Read: 231

Time:44months ago

Source:

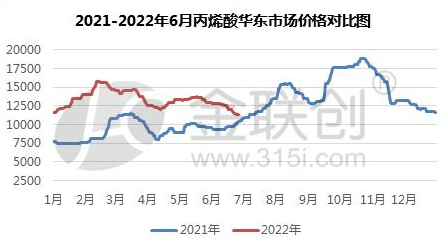

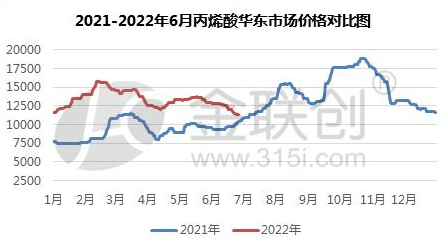

Due to the first quarter of 2022 international crude oil surge to stimulate the acrylic raw material propylene price trend rapidly pushed up, the domestic acrylic market followed by the raw materials and the overall chemical environment rose, the price gradually climbed, from the high price hovering. By acrylic production enterprises led the quotation to push mainly, market traders hype and actively follow up the rise to promote as a supplement, the downstream part of the industry under the impact of the epidemic just need to purchase in advance, the first half of the domestic regional hazardous chemicals logistics control increased cross-regional supply difficulties. The spot market maintained a price-free stage in the first quarter, with mainstream corporate quotations and secondary market spot pushing to a high level, pulling up the average price level of acrylic in the first half of the year as a whole. According to Jinlianchuang's data monitoring, the overall price of acrylic acid fluctuated above the 12000 yuan/ton level in the first half of 2022. The highest price appeared in mid-February, and the high-end price was around 15600 yuan/ton. Domestic acrylic East China market average price level compared to the same period in 2021 rose by about 44%.

In terms of cost, the first half of 2022 acrylic production enterprises are relatively profitable. Especially in the first quarter, the acrylic market in the international crude oil and raw material rally led by the multi-support to open the price of the rising trend, and acrylic enterprise price quotations and market to promote the operation of the progressive promotion, raw material propylene gradually rational decline stage acrylic market in the domestic epidemic and other influence of the continued high consolidation, production enterprises theoretical earnings rose. According to Jinlianchuang on acrylic acid and raw material propylene half a year average price rough calculation unit quality profit space, 2022 January-June acrylic acid unit quality within the theoretical profit space in 5813 yuan/ton, compared with the previous year under the same calculation standard profit space growth rate is obvious.

First half supply pattern

In addition, from the supply pattern, China acrylic production capacity fluctuations in the first half of 2022 are limited, due to the statistics of domestic production enterprises equipment capacity of some enterprises are long-term parking, so the first half of 2022 production capacity was revised to 3.39 million tons/year. In addition, due to the impact of the epidemic in the first half of 2022 and the restrictions on domestic transportation such as logistics, the domestic acrylic supply inventory showed an overall abundant situation. In addition, the supply speed of domestic production enterprises slowed down significantly in the first half of the year, and the logistics was restricted due to the impact of the domestic epidemic during the peak season of small demand in March -4 months, which showed a more obvious impact on the contradiction between supply and demand in the first half of the year.

Due to the impact of the domestic epidemic in the first half of the year, some areas are significantly restricted by the logistics of hazardous chemicals, and the recovery of overseas product trade has also increased the proportion of acrylic imports to a certain extent. Among them, the expected import volume in January-June is 19,400 tons, up 71.64% from the same period in 2021, and the expected export volume in January-June is 58,900 tons, down 1.61% from the same period in 2021.

Demand in the first half of the year

from the demand side, the downstream industry construction and coatings and other industries in the traditional peak season demand driven weak, in the market demand level, China's acrylic acid downstream demand is still mainly concentrated in the field of coatings and construction industry water reducer, concrete cement and other fields, the current coating industry overall operating rate remains low, the consumption of acrylic acid and other raw materials show a weak and stable trend, the driving force is limited. The demand for concrete cement, such as water-reducing agents, also showed significant weakness in the first half of the year. For the terminal downstream real estate industry overall economic improvement is not good, the first half of 2022 demand led to flat.

comprehensive view, the first half of 2022 domestic acrylic market basically maintain the ups and downs of the trend of operation, supply and demand pattern for the whole year showed a stalemate and stalemate situation.

outlook for the second half of 2022, China's acrylic market is expected to maintain a range of volatility trend, the main promoter of price push will still be dominated by manufacturers. In addition, the domestic market as manufacturers still have new capacity to put into production plans and show the supply pattern continues to usher in the possibility of changes. It is expected that the supply and demand game in major regions is still the focus of the market trend.

China's acrylic market in the second half of 2022, supply and demand are still the main factors affecting price fluctuations. In the second half of 2022, it is expected that with the gradual expansion of acrylic acid production capacity, the contradiction between supply and demand will continue to intensify in 2022. The gradual change pattern of downstream demand and the competition of core enterprises on the supply side will also become the main pattern contradiction in the future. The price is expected to show a phased rhythm change, and the price trend range of acrylic acid is expected to be around 9,000-12,000 yuan/ton in the second half of 2022. Year-round highs may occur in September-October.

. * Disclaimer: The content contained in it comes from public channels such as the Internet and WeChat public numbers. We maintain a neutral attitude towards the views in this article. This article is for reference only. The copyright of the reprinted manuscript belongs to the original author and the organization. If there is any infringement, please contact the customer service of Huayi Tianxia to delete it.

Mainly

Mainly

Polyurethane

Polyurethane

Fine Chemical

Fine Chemical

.png)