On January 1, 2022, RCEP (Regional Comprehensive Economic Partnership Agreement) came into effect, taking the lead in China, Japan, New Zealand, Australia and 10 ASEAN countries including Brunei, Cambodia, Laos, Singapore, Thailand and Vietnam. This means that the world's largest free trade zone has officially set sail.

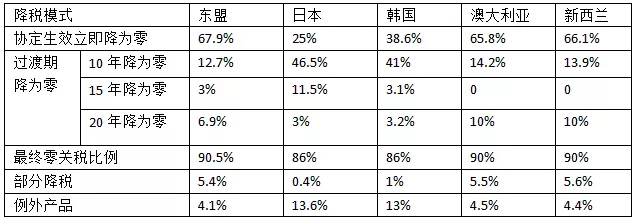

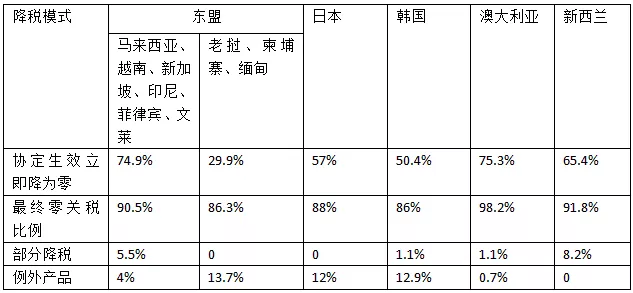

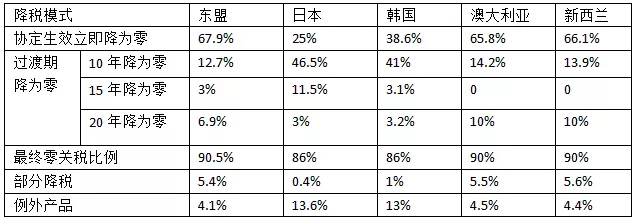

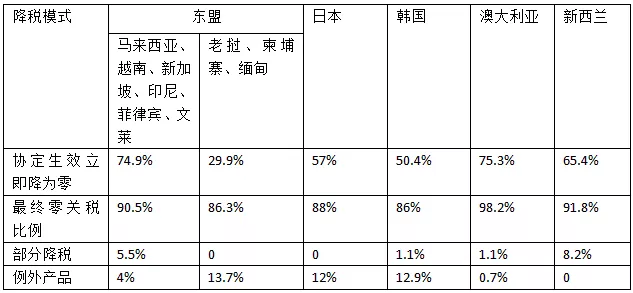

the proportion of immediate zero tariff between China and Australia and New Zealand exceeds 65%, and the proportion of immediate zero tariff with South Korea is 39% and 50%. China and Japan have newly established free trade relations, and the proportion of immediate zero tariff has reached 25% and 57% respectively. On this basis, RCEP member states will basically achieve 90% products in about 10 years to enjoy zero tariffs.

So, how can chemical enterprises seize the RCEP opportunity and enjoy preferential tariff policies?

RCEP is the abbreviation of the Regional Comprehensive Economic Partnership, that is, the Regional Comprehensive Economic Partnership. RCEP was initiated by the ten ASEAN countries and invited China, Japan, South Korea, Australia, and New Zealand to participate ("10 5") to reduce tariffs and non-tariff barriers. Establish a free trade agreement with a unified market of 15 countries. After approval comes into effect, "tariff concessions among members are mainly based on the commitment to immediately reduce to zero tariff and to zero tariff within 10 years".

RCEP is the world's largest free trade agreement with the largest population, the largest economic and trade scale, the most diverse member structure and the greatest development potential.

Important historical stages

●On November 15, 2020, the Fourth Regional Comprehensive Economic Partnership Agreement Leaders' Meeting was held by video. After the meeting, 10 ASEAN countries and 15 Asia-Pacific countries including China, Japan, South Korea, Australia, and New Zealand formally signed the Regional Comprehensive Economic Partnership Agreement.

: On March 22, 2021, the head of the International Department of the Ministry of Commerce said that China had completed the RCEP approval and became the first country to ratify the agreement. On April 15, China formally deposited the approval of the Regional Comprehensive Economic Partnership Agreement with the Secretary-General of ASEAN. On November 2, the ASEAN Secretariat, the custodian of the Regional Comprehensive Economic Partnership Agreement, issued a notice announcing that six ASEAN member states, including Brunei, Cambodia, Laos, Singapore, Thailand and Vietnam, and four non-ASEAN member states, including China, Japan, New Zealand and Australia, have formally submitted their approval documents to the ASEAN Secretary-General, reaching the entry into force threshold.

●On January 1, 2022, the Regional Comprehensive Economic Partnership Agreement (RCEP) officially entered into force. The first batch of countries to enter into force include Brunei, Cambodia, Laos, Singapore, Thailand, Vietnam and other ASEAN 6 countries and China, Japan, New Zealand, Australia and other non-ASEAN 4 countries.

● RCEP will take effect for South Korea from February 1, 2022.

Tariff concession commitment RCEP Parties apply tariff commitment tables in two broad categories.

One is "uniform concessions", that is, the same product applies the same tax reduction arrangements to other parties. Eight parties, including Australia, New Zealand, Malaysia, Singapore, Brunei, Cambodia, Laos and Myanmar, all have this model. These parties have only one tariff commitment table, that is, the same product originating from different parties under RCEP will apply the same tax rate when the above parties import.

the other category of is "country concessions", which apply different tax reduction arrangements to other contracting parties. Countries adopting this model include South Korea, Japan, Indonesia, Vietnam, Thailand, the Philippines and China. This means that "the same product originating in different contracting parties applies different RCEP agreement tax rates at the time of import". China has reached tariff commitments on trade in goods with Japan, South Korea, Australia, New Zealand and ASEAN respectively, with a total of five tariff commitments.

China's Tariff Commitment to Other Parties (Goods Proportion)

Other Contracting Parties Tariff Commitments to China (Goods Proportion)

before RCEP, China has reached free trade agreements with ASEAN, South Korea, Australia and New Zealand. With the conclusion of RCEP, member states have new free trade relations and new tax reduction commitments, which will bring more benefits to domestic enterprises.

First, ASEAN has significantly expanded the scope of zero-tariff products for our countries. Indonesia, the Philippines, Cambodia, Myanmar, Malaysia and other countries have added new tax reduction products to us, mainly including automobiles and parts, motorcycles, chemicals, electromechanical, and steel products. Enterprises will benefit from the new tax cuts.

second, RCEP has added an important free trade partner to us, Japan. China and Japan have reduced tariffs on products in many fields such as machinery and equipment, electronic information and chemical industry.

Third, domestic import enterprises will also enjoy tangible benefits. Enterprises will import advanced technology, important equipment, key parts, consumer goods, medicine and nursing equipment at a lower cost, as well as imported design research and development, energy conservation and environmental protection and other productive services to better meet the domestic market consumption upgrading demand.

Tariff Commitment Table (Detailed List) China's Tariff Commitment to ASEAN Member States

http://fta.mofcom.gov.cn/rcep/rceppdf/02%20Schedules%20-%20CN%20for%20ASEAN_cn.pdf

China's Tariff Commitment to Japan

http://fta.mofcom.gov.cn/rcep/rceppdf/04%20Schedules%20-%20CN%20for%20JP_cn.pdf

China's Tariff Commitment to South Korea

http://fta.mofcom.gov.cn/rcep/rceppdf/05%20Schedules%20-%20CN%20for%20KR_cn.pdf

China's Tariff Commitment to Australia

http://fta.mofcom.gov.cn/rcep/rceppdf/03%20Schedules%20-%20CN%20for%20AU_cn.pdf

China's Tariff Commitment to New Zealand

http://fta.mofcom.gov.cn/rcep/rceppdf/06%20Schedules%20-%20CN%20for%20NZ_cn.pdf

Brunei's Tariff Commitment to China

http://fta.mofcom.gov.cn/rcep/rceppdf/23%20Schedule%20-%20BN.pdf

Cambodia's Tariff Commitment to China

http://fta.mofcom.gov.cn/rcep/rceppdf/25%20Schedule%20-%20CA.pdf

Laos Tariff Commitment to China

http://fta.mofcom.gov.cn/rcep/rceppdf/35%20Schedule%20-%20LA.pdf

Thailand's Tariff Commitment to China

http://fta.mofcom.gov.cn/rcep/rceppdf/50%20Schedule%20-%20TH.pdf

Vietnam's Tariff Commitment to China

http://fta.mofcom.gov.cn/rcep/rceppdf/55%20Schedules%20-%20Viet%20Nam-For%20CN.pdf

Japan's Tariff Commitment to China

http://fta.mofcom.gov.cn/rcep/rceppdf/11%20Schedule%20-%20JP1.pdf

New Zealand Tariff Commitment to China

http://fta.mofcom.gov.cn/rcep/rceppdf/21%20Schedule%20-%20NZ.pdf

Australia's Tariff Commitment to China

http://fta.mofcom.gov.cn/rcep/rceppdf/09%20Schedule%20-%20AU.pdf

South Korea's Tariff Commitment to China

http://fta.mofcom.gov.cn/rcep/rceppdf/16%20Schedules%20-%20KR%20for%20CN.pdf

How can I enjoy RCEP preferential tariff treatment?

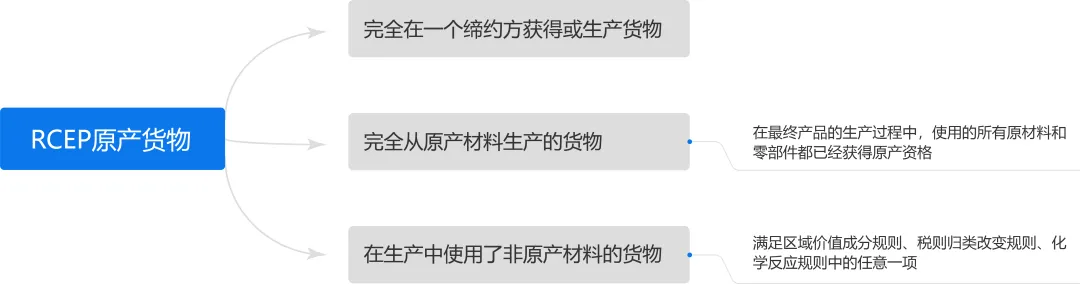

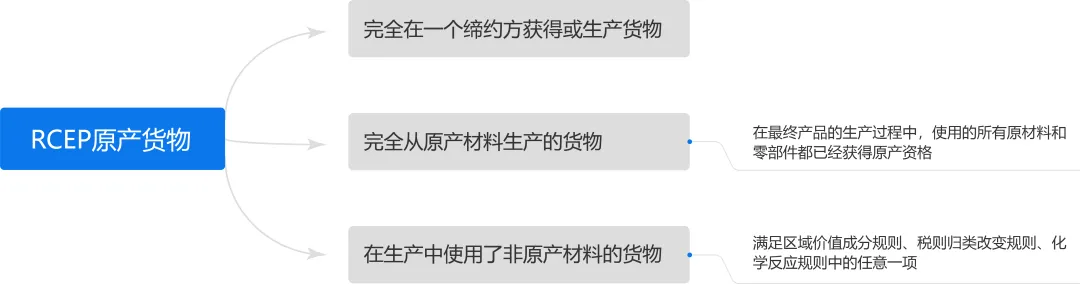

the relationship between rules of origin and tariff concessions are regarded as goods of origin as the basis for enjoying RCEP preferential tariff treatment. The following are the three criteria that meet the original goods:

(I) fully acquired or produced

RCEP Chapter III Article 3 provides detailed provisions on fully acquired or produced goods, mainly refers to the territory of one (only one) contracting party through planting, harvesting, picking, breeding, hunting, farming, extraction and other means of fully acquired or produced goods.

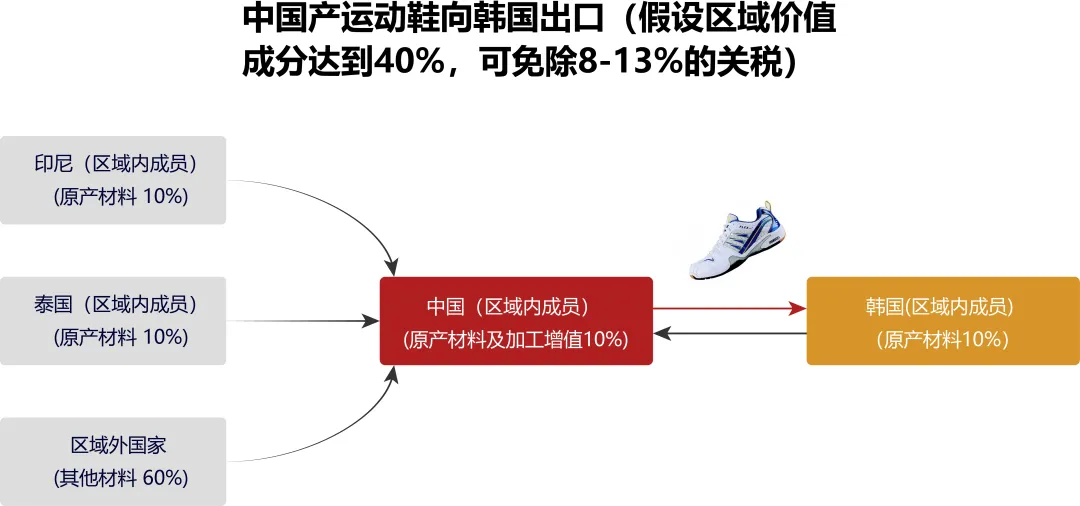

(II) area component accumulation rules

materials that meet the requirements of origin and are used in another Party for the production of another goods or material shall be deemed to originate in the Party that processes or processes the finished goods or materials.

For example, Party A, Party B, Party C and Party D are all parties to the RCEP agreement. Country A uses the original goods A from countries B, C and D as raw materials to continue processing and manufacturing product B. According to the regional composition accumulation principle, the original goods A shall be recognized as originating from country A for processing and manufacturing product B.

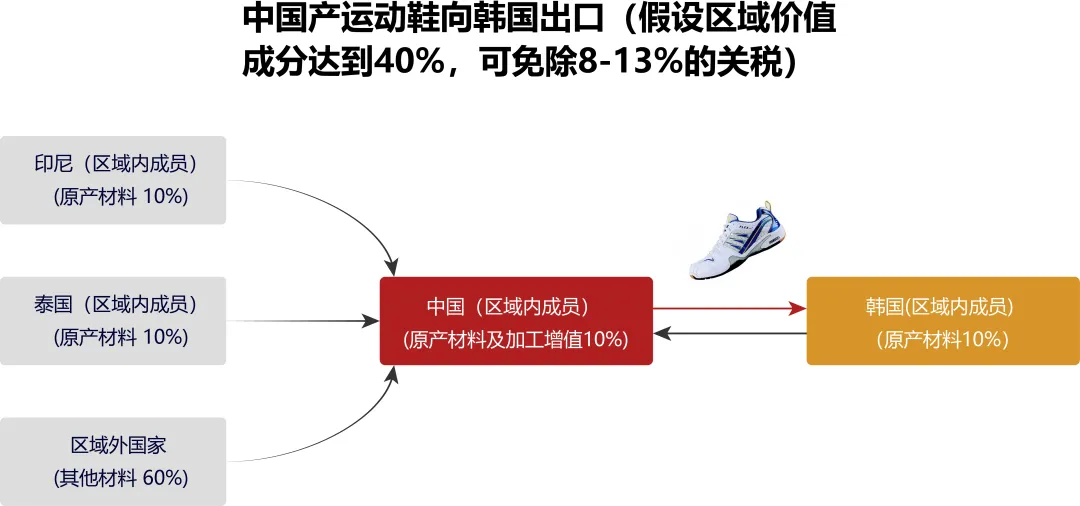

the essence of accumulation principle is to regard all RCEP parties as a whole. The attribute of "origin" can be transmitted from the first party to the next party, realizing a dynamic process of "accumulation" of origin value components throughout the region ". Exporters through the accumulation principle will be easier to meet the regional value component 40%(RVC40) ratio requirements or other substantial change requirements, can enjoy the regional preferential policies.

(III) product specific rules of origin

a party uses goods of non-origin materials, if they conform to the specific rules of origin of the product, they can also be regarded as goods of the party's origin. Product-specific rules of origin include the Regional Value Content ("RVC"), the Change in Tariff Classification ("CTC") and the Chemical Reaction Rule (Chemical Reaction Rule, "CR"). If the goods meet any of the preceding rules, they can be regarded as goods of origin. If they meet multiple rules, the exporter is allowed to choose to apply specific rules.

RCEP regional value component rules set the standard for RVC40, that is, the goods of the regional value component ratio is not less than 40%, can be determined to be the area of origin goods, applicable to the agreement area of the preferential tax rate.

Certificate of Origin Information Requirements

✔Name and address of importer and exporter, manufacturer

✔Goods Description, Quantity, HS Code (6 digits), Price (Regional Value Component Standard)

✔Certificate of Origin No.

✔of Origin Standards Applicable to

✔exporter or producer declares

✔The issuing agency signs and approves that the goods meet the requirements

✔RCEP country of origin

✔determine the details of the delivery of the goods, such as the invoice number, date of origin, name of the ship or flight number of the aircraft and the port of discharge

✔back-to-back certificate of origin: the number of the original certificate of origin, the date of issue, the RCEP country of origin of the first exporting party and the authorization code of the approved exporter of the first exporting party (if applicable)

Chemical companies enjoy RCEP dividends BASF

BASF (China) Co., Ltd., located in Pudong, Shanghai, is BASF's headquarters in China. Its main export destinations for chemical products are RCEP member countries such as ASEAN and South Korea. Recently, Shanghai BASF Polyurethane Co., Ltd., a subsidiary of BASF (China) Co., Ltd., has the latest batch of chemical products that are about to be exported. After applying for the relevant certificate of origin, it will enter the destination market with zero tariff. Under the preferential policy, the average tax reduction and exemption for each ticket is 16,000 yuan.

shadoma (Guangzhou) Chemical Co., Ltd., a subsidiary of Akoma Group, was signed the first certificate of origin under RCEP in Guangdong Province of China, and became the first batch of approved exporters recognized by Guangzhou Customs and signed the first declaration of origin under RCEP. With this RCEP certificate of origin, chemical products produced by Sadoma will enjoy preferential tariff treatment for export to RCEP countries, and some products to Japan will enjoy zero tariff preference, significantly reducing import and export costs and enhancing the market competitiveness of export products.

Recently, Xinxiang Chemical Fiber Co., Ltd. (hereinafter referred to as Xinxiang Chemical Fiber) passed the Zhengzhou Customs review and became the first batch of Henan Province to obtain the "Regional Comprehensive Economic Partnership Agreement" (RCEP) certificate of origin.

In 2016, Xinxiang Chemical Fiber became the first enterprise in Xinxiang, Henan to pass AEO advanced certification, and it was also the first domestic enterprise to export spandex stably and continuously to Europe. This time to become an approved exporter, so that enterprises can enjoy customs clearance in relevant parties with their own declaration of origin, and can more flexibly plan and arrange the production and export of goods.

Source: We maintain a neutral attitude towards the views in this article. * Disclaimer: The content is derived from public channels such as the Internet and WeChat public accounts. This article is for reference only. The copyright of the reprinted manuscript belongs to the original author and the organization. If there is any infringement, please contact the customer service of Huayi Tianxia to delete  Mainly

Mainly

Polyurethane

Polyurethane

Fine Chemical

Fine Chemical

.png)