The social situation in Shanghai was cleared. At the press conference on the epidemic prevention and control work in Shanghai held on May 16, it was confirmed that the normal production and living order was fully restored from June 1 to mid-to-late Shanghai.

As of May 14, among more than 9,000 industrial enterprises above scale in Shanghai, more than 4400 have resumed work, accounting for nearly 50%; The resumption rate of the first batch of "whitelist" enterprises has exceeded 95%. For example, manufacturing and logistics enterprises such as BASF Catalyst, a subsidiary of multinational chemical group, and Milwaukee, a professional asset-type third-party dangerous goods logistics supplier with chemical dangerous goods storage qualification, have resumed production.

As more enterprises resume work and resume production, what matters should enterprises pay attention?

Be alert to freight increase

previously, under the influence of this round of domestic epidemic, both terminal orders and the outbound of upstream factories were greatly disturbed, which once became an important factor in the weakness of plate varieties such as chemical industry and nonferrous metals. This also means that with the recovery of logistics, the expansion of demand is likely to bring a phased boost to bulk commodities.

With the full resumption of work and production in Shanghai, the backlog of goods may prompt the emergence of Rush. The industry estimates that the volume of goods received can be boosted as soon as the end of May and the beginning of June.

Tim Huxley, founder of Hong Kong Wenhua Shipping (Mandarin Shipping), believes that the current situation may take some time to fully return to normal, however, based on China's rapid rebound at an alarming rate after the epidemic was controlled in 2020, it may help stabilize confidence. At that time, the freight rate and transportation demand showed the strongest rebound in history. Although the future development is still unknown, whether the factory resumes work or the products are exported again, obviously there will be a large number of repressed demands coming later.

Lee Klaskow, a senior logistics analyst at Bloomberg think tank, also wrote in a recently released research report:" the epidemic in China puts pressure on demand, which relieves the bottleneck in the supply chain to some extent. Once the restrictions on the epidemic in China are relaxed, the freight flow may surge, which we think may boost the demand for liner capacity and lead to an increase in freight."

According to the data, in May 8-14, the national vehicle freight flow index was 94, up 8.3% month on month; Except Qinghai, Henan and other provinces and cities, the vehicle freight flow index of other provinces and cities all rebounded to varying degrees. National Gold Digital Future Lab data show that the national truck logistics intensity this week is 14, up 9% month on month; Except Beijing, the truck logistics intensity index of all provinces and cities in North China has obviously rebounded.

Chemical raw materials rebound

in the short term, after the epidemic was unsealed, the logistics blocking point was opened, the delivery on the supply side was smooth, and the replenishment on the demand side was enhanced, which was beneficial to the chemical industry. Previously, the downstream was mainly limited by financial pressure and confidence, and the raw material inventory of the terminal was at a historically low level. The demand for restocking after unsealing will lead to a small rebound in chemicals. Currently, chemicals are in the early stage of this rebound.

In April 2022, among 331 products tracked by Zhuochuang Information, 105 varieties rose, and the rising varieties declined compared with last month. The top increases were liquid chlorine, glufosinate, kerosene palm oil and liquid alkali respectively, the increase was 34.78%, 28.57%, 23.49%, 23.27% and 20.98% respectively. 190 varieties fell, and the proportion of falling varieties increased significantly. The top declines were perchloroethylene, glacial acetic acid, argon, propylene glycol and aniline, which decreased by 37.44%, 27.33%, 20.05%, 19.60% and 16.98% respectively.

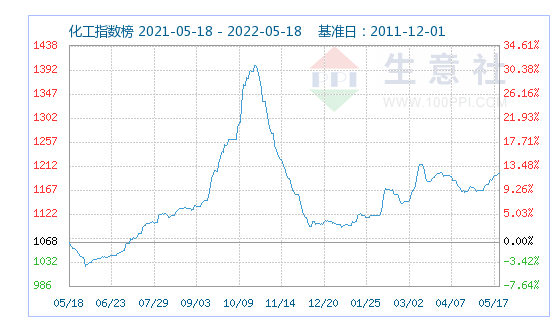

According to the data of the business Society, the chemical index was 1198 points on May 17, which was 14.43% lower than the highest point of 1400 points (2021-10-23) in the cycle, and 100.33% higher than the lowest point of 598 points on April 08, 202020. (Note: cycle refers to 2011-12-01 to present)

previously, due to the epidemic, "Gold three silver four" changed into "copper three iron four", and this situation may be improved.

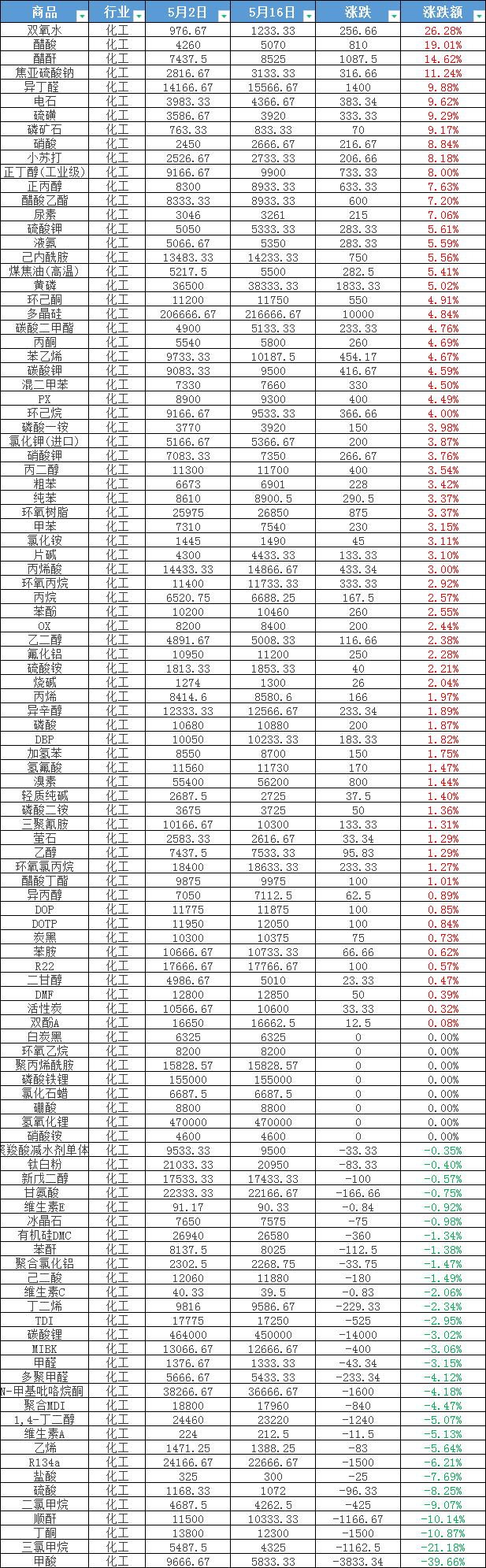

According to the data, in the second week of May, among 101 chemical varieties tracked by average price last week, the prices of 47 varieties rose, the prices of 39 varieties fell, and the prices of 15 varieties were stable. The top five varieties are acetic acid, acetic anhydride, glufosinate, nitric acid and potassium chloride respectively; While the top five varieties are urea (Baltic small grain), silicon metal, trichloroethylene, methyl ethyl ketone and methionine respectively.

With the increasing demand for downstream resumption of production, energy shortage and other factors, it is expected that the market price of raw materials will continue to improve in late May. For chemical industry, it is necessary to prepare for stock.

Source: material viewpoint* Disclaimer: the content contained is from public channels such as the Internet and WeChat public accounts. We maintain a neutral attitude towards the views in this article. This article is for reference and communication only. The copyright of the reprinted manuscript belongs to the original author and organization. If there is any infringement, please contact Huanyi world customer service to delete it. Mainly

Mainly

Polyurethane

Polyurethane

Fine Chemical

Fine Chemical

.png)