their ex-factory prices. After the festival, the logistics recovered and improved. The market continued to explore slightly. However, the downstream demand continued to be limited. The market in East China was abundant in stock, the atmosphere was flat, and the market gradually consolidated sideways. In the middle of the day, as the demand continued to be light, the raw material liquid chlorine withdrew, and the market was bearish and other falling atmosphere, the factory inventory was under pressure, shandong on behalf of the factory decisively lowered the factory price, downstream risk aversion, prices fell to the lowest point of the month, Wanhua Phase II parking, Sinochem Quanzhou down negative, ring C stop the rebound, by the downstream demand for a short period of influence, rebound only 200 yuan/ton, hold steady wait-and-see.

Traditional demand off-season, downstream confidence building slowly, new capacity pressure is still large and.

in June, Shanghai production and life slowly orderly release, but the demand has not improved, the rise and fall is still frequent, the range is limited. In the first ten days of June, the market continued at the end of May, with a sideways consolidation for about a week. Then, under the increase in supply, the inventory was under pressure. The factory decisively lowered the ex-factory price, and the downstream pursued the rise and the fall. After the fall to 10400 yuan/ton, the factory's profit squeeze was obvious, leaving the profit mentality no longer, and the downstream also followed up on bargain hunting cautiously. It was only a flash in the pan. Huan C also saw a 1-day rise again, up 100 yuan/ton, three yue parking, China sea shell epoxy propane device accident parking, but the big valley new production capacity news short market, downstream mentality is difficult to have a greater improvement, the market more with the use of pick-up, cautious wait-and-see follow-up, market sentiment is relatively empty, follow-up or decline is expected.

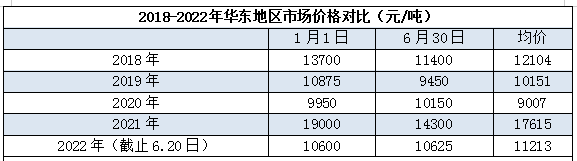

Data source: Jin Lianchuang

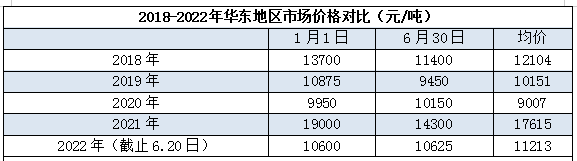

the first half of 2022, as of June 20, the average price in the East China market was about 11213 yuan/tonne, much lower than in 2021, and of course the market was relatively out of control in 2021, slightly close to 2018-2019.

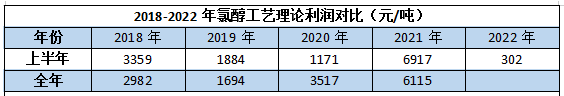

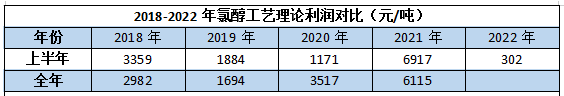

Epoxy propane chlorohydrin process theory first half profit shrinkage serious, year-on-year decline of more than 90%.

2022, the theoretical profit of chlorohydrin process was about 2400 yuan/ton at the highest and -1000 yuan/ton at the lowest, with an average of about 300 yuan/ton. In January, Zhenhai Phase II started its car and withdrew from the market one after another before the Spring Festival. Demand weakened, prices fell under pressure, and profits started to hang upside down. In February, thanks to the return of the Spring Festival, logistics and demand improved compared with the previous period, and profits became positive, most of them fluctuate around the 1000 yuan/ton. In March-May, the epidemic broke out in Shanghai and many parts of the country. The demand continued to weaken compared with the previous situation. Under the condition of poor logistics, the price of propylene oxide fluctuated around the cost line, the price rose and fell frequently, and the theoretical profit of chlorohydrin also changed frequently. In June, the factory control mentality was more cautious. Under the condition of superimposed supply contraction, Shanghai's control gradually relaxed. Although the real impact was not great, the market mentality also relaxed, at the same time, the price of propylene fell, liquid chlorine shock amplitude narrowed, although the theoretical profit level is not high, but the pressure is significantly reduced compared to the previous.

* Disclaimer: The content contained in the content is derived from public channels such as the Internet and WeChat public accounts. We maintain a neutral attitude towards the views in the text. This article is for reference only. The copyright of the reprinted manuscript belongs to the original author and the organization. If there is any infringement, please contact Huayi Tianxia Customer Service to delete it.

Mainly

Mainly

Polyurethane

Polyurethane

Fine Chemical

Fine Chemical

.png)