Rapid Growth of Propylene Oxide Industry in 1.

propylene oxide as the key extension direction of downstream fine chemicals in the propylene industry chain, it has received unprecedented attention in China's chemical industry. This is mainly due to its important position in fine chemicals and the development trend brought about by the convergence of the industrial chain of new energy-related products. According to statistics, by the end of 2023, the scale of China's propylene oxide industry has exceeded 7.8 million tons/year, which is nearly ten times higher than that in 2006. From 2006 to 2023, the industrial scale of propylene oxide in China showed an average annual growth rate of 13%, which is rare in the chemical industry. Especially in the last four years, the average growth rate of the industry scale has exceeded 30%, showing an amazing growth momentum.

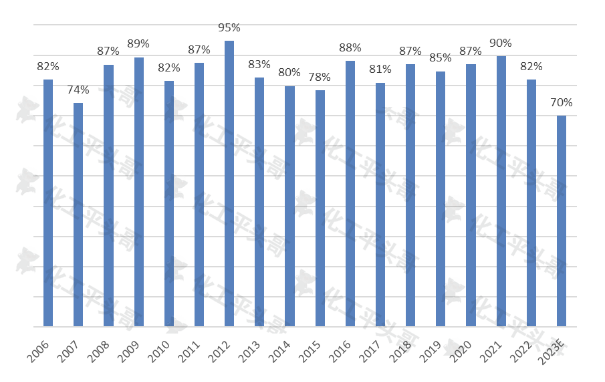

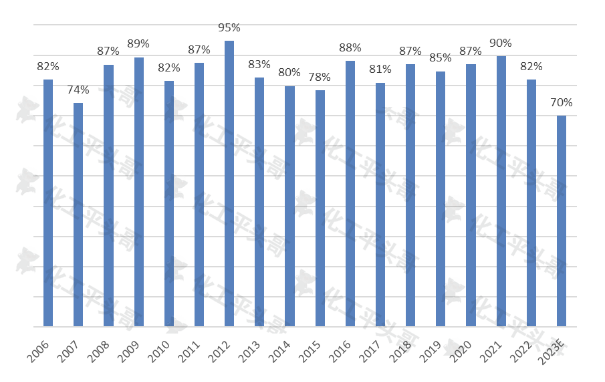

Figure 1 Annual operating rate of propylene oxide in China

behind this rapid growth, there are multiple factors to promote. First of all, propylene oxide, as an important extension of the downstream of the propylene industry chain, is the key to the development of private enterprises to achieve fine rate. With the transformation and upgrading of the domestic chemical industry, more and more companies have begun to pay attention to the field of fine chemicals. As an important part of it, propylene oxide has naturally received widespread attention. Secondly, the development experience of successful enterprises such as Wanhua Chemical has set a benchmark for the industry, and its successful industrial chain integration and innovative development model have provided reference for other enterprises. In addition, with the rapid development of the new energy industry, the industrial chain connection between propylene oxide and new energy-related products has also brought a broad space for development.

However, this rapid growth has also brought a series of problems. First, the rapid expansion of the scale of the industry has led to an increasing contradiction between supply and demand. Although the market demand for propylene oxide continues to grow, the growth rate of supply is obviously faster, which makes the operating rate of enterprises continue to decline and the market competition is becoming more and more fierce. Secondly, the phenomenon of homogenization competition in the industry is serious. Due to the lack of core technology and innovation capabilities, many companies lack differentiated competitive advantages in product quality and performance, and can only compete for market share through price wars and other means. This not only affects the profitability of enterprises, but also restricts the healthy development of the industry.

2. the intensification of the contradiction between supply and demand

with the rapid expansion of the scale of propylene oxide industry, the contradiction between supply and demand is also increasing. In the past 18 years, the average operating rate of propylene oxide in China is about 85%, maintaining a relatively stable trend. However, starting from 2022, the operating rate of propylene oxide will gradually decrease and is expected to drop to about 70% in 2023, which is a historical low. This change fully illustrates the intensity of market competition and the intensification of the contradiction between supply and demand.

There are two main reasons for the intensification of the contradiction between supply and demand. On the one hand, with the rapid expansion of the scale of the industry, more and more enterprises have poured into the propylene oxide market, resulting in intensified market competition. In order to compete for market share, companies have to lower prices and increase production, which has led to a declining operating rate. On the other hand, the downstream application field of propylene oxide is relatively limited, mainly concentrated in the fields of polyether polyol, dimethyl carbonate, propylene glycol and alcohol ether. Among them, polyether polyol is the main downstream application field of propylene oxide, accounting for 80% or more of the total consumption of propylene oxide. However, the growth rate of consumption in this area is in line with the growth rate of China's economy, and the growth rate of industrial scale is less than 6%, which is significantly slower than the growth rate of propylene oxide supply. This means that although market demand is growing, the growth rate is far less than the growth rate of supply, which leads to the aggravation of the contradiction between supply and demand.

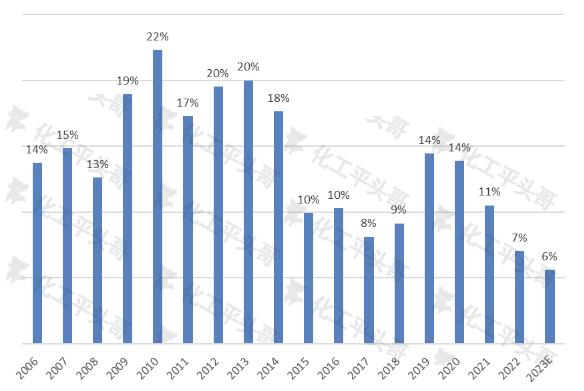

Decrease in 3. import dependence

import dependence is one of the main indicators to measure the supply gap in the domestic market, and it is also an important parameter to reflect the level of import scale. In the past 18 years, China's import dependence on propylene oxide has averaged about 14%, reaching 22% at the highest. However, with the rapid development of the domestic propylene oxide industry and the continuous improvement of the domestic scale, the import dependence has shown a decreasing trend year by year. It is expected that by 2023, China's import dependence on propylene oxide will be reduced to about 6%, a record low in the past 18 years.

Fig.2 Trend of import dependence of propylene oxide in China

the reduction in import dependence is mainly due to two factors. First of all, with the rapid expansion of the domestic propylene oxide industry, the quality and performance of domestic products have been significantly improved. Many domestic enterprises have made important breakthroughs in technological innovation and product research and development, making domestic propylene oxide almost the same in quality as imported products. This allows domestic companies to gain a greater competitive advantage in the market and reduce their dependence on imported products. Secondly, with the continuous increase of domestic propylene oxide production capacity, the market supply capacity has been significantly improved. This enables domestic enterprises to better meet market demand and reduce the demand for imported products.

However, the reduction of import dependence also brings a series of problems. First of all, with the continuous expansion of the domestic propylene oxide market and the continuous growth of demand, the supply pressure of domestic products is also increasing. If domestic enterprises are unable to further improve their output and quality, the contradiction between supply and demand in the market may be further aggravated. Secondly, with the reduction of import dependence, domestic enterprises are facing greater market competition pressure. In order to compete for market share and maintain competitiveness, domestic enterprises need to continuously improve their technological level and innovation capabilities.

Analysis of future development of 4.

China's propylene oxide market will face a series of profound changes in the future. According to statistics, it is estimated that by 2030, the scale of China's propylene oxide industry will exceed 14 million tons/year, and the average annual growth rate will remain at a high level of 8.8 from 2023 to 2030. This rapid growth rate will undoubtedly further exacerbate the supply pressure on the market and increase the risk of overcapacity.

The operating rate of the industry is usually regarded as an important indicator to assess whether the market is surplus. When the operating rate is less than 75%, the market may be surplus. The operating rate is directly affected by the growth rate of the terminal consumer market. At present, the main downstream application field of propylene oxide is polyether polyols, accounting for more than 80% of the total consumption. However, other applications such as dimethyl carbonate, propylene glycol and alcohol ethers, flame retardants, etc., although there is a relatively small proportion, the consumption of propylene oxide support is limited.

It is worth noting that the consumption growth rate of polyether polyols is basically the same as that of China's economic growth rate, and its industrial scale growth rate is less than 6%, which is significantly lower than the supply growth rate of propylene oxide. This means that in the case of relatively slow growth on the consumer side, the rapid growth on the supply side will further worsen the supply and demand environment of the propylene oxide market. In fact, 2023 may already be the first year of oversupply in China's propylene oxide industry, and the probability of oversupply in the long term is still large.

Propylene oxide, as a transitional product in the rapid development of China's chemical industry, has its unique characteristics. It requires the product to have the characteristics of homogeneity and scale, while the investment and technical threshold is relatively low, and the raw materials are easy to obtain. In addition, it also needs to have the property of the middle end of the industrial chain, that is, it can realize the downstream extension of the industrial chain. This kind of products plays a key role in the process of fine development of chemical industry, but it also faces the risk of market homogenization impact.

Therefore, for the production of propylene oxide enterprises, how to seek the differentiation of industrial chain development in the fierce market competition, and how to use more advanced technology to reduce production costs, will become an important strategic consideration for its future development.

Mainly

Mainly

Polyurethane

Polyurethane

Fine Chemical

Fine Chemical

.png)