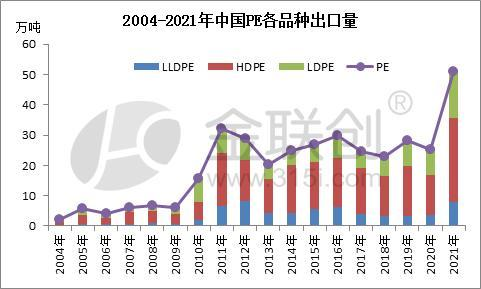

From the change of China's import volume from 2004 to 2021, we can see that since 2004, the trend of China's PE import volume has been divided into four stages, and the details are as follows.

Data source: Jin Lianchuang

the first stage is 2004-2007, at this time, China's demand for plastics is low, and PE imports remain low. In 2008, the domestic new devices were relatively concentrated and suffered a serious financial crisis, and the import volume of PE in China was relatively small.

The second phase is 2009-2016, after China's PE imports rose sharply, it entered a stage of steady growth. In 2009, due to the emergence of domestic and foreign capital injections to rescue the market, global liquidity margin, domestic general trade volume increased, speculative demand was booming, import volume increased significantly, and the growth rate reached 64.78%. Then in 2010, the exchange rate changed and the RMB exchange rate continued to appreciate, in addition, the framework agreement of ASEAN free trade area takes effect, and the import cost decreases. The import volume from 2010 to 2013 remains high and the growth rate remains high. By 2014, the new capacity of domestic PE increased significantly, and the domestic production of General materials increased rapidly. In 2016, the West officially lifted the sanctions against Iran, and Iranian sources were more willing to export to Europe with higher prices, at this time, the growth rate of domestic imports declined.

The third stage is 2017-2020, China's PE imports increased significantly again in 2017, PE production capacity at home and abroad is increasing and overseas production is more concentrated. As a major consumer of PE, China is still an important export released by the world's production capacity. Since 2017, the growth slope of China's PE imports plus-sized significantly. By 2020, China's large refining and light hydrocarbon new units have been launched one after another, and the domestic supply has increased significantly. However, from the perspective of consumption, overseas demand is more seriously affected by the "new Crown epidemic". The epidemic prevention and control situation in China is relatively stable, and demand is the first to recover. Overseas resources are more inclined to supply low prices to the Chinese market, china's PE import volume maintained a medium-high growth, with China's PE import volume reaching 18.53 million tons in 2020. However, the driving factor for the increase of PE import volume at this stage is mainly supply consumption, rather than just need to drive, and the competitive pressure of internal and external disks gradually appears.

In 2021, China's PE import trend entered a new stage, according to customs statistics, China's PE import volume was about 14.59 million tons in 2021, a decrease of 3.93 million tons compared with 2020, a decrease of 21.29%. Affected by the global epidemic, international restricted fleet available, ocean freight increased significantly, and the price of polyethylene inside and outside disks was upside down. In 2021, domestic polyethylene imports decreased significantly. In 2022, China's production capacity continued to expand, and the arbitrage window of internal and external disks was still difficult to open. The international PE import volume remained low, and China's PE import volume might enter the downward channel in the future.

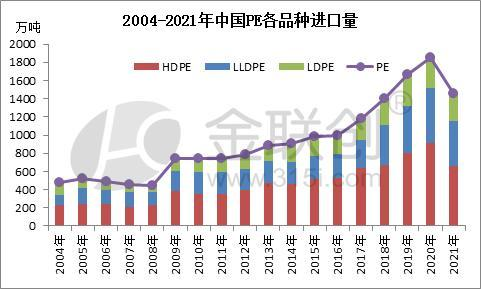

Data source: Jin Lianchuang

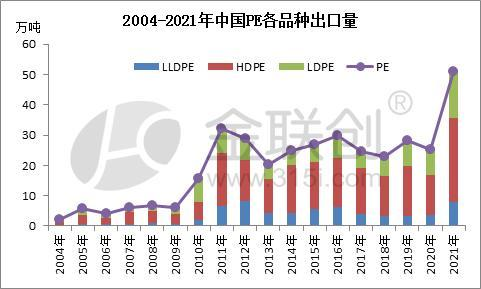

from the perspective of the export volume of PE varieties in China from 2004 to 2021, the overall import volume of PE in China is relatively low and the amplitude is relatively large.

China's PE export volume was less than 100,000 tons from 2004 to 2008, after June, 2009, the country raised the export tax rebate rate of some plastics and its products such as other primary-shaped Ethylene polymers to 13%, and the domestic PE export enthusiasm increased.

Domestic PE exports increased significantly in 2010-2011, however, since then, domestic PE exports have encountered another bottleneck. Although domestic PE production capacity has been increasing, there is still a large gap in China's PE supply. The export is restricted by cost, quality demand and transportation conditions, it is difficult to have a big increase.

From 2011 to 2020, China's PE export volume fluctuated in a narrow range, its export volume is basically between 20-300,000 tons. In 2021, China's PE exports surged, with the annual total exports reaching 510,000 tons, an increase of 260,000 tons compared with 2020, an increase of 104 percent year-on-year.

Investigate the reason, after 2020, China's large refining and light hydrocarbon units were concentrated, and the production capacity was effectively released in 2021. China's PE production increased, especially HDPE varieties. New units had a large number of production resources and plus-sized market competition pressure, more new resources are put on the market at low prices, and the price difference between the internal and external disks is upside down for a long time., its resource sales to Southeast Asia increased significantly. In addition, the United States suffered extremely cold weather, international supply tightened, and China's PE resource sales to South America and other places increased.

The continuous growth of production capacity is a serious problem that China has to face in PE supply, at present, due to the constraints of cost, quality demand and transportation conditions, domestic PE export is still difficult. However, with the continuous growth of domestic production capacity, it is very important to strive for overseas sales. In the future, the global polyethylene competition pressure will become more and more severe, and the supply and demand pattern of domestic and foreign markets still needs further attention.

* Disclaimer: the content contained is from public channels such as the Internet and WeChat public accounts. We maintain a neutral attitude towards the views in this article. This article is for reference and communication only. The copyright of the reprinted manuscript belongs to the original author and organization. If there is any infringement, please contact Huanyi world customer service to delete it. Mainly

Mainly

Polyurethane

Polyurethane

Fine Chemical

Fine Chemical

.png)