The market price of chemical products has been falling continuously for about half a year. Under the premise that oil prices remain high, most links in the chemical industry chain have a value imbalance. The more terminal the industrial chain, the greater the cost pressure of the industrial chain. Therefore, many chemical products are currently in a state of high cost but sluggish consumer market, resulting in poor production economy of many chemical products.

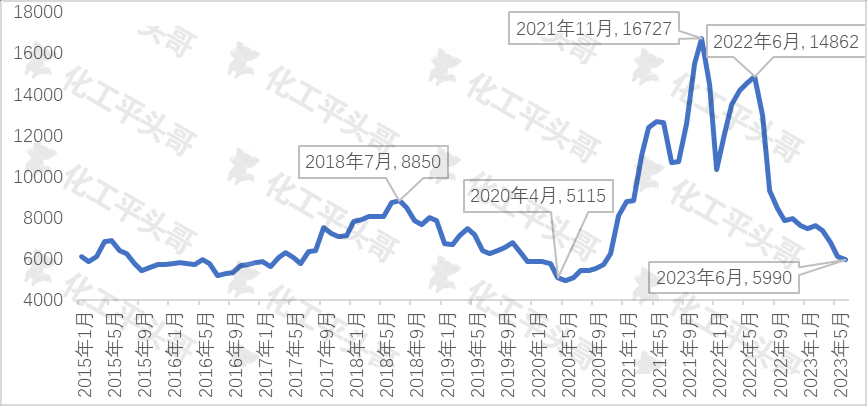

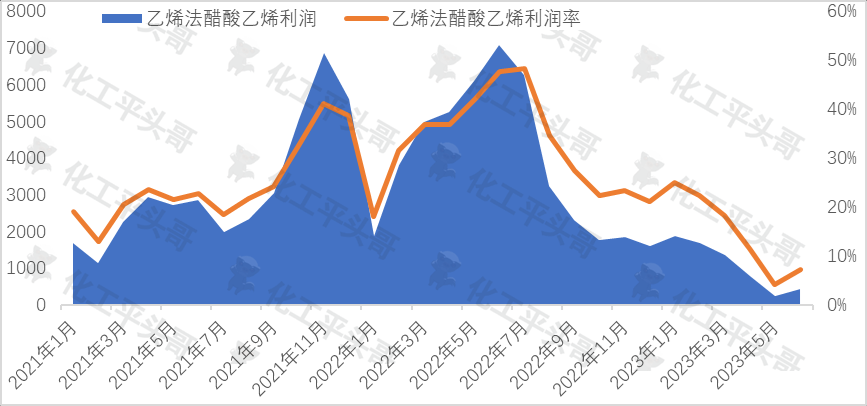

The market price of vinyl acetate has also continued to fall. Throughout the past few years, the market price of vinyl acetate has fallen from 14862 yuan/ton in June 2022 to June 2023. It has fallen for nearly a year, and the lowest price has fallen to 5990 yuan/Ton. Based on price trends in the past few years, April 2020 saw the lowest price in history, with the lowest price of 5115 yuan/ton, the highest price in November 2021 and the highest price of 16727 yuan/ton.

Figure 1 Price Trend of Vinyl Acetate in Recent Years (Unit: RMB/ton)

source: Business

although the price of vinyl acetate has been falling for a year, the production profit of vinyl acetate has been high and the production economy is good. Why does vinyl acetate maintain higher prosperity?

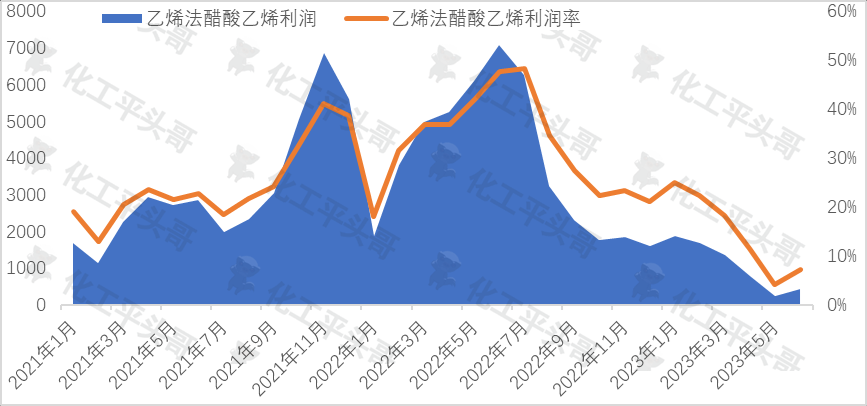

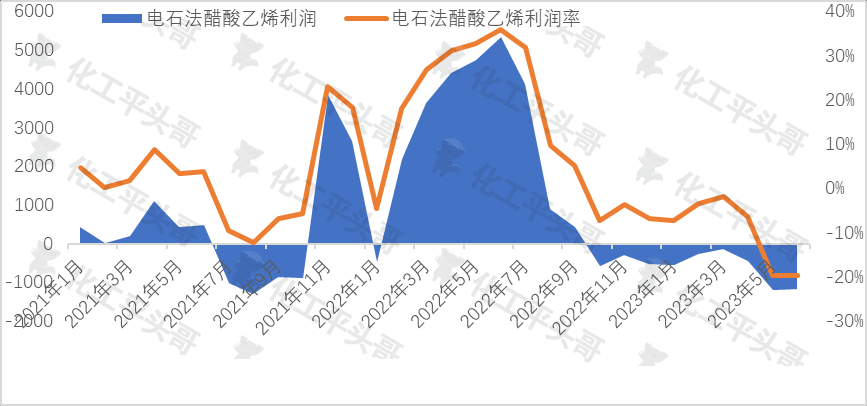

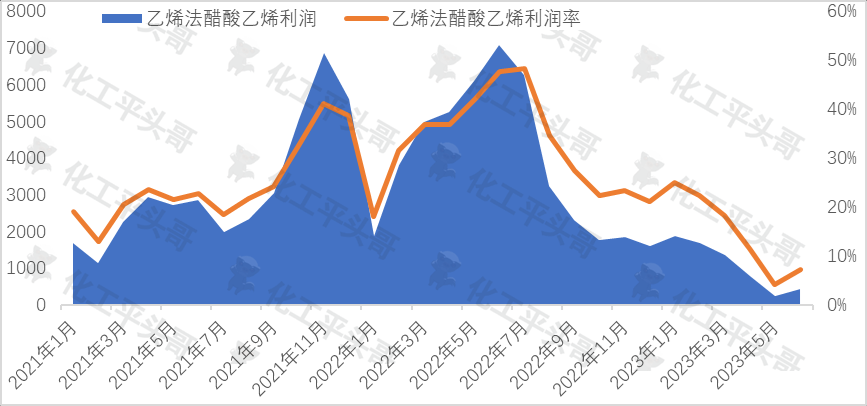

According to relevant data, as of mid-to-late June 2023, the market price of vinyl acetate was 6400 yuan/ton. According to the price level of ethylene and calcium carbide vinyl acetate raw materials at that time, the profit margin of ethylene vinyl acetate was about 14%, and the profit margin of calcium carbide vinyl acetate was at a loss. In addition, judging from the vinyl acetate profit margin monitored by the information company, the highest profit margin in 2023 is about 47% in individual time, and the profit margin is currently the highest profit margin product in bulk chemicals.

According to the changes in the profit margin of ethylene vinyl acetate, the profit margin of ethylene vinyl acetate has been profitable in the past few years, with the highest profit margin reaching more than 50% and the average profit margin of about 15%. It can be seen that ethylene vinyl acetate is a relatively profitable product in the past two years, the overall business climate is good, the profit space is stable.

Fig.2 Profit margin change of ethylene acetate in recent years

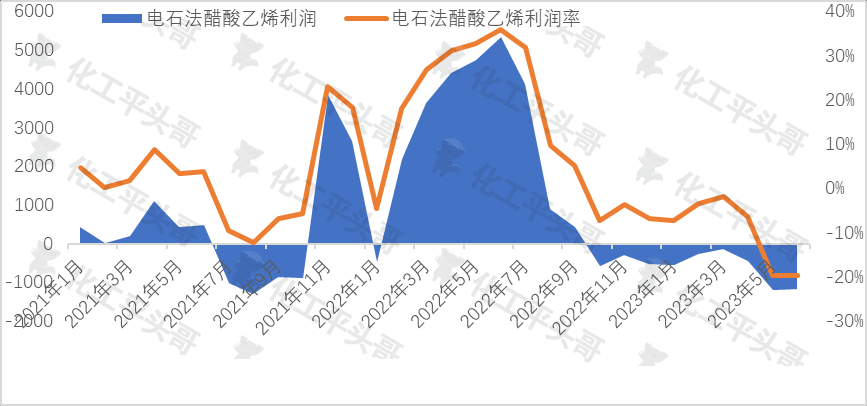

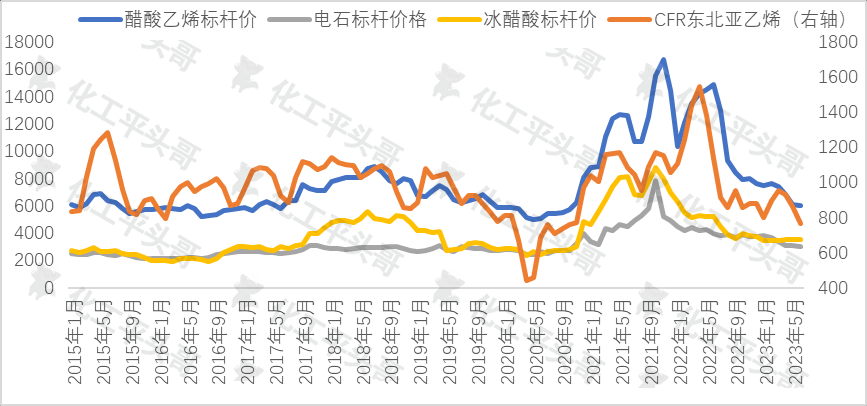

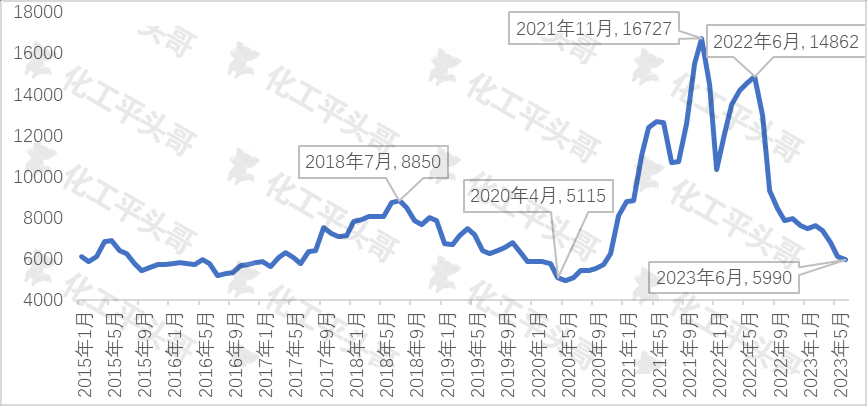

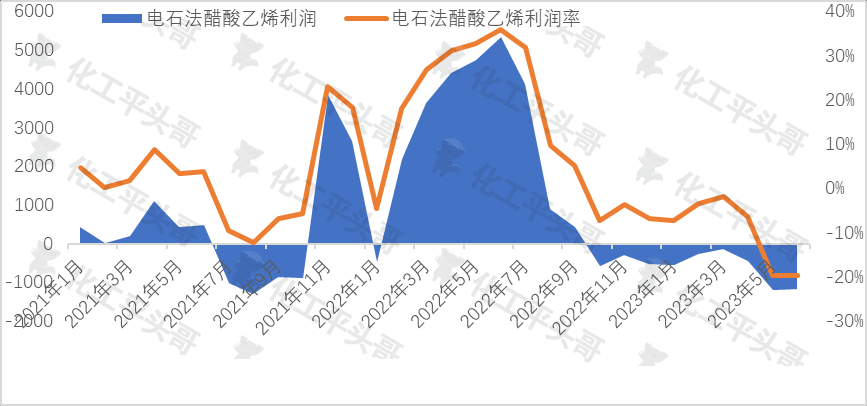

as far as calcium carbide vinyl acetate is concerned, in the past two years, except for March 2022 and July 2022, it has been in a loss state at other times. As of June 2023, the profit margin of calcium carbide vinyl acetate was about 20% of the loss. Over the past two years, the average profit margin for calcium carbide vinyl acetate has been 0.2 per cent. It can be seen that the prosperity of calcium carbide vinyl acetate is not good, and the overall situation is at a loss.

Figure 3 Changes in the profit margin of calcium carbide vinyl acetate over the past few years.

It can be seen that from the monitoring data of information companies, higher profit levels of vinyl acetate are not common. At present, only ethylene vinyl acetate is profitable, while calcium carbide has been at a loss for the past few years.

Ethylene vinyl acetate has maintained a high margin for the following reasons:

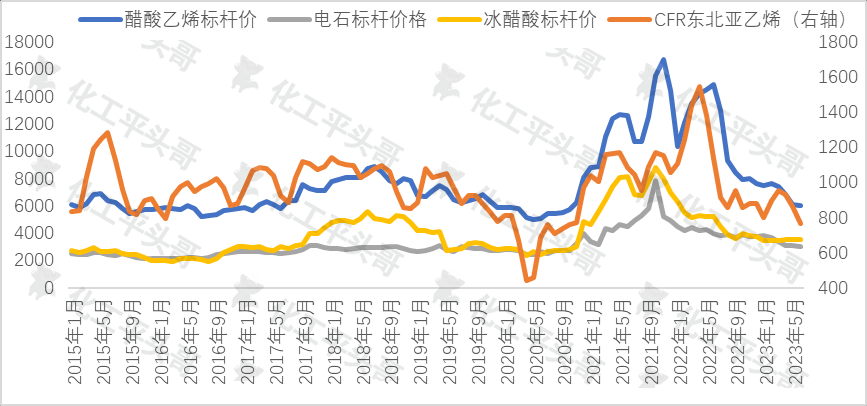

first, the proportion of raw material costs in different production processes is different. In ethylene acetate, the unit consumption of ethylene is 0.35 and that of glacial acetic acid is 0.72. According to the average price level in June 2023, the proportion of ethylene in ethylene acetate is about 37% and that of glacial acetic acid is 45%. Therefore, the price fluctuation of glacial acetic acid has the greatest impact on the cost change of ethylene acetate, followed by ethylene.

As for the cost of calcium carbide vinyl acetate, calcium carbide accounts for about 47% of the cost of calcium carbide vinyl acetate, and glacial acetic acid accounts for about 35% of the cost of calcium carbide vinyl acetate. Therefore, in the calcium carbide vinyl acetate method, the change in the price of calcium carbide has a greater impact on the cost, which is very different from the cost impact of the ethylene method.

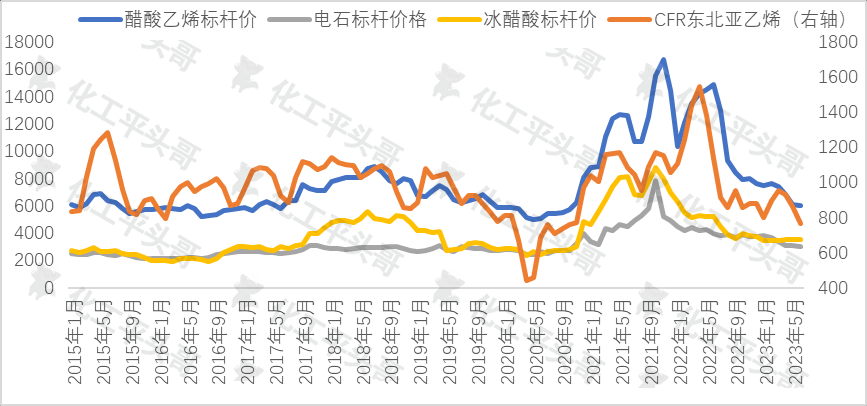

The second raw materials ethylene and glacial acetic acid decreased significantly, resulting in a significant reduction in costs. According to relevant data, in the past year, CFR Northeast Asia ethylene prices fell 33%, glacial acetic acid prices fell 32%. However, the production cost of calcium carbide vinyl acetate is mainly limited by the price of calcium carbide. In the past year, the price of calcium carbide has fallen by 25%.

Therefore, from the two different production processes, the raw material cost of ethylene vinyl acetate is greatly reduced, and the cost reduction is greater than that of the calcium carbide method.

Figure 4 Price fluctuation of vinyl acetate and main raw materials (unit: RMB/ton, USD/ton)

third, while the price of vinyl acetate has declined, it has not fallen as much as for other chemicals. In the past year, the price of vinyl acetate has fallen by 59%, which seems to be a big drop, but the price of other chemicals has fallen even more.

Vinyl acetate has maintained a certain profit margin, mainly because of the cost reduction caused by the decline in raw material prices, rather than the support of the consumer market for its price, which is also the current situation of value transmission in the vinyl acetate industry chain. Judging from the current situation of China's chemical market in the short term in the future, if there is no large-scale consumer market stimulus policy, it is difficult to fundamentally change the weak state of China's chemical market. It is expected that the value chain of vinyl acetate will continue to maintain the logic of downward transmission. It is expected that the production profit of the end-consumer market, especially polyethylene and EV products, will be maintained by reducing the profit of vinyl acetate.

As far as calcium carbide vinyl acetate is concerned, in the past two years, except for March 2022 and July 2022, it has been in a loss state at other times. As of June 2023, the profit margin of calcium carbide vinyl acetate was about 20% of the loss. Over the past two years, the average profit margin for calcium carbide vinyl acetate has been 0.2 per cent. It can be seen that the prosperity of calcium carbide vinyl acetate is not good, and the overall situation is at a loss.

Figure 3 Changes in the profit margin of calcium carbide vinyl acetate over the past few years.

It can be seen that from the monitoring data of information companies, higher profit levels of vinyl acetate are not common. At present, only ethylene vinyl acetate is profitable, while calcium carbide has been at a loss for the past few years.

Ethylene vinyl acetate has maintained a high margin for the following reasons:

first, the proportion of raw material costs in different production processes is different. In ethylene acetate, the unit consumption of ethylene is 0.35 and that of glacial acetic acid is 0.72. According to the average price level in June 2023, the proportion of ethylene in ethylene acetate is about 37% and that of glacial acetic acid is 45%. Therefore, the price fluctuation of glacial acetic acid has the greatest impact on the cost change of ethylene acetate, followed by ethylene.

As for the cost of calcium carbide vinyl acetate, calcium carbide accounts for about 47% of the cost of calcium carbide vinyl acetate, and glacial acetic acid accounts for about 35% of the cost of calcium carbide vinyl acetate. Therefore, in the calcium carbide vinyl acetate method, the change in the price of calcium carbide has a greater impact on the cost, which is very different from the cost impact of the ethylene method.

The second raw materials ethylene and glacial acetic acid decreased significantly, resulting in a significant reduction in costs. According to relevant data, in the past year, CFR Northeast Asia ethylene prices fell 33%, glacial acetic acid prices fell 32%. However, the production cost of calcium carbide vinyl acetate is mainly limited by the price of calcium carbide. In the past year, the price of calcium carbide has fallen by 25%.

Therefore, from the two different production processes, the raw material cost of ethylene vinyl acetate is greatly reduced, and the cost reduction is greater than that of the calcium carbide method.

Figure 4 Price fluctuation of vinyl acetate and main raw materials (unit: RMB/ton, USD/ton)

third, while the price of vinyl acetate has declined, it has not fallen as much as for other chemicals. In the past year, the price of vinyl acetate has fallen by 59%, which seems to be a big drop, but the price of other chemicals has fallen even more.

Vinyl acetate has maintained a certain profit margin, mainly because of the cost reduction caused by the decline in raw material prices, rather than the support of the consumer market for its price, which is also the current situation of value transmission in the vinyl acetate industry chain. Judging from the current situation of China's chemical market in the short term in the future, if there is no large-scale consumer market stimulus policy, it is difficult to fundamentally change the weak state of China's chemical market. It is expected that the value chain of vinyl acetate will continue to maintain the logic of downward transmission. It is expected that the production profit of the end-consumer market, especially polyethylene and EV products, will be maintained by reducing the profit of vinyl acetate.

Mainly

Mainly

Polyurethane

Polyurethane

Fine Chemical

Fine Chemical

.png)