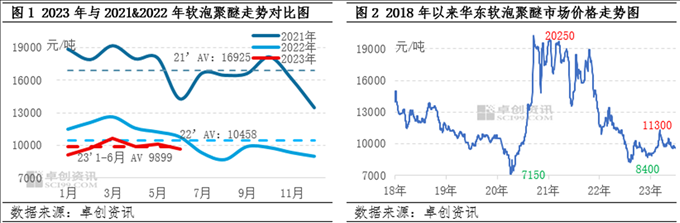

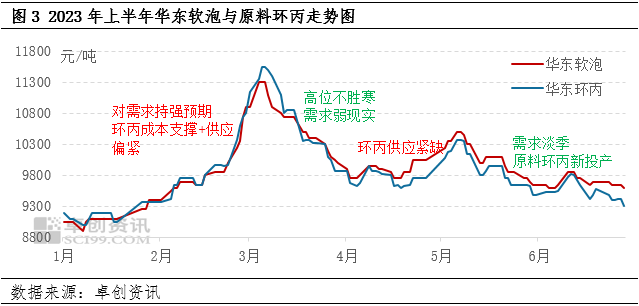

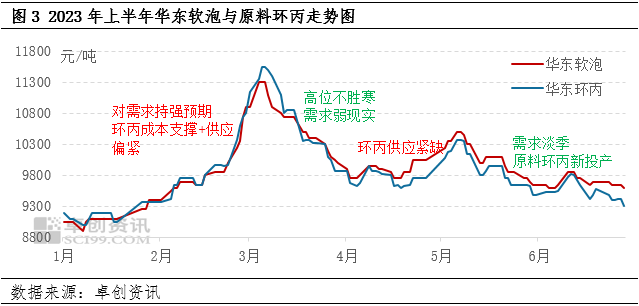

In the first half of this year, the flexible polyether market showed a trend of rising first and then falling, and the overall price center of gravity sank. However, due to the tight supply of raw material cyclopropyl in March, the price rose strongly, and the soft bubble market continued to rise. The price in the first half of the year was as high as 11300 yuan/ton, exceeding expectations. From January to June 2026, the average price of soft foam polyether in East China was 9898.79 yuan/ton, down 15.08 from the same period last year. In the first half of the year, the low point of the market price in early January was 8900 yuan, and the price difference between the high and low ends was 2600 yuan/ton, and the market fluctuation gradually narrowed.

The downward movement of the market price center of gravity is mainly the result of the downward drag on the price of raw materials, as well as the relatively abundant market supply, demand "strong expectations of weak reality" mutual game. In the first half of 2023, the soft bubble market can be roughly divided into a low-high stage-the shock fall stage.

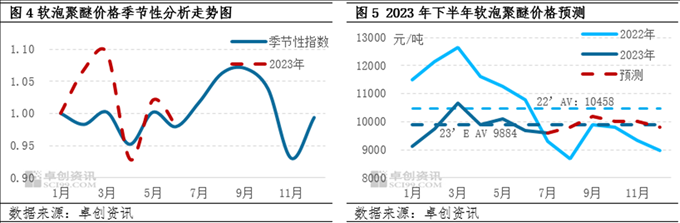

January-Early March, Price Volatility Up

1, the raw material cyclopropyl continues to soar. During the Spring Festival, the delivery of raw materials was smooth and prices fluctuated. At the beginning of March, affected by the maintenance of raw materials such as the first phase of the town and the sea, the supply was tight and the price rose strongly, which promoted the continuous rise of the soft bubble market and the price rise in the first half of the year.

2, the impact of social factors gradually weakened, the market on the demand side of the recovery has a good expectation, the seller is willing to support the price, before and after the Spring Festival market bearish, after the holiday market low-cost supply is difficult to find. At this stage, the downstream demand is small, maintaining rigid demand procurement, especially the Spring Festival return to the market, dragging down the market mentality.

From mid-March to June, price volatility declined and market volatility gradually narrowed.

1, raw materials, new production capacity of cyclopropyl continues to put into the market, the industry mentality is negative, the second quarter gradually affected the cyclopropyl market supply, cyclopropyl prices fell, driving the price of flexible foam polyether market prices fell;

the recovery of downstream demand in February and March was lower than expected, and the increase in downstream orders in April was limited. Starting from May, it gradually entered the traditional off-season, dragging down the downstream purchasing mentality. The supply of polyether market is relatively abundant, the market supply and demand continues to play, and the price continues to fall. Downstream mostly on-demand replenishment. When prices rebound from low levels, it will lead to downstream demand for centralized purchases, but it will last half a day to a day. At the beginning of May, due to the shortage of raw material cyclopropyl, the price rose, the soft foam polyether market rose by about 600 yuan/ton, while the polyether market mostly showed price rise and fall, and the price rose passively.

At present, polyether polyols are still in a period of capacity expansion. As of the first half of the year, China's annual production capacity of polyether polyols has been expanded to 7.53 million tons. The factory maintains the start-up strategy of fixed production by sales. The overall start-up of large factories is OK, while the start-up of small and medium-sized factories is not ideal, and the start-up level of the industry is slightly higher than 50%. Compared with the demand, the supply of flexible foam polyether market has been in a relatively abundant state. From the perspective of downstream demand, as the influence of social factors gradually fades, industry insiders are optimistic about the demand in 2023, but the recovery of industrial demand in the first half of the year is not as expected. In the first half of the year, the main downstream sponge industry before the Spring Festival inventory is less, after the Spring Festival procurement volume is lower than expected. March to April on-demand inventory, May to June into the traditional off-season. The recovery of the sponge industry in the first half of the year was much lower than expected, dragging down the purchasing mentality. At present, with the rise and fall of the soft bubble market, most of the downstream has turned to rigid procurement, with a procurement cycle of one to two weeks and a procurement time of half a day to one day. Changes in the downstream procurement cycle also affect the current polyether price fluctuations to some extent.

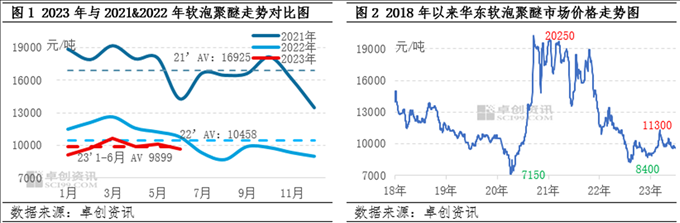

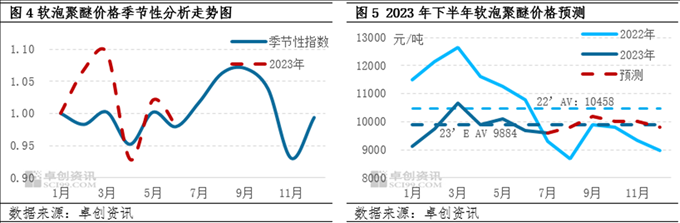

Soft bubble polyether market in the second half of the year, the price may return after a small decline.

The market center of gravity is likely to be slightly weak again in the fourth quarter, with the market fluctuating with raw materials in the supply and demand game.

1, in the raw material cyclopropyl end, cyclopropyl part of the new production capacity has been gradually put into the market. There is still new capacity to be released in the third quarter. It is expected that the supply of raw materials in the third quarter will continue to show an upward trend, and the competition pattern will become increasingly fierce. The market may still have a small downward space, soft bubble polyether may be accompanied by a small bottom. It is expected that the rise and fall of the soft bubble market will remain within 200-1000 yuan/ton;

2, flexible foam polyether market supply may still maintain a relatively sufficient demand state. In the second half of the year, Shandong, southern factories and other devices have maintenance plans, or local period polyether market supply is tight, the operator's mentality to form a favorable support, or drive the market to rise slightly. Inter-regional supply flow or is expected to strengthen;

3. On the demand side, starting from the third quarter, the downstream has gradually stepped out of the traditional off-season, new orders are expected to gradually increase, and the trading activities and sustainability of the polyether market are expected to gradually improve. According to industry inertia, most of the downstream purchases raw materials for the peak season in advance when the price is appropriate in the third quarter, and market transactions in the third quarter are expected to improve compared with the second quarter;

4. From the seasonal analysis of soft foam polyether, in the past ten years, the soft foam market has risen sharply from July to October, especially in September. As the market gradually ushers in the traditional "golden nine silver ten" peak demand season, it is expected that market transactions will continue to improve. In the fourth quarter, the automobile industry and sponge industry are expected to increase orders and form support on the demand side. With the completion of the real estate area and the continuous increase in the output of the automobile industry, or to a certain extent, the market demand for flexible foam polyether.

Based on the above analysis, it is expected that the soft foam polyether market will gradually rebound after bottoming out in the second half of the year, but due to seasonal effects, there will be a correction trend at the end of the year. In addition, the upper limit of the early market rebound will not be very high, and the mainstream price range may be between 9400-10500 yuan/ton. According to the seasonal law, the high point in the second half of the year is likely to appear at 9 o'clock and October, and the low point may appear in July and December.

Mainly

Mainly

Polyurethane

Polyurethane

Fine Chemical

Fine Chemical

.png)