As the situation in Russia and Ukraine continues, some Western countries represented by the United States have issued sanctions against Russia: united States in terms of economy, international trade, technology and so on, many sanctions policies against Russia have been issued; EU announced sanctions against Russia by means of natural gas import and finance to Russia; japan release Economic sanctions such as freezing assets of Russian financial institutions, etc; united Kingdom, Canada, South Korea, Australia other countries have also followed the trend and issued relevant sanctions policies one after another; the Russia-Ukraine war attracted the goals of the whole world. China was forced to become the leading role in this war, which was constantly "Arch Fire" by the United States and closely related to European countries. China's influence in the world has led to the official position of China and the attitude of the Chinese people, which has a certain influence on the situation of this game.

If China is "restricted", what will happen to the chemical industry? China not only imports a large amount of crude oil, natural gas, propane and other energy products every year, but also imports a large number of basic chemical products and polyolefin products, such as high-end polyolefin products. If China is "restricted", it will also take relevant measures in international trade, finance, technology and other fields according to the sanctions against Russia. This article mainly analyzes what changes will happen to China's polyolefin industry chain if China is "restricted. It has little impact on China's import and export trade of polyethylene and polypropylene

according to statistics, in 2021, China imported polyethylene mainly from Saudi Arabia, Iran, UAE, Singapore, South Korea and the United States, of which imports from the Middle East accounted for the largest proportion, while imports from the United States accounted for a small proportion. According to export data, China's largest export country of polyethylene is Hong Kong, Vietnam, Brazil, South Korea and Colombia, among which China exports to Hong Kong, mainly through Hong Kong re-export trade to Southeast Asian countries, there is no country imposing sanctions on Russia this time. According to customs statistics, polypropylene products imported from China in 2021 mainly came from South Korea, Singapore, Saudi Arabia, UAE, Thailand and other countries. In the past few years, China imported the largest polypropylene products from South Korea. From the perspective of export, in the past few years, China's exports to Vietnam, Hong Kong and Thailand accounted for the largest proportion. China accounts for a relatively small proportion of the export volume of countries that impose sanctions on Russia this time. So, in general, among China's polyethylene and polypropylene import and export countries, the import and export trade volume between Russia sanctions countries and China's polypropylene accounts for a small proportion. If these countries impose sanctions on China, it affects the normal trade of polyolefin products between China and these countries, so it is expected that it will not have a serious impact on the import and export of polyolefin industry in China. Imports of special polyolefin products may be affected

although China's polyolefin industry is developing rapidly, a large number of polyolefin products are imported to China every year.. According to customs statistics, China's total imports of polypropylene in 2021 were about 4.8 million tons, and the total imports of polyethylene were 14.59 million tons. In addition, other high-end polyolefin products are imported in large quantities, such as engineering plastics, synthetic resin, thermoplastic elastomer, etc. Among these imported products, China has a large number of imported products, mainly polyolefin products that cannot be produced independently or whose independent output is not enough to support China's consumption. These products also have the characteristics of high-end application fields and high technical barriers. According to relevant statistics, in 2020, the self-sufficiency rate of China's high-end polyolefin was only 41%, while in 2021, the self-sufficiency rate of China's high-end polyolefin was still less than 50%. Therefore, these high-end polyolefin products play an obvious role in product differentiation for the development of China's polyolefin industry and are of great significance to the stable production of high-end plastic products in China. Table 1 statistics on self-sufficiency rate of high-end naval stores in China in 2020

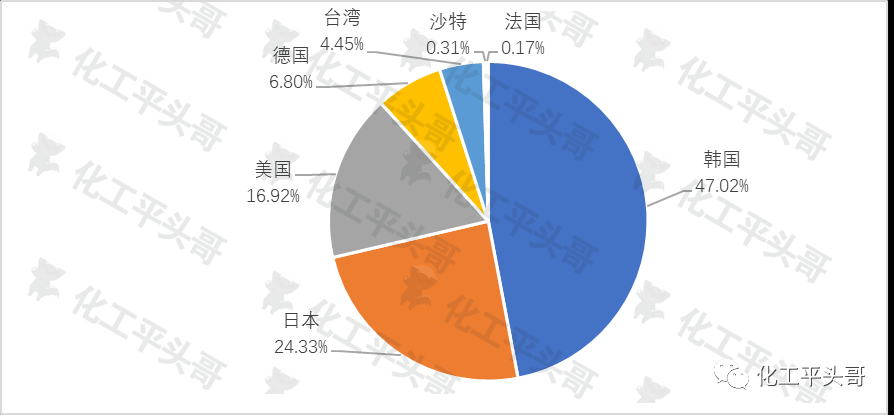

according to incomplete statistics from the source countries of high-end polyolefin products imported from China, in 2021, the source countries of China's high-end polyolefin products mainly came from South Korea, Japan and the United States, among which the high-end polyolefin products imported from South Korea accounted for about 47%, accounting for a huge proportion. Japan and the United States account for 24% and 17% respectively. If China is "restricted", it will have a huge impact on China's high-end polyolefin imports. Figure 1 Proportion of China's high-end polyolefin products imported from countries china's polyolefin products imported from the United States have the greatest impact.

According to the survey, in 2021, the international trade scale of polyolefin products between China and the United States and the import market, in 2021, the linear low density polyethylene of China's imports of the primary shape of the United States was about 350,000 tons, which was the largest product in the scale of imported polyolefin products. The average import price was 7570 yuan/ton. Most of China's LLDPE products imported from the United States are metallocene high-end LLDPE Products, such as high-end product packaging films, such as heavy packaging bags, metal dustbin lining, food packaging, stretch films, etc.

In addition, about 250,000 tons of polyethylene in primary shape were imported from the United States in 2021, with a proportion of <0.94 and an average import price of 9357 yuan/ton, ranking second in China's polyolefin products imported from the United States. Imported polyethylene products mainly focus on high-end pipes, auto parts, medical equipment, high-end electronics and electricity, etc. In the field of health care, high-end polyolefin is used in medical equipment, laboratories, cosmetics, syringe and diagnostic instrument, etc, in addition, from the perspective of import type, relatively high-end polyolefin products, such as other primary-shaped ethylene-α-olefin copolymer, imported about 50,000 tons in 2021, and the average import price was about 13,000 yuan/ton. This kind of product, with POE as the main representative, has also become the representative of high-end imported polyolefin products. However, due to the shortage of localization technology, such products are in short supply and require a large amount of supplement of imported resources. Table 2 Statistics of China's polyolefin products imported from the United States in 2021

in addition, for products exported from China to the United States, among the polyolefin products exported from China to the United States in 2021, Ethylene polymers with unlisted primary shape exported the largest volume, about 40,000 tons, and the average export price was about 10,000 yuan/ton. On the one hand, these products have a certain export arbitrage range with the United States; On the other hand, they are also primary products of domestic polyolefin products, as well as polyolefin products with insufficient production and supply in the United States. Table 3 statistics of polyolefin products exported from China to the United States in 2021

as a global manufacturing factory, China's production of high-end products, on the one hand, meets the needs of the Chinese market, and there are still a lot of consumption needs for the European and American markets. Therefore, after the imported high-end polyolefin products are affected, they will also be transmitted through the industrial chain, which will eventually affect the supply of high-end polyolefin products in Europe and America.

Source: chemical Pingtou brother* Disclaimer: the content contained is from public channels such as the Internet and WeChat public accounts. We maintain a neutral attitude towards the views in this article. This article is for reference and communication only. The copyright of the reprinted manuscript belongs to the original author and organization. If there is any infringement, please contact Huanyi world customer service to delete it.

Mainly

Mainly

Polyurethane

Polyurethane

Fine Chemical

Fine Chemical

.png)