In April 2024, the engineering plastics market showed a mixed trend. The tight price of goods has become the mainstream factor to promote the rise of the market, the major petrochemical plants parking price strategy to stimulate the in stock market to rise. However, weak market demand has also led to a decline in the prices of some products. Specifically, PMMA the prices of products such as PC and PA6 rose, while the prices of PET, PBT, PA6 and POM fell.

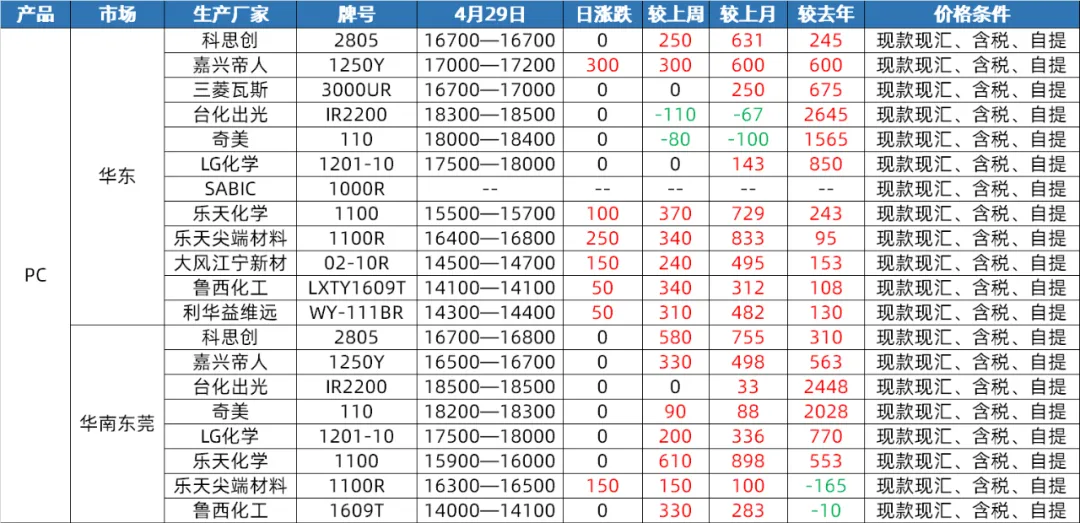

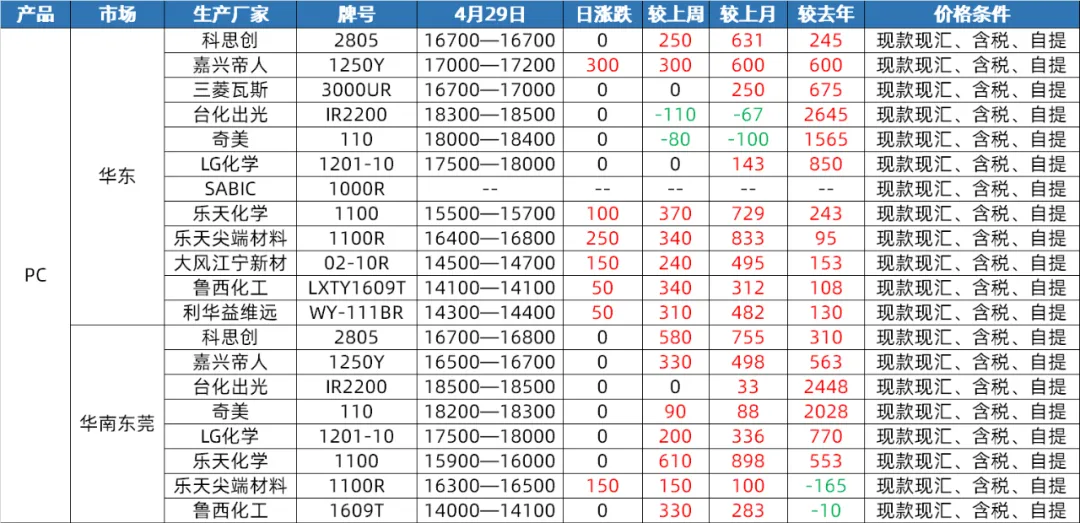

The PC Market

supply side: in April, the domestic PC market experienced a narrow range of shocks and broke upward. At the end of the month, prices rebounded to the highest level since the fourth quarter of last year. In the first half of the month, although Hainan Huasheng's PC devices were stopped for maintenance, other domestic PC devices were generally running smoothly and there was little pressure on both the supply and demand sides. However, with the sharp rebound of PC upstream raw materials and the continued rise of parallel materials in the second half of the year, coupled with the stocking operations of some downstream factories before May Day, PC in stock prices rose rapidly. In May, although there is still a PC unit maintenance plan, it is expected that the maintenance losses will be hedged and Hengli Petrochemical's 260000-ton/year PC unit capacity will be gradually released. Therefore, it is expected that the domestic PC supply in May will increase compared with this month's expectation.

Demand side: in late April, despite the rise in PC market prices, there was no obvious positive expectation on the demand side. Downstream purchases of PCs did not push the market up further. Entering May, the demand side is expected to remain stable, making it difficult to have a significant boost to the PC market.

Cost side: in terms of cost, the raw material bisphenol A is expected to fluctuate in a high and narrow range in May, with limited cost support for PC. In addition, as PC prices rise to nearly half a year high, and the fundamentals are not good enough, market risk is expected to rise, profit-taking and shipment will also increase, further compressing the profit margin of PC.

PA6 Slice Market

supply side: in April, the supply side of PA6 slice market was relatively sufficient. Due to the restart of the raw material caprolactam part of the overhaul device, the start-up load increased, the raw material inventory of the polymerization plant is at a high level. At the same time, on-site supply also showed sufficient state, some polymerization plants, although the in stock inventory is limited, but most in the delivery of pre-orders, the overall supply pressure is not great. In May, the supply of caprolactam continued to remain sufficient, the operation of the polymerization plant also remained at a high level, and the on-site supply remained sufficient. In the first half of the year, some factories continued to deliver pre-orders, and supply pressure is expected to continue. However, it is worth noting that the recent development of export trade, the increase in aggregate export orders, or the continued negative value of a small number of factory inventories, will have a certain impact on the supply side.

Demand side: in April, the market demand for PA6 slices was flat. Aggregation downstream multi-on-demand procurement, limited demand. The northern factory will lower the ex-factory price under the influence of downstream demand. However, near the May Day holiday, the market transaction atmosphere has improved, some polymerization factory presale to the end of the May Day holiday. In May, the demand side is expected to remain stable. In the first half of the year, some factories continued to deliver pre-orders, aggregation downstream is still more on-demand procurement, demand is limited. However, considering the good development of export trade and the increase of aggregate export orders, this will have a certain positive impact on the demand side.

Cost side: in April, weak cost support was the main feature of PA6 slice market. The price fluctuation of raw material caprolactam has a certain impact on the chip cost, but on the whole, the cost support is limited. Going into May, the cost side is expected to continue to fluctuate. Due to the abundant supply of caprolactam, its price fluctuations will have a direct impact on the cost of PA6 chips. It is expected that the market will be weak and stable in the first half of the year, while the market may follow the cost fluctuations and show a certain adjustment trend.

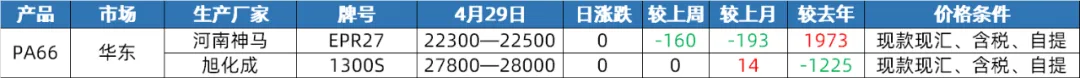

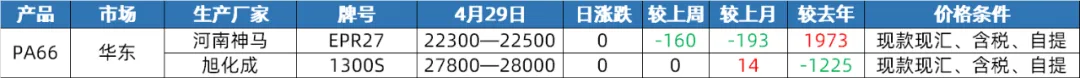

PA66 Market

supply side: in April, the domestic PA66 market showed a volatile operation, with the average monthly price down 0.12 percent from the previous year, down 2.31 percent from last year. Although the implementation price of raw material hexamethylene diamine was raised by 1500 yuan/ton, Tianchen Qixiang hexamethylene diamine production was stable and the supply of raw materials increased, resulting in a weak consolidation of the in stock price of hexamethylene diamine. On the whole, the supply side is relatively stable and the market is in abundant supply of in stock. Entering May, the adiponitrile plant of Invista is planned to be overhauled for one month, but the implementation price of hexamethylene diamine in stock is stable at 26500 yuan/ton, and the hexamethylene diamine plant of Tianchen Qixiang also maintains stable operation. Therefore, it is expected that the supply of raw materials will continue to remain stable and there will be no major fluctuations in the supply side.

Demand side: april terminal demand is weak, downstream resistance to high prices is strong, the market to just need to purchase. Although the supply is stable and abundant, the lack of demand makes it difficult for the market to have obvious upward momentum. It is expected that the terminal demand will remain weak in May, and there is no good news to boost it. Downstream enterprises are expected to continue to just need to purchase, market demand is difficult to improve significantly. Therefore, from the demand side, PA66 market will still face some downward pressure.

Cost side: in April, the cost surface support was relatively stable, and the prices of hexamethylene and adipic acid showed a volatile operating trend. Despite the fluctuations in raw material prices, the overall cost support has not changed significantly. Entering May, the overhaul of the Invista adiponitrile plant may have some impact on raw material costs, but the prices of hexamethylene diamine and adipic acid are expected to remain relatively stable. Therefore, from the cost side, PA66 market cost support is still relatively stable.

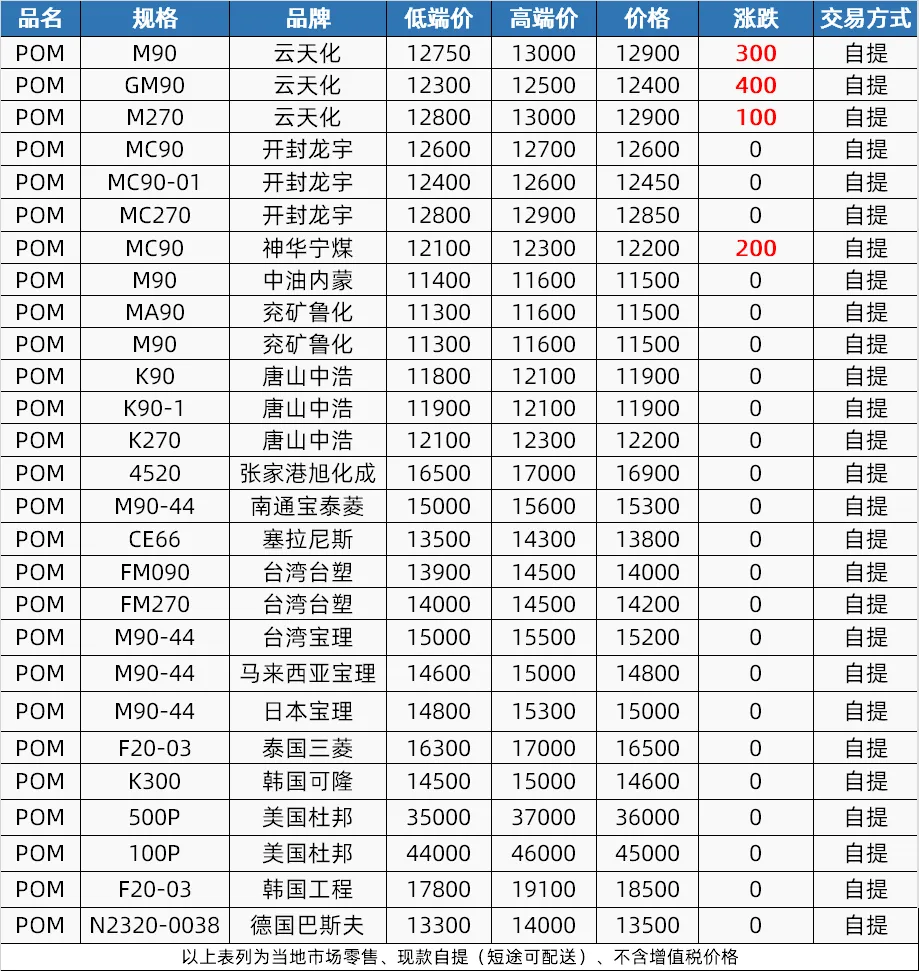

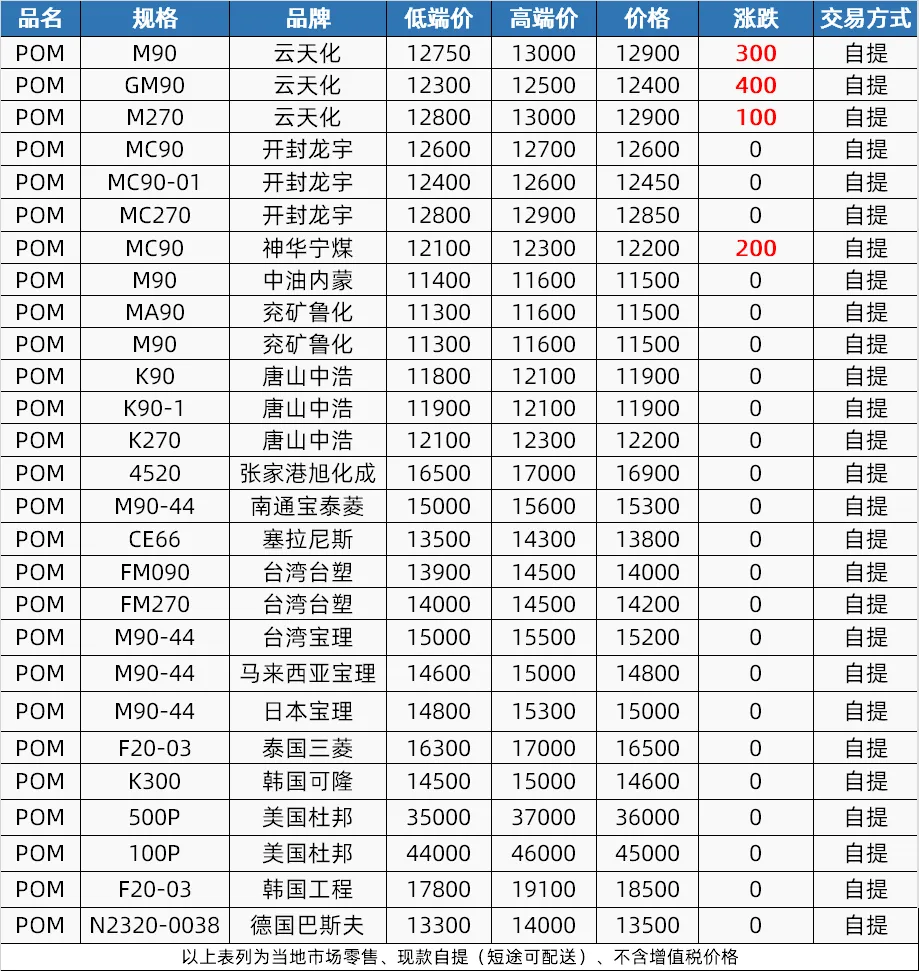

The POM Market

supply side: in April, the supply of the PO M market experienced a process of first decline and then rise. Early due to the Qingming holiday and petrochemical plant price cuts, the market supply is loose. May is expected to maintain a certain positive supply side, Shenhua Ningmei, Xinjiang Guoye has maintenance plans, while Hengli Petrochemical plans to increase production, the overall supply will remain tight.

Demand side: in April, PO M market demand was weak and terminal receiving capacity was poor. May is expected to continue the end demand for small single rigid demand, the factory to maintain 5-6 into the start, waiting for new order guidance.

Cost side: the cost side had limited impact on the POM market in April, but mid-to-high-end offers are expected to remain firm in May due to the impact of an increase in imports. However, weak demand and low-end supply competition will affect the low-end offer, may show a decline in expectations.

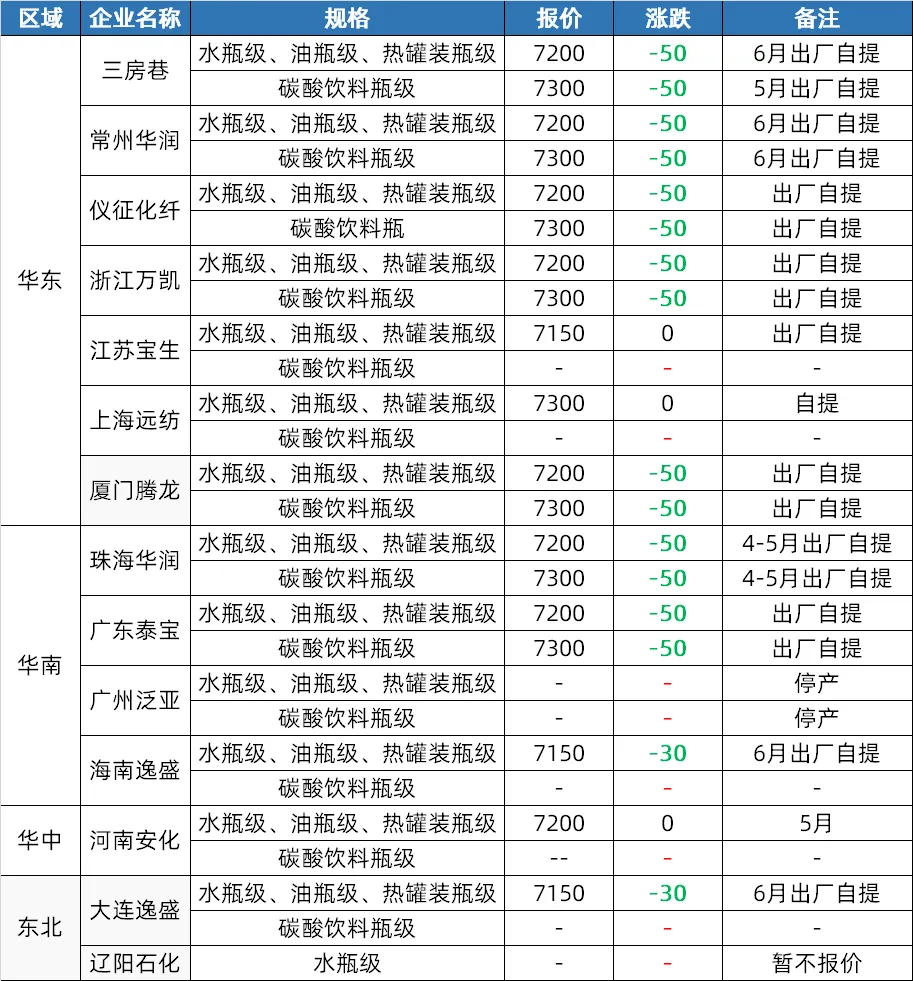

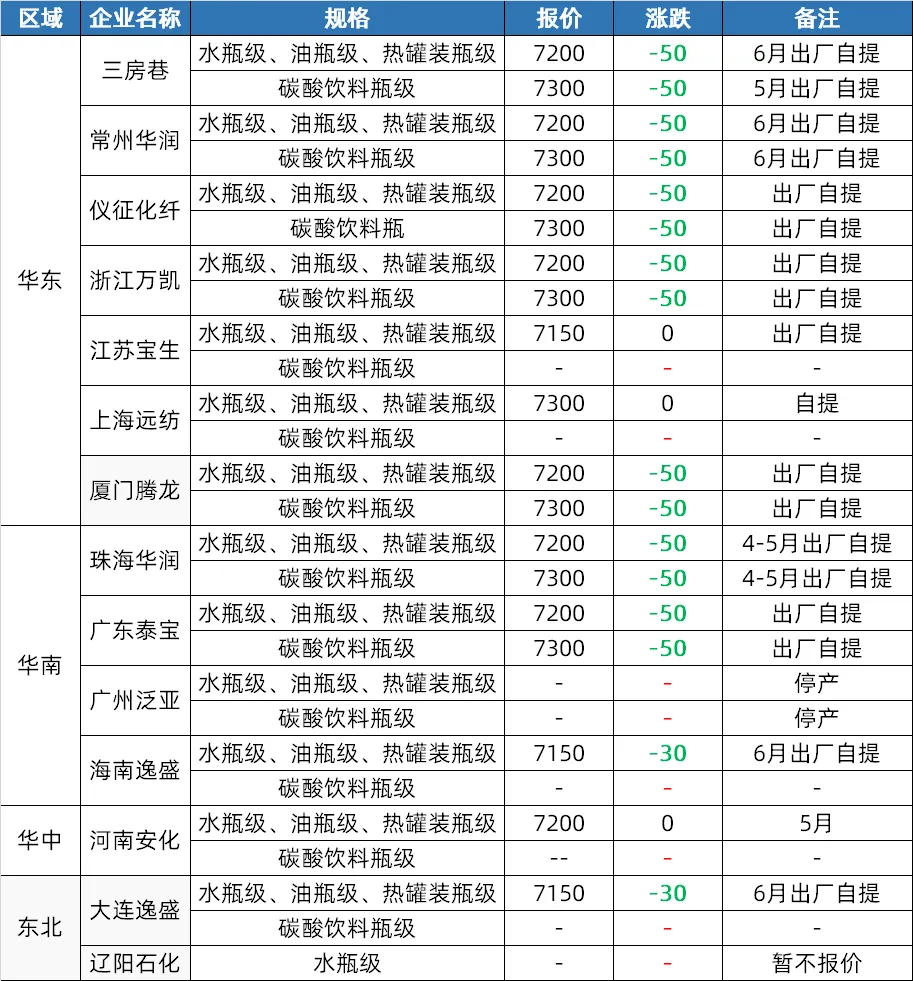

The PET Market

supply side: in April, the polyester bottle market was boosted by crude oil and raw materials, and prices rose. The price of raw materials fell in the second half of the month, but the factory stood up and the market still maintained a certain price level. In May, the southwest part of the device or according to the raw material situation adjustment, the new device put into operation under the expectation, the supply or a small increase.

Demand side: market concerns in April drove downstream and traders to replenish stocks, with active trading in the second half of the month. In May, the soft drink industry is expected to enter the replenishment season, PET sheet demand increased, domestic demand as a whole to good.

Cost side: cost support was strong in the first half of April and weakened in the second half. Going into May, lower crude oil expectations and changes in feedstock supply could lead to weak cost support.

The PBT Market

supply side: in April, the PBT plant was overhauled less and started on the high side, resulting in a loose supply side. In May, some PBT devices are expected to be overhauled, and the supply is expected to decline slightly. However, overall, the supply side will remain high.

Cost side: in April, the cost side showed a volatile trend, PTA market prices first strong and then weak, BDO continued to decline, poor cost transmission. In May, PTA market prices or first after the market, processing fees are low; BDO market prices are at a low level, high market prices are blocked, the cost side is expected to maintain range fluctuations.

Demand side: april downstream and terminal more bargain replenishment, transactions around just need small orders, market demand is difficult to improve. In May, the PBT market ushered in the traditional off-season, spinning field is expected to start or decline, modified field demand is OK but profits decline, and affected by the market bearish mentality, take the goods enthusiasm is not high, more with the use of mining. Overall, the demand side may remain depressed.

PMMA Market

supply side: in April, PMA particle market production increased due to the increase in capacity base, but plant starts decreased slightly. It is expected that the tight particle in stock situation in May will not be fully alleviated in the short term, coupled with some factories or maintenance expectations, supply support still exists.

Demand side: downstream just need to purchase, but chase high caution. Into May, the terminal buying mentality is still cautious, the market to maintain just need. Demand side:

cost side: april raw material MMA market average price rose significantly, East China, Shandong, South China market average monthly price rose 15.00 percent, 16.34 percent, 8.00 percent, cost pressure led to particle market prices. MMA prices are expected to remain high in the short term, and particle plant costs will continue to be under pressure. Cost side:

Mainly

Mainly

Polyurethane

Polyurethane

Fine Chemical

Fine Chemical

.png)