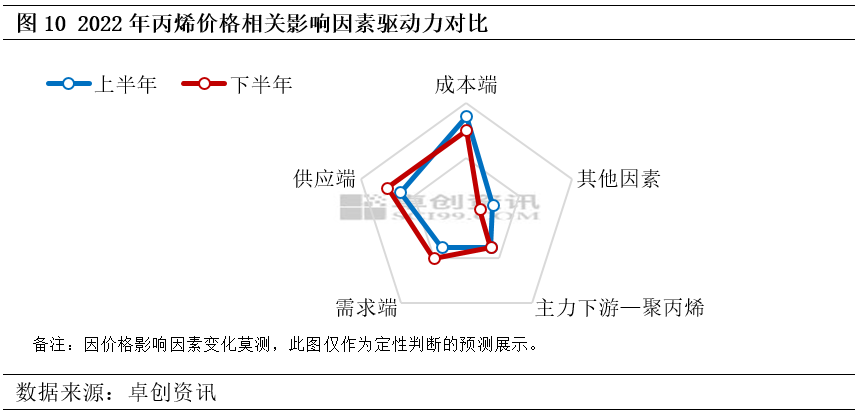

In the first half of 2022, the domestic propylene market price rose slightly year-on-year, and the high cost was the main factor supporting the propylene price. However, the continuous release of new production capacity led to increased market supply pressure, but also to the propylene price rise to form a certain constraint, the first half of the propylene industry chain overall profitability declined. In the second half of the year, the cost side pressure or slightly eased, and the supply and demand side of the impact is expected to improve, the second half of the propylene price first rise and then fall probability is larger, the average price level or less than the first half.

The first half of 2022 domestic propylene market main factors are as follows:

in

1. The cost increased significantly year-on-year, which provided a favorable support for propylene prices.2. The rising trend of total supply is a drag on the rise in propylene prices.

3. Demand increases but downstream profits shrink, and the boost to propylene prices is relatively limited.

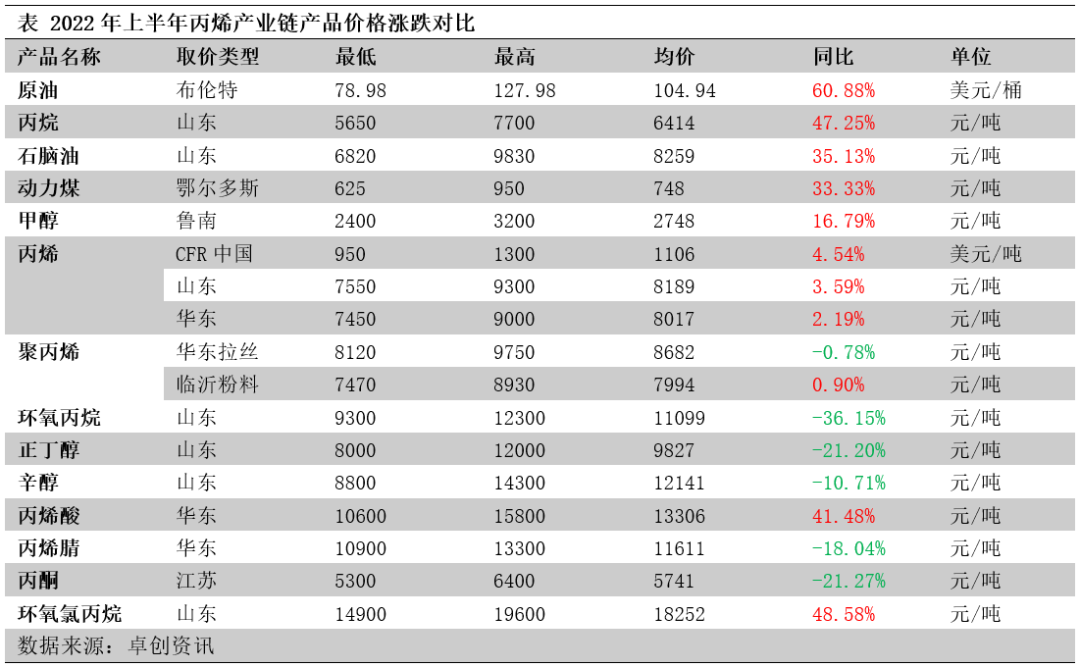

Propylene raw materials rose more than downstream products, industrial chain profitability decline

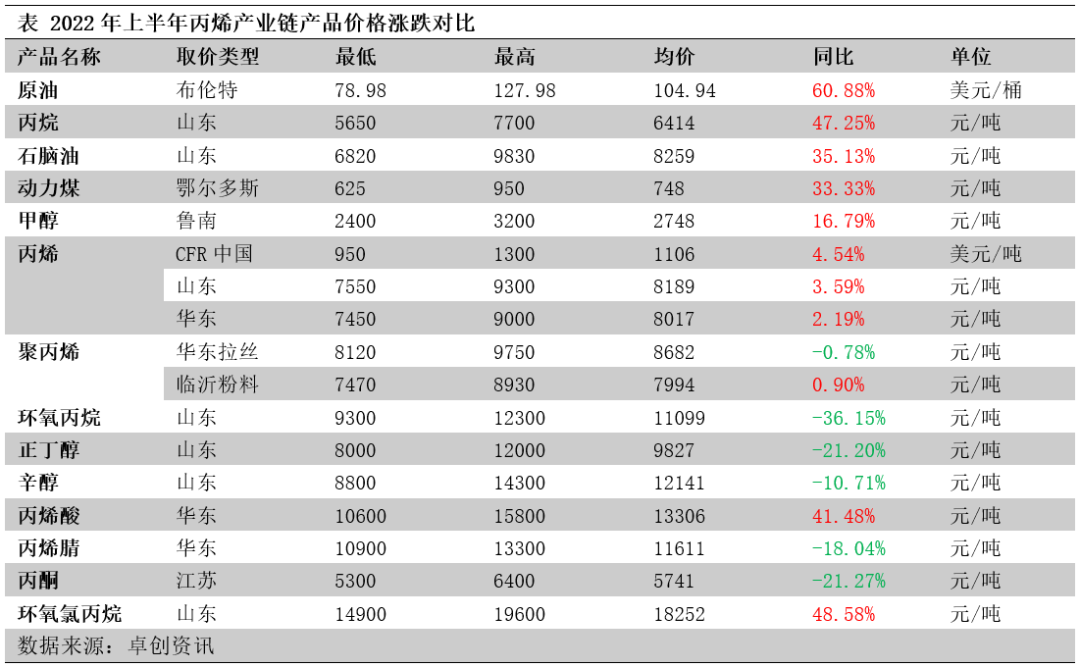

In the first half of 2022, the price increase of propylene industry chain products decreased from raw materials to downstream products. As can be seen from the table below, the price of propylene raw materials, mainly crude oil and propane, increased significantly in the first half of the year, especially the year-on-year increase in oil prices reached 60.88%, resulting in a significant increase in propylene production costs. Compared with raw materials, domestic propylene prices rose less than 4% year-on-year, and the propylene industry fell into a state of significant losses. Propylene downstream derivatives prices fell mainly year-on-year, epoxy propane, butyl alcohol, acrylonitrile, acetone prices fell more significantly. The increase in raw material prices overlaid with the decline in the price of the product itself, the profitability of propylene downstream derivatives generally declined in the first half of the year.

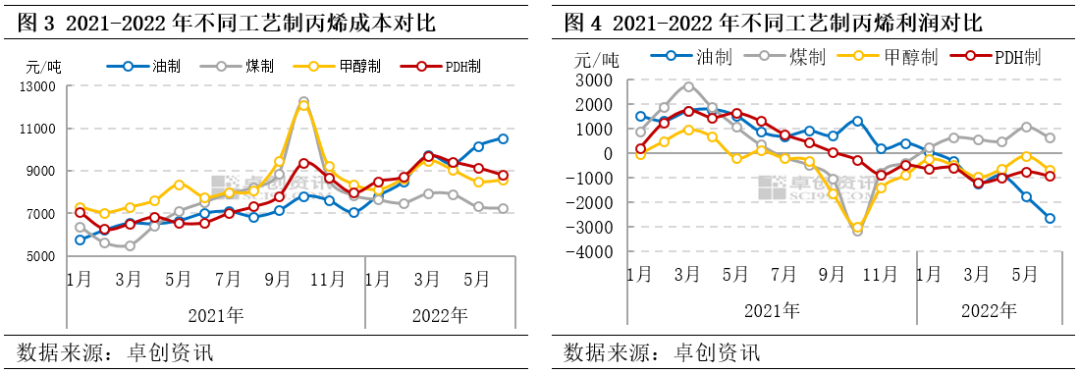

Propylene costs rose significantly year-on-year, forming a favorable support for propylene prices.

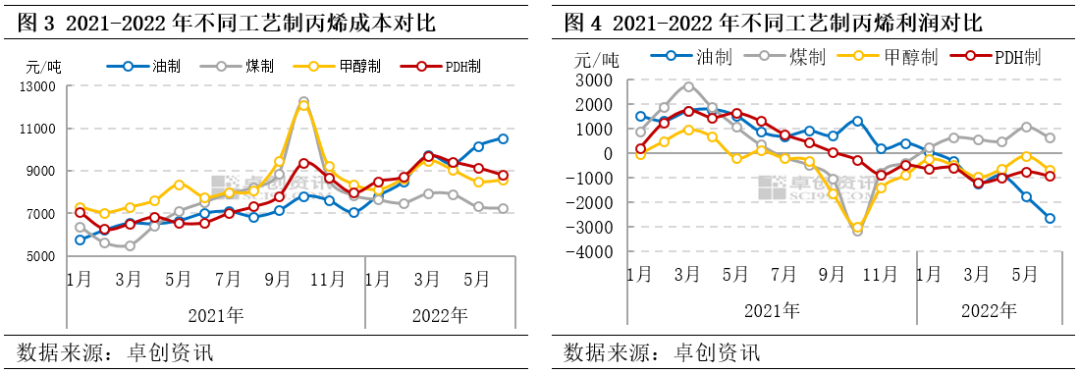

costs rose significantly and most processes fell into losses. In the first half of 2022, the profit situation of the propylene industry was poor, and the cost of propylene production by different processes increased by different rates year-on-year, with an increase of 15%-45%, indicating that the price center of raw materials has increased significantly. Although the center of gravity of propylene price has also moved up, the increase is less than 4%. As a result, the profit of propylene produced by different processes decreased significantly year-on-year, by 60%-262%. Except for the slight profit of coal-based propylene, the rest of the process propylene is in obvious losses.

Propylene total supply trend up, the propylene price rise formed a drag

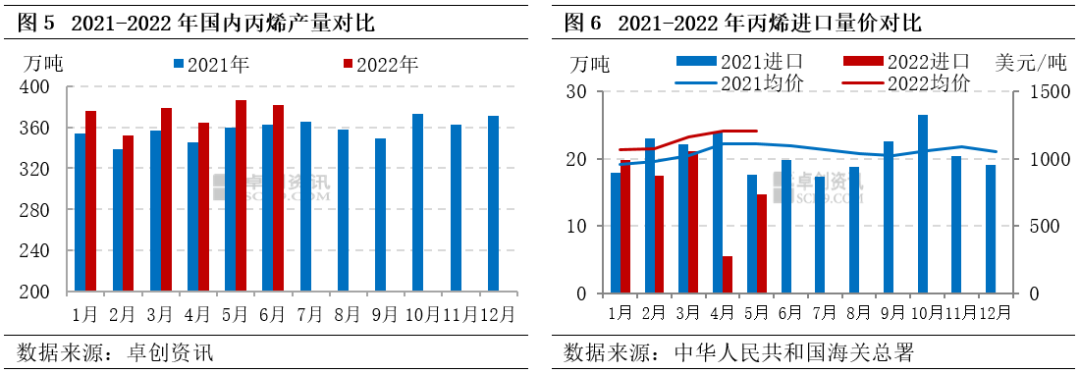

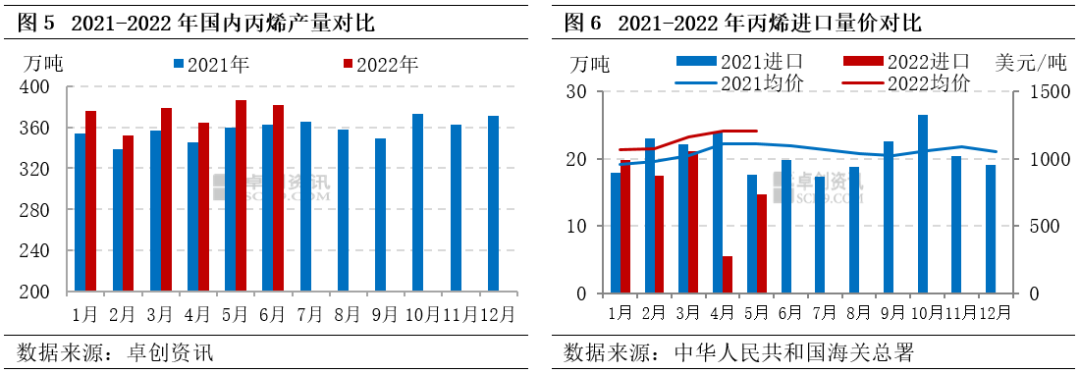

New production capacity continued to be released, and production capacity increased simultaneously. In the first half of 2021, a number of propylene units, including Zhenhai Refining Phase II, Lihuayi, Qixiang, Xinyue, Xinjiang Hengyou, Srbang, Anqing Taihengfa, Xintai, Tianjin Bohua, etc., were put into operation. The new production capacity is mainly distributed in Shandong and East China, with a small amount in Northwest, North China and Central China. The new capacity production process is mainly PDH, and individual cracking, catalytic cracking, MTO and MTP production processes also exist. In the first half of 2022, the domestic propylene production capacity increased by 3.58 million tons, and the total domestic propylene production capacity increased to 53.58 million tons. The release of new propylene capacity led to an increase in production, with total domestic propylene production of 22.4 million tons in the first half of 2022, up 5.81% from the same period in 2021.

average import price rose year-on-year, import volume shrank significantly. In the first half of 2022, the average import price rose year-on-year, the import arbitrage opportunities are limited, coupled with the continued expansion of domestic propylene, squeezing part of the import share, propylene import volume reduction is more obvious. In particular, in April 2022, domestic propylene imports were only 54,600 tons, a record low in nearly 14 years. Total propylene imports are expected to be 965,500 tonnes in the first half of 2022, down 22.46% from the same period in 2021. As domestic propylene supply continues to increase, the import market share is further compressed, in line with market expectations.

Propylene demand increases but downstream profits shrink, the price of propylene boost is relatively limited.

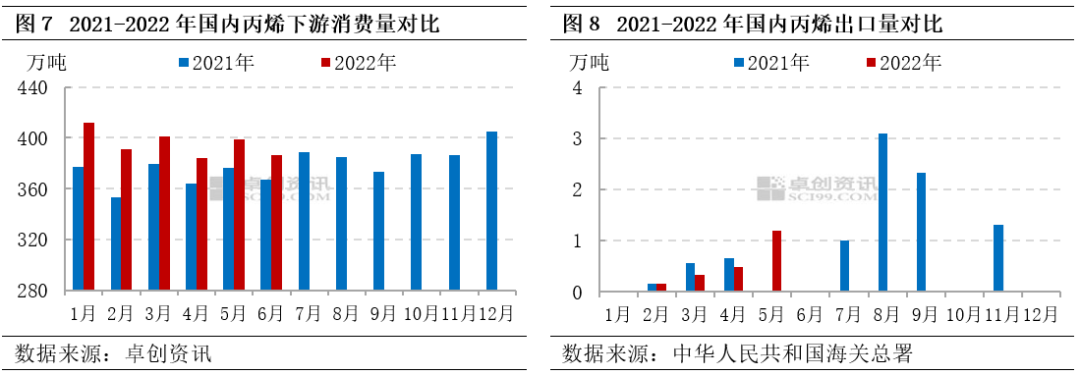

the release of new downstream capacity, propylene consumption increased year-on-year. The first half of 2022 includes Lianhong New Materials, Weifang Shufukang Polypropylene Plant, Lijin Refining and Chemical, Tianchen Qixiang Acrylonitrile Plant, Zhenhai Phase II, Tianjin Bohua Propylene Oxide Plant and Zhejiang Petrochemical Acetone Plant and other downstream units put into operation, driving the growth of propylene consumption. Downstream new capacity is also mainly concentrated in Shandong and East China, with a small distribution in North China. In the first half of 2022, the total downstream domestic consumption of propylene was 23.74 million tons, an increase of 7.03% compared with the same period in 2021.

domestic enterprises actively export, propylene export volume increased year on year. Domestic propylene production capacity rapid expansion, market competition pressure significantly increased, some mainstream factories actively seek export opportunities, coupled with the emergence of arbitrage space stage, propylene exports increased significantly year-on-year. Total domestic propylene exports in the first half of 2022 are expected to be around 30,000 tons, up 106.89% from the same period in 2021.

the profits of downstream products of

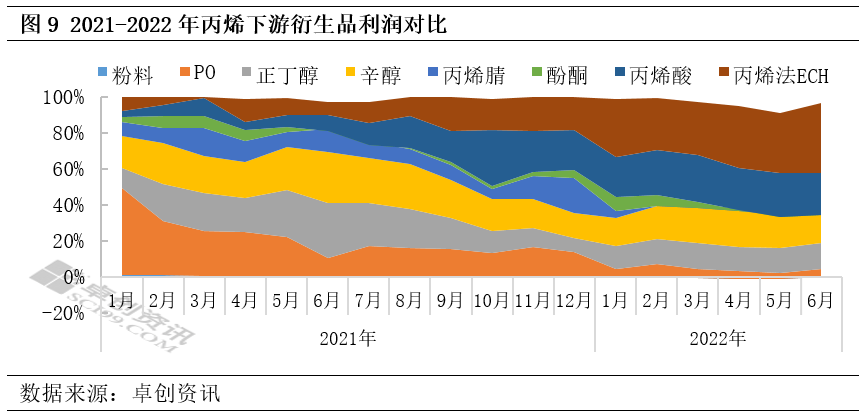

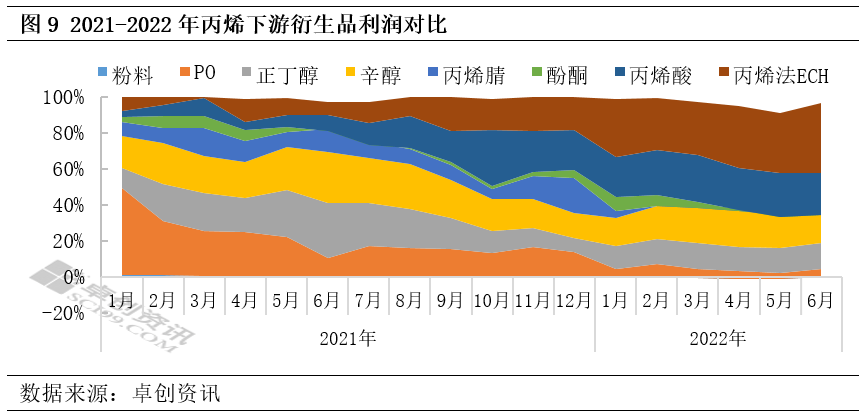

have shrunk, and the acceptance of raw material prices has declined. Raw material prices rose in the first half of 2022, while propylene downstream derivatives prices fell mainly, and the profitability of propylene downstream products generally declined. Among them, the profitability of butanol and acrylic acid is relatively stable, and the profitability of propylene ECH is enhanced. However, the profits of polypropylene powder, acrylonitrile, phenol ketone and propylene oxide all shrank significantly, and the main downstream polypropylene fell into long-term losses. Propylene downstream plants to the decline in the acceptance of raw material prices, procurement enthusiasm is not good, to a certain extent, affecting propylene demand.

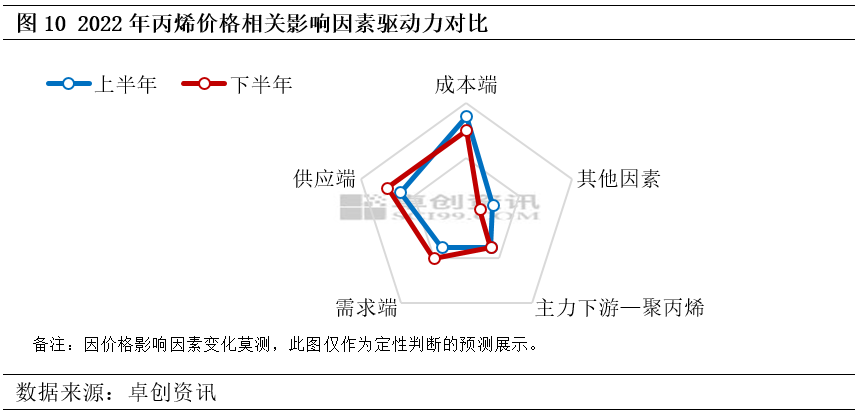

Propylene prices in the second half of the year are expected to rise and then fall, the average price level or less than the first half

on the cost side, there is a certain possibility of a fall in raw material prices in the second half of the year, propylene cost support or slightly weakened, the cost side is still the main factor affecting propylene prices, but the intensity of the impact is lower than the first half or slightly.

the supply side, the import volume in the first half of the year was relatively small. With the gradual recovery of import volume, the import volume is expected to increase slightly in the second half of the year. In the second half of the year, there are still some new production capacity plans to put into production, propylene supply volume continues to expand, market supply pressure is not reduced, the supply-side impact is still strong.

the demand side, the main downstream polypropylene profit and start-up situation is still the key factors affecting propylene demand, other chemical downstream demand is expected to be relatively stable. The improvement of downstream demand in July is not expected to be large, and the terminal demand in August-October is relatively strong, and some of the downstream new capacity is planned to be put into production, which is good for propylene demand, which in turn supports propylene prices. November-December enters the off-season of demand, and the downward pressure on propylene prices may increase.

comprehensive point of view, the second half of the propylene market price first rise and then fall probability is greater, the average price center of gravity or less than the first half of the year. It is estimated that the average price of Shandong propylene market in the second half of the year will be 7700-7800 yuan/ton, and the price range will be 7000-8300 yuan/ton.

Source: Zhuo Chuang Information, Clarkson Research CRSL * Disclaimer: The content contained in the content comes from the Internet, WeChat public number and other public channels, we maintain a neutral attitude towards the views in the article. This article is for reference only. The copyright of the reprinted manuscript belongs to the original author and the organization. If there is any infringement, please contact Huayi Tianxia Customer Service to delete it.

Mainly

Mainly

Polyurethane

Polyurethane

Fine Chemical

Fine Chemical

.png)