Phenol acetone was originally a "same root" co-production device, but the "phenol strong ketone weak" situation has been dominant. Although the situation was reversed in 2020, the time was short. In 2021, phenol returned strongly. In 2022, the support from the cost side was significantly increased. The cost of phenol ketone factory was under pressure, especially in April and May, it gradually dropped to below the profit and loss line.

into 2022, the continued rise in crude oil futures prices, resulting in an increase in the overall cost of chemicals, but based on the differentiation of supply and demand fundamentals of each product, the downward transmission of costs has weakened. Under the tight balance between supply and demand, the price of pure benzene in East China followed up the rising price of crude oil, and in June, it stood at the 10,000 yuan mark, a new high in 8 years, but propylene due to the continuous expansion of production capacity in recent years, the growth rate of supply is greater than the growth rate of demand, the formation of market prices suppressed, the rise is relatively flat. But overall, the phenolic ketone plant is still under the high cost of raw materials from the upper end of the suppression, the theoretical gross margin gradually fell below the profit and loss line. In a short period of time, in addition to paying attention to the trend of raw materials, changes in supply and demand also need to be closely followed up.

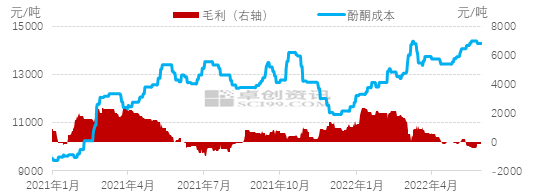

Phenolic ketone factory theoretical gross profit positive to negative

Figure 1 Comparison of Cost and Gross Profit Trend of Phenolic Ketone Enterprises in 2021-2022

Data source: Zhuo Chuang Information

As can be seen from the chart above, the theoretical cost of the domestic phenol-ketone plant increased significantly in January-May 2022, but the downstream did not keep up with the pace of cost-side increases, and the theoretical gross margin of the phenol-ketone plant was squeezed. According to the data monitoring of Zhuochuang Information, the average theoretical cost of phenol ketone factory from January to May is: 12408 yuan/ton, 12958 yuan/ton, 13778 yuan/ton, 13543 yuan/ton and 14171 yuan/ton respectively; the average theoretical gross profit of the phenol ketone factory from January to May was 1992 yuan/ton, 1923 yuan/ton, 779 yuan/ton, 121 yuan/ton, -167 yuan/ton, and the gross profit value gradually changed from positive to negative.

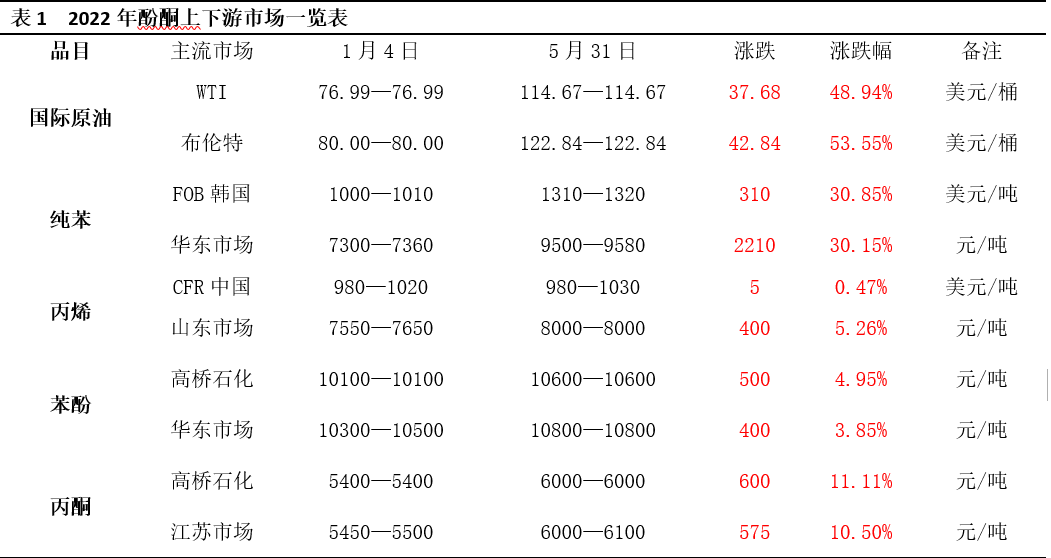

Pure benzene rose more than 30%, cost side support strong.

into 2022, international oil prices into a strong channel, the price center of gravity continues to rise. As of May 31, WTI closed at $114.67/barrel and Brent at $121.67/barrel, up about 50%. In the process of downward transmission of cost, pure benzene is eye-catching. Pure benzene FOB Korea prices and East China market prices rose more than 30%. In addition to the transmission of crude oil cost, due to the peripheral disproportionation of raw materials into gasoline components, the production of pure benzene decreased, the peripheral supply of pure benzene has not improved, the high price of pure benzene and tight supply also brought strong support to the pure benzene market. Compared with pure benzene, the increase of propylene, another raw material of phenol ketone, is slightly limited. From January to May, the price of propylene in Shandong Province increased by only about 5%.

the "rising tide lifts all boats", under the favorable transmission of the sharp rise in pure benzene, phenol factories and the East China market also rose to varying degrees, but the increase did not exceed 5%. In the fourth quarter of 2021, newly-built bisphenol A units in the downstream were put on the market, which enlarged the demand gap in the phenol market and laid a high level of 10,000 yuan in the phenol market at the beginning of 2022. However, under the dual influence of the release of phenol ketone production capacity and the decline of logistics capacity in the second phase of Zhejiang Petrochemical Company, the phenol market continued to have a little limited space to rise and fell into a wide shock pattern. Related products acetone January-May factory prices and market prices increased by more than 10%. On the one hand, the price of acetone is at a relatively low level, on the other hand, some downstream industries put into production to increase the demand for acetone market, stimulating the market price to rise.

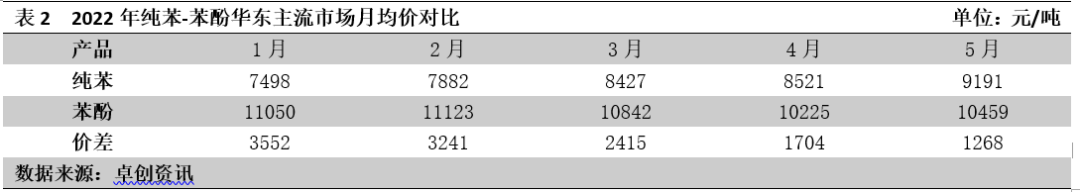

Pure benzene-phenol mainstream market monthly average price difference gradually narrowed

As can be seen from Table 2, in 2022, under the strong support of high oil prices, the price of pure benzene in the upstream has shown an overall upward trend due to its own shortage of supply environment. Although the demand for bisphenol A in the downstream of phenol remains stable, the new phenolic ketone production capacity has been gradually released during this period. In addition, since March, due to the impact of the decline in inter-regional logistics capacity, abrasives and thermal insulation materials in the downstream traditional industries have been understarted, and the cost-oriented transmission is limited, as a result, the price difference between phenol and pure benzene is narrowed, and the cost pressure of phenol section is increasing day by day. As of May 31, the closing price of pure benzene in East China market was 9540 yuan/ton, and the closing price of phenol in East China market was 10800 yuan/ton. The difference between the two was 1260 yuan/ton. The theoretical gross profit of phenol section was still fluctuating near the break-even line.

Figure 2 Price Fluctuation Trend of Phenol East China Mainstream Market in 2021-2022

Data source: Zhuo Chuang Information

although compared with the price trend of pure benzene market, phenol has not kept up with the rising pace of cost, compared with the price trend chart of phenol mainstream market in East China in 2021-2022, as of May 31, the phenol market in 2022 is still at a high level compared with the data of the same period in 2021, and the bottom supporting effect of cost surface is still very obvious. However, under the background of high cost collision and short-term imbalance between supply and demand, the trading space is limited, and the buying trend just needs to be followed up, the market amplitude has narrowed compared to 2021, with the overall range of 10,000-11,500 yuan/tonne.

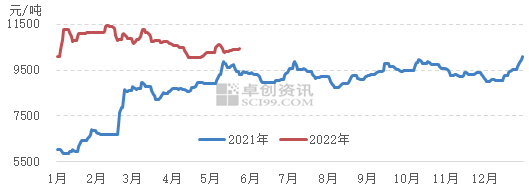

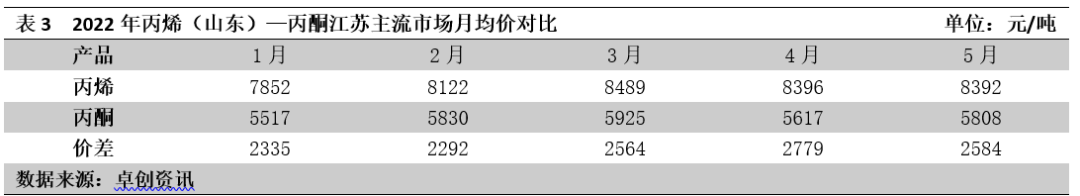

Propylene-acetone mainstream market monthly average price difference gradually widened

As can be seen from Table 3, the price difference between China's propylene Shandong market price and Jiangsu acetone price gradually widened from January to May 2022, and the price difference was above 2000 yuan/ton. Judging from the proportion of downstream products of propylene, polypropylene is one of the largest downstream products, while the proportion of acetone is only around 3%. With the expansion of phenolic ketone units in the second half of the year, the demand for propylene has increased.

Figure 3 Price Fluctuation Trend of Acetone Jiangsu Mainstream Market in 2021-2022

Data source: Zhuo Chuang Information

From January to May 2022, the market price of acetone in Jiangsu region was below 6000 yuan/ton, although there was a breakthrough in the middle, but it lacked sustainability. In the past five months, the fluctuation space of acetone market in Jiangsu region fluctuates in the range of 5300-6400 yuan/ton. Although acetone continues to hit the 6000 yuan/ton mark, the power is still insufficient. The cost side of the phenolic ketone plant is under pressure, the supply and demand side game and the limited transportation efficiency in some regions, all of which have a negative impact on the acetone market price within a certain period of time.

Short-term Phenolic Ketone Market Trend Forecast

entered June. The price of pure benzene in the upstream showed strong performance. The market price quickly broke through the integer mark of 10,000 yuan, reaching a high level in the past 8 years. Under the background of high cost, the cost of phenol ketone factory was under pressure, and the enthusiasm for raising the price of new orders in phenol factory increased. However, some downstream factories still need time to reduce the stock and the downward transmission of costs still needs to wait. In the short term, it is difficult for upstream pure benzene to reverse the downward market for the time being, under the cost and demand game, the phenol market may show a high volatility situation, focusing on the negative feedback brought about by the changes in supply and demand fundamentals and the downward transmission pressure of costs. Acetone market short-term cost support, the decline space is limited, but the current rise still needs time; follow-up attention to the supply and demand side of the game, especially the downstream MMA new capacity production, sales, as well as the acetone purchase volume stability.

Source: Zhuo Chuang Information * Disclaimer: The content is derived from public channels such as the Internet and WeChat public accounts. We maintain a neutral attitude towards the views in this article. This article is for reference only. The copyright of the reprinted manuscript belongs to the original author and the organization. If there is any infringement, please contact Huayi Tianxia Customer Service to delete it. Mainly

Mainly

Polyurethane

Polyurethane

Fine Chemical

Fine Chemical

.png)