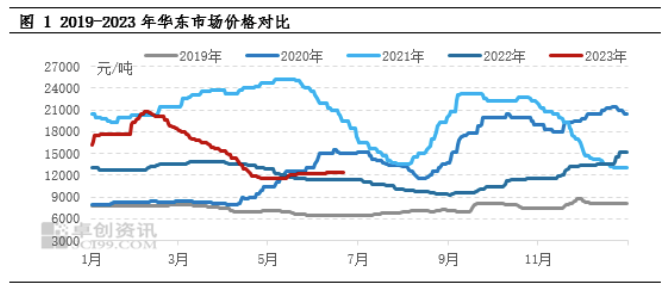

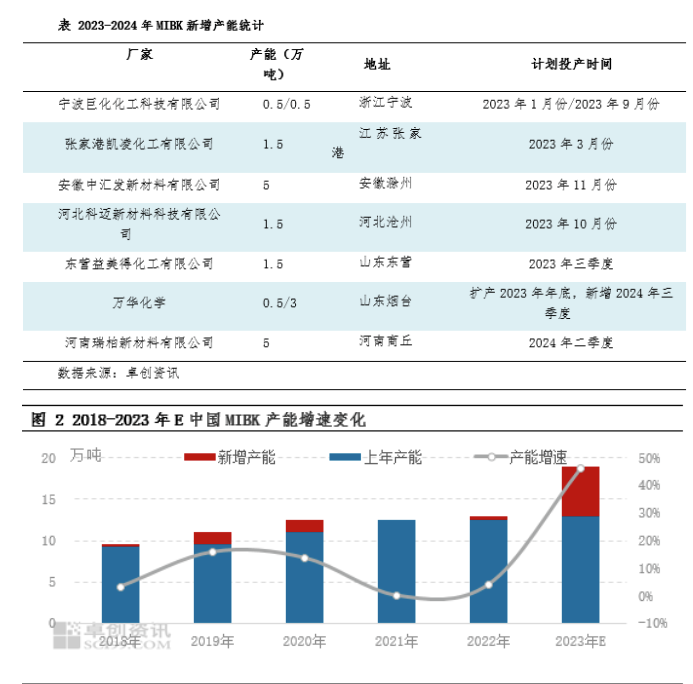

The MIBK market has been volatile since 2023. Taking the market price in East China as an example, the amplitude of the highs and lows is 81.03 percent. The main influencing factor is that Zhenjiang Li Changrong High Performance Materials Co., Ltd. stopped operating MIBK equipment at the end of December 2022, resulting in a series of changes in the market. In the second half of 2023, domestic MIBK production capacity will continue to expand, and the MIBK market is expected to face pressure.

Price review and the logic behind it

during the uptick phase (21 December 2022 to 7 February 2023), prices increased by 53.31 percent. The main reason for the rapid rise in prices is the news of Zhenjiang Li Changrong equipment parking stimulus. In terms of the absolute value of capacity, Zhenjiang Li Changrong has the largest capacity equipment in China, accounting for 38%. The closure of Li Changrong's equipment has caused market participants to worry about a shortage of supply in the later period. As a result, they are actively looking for supplementary supplies, and market prices have risen sharply unilaterally.

During the decline phase (February 8 to April 27, 2023), prices fell by 44.1 percent. The main reason for the continued decline in prices is that terminal consumption is lower than expected. With the release of some new production capacity and the increase of import volume, the pressure of social inventory has gradually increased, leading to the instability of market participants. As a result, they actively sell commodities and market prices continue to fall.

As MIBK prices fell to lower levels (April 28 to June 21, 2023), maintenance of multiple sets of equipment in the country increased. In the second half of May, the inventory of production enterprises was controllable, and the above quotation increased shipments. However, the start-up load of the major downstream antioxidant industry is not high, and the overall rise is expected to be cautious. Until early June, due to the release of new capacity plans, the downstream extraction industry advanced quantitative purchases supported the rise in the center of gravity of the transaction, down from 6.89 in the first half of the year.

Capacity will continue to expand in the second half of the supply pattern will change

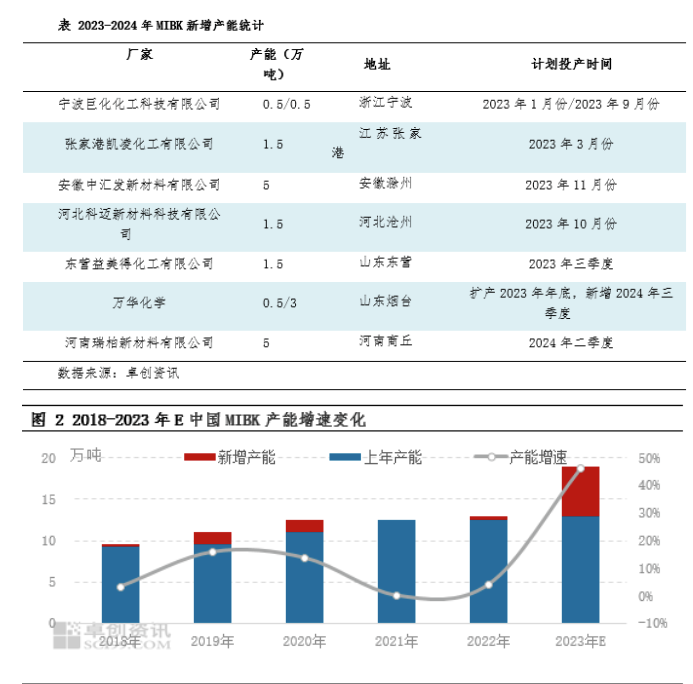

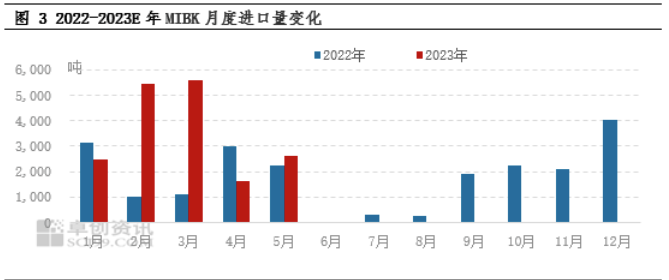

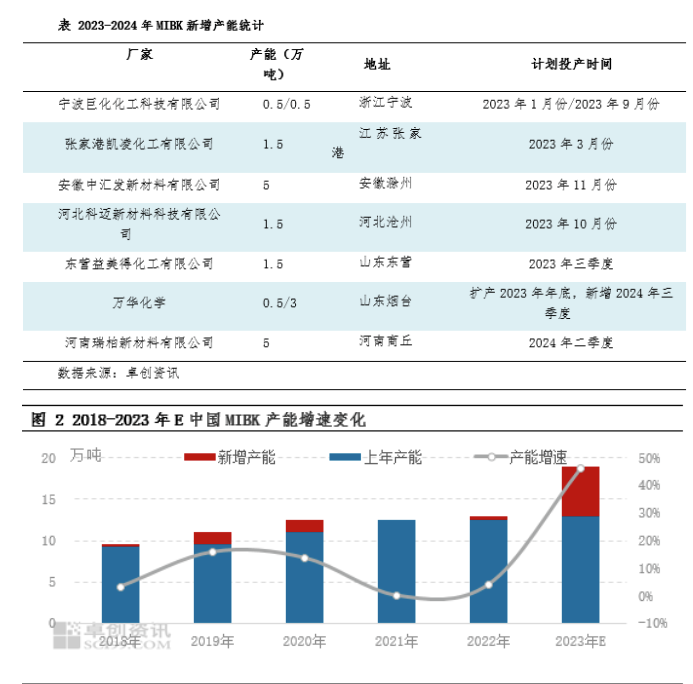

in 2023, China will start production of 110000 tons of new MIBK capacity. Excluding Li Changrong's parking capacity, capacity is expected to grow by 46% YoY. Among them, the first quarter of 2023 new production capacity of 20000 tons, respectively, Juhua and Kailing two new production enterprises. In the second half of 2023, China MIBK plans to release 90000 tons of new capacity, respectively, by China Huifa and Comay. In addition, the expansion of Juhua and Yifu Virtue has been completed. It is estimated that by the end of 2023, the domestic MIBK production capacity will reach 190000 tons, most of which will be put into production in the fourth quarter, and supply pressure may gradually appear.

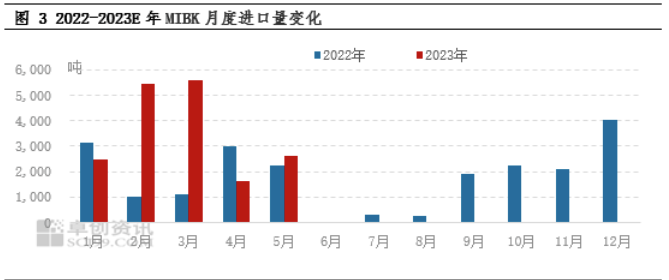

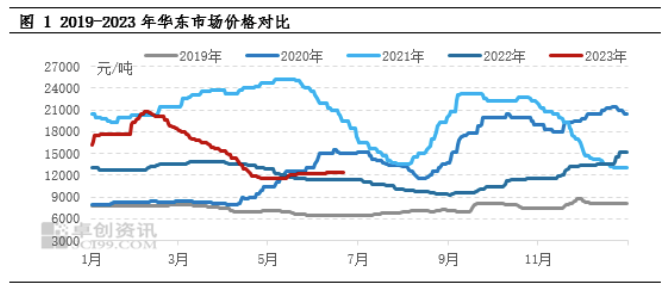

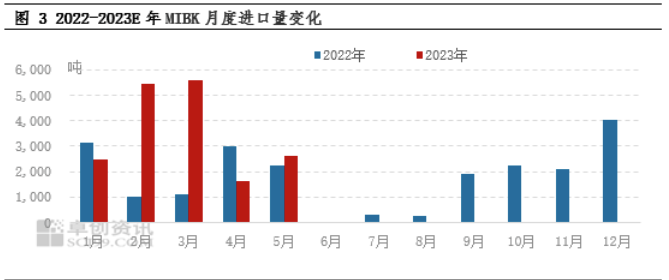

According to customs statistics, from January to May 2023, China's MIBK imported 17800 tons, up 68.64 percent year-on-year. The main reason is that the monthly import volume in February and March exceeded 5000 tons. The main reason is that Zhenjiang Li Changrong equipment parking, which makes the middlemen and some downstream customers actively look for import sources to supplement, resulting in a substantial increase in imports. In the later period, due to the sluggish domestic demand and the fluctuation of RMB exchange rate, the price difference between domestic and foreign markets was small. Imports are expected to drop significantly in 2H20 given the expansion of MIBK in China.

The overall analysis shows that in the first half of 2023, although China released two sets of new production capacity, the output growth after the new production capacity input can not keep up with the lost output after the shutdown of Li Changrong equipment. The domestic supply gap is mainly supplemented by imported supply. In the second half of 2023, domestic MIBK equipment will continue to expand, and the price trend of MIBK in the later period will focus on the production progress of new equipment. Overall forecast, the third quarter of the market supply can not be fully replenished. According to the analysis, it is expected that the MIBK market will consolidate within the range. After the concentrated expansion in the fourth quarter, the market price will face pressure. During the uptick phase (21 December 2022 to 7 February 2023), prices increased by 53.31 percent. The main reason for the rapid rise in prices is the news of Zhenjiang Li Changrong equipment parking stimulus. In terms of the absolute value of capacity, Zhenjiang Li Changrong has the largest capacity equipment in China, accounting for 38%. The closure of Li Changrong's equipment has caused market participants to worry about a shortage of supply in the later period. As a result, they are actively looking for supplementary supplies, and market prices have risen sharply unilaterally.

During the decline phase (February 8 to April 27, 2023), prices fell by 44.1 percent. The main reason for the continued decline in prices is that terminal consumption is lower than expected. With the release of some new production capacity and the increase of import volume, the pressure of social inventory has gradually increased, leading to the instability of market participants. As a result, they actively sell commodities and market prices continue to fall.

As MIBK prices fell to lower levels (April 28 to June 21, 2023), maintenance of multiple sets of equipment in the country increased. In the second half of May, the inventory of production enterprises was controllable, and the above quotation increased shipments. However, the start-up load of the major downstream antioxidant industry is not high, and the overall rise is expected to be cautious. Until early June, due to the release of new capacity plans, the downstream extraction industry advanced quantitative purchases supported the rise in the center of gravity of the transaction, down from 6.89 in the first half of the year.

Capacity will continue to expand in the second half of the supply pattern will change

in 2023, China will start production of 110000 tons of new MIBK capacity. Excluding Li Changrong's parking capacity, capacity is expected to grow by 46% YoY. Among them, the first quarter of 2023 new production capacity of 20000 tons, respectively, Juhua and Kailing two new production enterprises. In the second half of 2023, China MIBK plans to release 90000 tons of new capacity, respectively, by China Huifa and Comay. In addition, the expansion of Juhua and Yifu Virtue has been completed. It is estimated that by the end of 2023, the domestic MIBK production capacity will reach 190000 tons, most of which will be put into production in the fourth quarter, and supply pressure may gradually appear.

According to customs statistics, from January to May 2023, China's MIBK imported 17800 tons, up 68.64 percent year-on-year. The main reason is that the monthly import volume in February and March exceeded 5000 tons. The main reason is that Zhenjiang Li Changrong equipment parking, which makes the middlemen and some downstream customers actively look for import sources to supplement, resulting in a substantial increase in imports. In the later period, due to the sluggish domestic demand and the fluctuation of RMB exchange rate, the price difference between domestic and foreign markets was small. Imports are expected to drop significantly in 2H20 given the expansion of MIBK in China.

The overall analysis shows that in the first half of 2023, although China released two sets of new production capacity, the output growth after the new production capacity input can not keep up with the lost output after the shutdown of Li Changrong equipment. The domestic supply gap is mainly supplemented by imported supply. In the second half of 2023, domestic MIBK equipment will continue to expand, and the price trend of MIBK in the later period will focus on the production progress of new equipment. Overall forecast, the third quarter of the market supply can not be fully replenished. According to the analysis, it is expected that the MIBK market will consolidate within the range. After the concentrated expansion in the fourth quarter, the market price will face pressure.

Mainly

Mainly

Polyurethane

Polyurethane

Fine Chemical

Fine Chemical

.png)