Acrylic nitrile propylene and ammonia are used as raw materials and are manufactured through oxidation reaction and refining process. It is an organic compound with the chemical formula C3H3N. It is a colorless liquid with pungent odor and flammable. Its vapor and air can form explosive mixture, which is easy to cause combustion in case of open flame and high heat, and release toxic gas, and react violently with oxidant, strong acid, strong base, Amine and bromine.

It is mainly used for raw materials of acrylic fibers and ABS/SAN resin. In addition, it is widely used in the production of acrylamide, paste and hexanitrile, synthetic rubber, Latex, etc.

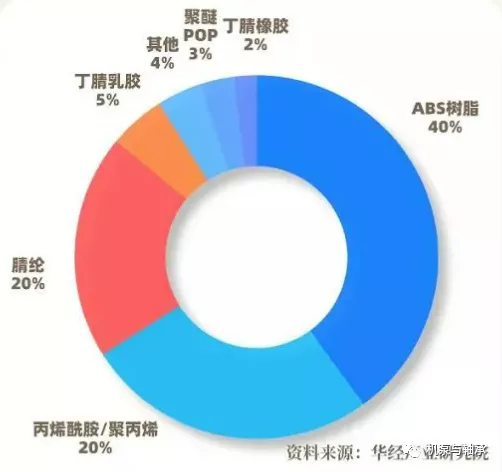

Acrylic nitrile market application

acrylic nitrile is an important raw material for the three major synthetic materials (plastic, synthetic rubber, synthetic fiber), the downstream consumption of acrylonitrile in China is concentrated in ABS, acrylic fiber and acrylamide, which account for more than 80% of the total consumption of acrylonitrile. In recent years, with the development of household appliances, automobiles and other industries, china has become one of the countries with the fastest growth in global acrylonitrile market consumption. Downstream products are widely used in various fields of national economy such as household appliances, clothing, automobiles, medicine, etc.

Acrylonitrile is manufactured by oxidation reaction and refining process of propylene and ammonia water. It is widely used in the industrial production of resin and acrylic fiber. Carbon fiber is an application field with rapid growth in future demand.

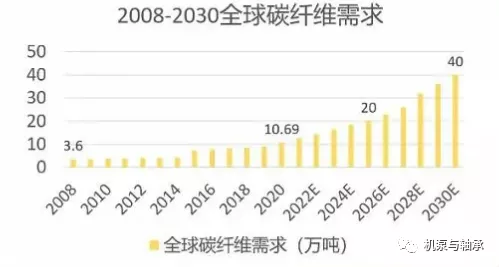

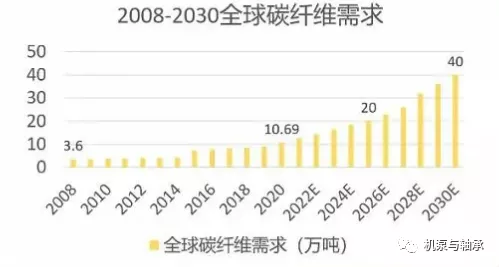

Carbon fiber, as one of the important uses of acrylonitrile downstream, is a new material that is mainly developed and produced in China at present. Carbon fiber has become an important member of lightweight materials, and has gradually taken the previous metal materials, which has become the core application material in civil and military fields.

With the sustained and rapid development of China's economy, the demand for carbon fiber and its composite materials continues to surge. According to relevant statistics, in 2020, China's carbon fiber demand reached 48,800 tons, an increase of 29% compared with 2019.

Source: Public Data arrangement

with the continuous development of science and technology, acrylonitrile market presents a great development trend: acrylic nitrile production route with propane as raw material is gradually being popularized; secondly, the research of new catalysts is still the research topic of scholars at home and abroad; third, the scale of the device is large; fourth, energy conservation and emission reduction, process optimization is increasingly important; fifth, wastewater treatment has become an important research content.

Main capacity output of acrylonitrile

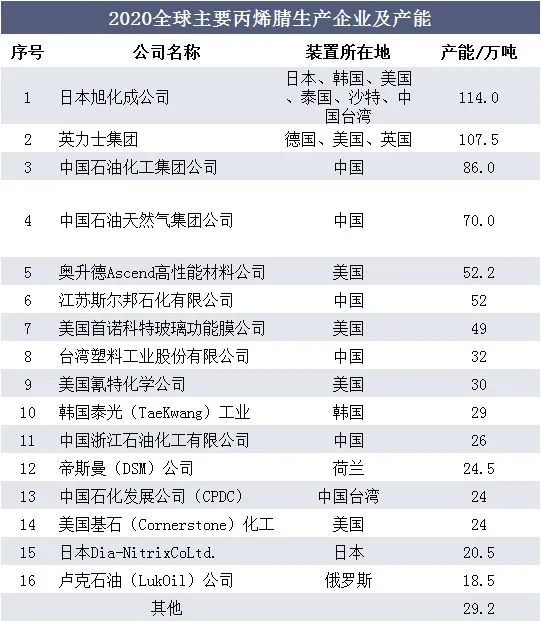

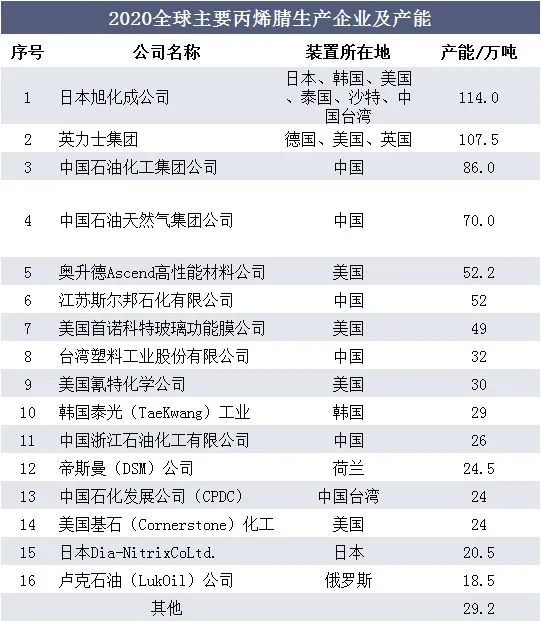

2020 acrylic nitrile manufacturers and production capacity

production capacity and output of acrylonitrile production enterprises in China in 2020

acrylic nitrile production units are mainly concentrated in China Petrochemical Corporation (hereinafter referred to as Sinopec) and China National Petroleum Corporation (hereinafter referred to as PetroChina). Among them, the total production capacity of Sinopec (including joint ventures) is 860,000 tons, accounting for 34.8% of the total production capacity; The production capacity of PetroChina is 700,000 tons, accounting for 28.3% of the total production capacity; private enterprises Jiangsu sierbang petrochemical, Shandong Haijiang Chemical Co., Ltd. and Zhejiang Petrochemical Co., Ltd. have acrylic nitrile production capacity of 520,000 tons, 130,000 tons and 260,000 tons respectively, accounting for about 36.8% of the total production capacity. Since the second half of 2021, 260,000 tons/year of Zhejiang Petrochemical Company Phase II, 130,000 tons/year of Korur Phase II, 260,000 tons/year of Lihuayi and 260,000 tons/year acrylic nitrile units in scherbang Phase III have been put into operation one after another, the new production capacity reaches 910,000 tons/year, and the total acrylic nitrile production capacity has reached 3.419 million tons/year.

Acrylic nitrile capacity expansion did not stop there. It is understood that in 2022, East China will have another 260,000 tons/year acrylonitrile new device, Guangdong will have a 130,000 tons/year device, Hainan will also have a 200,000 tons/year device. The new domestic production capacity is no longer limited to East China, and will be distributed in many regions in China, especially the production of Hainan's new factory makes the products close to the South China and Southeast Asia markets, and it is also very convenient to export by sea.

The greatly increased production capacity has brought about an increase in output. Statistics from Jin Lianchuang show acrylic nitrile production continued to refresh its high point in 2021. By the end of December 2021, the total domestic acrylonitrile production exceeded 2.317 million tons, an increase of 19% year-on-year, while the annual consumption was about 2.6 million tons, and the industry's overcapacity appeared.

Acrylic nitrile future development direction

in the past 2021, acrylonitrile exports exceeded imports for the first time. Last year, the total import volume of nitrile products was 203,800 tons, down 33.55% from the previous year, while the export volume reached 210,200 tons, an increase of 188.69% over the previous year.

This is inseparable from the centralized release of new domestic production capacity and the transition from tight balance to surplus in the industry. In addition, the shutdown of multiple units in Europe and America in the first and second quarter led to a sharp drop in supply. At the same time, Asian units were in the planned maintenance cycle. In addition, domestic prices were lower than those in Asia and Europe and America, helping acrylic nitrile export volume, including Taiwan Province of China, neighboring South Korea, India, Turkey and other places have certain export supply.

While the export volume increases, the number of exporting countries also increases. Previously acrylic nitrile export products were mainly sent to South Korea and India. In 2021, with the reduction of overseas supply, acrylonitrile export plus-sized and was distributed to the European market sporadically, involving 7 countries and regions such as Turkey and Belgium.

According to the forecast, in the next five years, the growth rate of China's production capacity is greater than that of downstream demand, and the import volume will further decline, while the export volume will continue to increase. In 2022, China's future export volume of acrylonitrile is expected to reach a high of 300,000 tons, thus reducing the operating pressure of the domestic market.

Source: Sinochem new net, machine pump and bearing,* Disclaimer: the content contained is from public channels such as the Internet and WeChat public accounts. We maintain a neutral attitude towards the views in this article. This article is for reference and communication only. The copyright of the reprinted manuscript belongs to the original author and organization. If there is any infringement, please contact Huanyi world customer service to delete it. Mainly

Mainly

Polyurethane

Polyurethane

Fine Chemical

Fine Chemical

.png)