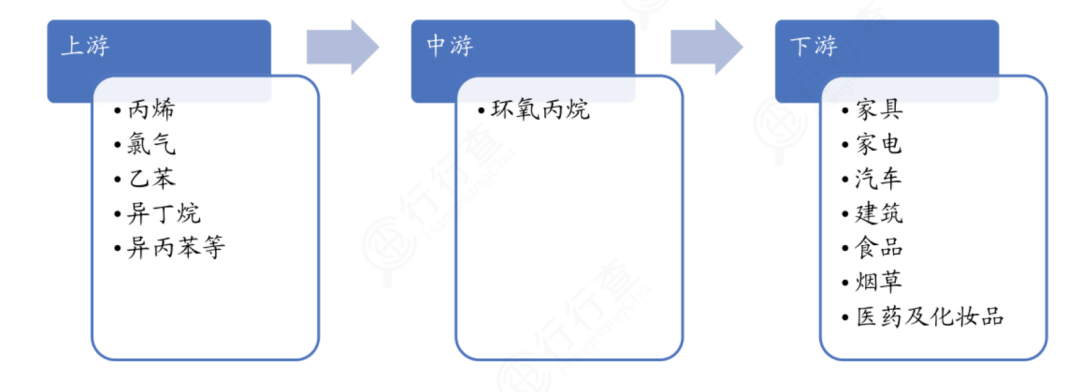

of propylene oxide (PO), also known as methyl ethylene oxide or propylene oxide, is an important intermediate in petrochemical industry and an important basic organic chemical synthesis raw material. It is the third largest propylene derivative after polypropylene and acrylonitrile. It is mainly used to produce polyether polyols, propylene glycol and various non-ionic surfactants.

propylene oxide derivatives are widely used in furniture, household appliances, automobiles, construction, food, tobacco, medicine, cosmetics and other industries, with nearly 100 downstream products. China is one of the major production and marketing places of propylene oxide in the world. In 2021, China's production capacity of propylene oxide is 5.39 million tons/year and the output is 3.7 million tons. In the future, the new production capacity of the industry will be mainly HPPO method. It is estimated that the total annual consumption of propylene oxide will reach 4.6 million tons by 2025.

Propylene oxide industry chain combing

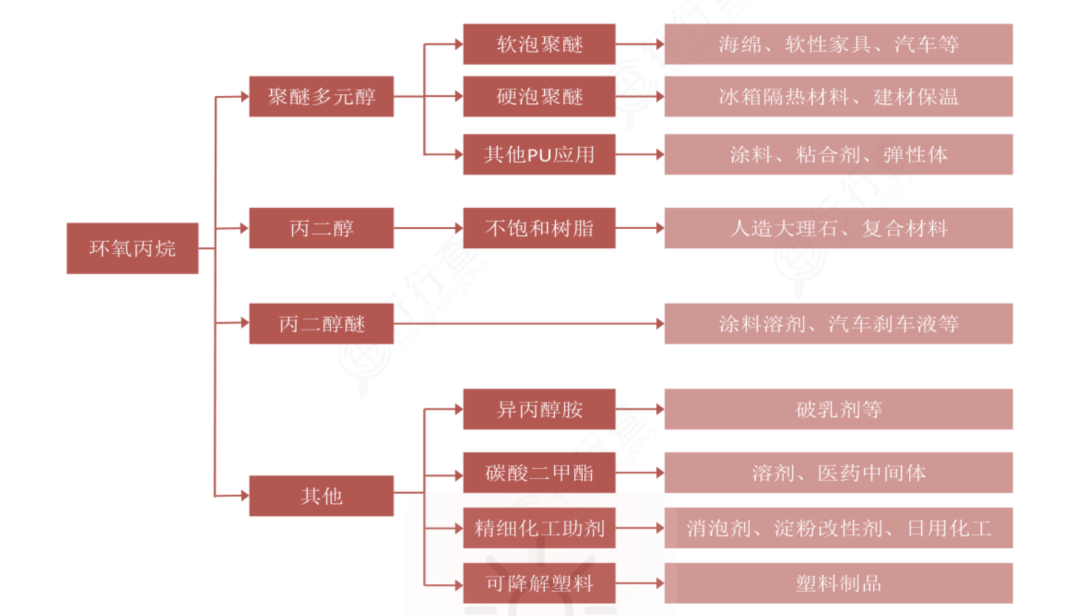

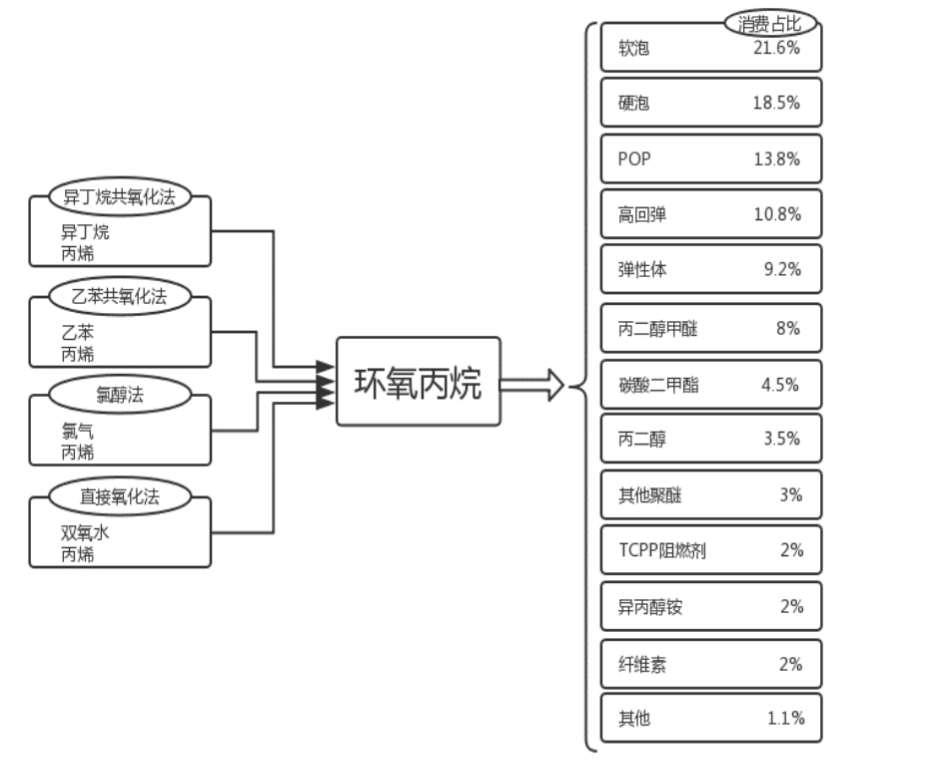

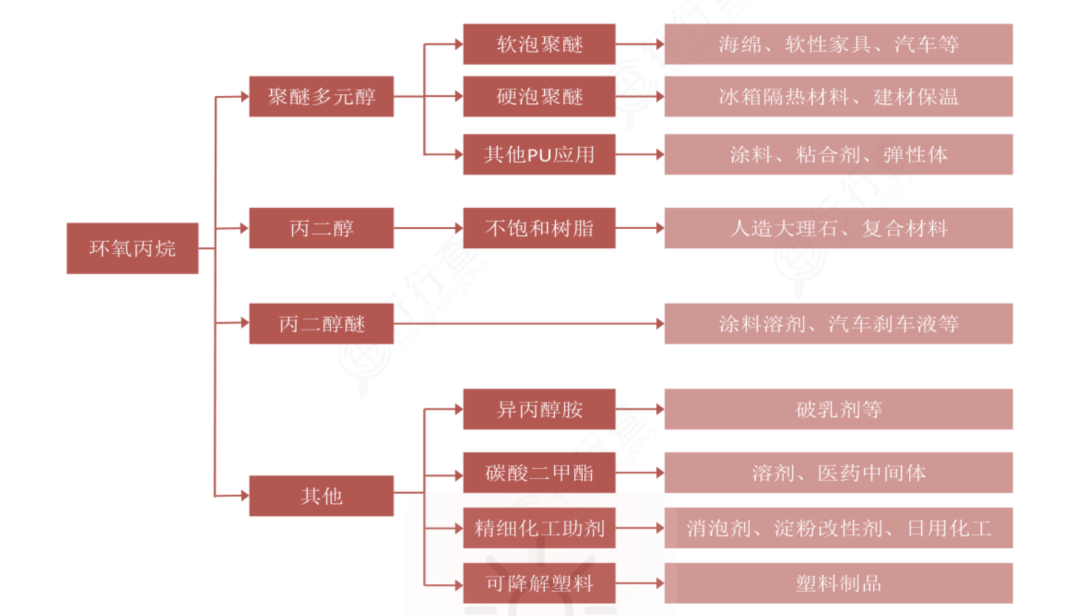

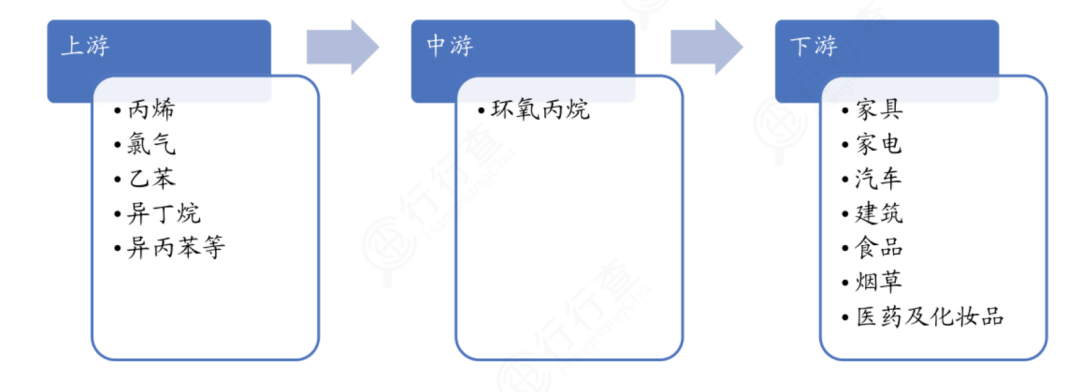

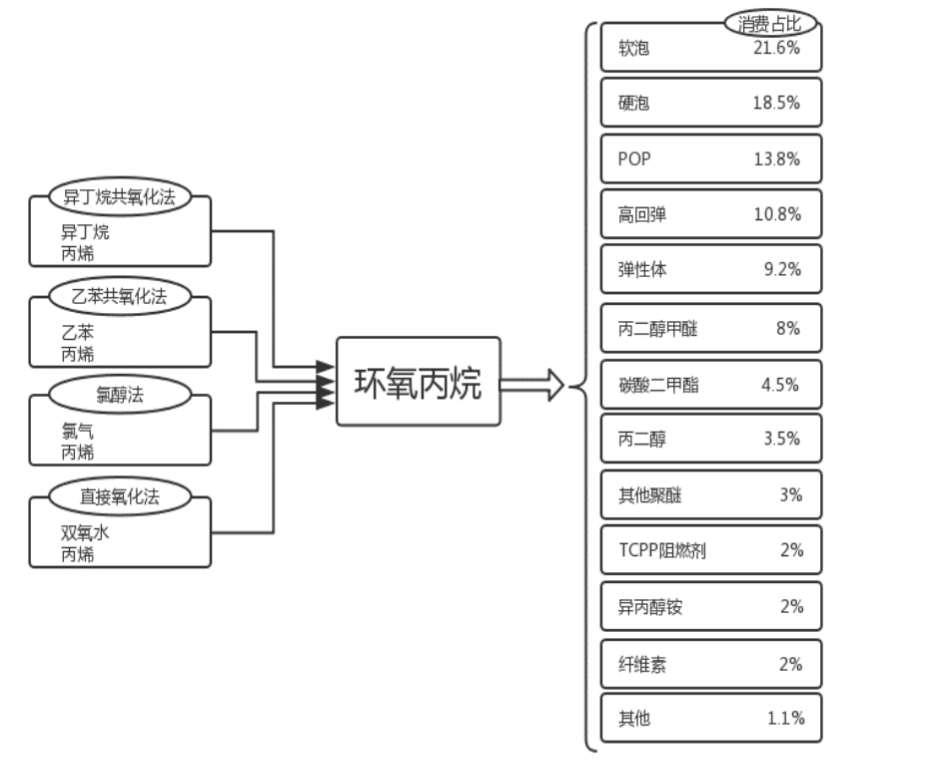

propylene oxide as a derivative of propylene. Its upstream raw materials are propylene and naphtha and propane needed to produce propylene. The main downstream products are polyether polyol, propylene glycol methyl ether, dimethyl carbonate, propylene glycol ether, etc.

Polyether polyol is the most important product of propylene oxide and the core raw material for synthetic polyurethane. It can be used in the production of sponge, fireproof material and thermal insulation material.

From the demand side, the consumption of polyurethane in China drives the demand for polyether polyols, thus driving the demand for propylene oxide. The application of polyurethane is mainly concentrated in four fields of furniture, automobile, construction and industrial insulation, and the dosage accounts for 2/3 of the total dosage of polyurethane. The prosperity of the domestic automobile and real estate pillar industries has a great impact on the demand for polyurethane, which in turn affects the demand for propylene oxide.

the overall overcapacity of domestic polyurethane downstream industry, especially the excess pressure of soft foam market. Downstream industry profit margin of 3-4%, profit distribution is mainly in the hands of upstream MDI, TDI, PO production enterprises, mainly by technical barriers, industry status.

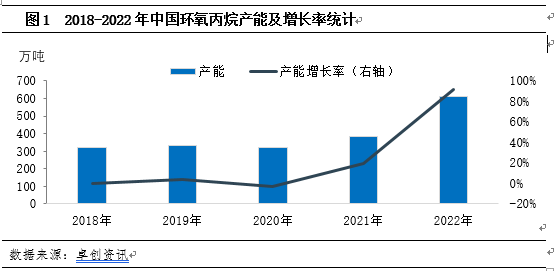

In 2022, propylene oxide supply and demand are weak, production capacity slows down.

of

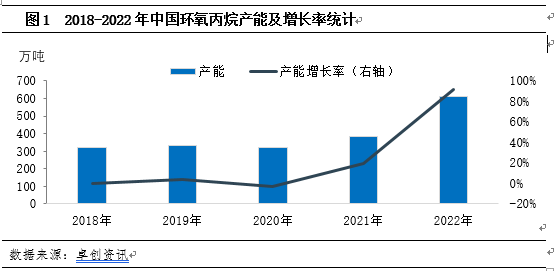

In 2022, the supply and demand of propylene oxide was weak, and the production capacity slowed down. Up to now, the total production capacity of propylene oxide in China is 4.272 million tons, and the main supply areas are concentrated in East China and Shandong. Shandong region still has the largest production capacity. In the first half of the year, the industry operating rate was 83.99%, down 5.48% year-on-year, the consumption is estimated to be 1.75 million tons, the difference between supply and demand is further expanded, and the industry gross profit is reduced by 83% year-on-year.

Capacity Growth Slows

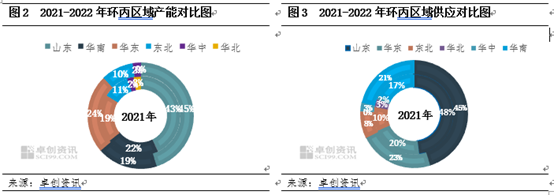

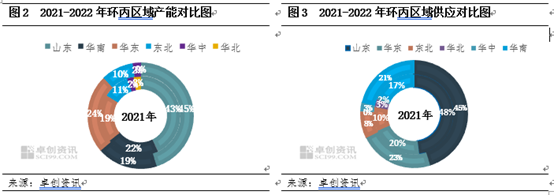

According to statistics, the 2022 annual plan to put into production can be in the vicinity of 2.45 million tons, the first half of the planned production capacity of 1.16 million tons, the actual new production capacity of only 585,000 tons, the production capacity slowed down, the new production capacity is mainly concentrated in Shandong and East China, mostly co-oxidation process.

East China's production capacity and output share have increased.

, with the landing of new equipment production capacity in 2022, the production capacity in East China will increase to 1.03 million tons, accounting for 24% of the total production capacity, up 4% year-on-year. Shandong will still be the largest area, accounting for 45%, up 1% year-on-year. In terms of actual production volume, in the first half of the year, due to the relatively stable operation of equipment in East China, the production volume will increase significantly year-on-year, and in the first half of the year, the production volume will increase by about 83,000 tons year-on-year, the start-up and stop of the equipment in Shandong is relatively flexible. Due to more maintenance of the equipment in the first half of the year, the output increase is limited year-on-year, with an increase of only about 35,000 tons.

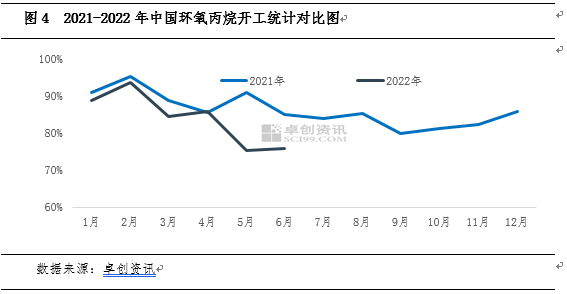

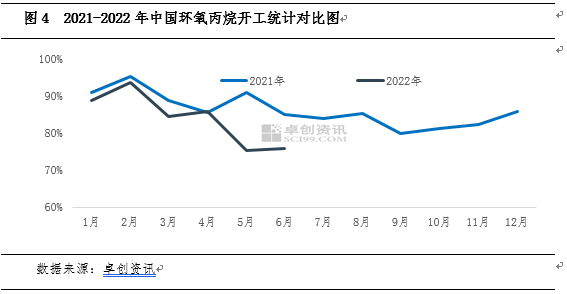

Year-on-year decline in starts

The first half of 2022 industry average in 84%, down 5 percentage points year-on-year, due to the first half of the non-market factors, the industry's overall demand is not as expected, coupled with raw material propylene liquid chlorine prices are high, cost pressure is obvious, gross margin space contraction is obvious.

Demand fell year-on-year and the gap between supply and demand widened.

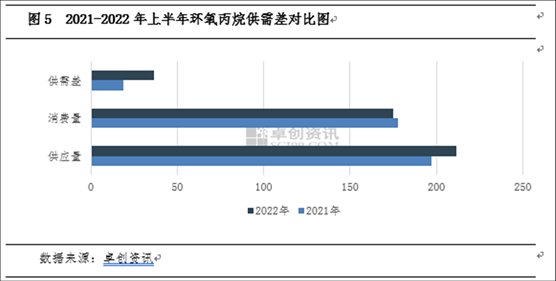

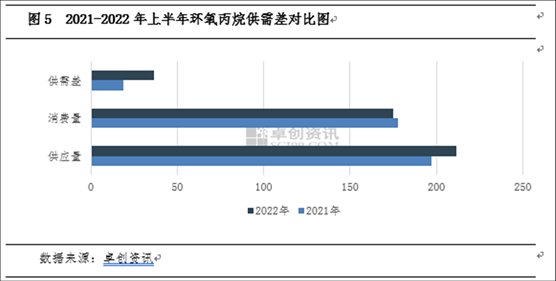

in the first half of the

, the industry demand is estimated to be around 1.75 million tons, the total supply is estimated to be 2.12 million tons, and the difference between supply and demand has widened to 370,000 tons. As the gap between supply and demand widens, the interregional arbitrage window is officially closed.

Gross margin shrinks

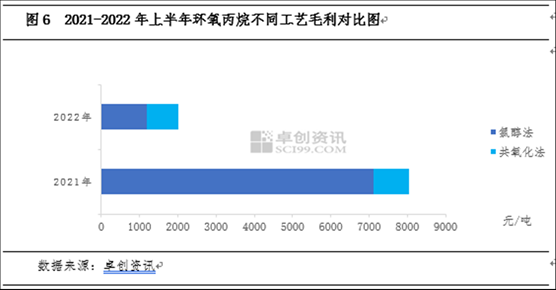

in the

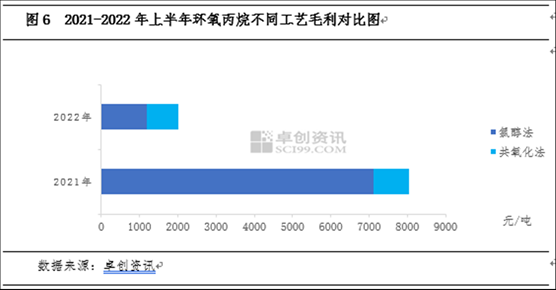

first half of the, the average gross profit of the chlorohydrin method was 1187 yuan/ton, down 5933 yuan/ton from 7120 yuan/ton in the same period last year, a year-on-year decrease of 83%, and other process gross profit space also shrank significantly.

in the first half of 2022 as a whole, the increase in production capacity and output is limited, the demand is also reduced, the gap between supply and demand is widening, the competition between regions is upgraded, the arbitrage window is closed, and there are still more plans for the production of new devices in the second half of the year. We must continue to pay attention to the landing time of new devices and the changes in the upstream and downstream markets. With the continuous landing of new devices, the industry's production capacity is expanding significantly, and the price of propylene oxide may gradually return to the product value itself, the value of the industrial chain is gradually transmitted downward.

Source: Zhuo Chuang Information, Leqing Think Tank * Disclaimer: The content contained in the content comes from the Internet, WeChat public number and other public channels, we maintain a neutral attitude towards the views in the article. This article is for reference only. The copyright of the reprinted manuscript belongs to the original author and the organization. If there is any infringement, please contact Huayi Tianxia Customer Service to delete it.

Mainly

Mainly

Polyurethane

Polyurethane

Fine Chemical

Fine Chemical

.png)