Read: 478

Time:52months ago

Source:

In October, the domestic glacial acetic acid industry chain mostly weakened, and the acetic acid market fell back at a high level. During the month, the operating rate of enterprises increased, and the supply side showed regional changes. Northwest and central China enterprise inventory increased faster, shipping intention is strong, prices significantly led the decline. Enterprises in North and East China have low inventories, but prices follow the market. downstream acetate, vinyl acetate, PTA, etc. due to the double control of the stage negative, just need the level is low. Therefore, the contradiction between market supply and demand is obvious.:

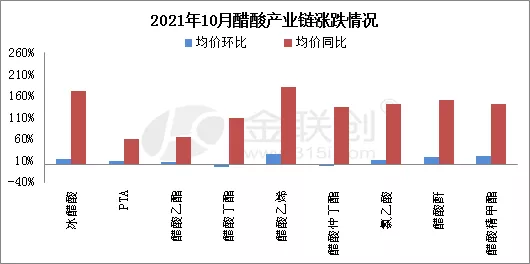

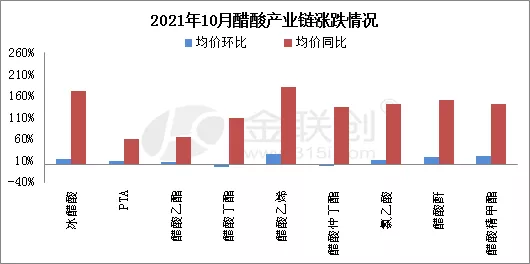

Table 1 The rise and fall of domestic acetic acid industry chain in October 2021 (unit: yuan/ton)

of Analysis of the ups and downs and trends of various products and upstream raw materials

Figure 1 2021 October Domestic Acetic Acid Industry Chain Rise and Fall Comparison Chart

Data source: Jin Lianchuang, a

, Jin Lianchuang monitored the monthly average price of 10 acetic acid industry chain products, month-on-month only butyl acetate, butyl acetate fell, other rose, year-on-year. The top three month-on-month increases were: vinyl acetate, methanol, acetic acid fine methyl ester; the year-on-year increase was: vinyl acetate, acetic anhydride, butyl acetate. Analysis of Main Products of Acetic Acid Chain

In October, the domestic ethyl acetate market fluctuated downward, with regional declines ranging from 250-560 yuan/ton. After the National Day, the market rose sharply. Due to the centralized replenishment of the terminal after the holiday, the low-end price of the market was active. Driven by the overall atmosphere, the market center of gravity was pushed up. In addition, the first ten days of double control, ethyl acetate operating rate is low, most enterprises reduce negative and parking, the lowest operating rate hit 30%. The supply side is not high, so companies reported higher after the holiday. But with the end of the post-holiday replenishment, the deal turned lighter. In addition, the raw material acetic acid fell sharply to suppress the mentality, the ethyl ester market began to fall at a high level. In the second half of the month, the ethyl ester market continued to fall, but during the period due to the shortage of spot in South China ports, from Shandong enterprises to bid for auto transportation to supplement the gap, resulting in an improvement in the northern market. However, in the case of ethyl enterprise supply increase, the operating rate increased to 57%, and the terminal demand is not good, the market's mainstream trend is mainly below.

In October, the domestic butyl acetate market rose first and then fell. In the first half of the month, the market price continued to rise. First, the price continued to rise due to the centralized replenishment of n-butanol after the festival, and the cost was strongly supported by butyl acetate. Second, the operating rate of butyl acetate is relatively low. Jinjiang, Jinyimeng and other devices are stopped, and the loads of Baichuan and Yisheng are relatively low. Therefore, the supply surface is tight, and the enterprise's offer follows the increase of raw materials. Third, butyl ester will be replenished centrally after the festival, so the transaction situation is slightly better. In the second half of the month, the market fell sharply, first, raw materials n-butanol and acetic acid fell sharply, the cost side fell sharply, suppressing the market mentality. However, the second half of the butyl acetate price on the raw material follow degree is not sensitive, so the profit margin of enterprises, this is because the butyl acetate load continues to be low, the supply side is tight, enterprises do not have to carry out fierce bidding sales.

, the domestic sec-butyl acetate market fluctuated and declined in October. In the month, the supply area was relatively low, and the overall construction was near 3.5. Zhongchuang stopped during the 11th period. No.23 stopped again due to steam problems. Dingying planned to restart at the end of this month and resume at the beginning of November. At present, except for the full load of Ruiyuan unit, other loads were relatively low, and Zhongchuang and Dingying were not released. In terms of raw materials, acetic acid dropped sharply one after another during the month, which had a significant impact on the market mentality, although the supply is low, the support for the center of gravity of the offer is limited. The downstream and terminal have a downward trend in the mentality of following acetic acid. Starting from the middle and late of the year, the operators have paid more attention to the auction dynamics of northwest supply. Affected by the decline, prices in many places have fallen. During the period affected by the policy side, the downstream and terminal start-up level is not good, cautious just need mainly, middlemen operating space is limited, the theoretical profit level of enterprises is still available. On the whole, supply and demand were both weak during the month, and there was a small amount of just-needed stock, but it did not support the market decline. At the end of the month, the industry was still waiting to see the decline. At present, the decline of acetic acid due to the news of the device has slowed down, and the later stabilization is more likely. Pay careful attention to the impact of raw materials.

In October, the domestic methyl acetate market operated at a high price. In the early stage, due to the influence of double control, the supply level on the market dropped sharply. Enterprises mainly arranged orders and delivered goods. In particular, there was no ship in South China, and most of them were mainly transported by automobile. The transportation cycle and freight rate were both rising, and the local transaction price was on the high side. In the later period, with the restart of Ruifeng Huaibei plant, the market mentality eased somewhat, but the overall situation was still tense and was not affected by the sharp decline of double raw materials, however, the downstream and terminals are cautious and wait-and-see, and the real intention is low. Northwest crude armour supply is tight, parking is more negative, others are more self-use, the cost is too high, and the export pressure is high. Overall, this month methyl acetate although the center of gravity is high, but the demand side showed a downward trend, part of the real single dark decline.

In October, the domestic n-propyl acetate market rose sharply, with a high level falling at the end of the month. Although the raw material glacial acetic acid continued to fall sharply during the month, the impact on n-propyl acetate was limited. The reason why the market rose sharply in the month was that the raw material n-propanol rose sharply in the month, and the cost was boosted by n-propyl acetate due to the shutdown of the Luxi plant. Second, the supply of n-propyl acetate is tight. Baichuan, Jinjiang, Rongxin and other enterprises have all dropped negative and stopped, and the market spot volume is limited, so the enterprises have been able to increase. Near the end of the month the market appeared high down, so the early price is too high, the terminal resistance is strong, lack of buying gas, trading is scarce. In addition, enterprises in the middle of the restart, supply side to improve. Under the contradiction between supply and demand, the market center of gravity is high and downward. In October, the domestic vinyl acetate market continued to rise sharply. In East China, for example, the high-end price has risen to 18500 yuan/ton, up near 21% from last month. It is reported that a small order was sold at the end of the month at 19000 yuan/ton. The supply area continued to be in short supply in the month. The construction in the northwest region was still low. The Great Wall planned to restart within the month. However, due to power rationing, it was postponed to early November. The earth only opened a set of 100,000 tons. Shuangxin and Mengwei operated at low load. Around 30% of Guangwei in South China, it remained for its own use and had little release. After the restart of Celanese, there was some relief to the market spot, but the overall situation was still tight. The price of calcium carbide in terms of raw materials is not high, it has a great impact on the cost of calcium carbide method. In addition, the goods are tight, and the enterprise's offer is high. It has risen to more than 17500 yuan/ton in the month, and the profit margin has expanded. Acetic acid has fallen one after another, but it has little impact on vinyl acetate, and the impact on ethylene procurement is obvious. Due to the long unloading cycle of ship cargo, some enterprises have ethylene procurement pressure. Downstream PVA, VAE emulsion and EVA resin are high-priced operation, the cost side of its support is obvious, but with the influence of the force majeure of Wacker and Dalian Yizheng VAE emulsion, the later release of vinyl acetate or increased. On the whole, the vinyl acetate market focus of tight prices, traders generally no goods, enterprises few inventory, more production and sales. In October, China's methanol market showed a rise before the suppression of the market, the overall volatility is larger, and port prices are still weaker than the mainland. Specifically: after the national day, local middle and lower reaches were replenished, and the energy consumption was double controlled and the power restriction was not reduced. in addition, some devices were passively stopped under the coal shortage, and the supply side was shrinking. in addition, the cost side was strongly supported. methanol prices continued to rise sharply under the support of multiple favorable conditions. prices in some areas continued to break through record highs. however, the port growth rate was less than that in the mainland, and some goods flowed back to the mainland market. As prices continue to rise, the profits of downstream enterprises are seriously frustrated, especially olefin factories. Some enterprises stop at a loss, and the demand side shows a contraction. Some olefin factories even take out methanol and methanol market trading gradually weakens. In addition, near the end of this month, the state regulates coal prices, and methanol futures and spot prices have dropped sharply. During this period, port prices are still lower than those of the mainland market, and some goods continue to flow into the mainland market. In October, the domestic glacial acetic acid market fell sharply, with a monthly decline of 1750-2200 yuan/ton. Mainly based on the contradiction between supply and demand, the mentality of the industry is strong. the National Day holiday after the market began to enter the downward channel, and the market decline continues to increase. First, the supply side gradually increased, with Tianjin Bohua Yongli and Sinopec Great Wall plant restart recovery, the enterprise operating rate fluctuated around 90%. Northwest and central China inventory pressure gradually appeared, the northwest region due to the early National Games, National Day holiday and Paralympic Games and other effects, long-term transportation restrictions, resulting in rapid increase in enterprise inventory. Great Wall because of the matching vinyl acetate month no restart plan, acetic acid all export, so the northwest sales pressure is strong. Central China enterprises, on the other hand, have a small proportion of their long term. Under the bearish mentality of the industry, the spot sales are not smooth and the number of orders signed is small, so the inventory is rising rapidly. Under the high inventory of the above-mentioned two enterprises, vigorously let the profit shipment, low-cost supply spread to North China, East China and South China, pull down the market center of gravity. Second, the demand side is low, the dual-control effect of acetate in most of the month start low, ethyl acetate and butyl ester start once fell to the lowest level of 2-3 percent. The operating rate of vinyl acetate northwest enterprises is relatively low, with the lowest falling to around 40%. PTA starts at the beginning of the month also showed a certain decline. Due to the decrease of acetic acid demand in different degrees within the month. The contradiction between supply and demand in the market is obvious. On the export side, due to the need for isolation due to the impact of foreign outbreaks, the transportation cycle is lengthened, resulting in insufficient ship capacity. In addition, based on the rapid decline in domestic prices, foreign investors more wait-and-see, procurement intentions continue to be delayed. In addition, the raw material methanol market continued to rise in the first half of the month, but based on the high profit state of acetic acid, methanol has limited impact on acetic acid. on the whole, the pre-acetic acid price is too high, and the contradiction between supply and demand intensified, leading to a rapid decline in acetic acid prices. In October, the domestic PTA average operating rate was around 72.05%, down 2.85 percentage points from the previous month. The overall maintenance loss in the month is about 1.1 million tons. In November, Hengli Petrochemical's 3 #2.2 million-ton plant is scheduled to be overhauled in early November for a period of about 20 days. Other plants have no parking plan yet, so the overall supply is still sufficient. The units that stopped or reduced production in the early stage of polyester have recovered less, and the downstream industries still have to go to the warehouse. If the margin of the double-control policy is relaxed in the later period, the polyester load is expected to gradually rise from November, and the demand side will form a certain positive effect on PTA prices, therefore, the overall supply pressure in November will not be great. The domestic glacial acetic acid industry chain is expected to oscillate in November 2021. Raw acetic acid is expected to slow down and may rebound. Downstream esters are more likely to wait and see changes in raw materials, and actual demand is more cautious. Vinyl acetate is expected to remain high, and the tight pattern of short-term futures is difficult to change. Jin Lianchuang believes that the market in November is mainly waiting for changes in policy and raw materials, and it is expected that demand will be more cautious and urgent. single product expectations are as follows: The domestic ethyl acetate market is still expected to decline in November. At present, the impact of double control weakened in November, the operating rate of enterprises will be further improved, and the supply is expected to be abundant. Terminal demand is expected to be poor, into the traditional off-season just demand will be reduced. However, raw acetic acid is expected to bottom out. On the whole, Jin Lianchuang believes that in November, ethyl acetate enterprises will return to the thin profit situation, the price down after the raw material fluctuations.

There is greater flexibility in the domestic butyl acetate market in November. In terms of supply and demand, the start of butyl acetate in November will be improved and the impact of dual control will be weakened. However, terminal demand is still poor, based on high and traditional factors. Therefore, the contradiction between supply and demand will gradually appear. Raw acetic acid and n-butanol market is expected to run widely. Overall consideration, Jin Lianchuang believes that the November acetate market is still weak, the profit margin of enterprises is lower than the current expectation, and the probability of following raw material fluctuations is higher. the domestic sec-butyl acetate market is expected to fluctuate in November. Under the restriction of demand, there is still some room for decline in the market. After Zhongchuang and Dingying restart, the supply side will rise, which may have some impact on the market mentality. Raw acetic acid is expected to be weak due to inventory digestion, but the possibility of rebound is not ruled out in the second half of the year. Therefore, downstream acetate is more concerned about the change of raw material surface. Jin Lianchuang believes that there are still uncertainties in the November market, and it is expected that the focus of inquiries will be cautious. Later, we need to pay attention to the impact of the xylene market on sec-butyl ester.

The domestic methyl acetate market is expected to decline at a high level in November. Raw material acetic acid and methanol declined greatly, but at present, affected by the demand side, the industry is obviously bearish. Pay attention to the resumption of production by enterprises that have stopped work in the later period. In the long run, the winter gas restriction restricts the start of some plants. Therefore, although the supply is expected to rise, the range is limited. Jin Lianchuang believes that the November market let the profit run. November domestic acetate market expectations are still down. The supply side of positive propyl enterprises increased, the end demand is expected to be poor, and the supply and demand fundamentals are expected to be weak. The expected impact of raw acetic acid and n-propanol is weakened. And the current price of n-propyl ester is too high. Jin Lianchuang believes that the market will continue to decline in November. The domestic vinyl acetate market is expected to be adjusted at a high level in November. In the short term, it is difficult to improve the tight state of goods. The Great Wall plans to restart around November 10. Attention is still needed in the later period. The purchase of large factories in terms of demand is relatively stable. However, the terminal small adhesive industry has already stopped due to high cost. Therefore, in comparison, the consumption level of vinyl acetate has declined and the heating season in November is coming, it is also necessary to pay attention to whether the Sichuan-dimensional limit gas is implemented in advance, and the raw material end needs to focus on electric stone and ethylene dynamics. Jin Lianchuang believes that vinyl acetate is still mainly high in November, and still needs to pay attention to the impact of policies in the northwest region on the start of construction. There is a possibility of improvement in the supply side in the later period, but it is difficult to affect the supply of ethylene method. It is reported that there is a two-week maintenance plan in Seranis in late November. Therefore, the mentality of the industry is relatively cautious. Under the support of cost, vinyl acetate is less likely to decline, and it mainly focuses on changes in supply and demand. In November, the domestic methanol market supply and demand increase is expected, the market is expected to bottom out after the rebound probability is greater. First of all, at the end of 10, the policy of coal price increase intervention, methanol market with coal prices are high down, and coal main logic drive is still in fermentation, methanol, EG and other coal chemical varieties short suppression still need to be vigilant. Secondly, based on the expectation of gas head parking in November, due to cost \guaranteed supply of coal-to-methanol parking and negative concentration, superimposed on the temporary stop of some Iranian devices, the supply side has a certain positive support. In addition, in the middle and late of the fourth quarter, the impact of overseas gas restrictions on imports should also be closely watched. At present, the domestic acetic acid market is expected to gradually stop falling after the decline in November. On the supply side, Sopp will stop for about a month in mid-November. Other enterprises have no information about maintenance for the time being, but accidents are not ruled out. On the demand side, the double-control effect is slightly weakened, the load of acetate, vinyl acetate, etc. has increased, and the just demand for acetic acid will increase. There is also a certain demand for exports. At present, based on the rapid decline in the price of acetic acid, foreign businessmen will wait and see. Once the price stabilizes, it is not ruled out that foreign businessmen have procurement actions. In addition, East China enterprises also have plans to collect sources of goods. On the whole, Jin Lianchuang believes that the decline in November will slow down, and the long-term rebound may be stopped. Jinlianchuang expects the PTA market to consolidate in November. Crude oil prices have a trend of high consolidation, and the cost side supports PTA firmly. Recently, PTA maintenance equipment has been restored one after another, and the supply has increased significantly. However, due to the influence of the double control policy, the downstream demand of PTA is still weak, the market transaction atmosphere is light, and the overall supply and demand pattern remains weak. However, PTA processing fees remain at the level of 700-800 yuan/ton, and enterprises are slightly optimistic. The current market lacks substantial positive boost, therefore, it is expected that the PTA market may be dominated by narrow consolidation.

Mainly

Mainly

Polyurethane

Polyurethane

Fine Chemical

Fine Chemical

.png)