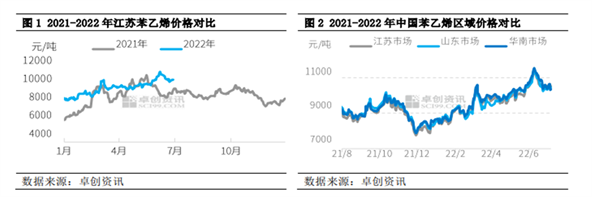

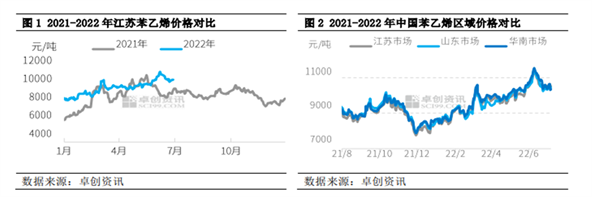

the market showed a volatile upward trend in the first half of 2022, Jiangsu styrene market average price of 9710.35 yuan/ton, up 8.99% month-on-month, up 9.24% year-on-year. The lowest price in the first half of the year was 8320 yuan/ton at the beginning of the year, and the highest price was 11470 yuan/ton in the first ten days of June, with a 37.86% amplitude. Fundamentally, styrene supply in the first half of 2022 showed a trend of first increase and then decrease, demand showed a gradual increase trend, the overall supply and demand structure showed a gradually tight state. "Black Swan" Incidents Frequent in the First Half of the Year Rush to a New High in Nearly Two Years

the main reason for the increase in styrene prices in the first half of the

is the result of global inflation from a macro perspective. The focus of bulk commodities has risen, which reflects that styrene is the cost support generated from the raw material end (crude oil), and pure benzene itself in the first half of the year The resources are also tight and continue to rise; from the perspective of styrene fundamentals, it is mainly in the centralized maintenance period with the domestic and foreign production equipment of styrene in the first half of the year, and the unplanned supply is also reduced more, the price difference between internal and external markets has increased styrene exports and also filled some of the negative effects of weak domestic demand on prices.

different regions of

styrene, new units will be put into operation in South China and Shandong markets in 2022, but with the unplanned shutdown of large units in the region, the supply and demand structure of the region has also changed in stages. South China and Jiangsu market from the discount to the water, while the Shandong market from the obvious discount Jiangsu market to the price difference gradually narrowed.

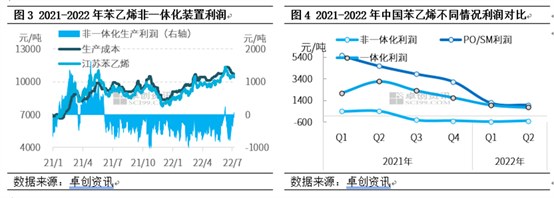

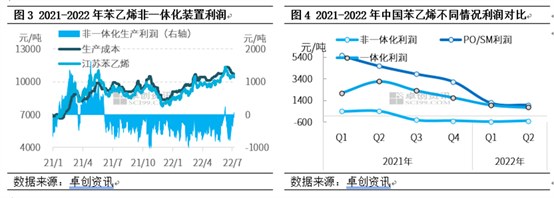

The first half of the year was "kidnapped" by costs. High costs determine the price of styrene.

the first half of 2022 styrene non-integrated device profit in -509 yuan/ton, compared with the same period last year 403 yuan/ton down 226.30%;

, after the Spring Festival in 2022, international oil prices have risen all the way, driving pure benzene to rise strongly. In the first half of the year, pure benzene market fundamentals are tight, pure benzene inventory continues to decline, price performance is relatively strong, pure benzene and styrene price difference gradually narrowed, once narrowed to a 500 or 600 level, but also made styrene production enterprises began to lose pressure to decline/shutdown, is also the first half of the styrene supply did not as expected growth reasons.

Domestic growth fell short of expectations and external demand increased more than expected.

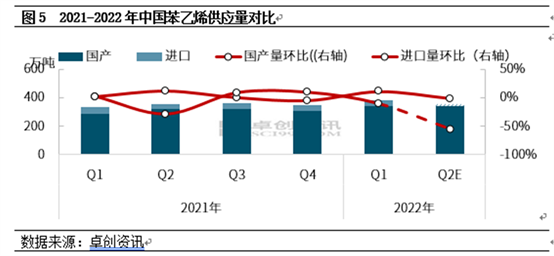

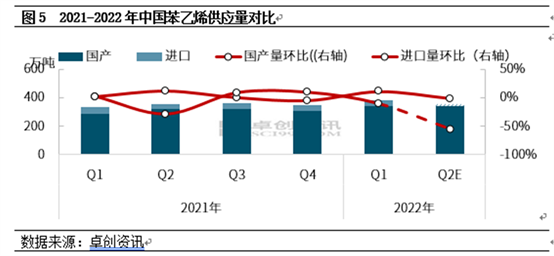

the first half of 2022 styrene is expected to put into production of large units have basically been put into production, as of July, China styrene has been put into production 2.88 million tons.

the production of the new styrene plant in the

was roughly as planned, the growth rate of domestic production was not as expected, mainly because on the one hand, some plants began to shut down for a long time against the background of long-term losses of styrene; on the other hand, there were more unplanned stoppages of styrene plants in the first half of the year. In the first half of 2021, domestic production was 6.8339 million tons, up 13% from the same period last year and 8% from the fourth quarter of last year. In the first half of the year, the import volume of styrene also decreased to a certain extent, which was related to the gradual production of domestic plants. The import volume of styrene in January-May 2021 was 730,400 tons, and the import volume in January-May 2022 was 522,100 tons, a year-on-year decrease of 28.51%.

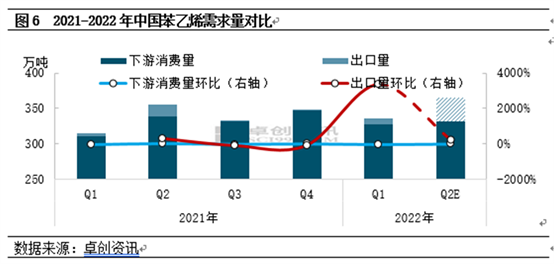

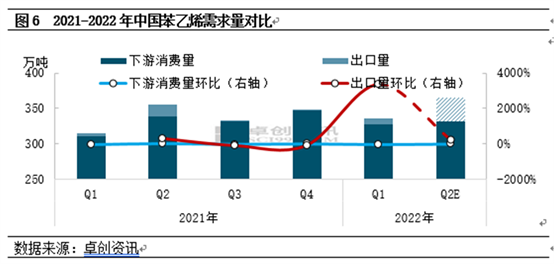

the tepid performance of styrene domestic demand in the first half of 2022. The market began to expect a recovery in demand after the Spring Festival. Until July, the terminal demand did not increase significantly. Especially in March-April, due to force majeure, the recovery of demand was interrupted. In the final analysis, the demand for terminal real estate and household appliances was weak, which was transmitted to the upstream raw material link. The downstream price did not go up and the inventory of finished products was still increasing. According to Zhuochuang's data, the downstream consumption of styrene in the first half of 2022 was 6.597 million tons, up 2% from the same period last year and down 3% from the fourth quarter of last year. Styrene exports continued to perform well in the first half of the year, with export data reaching a record high. In 2021, China's styrene exports were 234,900 tons, up 770.00% year-on-year. Exports from January to May 2022 were 342,200 tons, up 80.42% year-on-year. On the one hand, the reason for the growth of exports is that there are more planned and unplanned overhauls of overseas installations, the supply is reduced, and there is a demand gap; on the other hand, in the inflationary environment, there are differences in domestic and foreign price increases, and there is a certain arbitrage space.

In the second half of the year, the supply and demand structure may change from tight to loose. The price is expected to be high and low.

fundamentals, styrene has not yet been put into production in the third quarter. In the fourth quarter, Guangdong Jieyang has 800,000 tons/year (October-November), Lianyungang Petrochemical 600,000 tons/year (October), Zibo Junchen (formerly Qiwangda) 500,000 tons/year (mid-October) and Zhejiang Petrochemical 600,000 tons/year (fourth quarter), anqing Petrochemical Company plans to put into operation a total of 2.9 million tons/year of 400,000 tons/year (end of year). In the third quarter, the styrene plant still has Zhejiang Petrochemical's 1.2 million-ton/year plant, which is scheduled to be overhauled for about 40 days in mid-August. The second phase of CNOOC and Shell plans to replace the catalyst at the end of July and the beginning of August. Therefore, it is expected that the supply of styrene will increase in the third quarter, but it will increase slowly. The downstream in the third quarter has a batch of plant plans to put into production, if the production goes smoothly, for styrene demand is a support, but the current downstream industry profits are losing money, for the downstream new plant production progress is expected to bring impact. Overall, the supply and demand structure of styrene is expected to turn loose from tight.

from the perspective of cost, the market's views on international oil prices are also quite different. The confusion of the oil market has increased the uncertainty of the styrene market in the second half of the year. If the oil price center fails to fall broadly in the third quarter, and the supply and demand of pure benzene in the third quarter is expected to remain tight, then the styrene market in the third quarter may not be particularly pessimistic. At present, some market participants are based on their concerns about the macro economy in the second half of the year and their pessimism about the real estate industry, for the time being, the market is bearish. Entering the fourth quarter, international oil prices have greater downward pressure, and pure benzene new equipment is also expected to have stable production, increased supply, cost support weakened, superimposed on the fourth quarter styrene industry demand will have further weakening expectations, the price center of gravity or is expected to further decline.

Source: Zhongyu Information * Disclaimer: The content is derived from public channels such as the Internet and WeChat public accounts. We maintain a neutral attitude towards the views in this article. This article is for reference only. The copyright of the reprinted manuscript belongs to the original author and the organization. If there is any infringement, please contact Huayi Tianxia Customer Service to delete it.

Mainly

Mainly

Polyurethane

Polyurethane

Fine Chemical

Fine Chemical

.png)