Vinyl Acetate (VAc), also known as vinyl acetate or vinyl acetate, is a colorless transparent liquid at normal temperature and pressure. VAc is one of the most widely used industrial organic raw materials in the world., through self-polymerization or co-polymerization with other monomer, derivatives such as polyvinyl acetate resin (PVAc), polyvinyl alcohol (PVA), polyacrylonitrile (PAN) can be generated. These derivatives are widely used in construction, textile, machinery, medicine, soil modifier, etc.

Overall analysis of vinyl acetate industry chain

the upstream of vinyl acetate industry chain is mainly acetylene, acetic acid, ethylene, hydrogen and other raw materials., the main preparation method is divided into two kinds, one is petroleum ethylene method, which is prepared by ethylene, acetic acid and hydrogen. It is greatly affected by crude oil price fluctuation and has the lowest cost at present. One is to prepare acetylene through natural gas or calcium carbide, and then synthesize vinyl acetate with acetic acid. The cost of natural gas is slightly higher than that of calcium carbide. The downstream is mainly to prepare polyvinyl alcohol, white latex (polyvinyl acetate emulsion), VAE, EVA and PAN, among which polyvinyl alcohol is the main demand.

Atlas of vinyl acetate industry chain

source: Public Data arrangement

1, vinyl acetate upstream raw materials

acetic acid, as the key raw material in the upstream of vinyl acetate, has a strong correlation between its consumption and vinyl acetate. Data show that since 2010, the apparent consumption of acetic acid in China has shown an overall growth trend. Only in 2015, it has declined due to the downward trend of industry prosperity and the change of downstream demand. In 2020, it reached 7.2 million tons, an increase of 3.6% compared with 2019. With the change of production capacity structure of downstream vinyl acetate and other products, the utilization rate has increased, and the acetic acid industry as a whole will continue to grow.

Source: Public Data arrangement

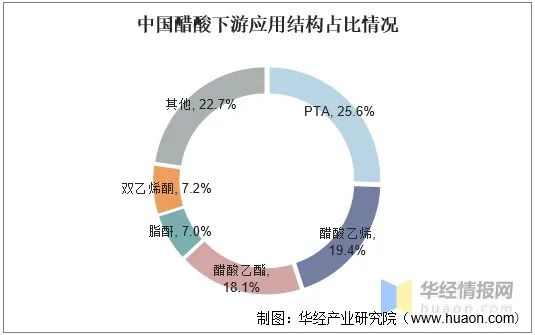

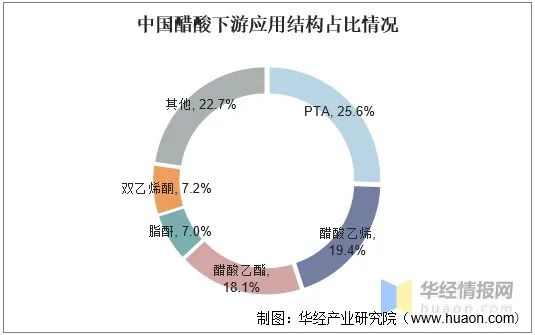

in downstream applications, 25.6% acetic acid is used to produce PTA (purified terephthalic acid),19.4% acetic acid is used to produce vinyl acetate, and 18.1% acetic acid is used to produce ethyl acetate. In recent years, the pattern of acetic acid derivatives industry is relatively stable. Vinyl acetate is one of the most important downstream applications of acetic acid.

Source: Public Data arrangement

2, vinyl acetate downstream structure

vinyl acetate is mainly used to produce polyvinyl alcohol and EVA, etc. Vinyl Acetate (Vac) is a simple ester of saturated acid and unsaturated alcohol. It can form polymers such as polyvinyl alcohol (PVA) and vinyl acetate-ethylene copolymer (EVA) through self-polymerization or polymerization with other monomer, the obtained polymer can be used for adhesive, paper or fabric upper glue, paint, ink, leather processing, emulsifier, water-soluble film and soil modifier, etc., in chemical industry, textile, light industry, paper making, architecture, automobile and other fields have wide application. The data shows that 65% of vinyl acetate is used to produce polyvinyl alcohol and 12% of vinyl acetate is used to produce polyvinyl acetate.

Source: Public Data arrangement

current Situation Analysis of vinyl acetate market

1, vinyl acetate capacity and operating rate

over 60% of the world's vinyl acetate production capacity is concentrated in Asia, while China's vinyl acetate production capacity accounts for about 40% of the world's total production capacity, making it the world's largest vinyl acetate production country. Vinyl acetate production in the world is divided into acetylene method and vinyl method. Compared with acetylene method, vinyl method has the characteristics of economy, environmental protection and high product purity. Since the energy power of China's chemical industry mainly depends on coal, the current vinyl acetate production is mainly based on acetylene method, and the products are relatively low-end. Domestic vinyl acetate production capacity expanded significantly from 2013 to 2016, but remained unchanged from 2016 to 2018. In 2019, China's vinyl acetate industry showed a situation of structural surplus. In calcium carbide, there was excess production capacity of acetylene plants and the industry concentration was relatively high. In 2020, China's vinyl acetate production capacity was 2.65 million tons/year, the same year-on-year.

Source: Public Data arrangement

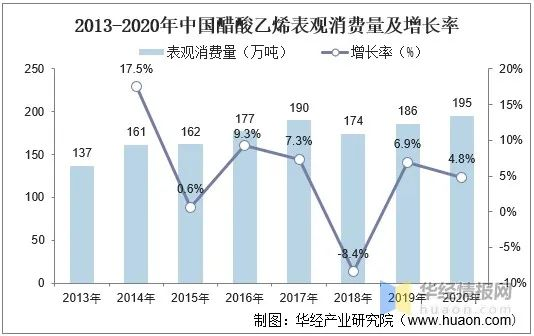

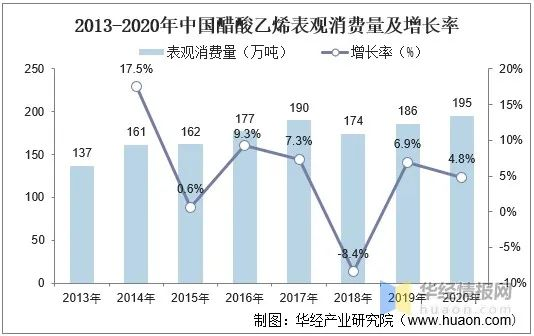

2, vinyl acetate consumption

as far as the consumption situation is concerned, the vinyl acetate market in China has shown a fluctuating upward trend as a whole. Due to the growth of downstream EVA and other demands, the vinyl acetate market in China has expanded steadily. The data shows that, except that the consumption of vinyl acetate in China was affected by factors such as the increase of acetic acid price in 2018, the consumption has declined. Since 2013, the demand of vinyl acetate market in China has risen rapidly, and the consumption has increased year by year, as of 2020, the low has reached 1.95 million tons, an increase of 4.8% year on year in 2019.

Source: Public Data arrangement

3, vinyl acetate average Market Price

judging from the market price of vinyl acetate, the industry price maintained a relatively stable trend in 2009-2020 due to the influence of overcapacity.. Affected by the contraction of overseas supply in 2014, the prices of products in the industry increased significantly. Domestic enterprises actively expanded their production, resulting in serious overcapacity. The price of vinyl acetate decreased significantly in 2015 and 2016. In 2017, affected by environmental protection policies, the price of industrial products rose sharply. In 2019, due to the sufficient supply of the upstream acetic acid market, the demand of the downstream construction industry slowed down, and the price of products in the industry dropped sharply. Affected by the epidemic in 2020, the average price of products decreased further. By July 2021, the market price of eastern China reached more than 12000, the price rise is huge, which is mainly due to the impact of the good news of the upstream raw oil price Gree and the overall less market supply caused by the shutdown or delay of some factories.

Source: Public Data arrangement

overview of ethyl acetate enterprises

the production capacity of four factories under Sinopec in the state-owned enterprise unit of ethyl acetate is 1.22 million tons/year, accounting for 43% of the country, while that of Anhui Wanwei Group is 750,000 tons/year, accounting for 26.5%. The foreign sector Nanjing Celanese 350,000 tons/year, accounting for 12%, private sector Inner Mongolia Shuangxin and Ningxia Land a total of 560,000 tons/year, accounting for 20%. At present, domestic vinyl acetate production enterprises are mainly distributed in northwest, east and southwest, with the production capacity in northwest accounting for 51.6%, East China accounting for 20.8%, North China accounting for 6.4%, and Southwest accounting for 21.2%.

Source: Public Data arrangement

prospect Analysis of vinyl acetate

1, vinyl acetate downstream EVA demand growth

vinyl acetate downstream EVA can be used as photovoltaic cell packaging film. According to the global new energy network, EVA is obtained by the polymerization of ethylene and vinyl acetate (VA), in which the mass fraction of VA is 5%-40%. Due to its good performance, products are widely used in foaming materials, functional greenhouse film, stretch wrap, injection blow molding products, blending agents, adhesives, wires and cables, photovoltaic cell sealing film, Hot Melt Adhesive and other fields. 2020 is the last year of photovoltaic subsidies. Many domestic head component manufacturers have announced the expansion of production. With the diversification of photovoltaic module sizes, the penetration rate of double-sided double-glass components has greatly increased, and the demand for photovoltaic module has exceeded expectations, stimulate EVA demand growth. It is estimated that 800,000 tons of EVA capacity will be put into production in 2021. According to estimates, the capacity growth of 800,000 tons EVA will drive the demand growth of 144,000 tons of vinyl acetate per year, thus driving the demand growth of 103,700 tons of acetic acid per year.

2, vinyl acetate overcapacity, high-end products still need to be imported

china's vinyl acetate has an overall overcapacity, and high-end products still need to be imported. At present, the supply of vinyl acetate in our country is greater than the demand, the overall overcapacity, and the surplus output depends on export consumption. Since the expansion of vinyl acetate production capacity in 2014, China's vinyl acetate export volume has increased significantly, and some imported products have also been replaced by domestic production capacity. In addition, China's export products are mainly low-end products, while imported products are mainly high-end products. At present, China's high-end vinyl acetate products still need to rely on imports, and vinyl acetate industry still has room for development in the high-end product market.

Source: China Economic Research Institute* Disclaimer: the content contained is from public channels such as the Internet and WeChat public accounts. We maintain a neutral attitude towards the views in this article. This article is for reference and communication only. The copyright of the reprinted manuscript belongs to the original author and organization. If there is any infringement, please contact Huanyi world customer service to delete it. Mainly

Mainly

Polyurethane

Polyurethane

Fine Chemical

Fine Chemical

.png)