Development Forecast of Chemical Related Varieties in 2022

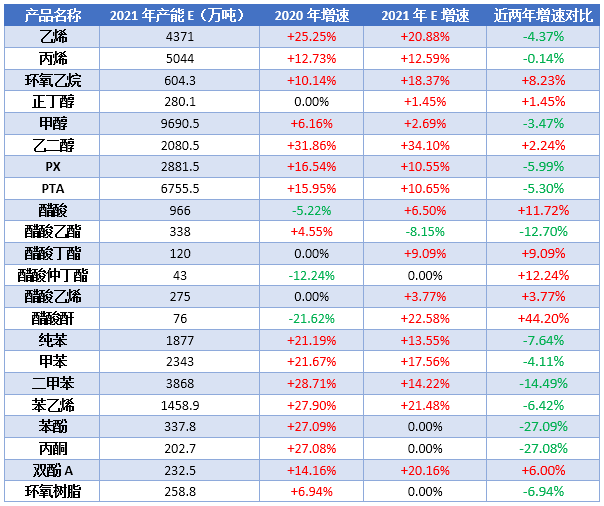

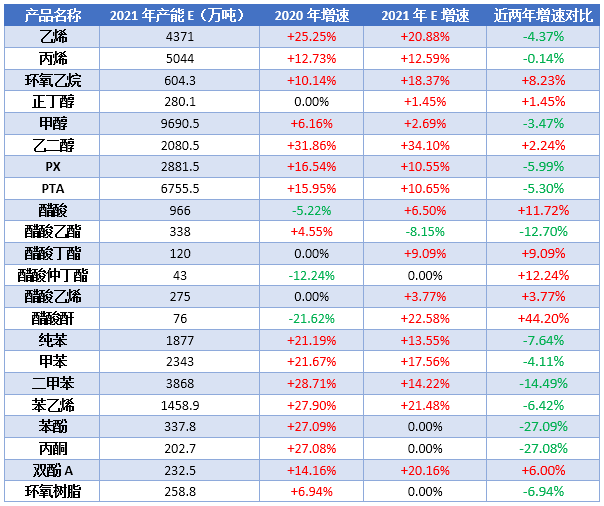

Under the background of carbon neutrality and energy consumption, the 2021 China's chemical industry production capacity growth rate of some products maintained a slowdown. We track 22 domestic chemical varieties, the production capacity growth changes in the past two years, ethylene, propylene, methanol, PX, TA, ethyl acetate, aromatic products most of the production capacity growth slowed down. From the perspective of industry development in 2021 alone, sec-butyl acetate, phenol, acetone and other products have not been added for the time being. The capacity growth rate of n-butanol, methanol and vinyl acetate products is controlled within 4%, while the annual capacity growth rate exceeds 18%, including ethylene, ethylene oxide, ethylene glycol, acetic anhydride, styrene, bisphenol A and other products, of which ethylene glycol this year's capacity growth rate is as high as 34%.

2022, the growth rate of China's phenol production capacity has not slowed down. Zhejiang Petrochemical (Phase II), Liaocheng Luxi Polycarbonate, Guangxi Huayi, Jiangsu Ruiheng, Qingdao Bay Chemical and Yantai Wanhua and other phenolic ketone plants are planned to be put on the market next year. If the production capacity of the newly-built plant is completely released, China's total phenol production capacity will reach 5.138 million tons by then, and the domestic self-sufficiency rate will be further increased, this is bound to suppress the supply of imports. In 2022, the import volume is expected to decline. At the same time, the phenol-bisphenol A- PC industry chain is integrated and developing steadily. The new production capacity of bisphenol A in the downstream is expected to be more. The increase in demand for phenol is well supported. The oversupply caused by the rapid expansion of phenol production capacity is relatively digested, but the situation that buyers occupy the market dominance is difficult to change.

2022 Qiaohao is the domestic acetone plant centralized production period, according to Jinlianchuang statistics, there are 6 sets of acetone plant planned to be put into production, most of the new capacity supporting downstream bisphenol A plant, the trend of the complete industrial chain is more obvious. Next year, the supply of acetone is still showing an increase, production significantly increased, is bound to have an impact on the purchase of goods, Asian export countries or will seek other supply directions, or with domestic enterprises to fight profits. However, the downstream bisphenol A new production capacity is also more, MMA also has several units planned to put into production, so acetone and downstream industry development is still relatively stable, the overall supply and demand to maintain a relatively balanced state.

2022. Driven by the steady expansion of downstream PC and epoxy resin production capacity, China's bisphenol A production capacity will increase. Eight new bisphenol A units, including Zhejiang Petrochemical (Phase II), Liaocheng Luxi Polycarbonate, Guangxi Huayi, Jiangsu Ruiheng, Qingdao Bay Chemical and Cangzhou Dahua, will be put on the market. By then, China's total bisphenol A production capacity will reach 4.405 million tons. It is worth noting that, A large number of new projects, mostly in the form of integration, phenol-bisphenol A- PC is still the trend of industrial chain development, bisphenol A supply side still has a gap, the tone of steady progress does not change. In addition, although some high-end products mainly rely on imports, but in the domestic supply increased significantly background, bisphenol A import dependence decreased year by year.

2022 is a year of concentrated expansion of styrene, Yantai Wanhua, Shandong Lihuayi, Zhenhai Refinery Liander, Bohua Development, Lianyungang Petrochemical and other large units will be released in mass production. Domestic production capacity and output continue to break through, while the self-sufficiency rate is also expected to rise significantly. At the same time from the import supply side, although there is still a continued contraction is expected, but after the rapid downward trend in 2021, further shrinkage space is relatively limited, the U.S. dollar import supply in the domestic market still has a place. In addition, combined with several major downstream expansion plans, the overall growth rate is relatively less than styrene, to PS industry new production is the most concentrated, EPS to some delayed production projects, ABS new release is relatively limited, focus on styrene and downstream industrial chain stage production mismatch opportunities and challenges.

. At present, there are 8 butyl acetate enterprises, of which Qianxin has the largest production capacity and is a leading domestic enterprise. The domestic production capacity of secondary butyl acetate in 2021 has not changed, still 5 enterprises, with a total production capacity of 430,000 tons. It is reported that during the year, enterprises can not reach full capacity production, some areas under the influence of power rationing policy, maintain at about 3-5 load, Dingying follow the upstream maintenance time is longer. No new news of sec-butyl ester has been heard in recent years. Acetic anhydride 2021 domestic total production capacity changes greatly, including Meng Xuan new materials, Anhui Tiancheng production, Mengzhou Dingxing device expansion, the overall effective production capacity increased to 760,000 tons/year, the future there is still a new device production plan.

2021 China's methanol production capacity of 96.905 million tons, the annual growth rate of less than 3 percentage points, the year's new capacity rate slowed down significantly, coupled with the industry carbon neutrality, energy consumption double control policy impact, the industry has entered the adjustment period, the subsequent new capacity also has a slowdown momentum. According to rough statistics, in the next three years, China will have about 12 million tons of new methanol production capacity (the actual progress of some projects may be delayed), of which there are many capacity expansion projects, and some small enterprises with partial production capacity will produce methanol from mineral heat tail gas. In addition, attention should also be paid to the industrialization process of future carbon dioxide catalytic hydrogenation to methanol projects. Downstream, olefins still account for half of China's methanol demand, but the traditional downstream demand increased steadily during the year, some small varieties are more worthy of attention, such as silicone, BDO, silicone, dimethyl carbonate (DMC) and other industries, the above part of the high-profit downstream development or cause market price changes.

expects China's ethylene glycol production capacity to reach 25.505 million tons and China's polyester production capacity to reach 74.585 million tons in 2022. If China's import volume is calculated at 7 million tons, it is predicted that the total supply will reach 32.505 million tons and the total demand will reach 24.986 million tons. China's ethylene glycol market supply and demand relationship is still difficult to reach a balance, the basic relationship of oversupply is difficult to improve, downstream demand growth rate is limited, ethylene glycol new production capacity slows down, in 2022 ethylene glycol is expected to new production capacity of 4.7 million tons. It can be seen that the difference between supply and demand of ethylene glycol is still widening year by year, and oversupply will become an important factor restricting the price rise of ethylene glycol for many years.

In 2021, China's ethylene production capacity was nearly 44 million tons, an annual growth rate of nearly 21%. During the year, the process of newly built and put into operation equipment was obviously diversified, with more light hydrocarbon utilization projects; traditional integrated cracking projects were added and expanded; and there was no new capacity in the coal/methanol olefin process during the year. According to incomplete statistics, the 2022 plan to put into production ethylene production capacity or will exceed 7 million tons/year. The new production capacity is an integrated project, all related downstream support. However, there are still some units that will have part of the spare amount of ethylene for sale, and the circulation of domestic ethylene commodities may continue to grow, which will have a certain impact on ethylene prices in Asia. During the "14th Five-Year Plan" period, with the successive commissioning or construction of various projects, the domestic ethylene production capacity is expected to reach 69 million tons/year. Affected by the energy consumption policy, some projects may also be shelved or eliminated. With the growth of ethylene and downstream supporting capacity, the competition in the derivatives market will become more and more fierce, which will force production enterprises to increase research and development efforts and promote industrial chain product upgrading.

It is estimated that China's propylene production capacity will be around 50.44 million tons in 2021, especially the propane dehydrogenation will enter the explosive period of production. It is expected that PDH production capacity will continue to expand at a high speed in the next two years. Under the background of "double carbon", the inherent "two highs" characteristics of coal chemical industry restrict its development space, and the structure of China's propylene production process will also undergo major changes. Looking ahead to 2022, the propylene industry gradually to "excess" development, production capacity growth rate far exceeds the demand growth rate, the industry burden increased, and propylene downstream supporting projects are mostly polypropylene, internal competitive pressure is not inferior to the propylene industry, its profitability changes will reverse the impact of the propylene market. There are also some original downstream devices to extend the upstream industrial chain projects, these projects will gradually squeeze the original market share and demand. At the same time, as the volume of domestic commodities continues to increase, propylene imports may continue to narrow, and exports may continue to grow. In the future, the competition within the propylene industry chain will be more intense, and the market competition pattern will evolve from single product market competition to product and product chain integration market competition.

2021, the total domestic ethylene oxide production capacity has exceeded 6 million tons/year, the annual growth rate of more than 18%. Ethylene oxide earnings performance is not as good as in previous years, as of the end of October, the average profit estimate is less than 50 yuan/ton. Ethylene has a guiding effect on ethylene oxide on the cost side, which is mostly reflected in the cost reference and mentality level. Affected by the policy during the year, the price trend of ethylene and ethylene oxide showed a big difference, which changed the long-term profit situation in previous years, and the fluctuation range of profit and loss was more obvious. During the year, the ethylene oxide market remained highly linked to downstream products, especially the polycarboxylic acid water-reducing agent monomer market. The impact of the ethylene glycol market on ethylene oxide is mostly reflected in the production conversion when profits fluctuate significantly. 2022, ethylene oxide has been listed is expected to add at least 650,000 tons/year of production capacity, downstream in addition to traditional areas of growth and process improvement, some enterprises have begun to layout to high value-added electrolyte materials field extension.

, it is expected that next year there will be 6 sets of PX units planned to be put into production, with a total production capacity of 11.89 million tons/year, if all can be put on schedule, next year PX production capacity is expected to increase by 41.3%. As the new units are generally equipped with downstream PTA units, most of which are self-supplied within the group, China's PX imports will still show a decreasing trend next year. Although PTA also has new capacity to launch, PX demand theoretically also increased, but the terminal polyester capacity increase is not big, PTA oversupply, the operating rate may not be as good as expected, thus limited demand for PX. Therefore, 2022 will be the process of a significant increase in PX domestic volume, squeezing the supply of imports, and the market will weaken as supply gradually exceeds demand.

expects 2022 domestic PTA market trend or continue the weak pattern. In terms of supply, with the increase of 6.5 million tons of PTA capacity in 2021, PTA overcapacity has become an industry consensus. Although there are new production of downstream polyester, the growth rate is far less than that of raw material PTA. From the demand side, the demand for downstream polyester and terminal textiles increased slowly, while textile exports declined year-on-year, and inventories in all links of the industrial chain remained high. In addition, there is uncertainty in the crude oil market, and the fundamental game is still in a see-saw state. At present, the PTA industry has formed an oligopoly market. After squeezing out high-cost devices, some form of price alliance is not ruled out. Therefore, the PTA market in 2022 may remain in a period of low processing fees as in 2021, which is expected to be around 400-600 yuan/ton.

The next five years, the domestic glacial acetic acid plant total about 5.2 million tons of plant plans to build new, need to pay attention to Guangxi Huayi, Hualu Hengsheng, Zhejiang Petrochemical and other projects, some of the project construction cycle is relatively long plus policy impact, the specific construction time to be determined. Based on the high price of glacial acetic acid in recent years, the company's production is profitable, so the glacial acetic acid project has been favored by many investors, and there are still many intention projects. On the demand side, the future new main force is still in PTA, in addition to other downstream such as chloroacetic acid, vinyl acetate, acetic acid acetonitrile and so on have been added. Acetate production capacity is too much, and future additions are limited.

At present, ethyl acetate domestic industry concentration is high, and obvious overcapacity. In recent years, Jiangsu Lianhai, Shanghai Huayi, Henan Shunda, etc. have all withdrawn from the ethyl acetate market. According to statistics, there are not many new projects of ethyl acetate at present. Zhuhai Qianxin's 300,000-ton/year plant is planned to be put into operation in early 2022, but at the same time it plans to close the 250,000-ton/year plant in Jiangmen, so the total production capacity changes are limited.

2022 China's pure benzene production capacity will continue to expand significantly, by the end of 2022 China's pure benzene will have more than 3.4 million tons/year of new production capacity released, when the total domestic production capacity will reach 22 million tons/year or so. The downstream supporting enterprise capacity has a certain follow-up, oversupply situation is not obvious. In 2022, the domestic pure benzene industry chain continued in 2021, showing high output, independent and controllable market, as well as the situation of strong demand, the dependence on imports has shown an overall downward trend in recent years, the downstream expansion of more capacity, especially the expansion of styrene, making the impact of the demand side stronger than in previous years. From the domestic fundamentals of 2022, domestic production capacity will still rise, mainly concentrated in large refining enterprises, domestic enterprise prices on the market price of the dominant power is almost completely better than foreign goods, downstream expansion of capacity to make the supply and demand side of a certain balance. However, the rapid expansion of downstream production capacity, although the demand for pure benzene increased, but still need to be alert to the expansion of downstream production capacity after its own market and price system and the impact of the industrial chain, if the supply and demand market is not fully matched, downstream rapid expansion after the existence of the reverse suppression of pure benzene prices.

2022 China's toluene, mixed xylene production capacity is still a year to continue a large pace of expansion, of which toluene theory new production capacity of 2.96 million tons, mixed xylene new production capacity of 5.37 million tons. In the new plant next year, toluene and mixed xylene are still for personal use. However, most of Jinzhou and Jinxi petrochemical products are planned to be exported, and Shenghong Refining and Chemical Co., Ltd. also has some external sales. With the production of the new plant, not only the production capacity of toluene and mixed xylene will increase, but also the growth of commodity volume will be higher than last year. From the point of time when each plant is planned to be put into operation, the domestic supply of toluene and mixed xylene in the first half of the year will first increase in concentration, which will narrow the domestic demand gap of mixed xylene, shrink the import volume, further increase the contradiction between domestic supply and demand of toluene, and increase the export pressure. In the second half of the plant, toluene, mixed xylene basically no export, as an intermediate product to produce PX and pure benzene. And in the second half of the year, PX plant production is relatively large, this part of the plant production at the same time, will once again increase the demand gap of mixed xylene.

Source: From the perspective of material, Jin Lianchuang * Disclaimer: The content contained in the content comes from public channels such as the Internet and WeChat official account. We maintain a neutral attitude towards the views in the article. This article is for reference only. The copyright of the reprinted manuscript belongs to the original author and the organization. If there is any infringement, please contact Huayi Tianxia Customer Service to delete

Mainly

Mainly

Polyurethane

Polyurethane

Fine Chemical

Fine Chemical

.png)