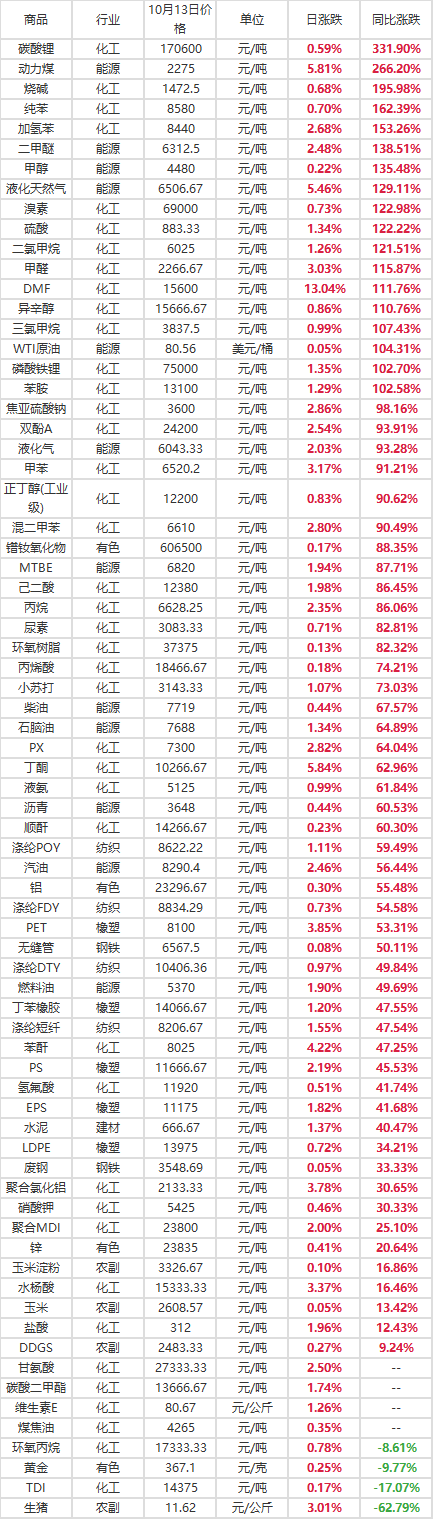

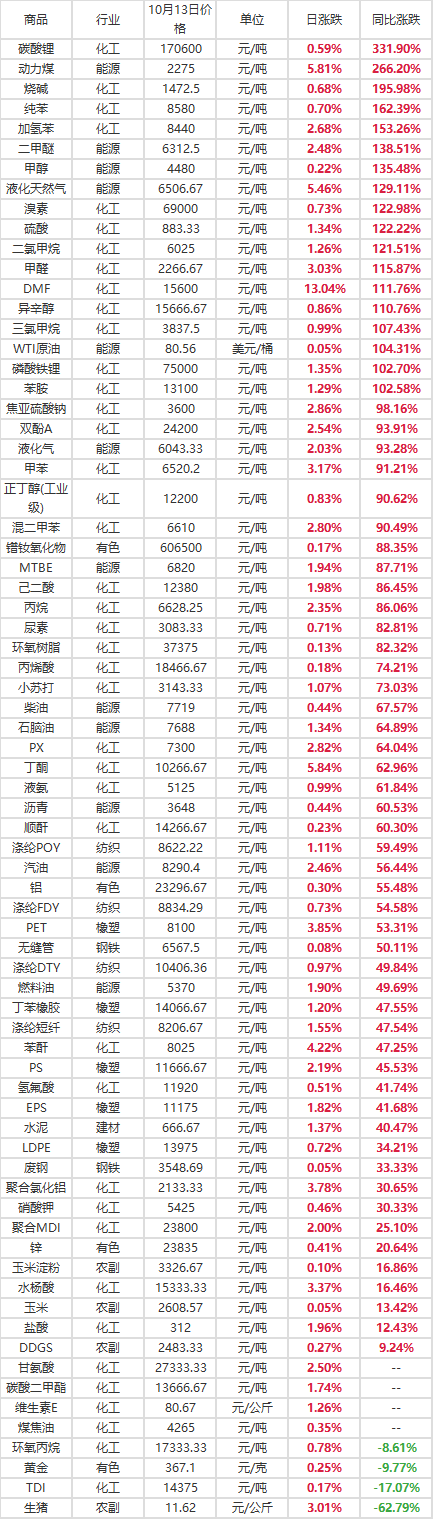

rose 7 times after the festival! The highest rise is 300%!

According to sources, major chemical enterprises will carry out off-peak production and periodic shutdown maintenance from November 2021 to March 2022. After the festival lithium carbonate, thermal coal, caustic soda, benzene and other raw materials high pull up, the highest rise over 300%.

Many chemical enterprises' net profit increased by more than 10 times!

As of October 10, 179 companies in Shanghai and Shenzhen have issued third-quarter performance forecasts, of which "pre-happy" 154 accounted for 86.03% of the total. Specifically, the 154 companies forecast a pre-increase of 110, a slight increase of 27, and a continued profit of 3, and another 14 companies announced that they would turn losses. It is worth mentioning that among the "pre-happy" enterprises, as many as 91 enterprises in the first three quarters of net profit growth is expected to reach or exceed 100%, accounting for 59.09%.

From the industry point of view, according to the Shenwan level industry, the 154 companies that reported "pre-happy" in the third quarter are mainly concentrated in chemical industry (34), electronics (20), machinery and equipment (18), power equipment (10), medicine and biology (9), non-ferrous metals (8), automobiles (7), building materials (6), steel (5), textile and apparel (5), transportation (5), architectural decoration (5) and other industries.

what is particularly eye-catching in the is that among the above-mentioned companies that have issued third-quarter performance forecasts, 14 have increased by more than 10 times. According to the classification of Shenwan's first-level industries, half of them come from the chemical industry! The seven are: Huachang Chemical, Polyfluoro, Yuanxing Energy, Jiangsu Thorpe, Tianyuan shares, Yida shares and Zangge Holdings.

▶▶Huachang Chemical and Polyfluoro two pre-increased by more than 5000%. Polyfluoro expects to achieve a net profit of 0.718 billion yuan to 0.738 billion yuan in the first three quarters, up 5173.71% to 5320.61% year-on-year. In the third quarter alone, the company realized a net profit of 0.41 billion yuan to 0.43 billion yuan, turning losses into profits. Polyfluoro explained that the market demand for its new material products is strong, the volume and price are rising, and the profitability is greatly improved. This year's interim report shows that its new materials mainly include lithium hexafluorophosphate and electronic grade hydrofluoric acid.

▶▶Huachang Chemical expects a profit of 1.4 billion -1.45 billion yuan in the first three quarters of 2021, up 5441%-5639% year-on-year. Among them, the third quarter profit was 524.09 million yuan -574.09 million yuan, up 4455%-4889% year-on-year. The main reasons for the growth in performance: first, the impact of the base, the impact of the epidemic in 2020, the decline in operating performance, resulting in a small base of operating performance in the same period last year; second, the effective release of operating performance, as well as the increase in product prices during the reporting period.

▶▶Yuanxing Energy turned a big turnaround year-on-year, with a net profit of 2.03 billion -2.13 billion yuan in the first three quarters and a loss of 52.8828 million yuan in the same period last year. During the reporting period, the price of the company's leading products increased significantly compared with the same period last year; in the third quarter, the company's holding subsidiary, Inner Mongolia Boda Field Chemical Co., Ltd., etc., routinely overhauled the urea plant, which reduced the profitability of the urea sector. In addition, the company intends to liquidate and cancel its wholly-owned subsidiary Inner Mongolia Yuanxing Jiangshan Chemical Co., Ltd., and the asset impairment loss is expected to be 0.224 billion yuan, which is expected to affect the third quarter net profit reduction of 0.224 billion yuan.

▶▶Jiangsu Thorpe expects to achieve a net profit of 2.13 billion -2.18 billion yuan in the first three quarters, an increase of 3901.44% to 3995.37% year-on-year. Among them, the net profit after deduction was 2.12 billion yuan -2.17 billion yuan, an increase of 4738.83% to 4852.96% year-on-year. For the reasons for the pre-increase in performance, the announcement said that during the performance forecast period, affected by factors such as the control of the domestic epidemic, the improvement of market supply and demand, and the higher prosperity of the domestic chemical industry, the price of the company's main products acetic acid and derivatives continued to be high, and its performance rose sharply.

▶▶Tianyuan shares expect the net profit attributable to shareholders of listed companies in the first three quarters of 2021 to be 0.48 billion yuan to 0.5 billion yuan, up 3028.3% to 3158.65% year on year. Basic earnings per share are 0.6147 yuan to 0.6403 yuan. The main reasons for the performance changes are: first, the market price of the products required by enterprise owners from January to September 2021 has risen sharply compared with the same period last year; second, the supporting advantages of the enterprise's own raw material base and industrial synergy; third, the production capacity benefits of the enterprise's "one body and two wings" emerging industries have begun to gradually release, gradually forming new profit growth points for enterprises. The production and operation of the enterprise are stable and normal.

▶▶Yida shares are expected to achieve operating income of 1.03 billion yuan to 1.08 billion yuan in the first three quarters of 2021, a year-on-year increase of 41.65%-47.38%; the net profit attributable to shareholders of listed companies is 85 million yuan to 100 million yuan, and a loss of 4.8451 million yuan in the same period last year. The announcement shows that in the first three quarters of 2021, due to the control of the domestic epidemic and the high prosperity of the domestic chemical industry, the price of the company's alcohol ether and alcohol ether ester series products is at a high level, and its sales revenue has been significantly higher than the same period last year. The increase in performance in the first three quarters of 2021.

This article is reprinted on the Internet, and the copyright belongs to the original author. Some articles cannot be contacted with the original author in time when they are pushed. If copyright issues are involved, please contact us and we will delete the articles as soon as possible.

Mainly

Mainly

Polyurethane

Polyurethane

Fine Chemical

Fine Chemical

.png)