2021 is the first year of the "14th Five-Year Plan" and the 100 anniversary of the founding of the Communist Party of China. It is a key year to ensure a good start and a good start in building a new development pattern and promote sustained and healthy economic development throughout the year. In order to clarify the national strategic intention, clarify the focus of government work, and guide and standardize the behavior of market entities, the "Fourteenth Five-Year Plan for The People's Republic of China National Economic and Social Development and the Outline of the 2035 Vision Goals" was announced on March 12, 2021. Among them, the outline of the industry development plan pays more attention to the development of high-performance fiber and its composite materials industry.

the

, with the support of favorable policies, the glass fiber and carbon fiber industries have also lived up to expectations. In the first three quarters, the added value of my country's industrial enterprises above designated size increased by 11.8% year-on-year, with an average growth of 6.4% in two years, of which the added value of the raw material manufacturing industry increased by 8.2% year-on-year. An average growth of 5%. Glass fiber due to the downstream market segments of many areas, the demand side has a strong support, especially domestic automotive, wind power demand continues to be strong.

from January to September this year, the total wholesale sales of passenger cars in the country was 14.602 million, a year-on-year increase of 11.3%. Among them, the production and sales of new energy vehicles reached a new high; in the first three quarters, the national wind power and photovoltaic cumulative power generation was 718 billion kWh, a year-on-year increase of 34.9%.

the prosperity of the downstream market, driving the demand for glass fiber, the overall business climate of the industry continues to improve, the following is a summary of the performance of each enterprise in the first three quarters:

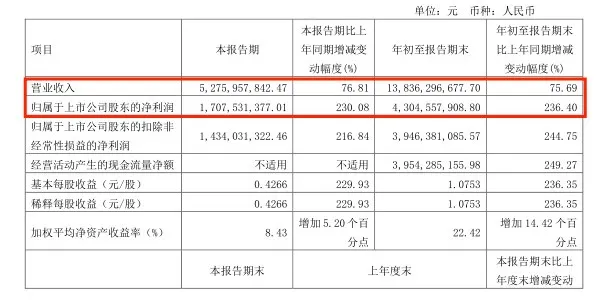

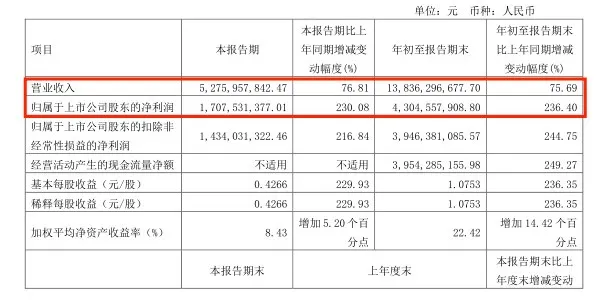

China Jushi China Jushi: operating income in the third quarter was 5.276 billion yuan, up 76.81% year-on-year; net profit was 1.708 billion yuan, up 230.08% year-on-year; operating income in the first three quarters was 13.836 billion yuan, up 75.69% year-on-year; net profit was 4.305 billion yuan, up 236.4% year-on-year.

of Sinoma Technology

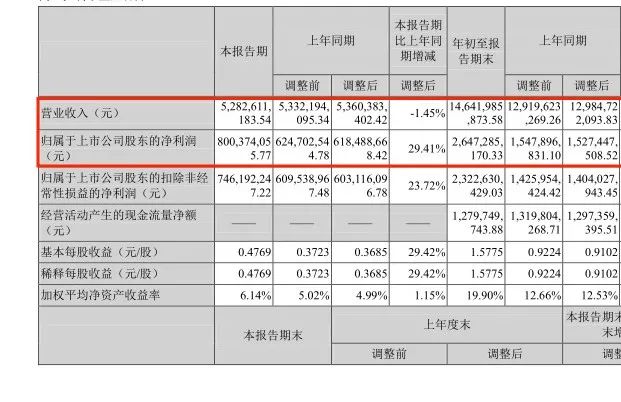

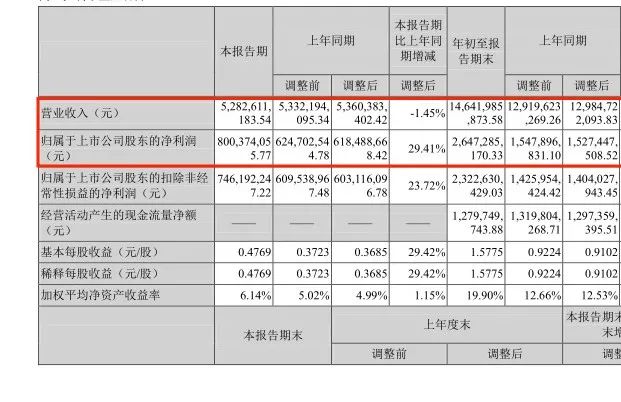

Sinoma Technology: In the first three quarters report, the company achieved main revenue of 14.642 billion yuan, up 12.76% year-on-year; net profit attributable to the parent was 2.647 billion yuan, up 73.31% year-on-year; of which, in the third quarter of 2021, the company achieved main revenue of 5.283 billion yuan; net profit attributable to the parent was 0.8 billion yuan, up 29.41% year-on-year.

Shandong slope fiber

Shandong Glass Fiber: The first three quarterly reports, the company in the first three quarters of 2021 to achieve total operating income 2.06 billion, a year-on-year increase of 50.6%; to achieve the return of net profit 0.45 billion, a year-on-year increase of 387.6%. In the third quarter, the company achieved a main revenue of 0.611 billion yuan, up 30.59% year-on-year; a single-quarter net profit of 0.119 billion yuan, up 293.99% year-on-year.

Changhai shares of

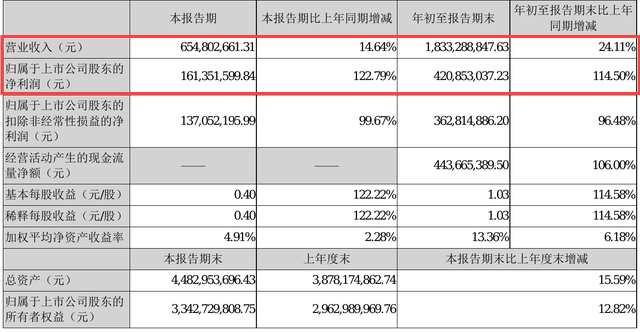

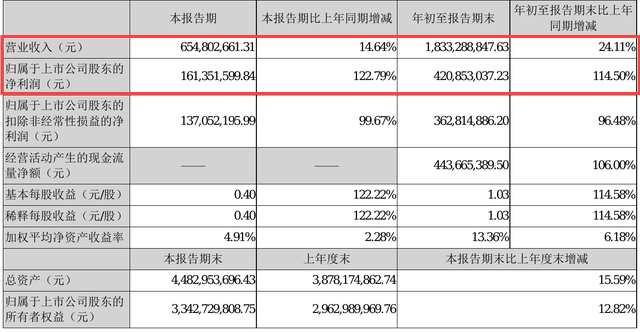

Changhai shares: the first three quarterly reports show that the company's main revenue in the first three quarters was 1.833 billion yuan, up 24.11% from the same period last year; the net profit attributable to the parent was 0.421 billion yuan, up 114.5% from the same period last year; in the third quarter of 2021, the company's single-quarter main revenue was 0.655 billion yuan, up 14.64% from the same period last year.

Jizhong Energy

Jizhong Energy: The first three quarterly reports show that in the third quarter, the company's main revenue was 9.012 billion yuan, up 60.45% year-on-year; the net profit attributable to the parent was 0.707 billion yuan, up 174.12% year-on-year; the operating income in the first three quarters was about 21.98 billion yuan, up 35.16% year-on-year; the net profit was about 1.367 billion yuan, up 66.28% year-on-year.

of Jiuding New Materials

Jiuding New Materials: The first three quarterly reports showed that in the third quarter, the company's main revenue was 0.367 billion yuan, a year-on-year decrease of 31.18%; the net profit attributable to the parent was 6.6205 million yuan, a year-on-year increase of 315.62%; the first three quarters achieved total operating income 1.03 billion, A year-on-year increase of 2%; realized a 32.439 million net profit attributable to the parent, a year-on-year increase of 192.9%.

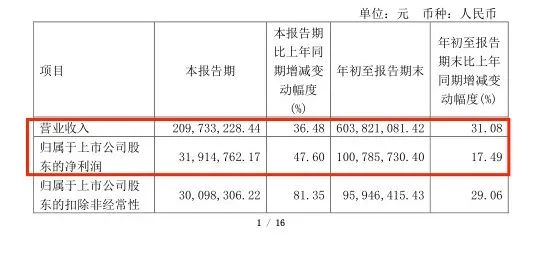

of Honghe Technology

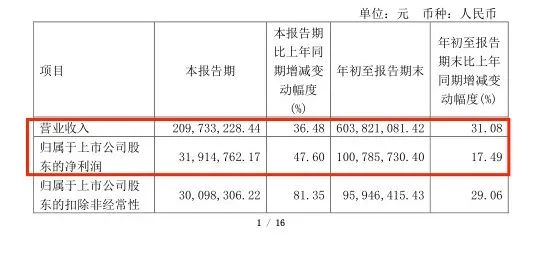

Honghe Technology: In the first three quarterly reports, the company achieved a 0.6 billion in total operating income in the first three quarters of 2021, an increase of 31.1% year-on-year; achieved a 0.1 billion in net profit attributable to the parent, an increase of 17.5% year-on-year; in the third quarter, the company achieved operating income of about 0.21 billion yuan, An increase of 36.48% year-on-year. The net profit attributable to shareholders of listed companies was about 31.91 million yuan, up 47.6% year on year.

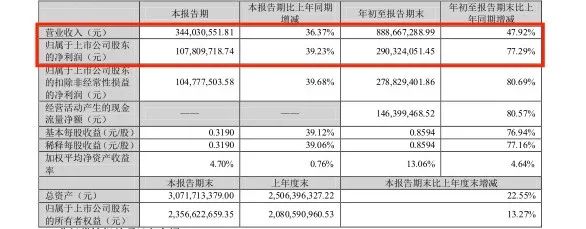

Philip

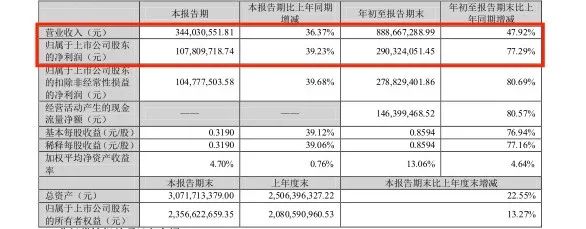

Philip reported in the first three quarters that the company achieved operating income of about 0.344 billion yuan in the third quarter, a year-on-year increase of 36.37%. The net profit attributable to shareholders of listed companies was about 0.108 billion yuan, up 39.23% year on year. Achieve basic earnings per share of 0.319 yuan, up 39.12% year-on-year.

in the automotive field, "lightweight design" has always been the center of the development of the industry, especially in recent years, various environmental protection policies and measures have been released, which is related to the development of emerging new energy vehicles. The glass fiber composite material can effectively reduce the weight of the car and reduce the energy required. For the new energy vehicles that are being vigorously promoted, it is also conducive to extending their battery life and helping their application market to promote in-depth. Therefore, glass fiber in the future automotive industry applications will usher in further development, industry demand will also be steadily rising.

in the field of wind power, glass fiber is mainly used to make blades, because glass fiber composite material has light weight, high strength and corrosion resistance and other excellent properties, can be the blade material of choice.

the National Development and Reform Commission, the Ministry of Finance, the People's Bank of China, the China Banking and Insurance Regulatory Commission, and the National Energy Administration jointly issued the "Notice on Guiding and Increasing Financial Support to Promote the Healthy and Orderly Development of Wind Power and Photovoltaic Power Generation Industries." The "Notice" emphasizes that local government departments and relevant financial institutions must fully understand the importance of developing renewable energy, work together to help enterprises tide over difficulties, and support the healthy and orderly development of wind power and other industries. The successive introduction of such policies to encourage the development of wind power is also one of the important engines to boost the domestic demand of glass fiber consumption.

Mainly

Mainly

Polyurethane

Polyurethane

Fine Chemical

Fine Chemical

.png)