Since August, the domestic acetic acid price has been rising all the way. At the beginning of the month, the average market price of 2877 yuan/ton has risen to 3745 yuan/ton, up 30.17 percent from the previous month. Continuous weekly price increases have increased acetic acid profits again. It is estimated that the average gross profit of acetic acid on August 21 is about 1070 yuan/ton. This time again broke through the "thousand yuan profit" also made the market doubt the sustainability of high prices.

The traditional downstream off-season in July and August did not have a large negative impact on the market. On the contrary, supply-side factors played a role in fueling the flames, thus transforming the acetic acid market, which was originally dominated by cost, into a supply-demand-led pattern.

Acetic acid plant operating rate decreased, good market

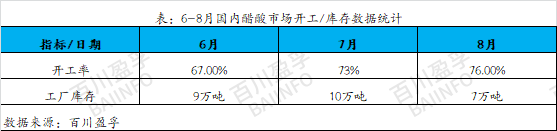

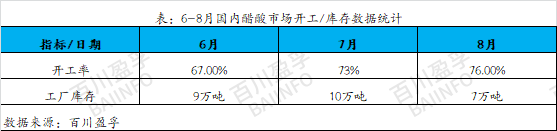

since June, the internal equipment of acetic acid has been planned to be overhauled one after another, resulting in the operating rate falling to a minimum of 67%. The production capacity of these maintenance equipment is relatively large, and the maintenance time is also relatively long. The inventory of each enterprise continues to decline, and the overall inventory is at a low level. It was originally thought that the maintenance equipment would gradually recover in July. However, the recovery progress of mainstream equipment has not yet reached the full start-up state, and the continuous start-up and stop alternation have resulted in the long-term goods that could not be sold according to the volume in June being restricted again in July, and the market inventory remains at a low level.

With the approach of August, the mainstream equipment for early maintenance has gradually recovered. However, the hot summer weather has caused frequent equipment failures of other manufacturers, and maintenance and failures have occurred in a concentrated manner. For these reasons, the operating rate of acetic acid has not yet reached a high level. After the accumulation of maintenance in the first two months, the supply of goods in the market was in short supply, which led to the oversold situation of all enterprises in August. The supply of in stock in the market was extremely tight, and the price also climbed to the peak. From this situation, we can see that the shortage of cash supply in August is not caused by short-term speculation, but the result of long-term accumulation. From June to July, various enterprises effectively controlled the supply side through maintenance and troubleshooting, and maintained the relative stability of acetic acid inventory. It can be said that this has provided favorable conditions for the increase in the price of acetic acid in August.

2. Downstream demand turns better, helping the acetic acid market rise

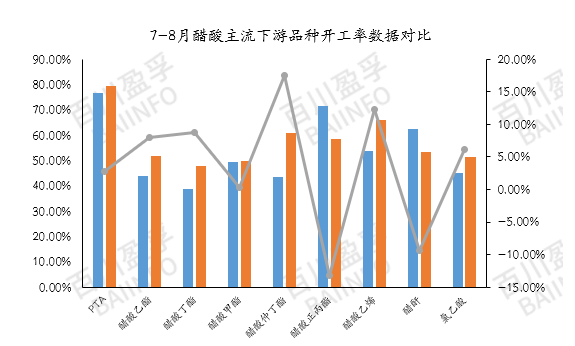

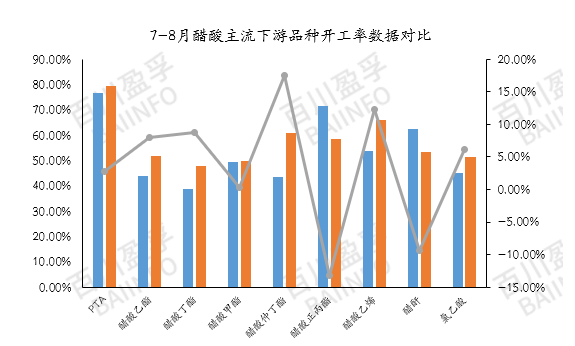

in August, the average downstream operating rate of mainstream acetic acid was about 58%, up about 3.67 from July. This shows the help of a slight improvement in domestic downstream demand. Although the average monthly operating rate has not yet exceeded 60%, the re-commissioning of equipment for certain products has produced a certain positive stimulus to the regional market. For example, the average operating rate of ethylene acetate soared 18.61 percent in August. The restart of the device this month was mainly concentrated in the northwest region, resulting in a tight in stock supply in the region and a strong atmosphere of price increases. At the same time, the operating rate of PTA is close to 80%. Although PTA has little effect on the price of acetic acid, its operating rate directly reflects the amount of acetic acid used. As the main downstream market in East China, the operating rate of PTA has also brought a certain positive impact on the acetic acid market.

After the market analysis

factory maintenance: at present, the inventory of various enterprises is maintained at a low level, and the market in stock supply is tight. Enterprises are very sensitive to inventory changes, once the inventory has accumulated, there may be another failure to stop production. Before the accumulation of inventory, the supply side remains fairly stable, and a slight "strategy adjustment" may once again have a positive boost to the market. It is estimated that around August 25, major installations in Anhui will have maintenance plans, which may overlap with the short-term maintenance time of Nanjing installations, while no regular maintenance plans have been announced in other areas for the time being. In this case, it is more necessary to pay close attention to the fluctuation of the inventory of each enterprise and the possibility of sudden device failure.

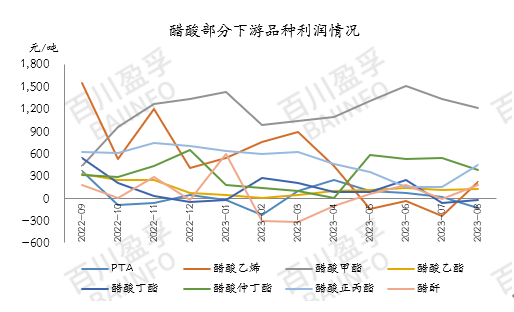

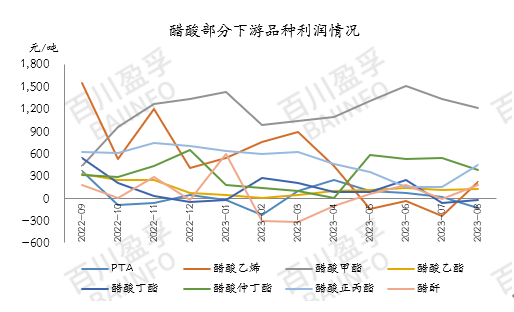

Downstream Demand: at present, the upstream acetic acid inventory is still controllable, the downstream plant temporarily through the short-term long-term about to maintain production, but the rapid rise in the price of upstream acetic acid makes it difficult to fully pass the pricing of downstream products to the end market demand. Some of the main downstream industries are facing profit pressure. At present, the main downstream products of acetic acid, with the exception of methyl acetate and n-propyl, the profits of the remaining products are almost the same as the cost line. Vinyl acetate (produced by the calcium carbide method), PTA and butyl acetate profits even appear upside down. As a result, a small number of enterprises have taken measures to reduce their burdens or stop production. The downstream industry is also watching to see if the price can be reflected in the terminal profit. If the profit of downstream products decreases and the price of acetic acid remains high, it is expected that the downstream may continue to reduce production to balance the profit situation.

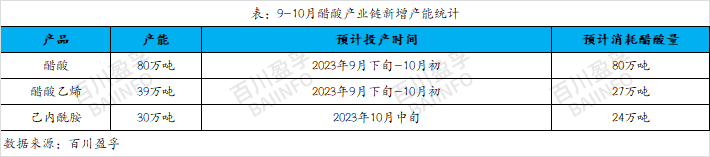

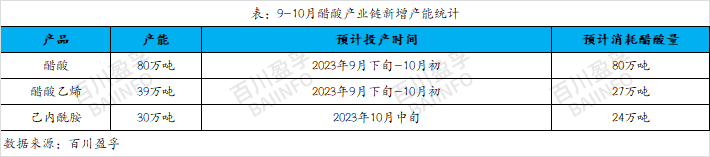

New capacity: it is estimated that at the end of September and the beginning of October, there will be a large number of new vinyl acetate production units, with a total new production capacity of about 390000 tons, which is expected to consume about 270000 tons of acetic acid. At the same time, the new production capacity of caprolactam is expected to reach 300000 tons, which will consume about 240000 tons of acetic acid. At present, it is understood that the above-mentioned downstream equipment expected to be put into production may begin to collect acetic acid in mid-September. In view of the current acetic acid market in stock supply is so tight, the commissioning of these new equipment is bound to produce positive positive support for the acetic acid market again.

In the short term, the price of acetic acid still maintains the momentum of high fluctuations, but the excessive increase in the price of acetic acid last week caused an increase in resistance from downstream manufacturers, leading to a gradual reduction in the burden and a weakening of purchasing enthusiasm. There are currently some over-overvalued price "bubbles" in the acetic acid market, so prices may fall slightly. On the September market, still need to pay close attention to the new production capacity of acetic acid production time. At present, the stock of acetic acid is low and can be maintained until early September. If the new capacity is not put into production as scheduled before the end of September, the new downstream capacity may be purchased in advance of acetic acid. Therefore, we are still optimistic about the market trend in September, and we need to pay close attention to the specific trends of the upstream and downstream at any time, and pay close attention to the real-time changes of the market.

Mainly

Mainly

Polyurethane

Polyurethane

Fine Chemical

Fine Chemical

.png)