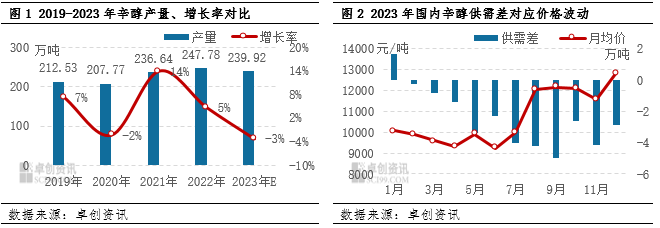

1. 2023 octanol overview of market output, supply and demand

in 2023, the octanol industry experienced a decline in production and a widening gap between supply and demand due to a number of factors. The frequent occurrence of parking and maintenance devices led to a negative annual increase in total domestic production, which is rare in many years. The total annual output is estimated to be 2.3992 million tons, a decrease of 78600 tons from 2022. Capacity utilization has also declined, from more than 100 per cent in 2022 to 95.09 per cent.

From a capacity point of view, according to the design capacity of 2.523 million tons, the actual capacity is higher than this figure. However, the increase in new production units has increased the capacity base, while new units such as Zibo Noao will not be put into production until the end of the year, and the release of production capacity in Ningxia Baichuan will be postponed until early 2024. This led to a decline in the start-up load rate of the octanol industry in 2023 and a loss of production.

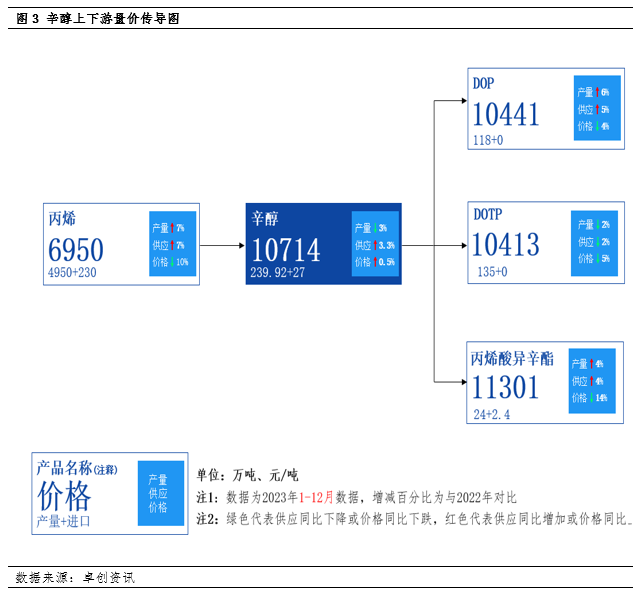

Deep Analysis of 2. Octanol Supply and Demand Relationship

1. Production decline and supply-demand gap: although the commissioning of the new unit was delayed and some of the modified units were not put into production as scheduled, the steady growth in downstream demand began to appear after the fourth quarter, providing support for the octanol market. In July-September, supply declined significantly due to centralized maintenance, while rising demand increased the negative level of the supply-demand gap.

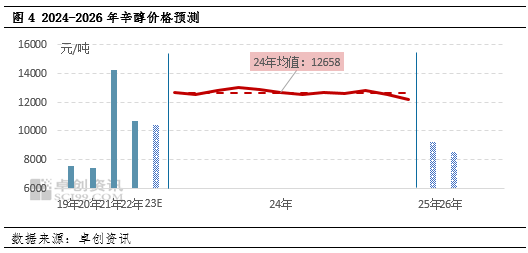

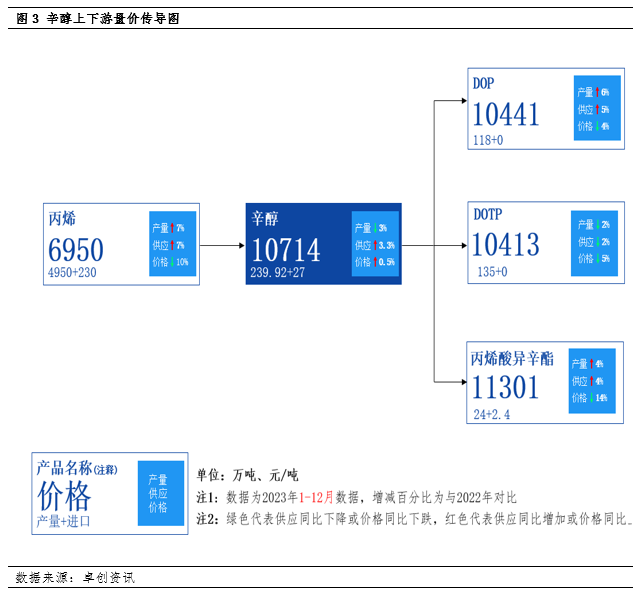

2. Main downstream demand analysis: plasticizer market sentiment rebounded, the overall demand showed an upward trend. Judging from the supply and demand of major downstream products such as DOP, DOTP and isooctyl acrylate, the supply of DOP is increasing obviously, with the total output increasing by 6%, contributing significantly to the growth of octanol consumption. DOTP production decreased by about 2%, but the actual overall fluctuation in the demand for octanol was not large. Isooctyl acrylate production increased by 4%, which also contributed to the growth of octanol consumption.

3. Upstream raw material price fluctuations: propylene supply continued to increase, but its price fell sharply, further widening the gap with the price of octanol. This eases the cost pressure on the octanol industry, but also reflects differences in upstream and downstream operating trends.

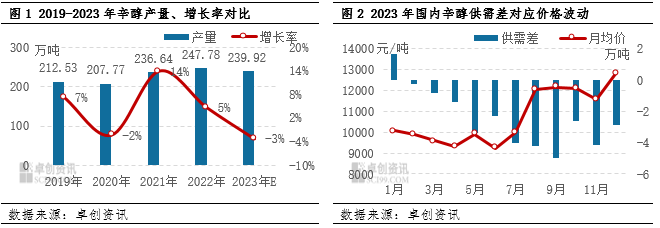

3. Future Market Outlook and New Capacity Uncertainty

1. Supply-side outlook: the release of new capacity is expected to face uncertainty in 2024. It is expected that most of the new installations of Anqing Shuguang expansion and satellite lithification may need to be released in the second half of the year to the end of the year. And Shandong Jianlan's transformation device may be postponed to the end of the year, which makes it difficult to loosen the supply capacity of octanol in the first half of the year. Coupled with the impact of spring maintenance and other factors, octanol is expected to remain strong in the first half of 2024.

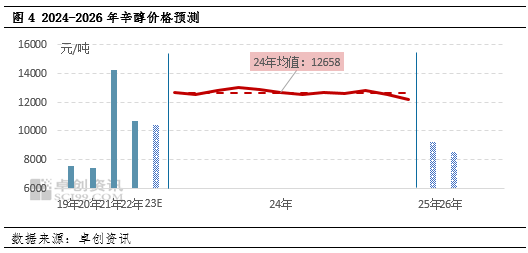

2. Demand-side boost expectations: from a macro and cyclical perspective, downstream demand is expected to be boosted in the future. This will further consolidate the tight supply-demand balance pattern of octanol and make the probability of the market running in the middle and high positions is high. It is expected that the market trend in 2024 is likely to show a high and low situation, after the second half of the year with the release of new capacity to the market supply, as well as the downstream demand side of the cyclical decline is expected, the price side may face some adjustment.

3. Future overcapacity and declining market focus: in the next few years, several octanol plants are planned to be put into operation more intensively. At the same time, the expansion of downstream demand is relatively slow, and the industry surplus will intensify. It is expected that the overall operating center of gravity of octanol will decline in the future, and the market amplitude may narrow.

4. Global commodity price outlook: the downward trend in global commodity prices is expected to slow in 2024. There may be a new round of commodity bull market, but this round of bull market may be relatively weak. If unexpected events occur during the economic recovery, commodity prices may adjust.

Overall, the octanol market is facing the challenge of declining production and widening gap between supply and demand in 2023. However, the steady growth of downstream demand has provided support for the market. Looking ahead, the market is expected to remain strong, but may face adjustment pressure in the second half of the year.

Looking ahead to 2024, the downward trend of global commodity prices or slowdown, 2024 prices generally show an upward state, or a new round of commodity bull market, but the level of the bull market or relatively weak, if some unexpected events in the process of economic recovery, commodity prices will also have a high probability of downward adjustment. It is estimated that the operating range of Jiangsu octanol is 11500-14000 yuan/ton, with an annual average price of 12658 yuan/ton. It is expected that the lowest price of octanol for the whole year will appear in the fourth quarter, which is 11500 yuan/ton; the highest price for the whole year will appear in the third quarter of 2., which is 14000 yuan/ton. It is estimated that from 2025 to 2026, the average annual price of Jiangsu octanol market will be 10000 yuan/ton and 9000 yuan/ton respectively.

Mainly

Mainly

Polyurethane

Polyurethane

Fine Chemical

Fine Chemical

.png)